This guide is designed to help investors evaluate their exposure to the dynamic and rapidly evolving fields of Artificial Intelligence and robotics. By breaking down the key layers within these technologies—from foundational hardware to advanced software and real-world applications—this guide equips investors with the knowledge they need to identify whether their current AI and robotics plays are targeting the right growth areas in the best ways. Understanding the nuances will help investors differentiate between funds that simply track popular themes and those that are positioned strategically to capture the next wave of value creation.

Our guide proceeds in four sections:

Section 1 offers an overview of the crucial AI bet that investors may not understand.

Section 2 details the key factors to consider when evaluating your Artificial Intelligence Exposure.

Section 3 details the key factors to consider when evaluating your Robotics Exposure.

Section 4 offers an overview of two meaningful investment options for these thematic areas the ARK Autonomous Technology and Robotics ETF (ARKQ) and the ARK Next Generation Internet ETF (ARKW).

1. Introduction: The AI Bet That Few Understand

Astute investors already understand that Artificial Intelligence (AI) is having profound downstream impacts on Robotics and driving a technological revolution poised to reshape all industries globally.

The amount of AI investment companies need to build their frontier models is staggering, potentially reaching more than $100 billion within the next three years.1

The Magnificent 6—Apple, Amazon, Google, Meta, Microsoft and Nvidia—have dominated the headlines, mainly in light of their efforts to expand and enhance their data centers with Nvidia’s GPUs.

As a result, most AI-focused ETFs have concentrated their holdings in those high-profile companies that have led the first wave of AI growth and delivered significant returns to investors. If investors believe that the Magnificent 6 will continue to dominate the AI landscape—and, given the scale of their capital investments, there is a compelling argument for their continued leadership of those companies—they should be well-positioned by maintaining exposure to the Nasdaq 100 Index2 as a core technology benchmark.

If investors want exposure to the next wave of AI growth simmering in companies beyond the Magnificent 6, then a uniquely differentiated, actively-managed satellite AI ETF could be an excellent complement to existing portfolios. ARK’s research suggests that significant asymmetries and untapped opportunities are unfolding across the AI stack.

Currently, most AI-themed ETFs are essentially Nasdaq 100 proxies, exhibiting near-perfect correlation, and so we must wonder whether paying 50-75 basis points (bps) for an AI-themed ETF is truly justified. We believe investors should seek differentiated exposure, questioning their fund manager thoroughly about their genuine 3-, 5-, and 10-year convictions and how their portfolio is positioned for this new technological supercycle.

In this guide, we aim to help investors identify the key factors to watch for when evaluating and comparing Artificial Intelligence and/or Robotics ETFs, so that they can be sure that their investments are well-positioned for long-term success.

2. Your Artificial Intelligence Exposure: Key Factors To Consider

Investors should understand how their chosen AI exposure captures value across the AI ecosystem. If you already hold a fund, seek clarity from your fund manager with respect to where, why, and to what extent the fund is positioned within the AI stack. The AI stack includes foundational technologies like semiconductors and data centers, platform applications, software services, and robotics integration. Understanding those relationships, and your exposure to various components within them, is key to determining whether a manager truly grasps AI's transformative potential or is simply chasing trends.

Understanding Your Exposure Across The AI Stack

The AI stack can be divided into four main layers: Compute (Chips), Infrastructure-as-a-Service (IaaS), Platform and Infrastructure Software (PIS) and Software-as-a-Service (SaaS). Each layer plays a distinct role in the development and deployment of AI, offering investment opportunities with varying levels of growth and risk.

- Compute (Chips): This foundational layer provides the processing power required to run AI models. Companies like Nvidia and AMD are at the forefront of this space, developing advanced AI chips that are essential for training and deploying machine learning algorithms. As AI adoption accelerates, the demand for high-performance computing will grow, making this segment a crucial part of the AI stack.

- Infrastructure-as-a-Service (IaaS): In the layer above Compute, IaaS provides the cloud infrastructure that allows businesses to access AI hardware and computing resources on demand. Major players like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Oracle Cloud dominate this space, enabling companies to scale their AI operations without investing in costly physical infrastructure. While IaaS is essential for the AI ecosystem, the market is heavily concentrated among those providers, which can limit its growth potential compared to other layers of the stack.

- Platform and Infrastructure Software (PIS): Sitting above the Infrastructure as a Service (IaaS) layer, the PIS layer provides the essential tools and platforms that developers use to build, deploy, and manage AI applications. Innovative platforms offered by companies like Databricks and Palantir lead the way in managing and analyzing vast datasets. Palantir, for instance, is positioned as the operating system for government and enterprise AI applications, with its AIP Now service offering ready-to-use solutions, similar to an app store, enabling rapid deployment across various enterprise functions. By providing a unified platform for data integration, analysis, and decision making, Palantir helps organizations leverage AI to enhance operational efficiency and strategic planning.

- Software-as-a-Service (SaaS): The layer at the top of the stack, SaaS delivers AI-powered applications directly to end-users. Companies like HubSpot and SAP offer solutions that automate and optimize customer relationship management and business operations. While SaaS plays a critical role in AI’s adoption, the rise of Platform and Infrastructure Software and custom AI platforms may challenge traditional SaaS offerings as businesses demand more tailored, scalable solutions.

.png)

Source: ARK Investment Management LLC, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

WHY IT MATTERS

Where an AI fund invests across the AI stack will affect its growth potential and risk profile. Many AI-focused funds allocate heavily toward the Compute and IaaS layers, resulting in excessive exposure to Mega-Cap tech. While those companies may provide consistent, steady growth, they often lack the asymmetric upside that we—and many others—discern in AI software companies positioned within the PIS and SaaS layers of the AI stack. As companies increasingly seek to leverage their underutilized data and enhance operational efficiency through AI, software applications will be essential enablers of adoption. Our research suggests that fund managers who are diversified across the AI stack, especially those with a greater emphasis on software, should be best positioned to capitalize on the next wave of the AI opportunity.

ARK'S APPROACH

We expect PIS companies to be the strongest growth engines of the AI stack. Accordingly, our investment process prioritizes PIS companies.

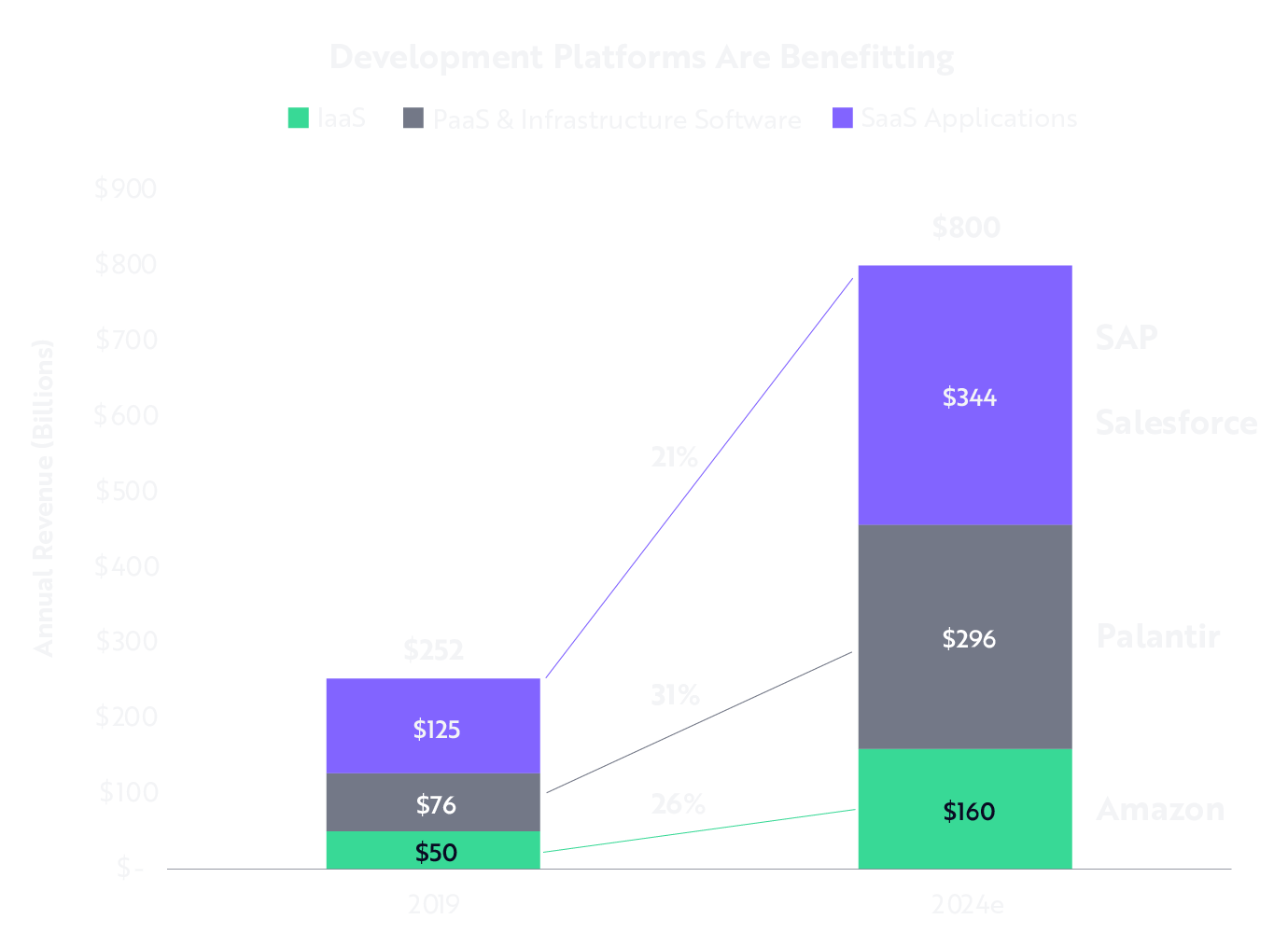

As indicated in the chart below, PIS has achieved a compound annual growth rate (CAGR) of 31% between 2019 and 2024, outpacing both IaaS (26%) and SaaS applications (21%).3 That growth was fueled by the rapid expansion of cloud deployments, but our research suggests that new catalysts beyond cloud adoption will drive the next phase of growth.4

Source: ARK Investment Management LLC, 2024, based on data from SWE-Bench and IDC as of August 7, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

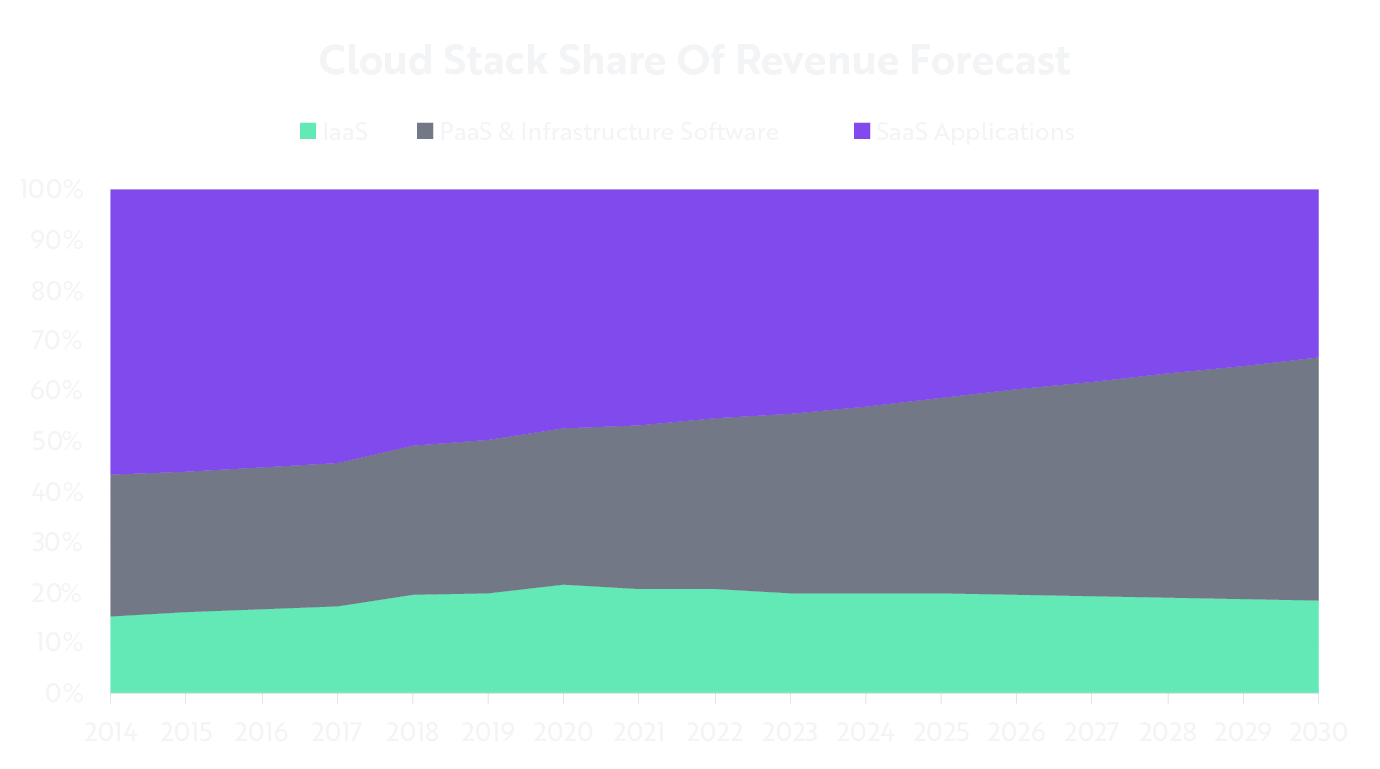

Our research indicates that advancements in AI will accelerate growth across cloud and software ecosystems, with projected growth rates ranging from 34% to 54% by 2030,5 in an optimal bullish scenario. PIS could capture the largest market share as AI increasingly reduces the marginal cost of creating custom software solutions. That shift positions data and application platforms to benefit further, while traditional SaaS incumbents face risks as businesses seek more customized AI-driven solutions. While we expect the size of the pie (i.e., the total addressable revenue) to increase dramatically, our research shows that PIS will take increasing market share relative to other areas of the cloud tech stack, as shown below.

Source: ARK Investment Management LLC, 2024, based on a range of underlying data from external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Hardware-To-Software Evolutions In Technology Cycles

The history of technology shows that hardware breakthroughs often lay the foundation for transformative software innovations. The pattern has repeated across multiple cycles, with some companies emerging as leaders in both phases. We believe the same pattern will emerge for Artificial Intelligence. In this section, we explore historical examples of this hardware-to-software progression that we hope will illuminate the broader technology landscape.

HARDWARE PHASE

Historically, major technological shifts began with advancements in hardware:

- IBM and Apple were pioneers in the personal computing revolution. IBM introduced the IBM PC in the early 1980s, while Apple revolutionized consumer technology with the Macintosh in 1984.

- In the smartphone revolution, Apple redefined mobile hardware with the iPhone in 2007, while Samsung became a leader in Android-powered hardware.

- The semiconductor industry, driven by Intel and Nvidia, provided the backbone for modern computing. Intel led with CPUs, while Nvidia transformed graphical computing with GPUs, setting the stage for advancements in AI.

- In consumer electronics, companies like Sony and Panasonic dominated with innovations in TVs, audio systems, and gaming consoles.

While those hardware advancements created the foundation for new industries, the software phase drove much of the value creation.

SOFTWARE PHASE

Once hardware reaches maturity and mass adoption, attention typically shifts to software, where much of the value is realized:

- Following the hardware-driven PC revolution, Microsoft capitalized by developing software like Windows and Office that became essential tools for businesses.

- Google leveraged the internet revolution by creating the Android operating system, a platform now used by billions of smartphones globally.

- The rise of cloud computing abstracted hardware infrastructure into virtual platforms, enabling companies like Amazon and Google to provide new software services and applications like Amazon Web Services (AWS) and Google Cloud, respectively.

The development of AI thus far follows a similar path. The hardware phase (e.g., semiconductors, GPUs) has laid the groundwork; but software advancements in areas like PIS and SaaS now play a crucial role in delivering value.

CURRENT TRENDS

Today, AI exemplifies the convergence of hardware and software, a fusion transforming entire industries:

- Companies like Tesla and Nvidia have driven hardware advancements in AI chips and self-driving technology, while software leaders like OpenAI and Google DeepMind are building on that foundation to create sophisticated AI models.

- Palantir and Databricks are leaders in platform infrastructure software, enabling businesses to extract value from their vast datasets. These companies bridge the gap between AI hardware (e.g., Nvidia chips) and actionable AI-driven insights.

The convergence of hardware and software—and their differences!—underscores the importance of understanding how AI exposure is positioned across the technology stack, from hardware to software, as discussed below.

HARDWARE COMPANIES ARE EXPANDING INTO SOFTWARE

History shows that even hardware-focused companies often evolve into software ecosystems. Apple and Nvidia exemplify that dynamic:

- Known for its hardware innovations, Apple now derives much of its value from software services like iOS and the App Store.

- Known for establishing dominance in GPU hardware, Nvidia expanded into AI software through platforms like CUDA, which supports advancements in machine learning and data science.

The transition from hardware to software is happening in AI space today. Leading companies are evolving to capture value at every level of the stack.

AI VALUE CHAIN: FROM HARDWARE TO SOFTWARE

.png)

Source: ARK Investment Management LLC, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

3. Your Robotics Exposure: Key Factors To Consider

Next, we turn to Robotics. Over the past decade, many robotics innovations—one thinks of the Roomba—have struggled to achieve large-scale adoption. And yet, the convergence of robotics and AI is now becoming a catalyst that unlocks transformative opportunities across industries like autonomous vehicles and drones. The shift enables unprecedented scale and efficiency, marking an astounding turning point for robotics. We believe investors should actively seek fund managers who understand these converging technologies and can identify the significant opportunities they present—positioning portfolios to capture the next wave of growth.

How Is AI Driving The Robotics Opportunity?

What’s driving the next wave of opportunities in robotics? Computing infrastructure. Machine learning. Autonomous navigation, sensors, and perception. Actuators and mechanics. We view the convergence of AI and robotics as a holistic phenomenon we call “Embodied AI”—the application of AI in the physical world, which we contrast with the productivity gains achieved by enhancing knowledge worker efficiency.

Importantly, the incorporation of large language models into robotic processes has increased robot effectiveness significantly, not only for previously familiar tasks but also for new tasks on which robots have yet to be trained. Transformer architecture, a cornerstone of this decade's AI revolution, has been the key driver of this stepwise increase in capability.

Sources: ARK Investment Management LLC, 2023. Gopalakrishnan, K. et al. 2022; Brohan, A. et al. 2022; Jang, E. et al. 2022. Compares performance of RT-1, the robotics transformer architecture to BC-Z, based on a recurrent neural net architecture. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Understanding Your Allocation To Robotics

Thus far, robotics has been concentrated in industrial manufacturing, with early-stage applications in industrial automation (like auto manufacturing), logistics and supply chain robotics (e.g., warehouse robotics), and surgical robotics (e.g., Intuitive Surgical).

Now, advanced applications are emerging that include autonomous vehicles, drones, and agricultural robotics, as well as collaborative robots designed to work alongside humans. ARK’s research suggests that this is one of the most exciting investment opportunities in the public equity markets, given a five-year time horizon.

Looking ahead, future applications, such as humanoid robots capable of operating at or above human parity, have the potential to fundamentally reshape the economy as we know it. If humanoid robots are able to operate at scale, they could generate tremendous revenue, split roughly equally between household and manufacturing robotics.6

Understanding how the convergence of AI and robotics is enabling the evolution of these many applications is essential to making smart AI investment decisions. Investors aiming to capitalize on the massive market opportunities associated with AI and robotics should seek fund managers who understand where robotics has been and where it is going.

The following diagram depicts what ARK’s research suggests will be the opportunity timeline:

.png)

Source: ARK Investment Management LLC, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

WHY IT MATTERS & ARK’S APPROACH

We believe that understanding where one's exposure lies along the robotics opportunity timeline above is crucial for assessing expected growth. Despite the magnitude of the investment opportunities created by recent advances in AI and robotics, few so-called “robotics” fund managers seem to capture the breadth of relevant exposure within their portfolios. Instead, our research suggests that most robotics fund managers remain focused on early-stage applications, which we believe represent smaller opportunities in more mature markets.

ARK’s investment process in robotics prioritizes the enablers, leaders, and beneficiaries of Embodied AI capabilities. Our high-conviction approach emphasizes advanced applications as the key focus area within robotics. Top holdings in the ARK Autonomous Technology and Robotics ETF (ARKQ) are terrific examples: Tesla is aligned directly with the autonomous vehicle opportunity, which we view as the world's largest AI project. Deere is advancing autonomous applications in agriculture. Iridium Communications and Rocket Lab are building networks of low-Earth orbit satellites that will enable Embodied AI to operate on a global scale.

4. ARK Autonomous Technology and Robotics ETF (ARKQ) and ARK Next Generation Internet ETF (ARKW)

The ARK Autonomous Technology & Robotics ETF (ARKQ) and the ARK Next Generation Internet ETF (ARKW) give investors exposure to companies that our research suggests will drive the next wave of AI and Robotics innovation. We have extremely high conviction in all these holdings. By focusing on Platform and Infrastructure Software and Embodied AI, we believe we offer a more forward-looking approach than many AI funds, especially those over-weighted in the “Magnificent 6” stocks.

ARKQ And ARKW Key Differentiators:

- AI Software Emphasis: A unique, primary focus on Platform and Infrastructure Software, where we believe the highest growth potential exists.

- A Portfolio Solution: Thanks to our highly active investment approach, our positioning is well-differentiated relative to common benchmarks. As of September 30, 2024, ARKQ and ARKW have an active share7 of 87% and 84%, respectively, relative to the Nasdaq 100 Index. For those reasons, we believe the addition of these strategies to a core portfolio represents minimal overlap, a true diversifier, and a forward-looking approach to identifying the next wave of value accrual across AI and robotics.

- ARKQ vs. ARKW:

- ARKQ focuses on companies involved in automation, robotics, and transportation.

- ARKW focuses on companies transforming the internet through AI, blockchain technology, and cloud computing. Additionally, ARKW offers exposure to cryptocurrency.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs' prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

Past performance is not indicative of future performance.

Specific companies are mentioned in this article as examples only, and are not a recommendation to buy, sell or hold any particular security. However, some of the companies discussed may be held in ARKQ and/or ARKW. For complete lists of ARKQ’s holdings click here, and for a complete list of ARKW’s holdings, click here.

The Nasdaq-100 Index is a stock market index made up of equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a modified capitalization-weighted index.

Securities in ARKQ or ARKW’s portfolio will not match those in any index. The actively managed ETFs are benchmark agnostic and corresponding portfolios may have significant non-correlation to any index. Index returns are generally provided as an overall market indicator. You cannot invest directly in an index.

An investment in an ARK ETF is subject to risks and you can lose money on your investment in an ARK ETF. There can be no assurance that the ARK ETFs will achieve their investment objectives. The ARK ETFs’ portfolios are more volatile than broad market averages. The ARK ETFs also have specific risks, which are described in the ARK ETFs' prospectuses.

ARK Investment Management, LLC is the investment adviser to the ARK ETFs.

Foreside Fund Services LLC, distributor.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Morales, J. 2024. “AI models that cost $1 billion to train are underway, $100 billion models coming — largest current models take 'only' $100 million to train: Anthropic CEO.” Tom’s Hardware.

A basis point (bp) is a unit of measurement that represents a change in a percentage or rate, and is equal to 1/100th of 1%, or 0.01%.

Compound annual growth rate is a business, economics and investing term representing the mean annualized growth rate for compounding values over a given time period.

This exposure would be through and investment vehicle. Indexes are unmanaged and are not available for direct investment.

Source: ARK Investment Management LLC, 2024. Based on data from IDC.

Source: ARK Investment Management LLC, 2024. Based on data from IDC.

Source: ARK Investment Management LLC, 2024. Based on data from IDC.

Korus, S. “How ARK Is Thinking About Humanoid Robotics.” ARK Investment Management LLC.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.