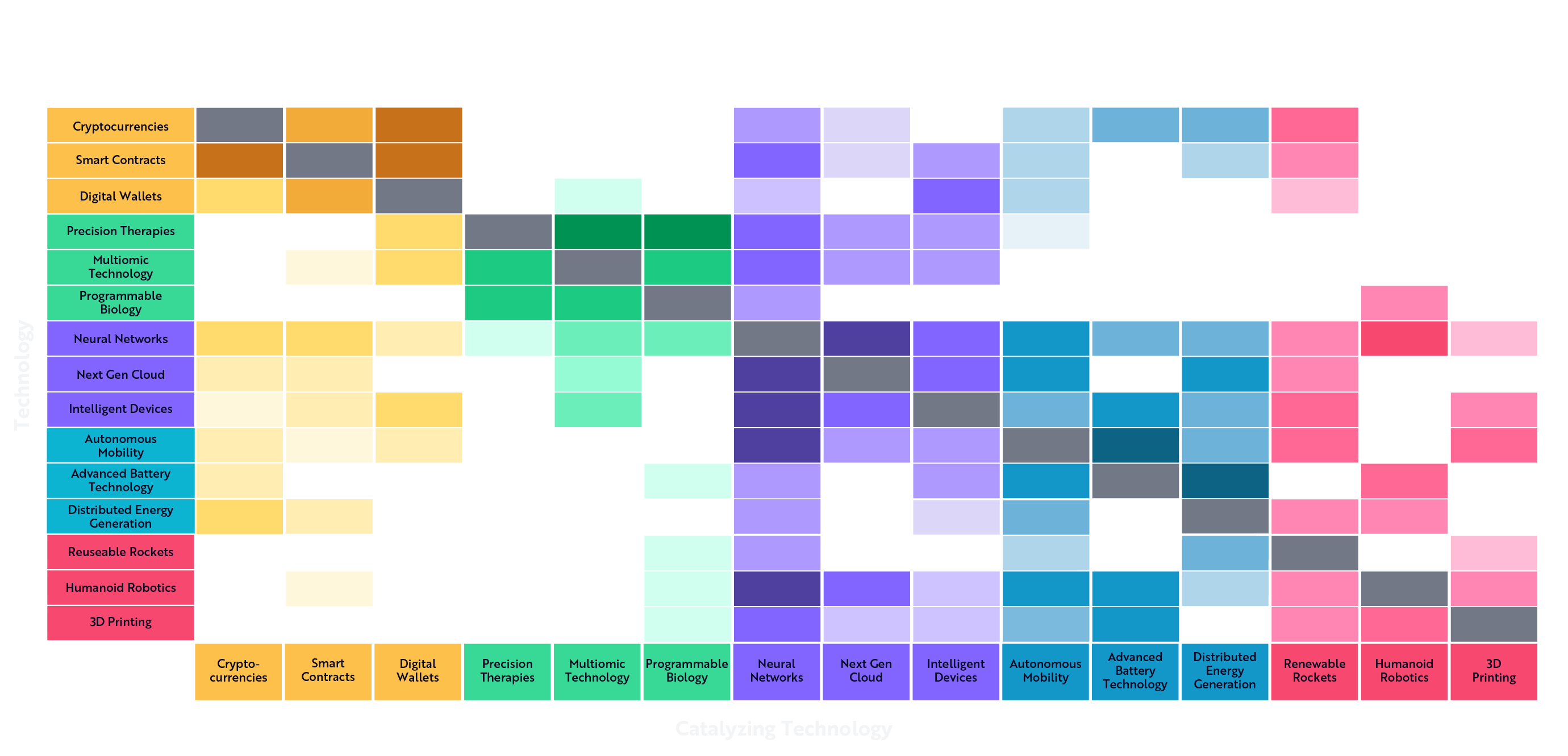

The Opportunity: Five Innovation Platforms Are Catalyzing Accelerated Growth

Today’s investors live in a unique historical period characterized by the simultaneous advancement of five major innovation platforms: public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics, each of which has the power to spur significant economic and societal changes. Our research suggests that their convergence is propelling the acceleration of innovation that presents investors with unprecedented opportunities.

Public Blockchains

Upon large-scale adoption, we believe all money and contracts are likely to migrate to Public Blockchains that enable and verify digital scarcity and proof of ownership. The financial ecosystem is likely to reconfigure to accommodate the rise of Cryptocurrencies and Smart Contracts, increasing transparency, reducing the influence of capital and regulatory controls, and collapsing the costs of contract execution. If that occurs, Digital Wallets will become increasingly necessary as more assets become money-like and corporations and consumers adapt to the new financial infrastructure. Many corporate structures may be called into question.

Artificial Intelligence (AI)

Computational systems and software that evolve with data are poised to solve intractable problems, to automate knowledge work, and to accelerate technology’s integration into every economic sector. The adoption of Neural Networks1 should prove more momentous than electrification. At scale, these systems will require unprecedented computational resources, and AI-specific compute hardware should dominate the Next Gen Cloud datacenters that train and operate AI models. The potential for end-users is clear: a constellation of AI-driven Intelligent Devices that permeate people's lives, changing the way that they spend, work, and play. The adoption of artificial intelligence should transform every sector, impact every business, and catalyze every innovation platform.

Multiomics

The cost to gather, to sequence, and to understand digital biological data is falling precipitously. Multiomic Technologies provide research scientists, therapeutic organizations, and health platforms with unprecedented access to DNA, RNA, protein, and digital health data. Cancer care should transform with pan-cancer blood tests. Fed by rich multiomic data and powered by Programmable Biology, AI systems running autonomous labs could collapse the cost of drug discovery, development, and trial, transforming returns in a sector that has stagnated. Biological discoveries should power novel Precision Therapies that target and cure rare diseases and chronic conditions, unlocking profound economics. Over time, the design and synthesis of novel biological constructs should yield advances in agriculture, material science, and even computation.

Energy Storage

The declining costs of Advanced Battery Technology should cause an increase in form factors, enabling Autonomous Mobility systems that collapse the cost of transportation. Electric drivetrain cost declines should unlock micro-mobility and aerial systems, including flying taxis, enabling business models that transform cities. Autonomy should reduce the cost of taxi, delivery, and surveillance by an order of magnitude, enabling frictionless transport that could increase the velocity of e-commerce and make individual car ownership the exception rather than the rule. Combined with large-scale stationary batteries and Distributed Energy Generation—notably solar and small-scale fission—these innovations should cause a transformation in energy, substituting electricity for liquid fuel and increasing system-wide resilience, reliability, and production.

Robotics

Catalyzed by artificial intelligence, Humanoid Robots should operate alongside humans and navigate legacy infrastructure, changing the way products are made and sold, and eventually the way we live our lives at home. 3D Printing should contribute to the digitization of manufacturing, increasing not only the performance and precision of end-use parts, but also the resilience of supply chains. Meanwhile, the world’s fastest robots, Reusable Rockets, should continue to reduce the cost of launching satellite constellations and enable uninterruptible connectivity and earth observation. Presently a nascent innovation platform, robotics ultimately could collapse the cost of transporting across distance, including hypersonic travel, as well as the cost of manufacturing complexity with 3D printers and the cost of physical work with AI-guided robots.

Central to all these dynamics is the potency of technological convergence, the process through which the advancements in one field propel developments in others, leading to a cascade of combined effects that amplify overall progress. Convergence dynamics are particularly compelling today as AI acts as a catalyst, enhancing and accelerating developments across a broad swath of innovations from multiomics to robotics. The most representative of AI today is neural networks, which, in short, are a computer system modeled on the human brain and nervous system. ARK believes that the acceleration in neural network innovation, specifically, is central to the convergence of technologies because neural networks dramatically enhance pattern recognition, prediction, and autonomous decision-making capabilities that unlock new functionality across sectors. Whether enabling real-time perception for autonomous vehicles, accelerating drug discovery through multiomic data analysis, or powering generative design in 3D printing, neural networks act as the intelligence layer that makes other technologies more effective, scalable, and adaptive. As cost declines in AI training and inference continue at an unprecedented pace, neural networks are becoming increasingly accessible, amplifying their influence across all innovation platforms.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Please note that the darker each representative color square in the chart is, the more we believe the technology is converging with artificial intelligence, and specifically with neural networks.

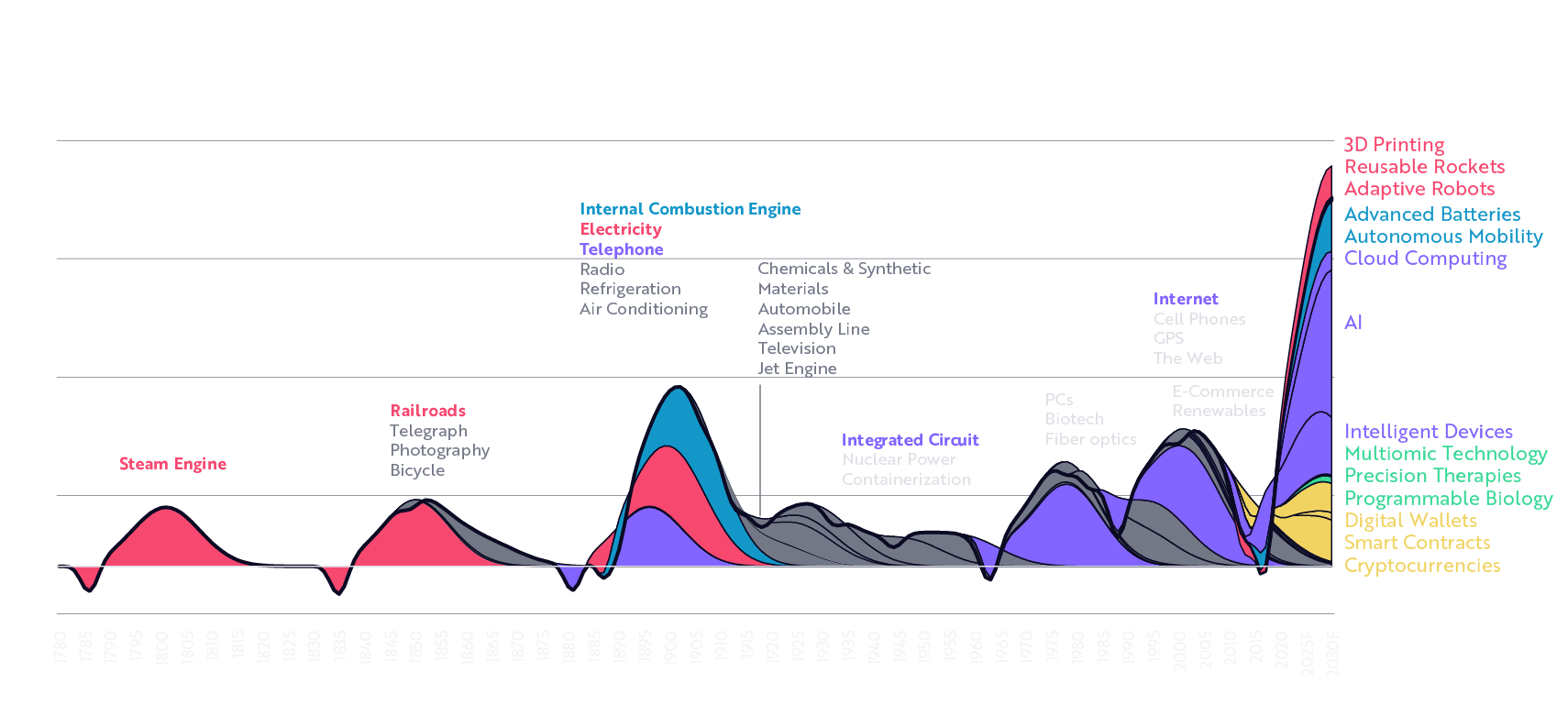

Historical Perspective and the Present Opportunity

History can help us to appreciate the vast potentialities of our current technological revolution.2

Prior to the discovery and proliferation of writing, the global economy was anemic, with growth rates below 0.04% in the 100,000 years prior to the rise of Rome. In the first 1,000 years AD, annual growth accelerated nearly four-fold to 0.14%. Then, plow technology and crop rotation strategies led to a population boom, more than doubling growth to 0.3% at an annual rate through 1500.

The printing press and the steam engine bookended the first industrial revolution, doubling growth again to 0.6% per year through 1900. Thereafter, electrification, telephony, the internal combustion engine, and digital computation and connectivity quintupled real economic growth to 3% at a compound annual rate, pushing global gross domestic product (GDP) to $107 trillion. As a result, global real per capita GDP has increased nearly 7-fold since 1900 from less than $2,000 to more than $13,400 in 2023.

Indeed, ARK’s research suggests that future historians will marvel at the cornucopia of critical inflections that occurred simultaneously during this moment of human progress: when previously unimaginable inflections associated with AI and DNA sequencing and editing made disease cures the standard of care; when robotics proliferated across our society and batteries became the fundamental unit of energy delivery; when blockchain and cryptocurrencies became the underlying structure that would grow to transform the entire business and financial landscape.

These technologically enabled changes offer long-term opportunities for companies and investors alike.

Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying sources, which may be provided upon request.3 The chart uses GPT 4 prompting to survey a comprehensive list of general purpose technologies using the identification framework detailed therein. Where available, academic literature is also used to assess attributable economic impact. A GPT-4 scoring rubric assesses technology-by-technology impacts. The impact measured directly is matched against the scoring to tune all scores to produce technology-by-technology estimates of economic impact (even when direct measures of economic impact are unattainable). Consistent with General Purpose Technology theory, these technologies are assumed to go through a period of investment in which economic impact is negative before productivity advances begin to realize into economic data. All technologies are assumed to have the same diffusion and realization cycle. If recent technologies are assumed to diffuse more quickly, the current wave would appear steeper. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. The historical economic impact of innovation does not guarantee a similar impact at any point in the future.

The accelerating convergence across public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics suggests that we are on the cusp of a step-function increase in real GDP growth rates that could reshape market capitalization. Disruptive technologies are becoming increasingly central to economic development; so should they become increasingly central to a sound investment strategy.

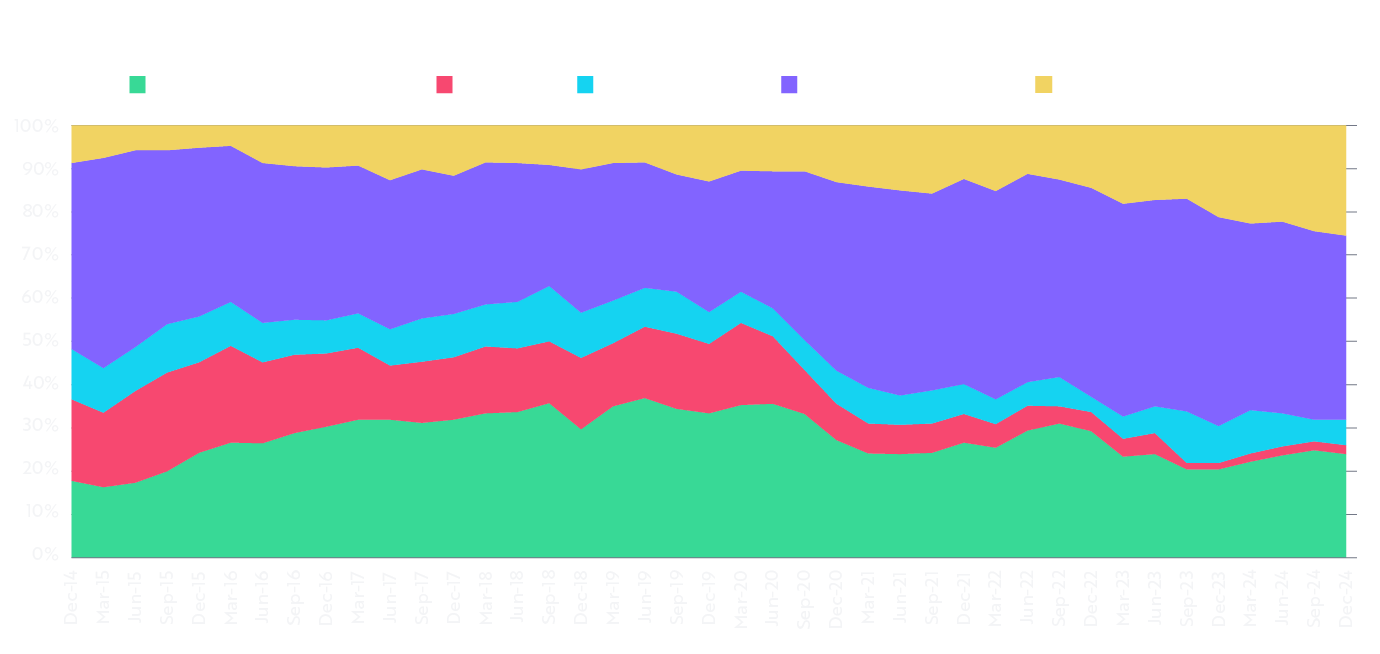

The ARK Innovation ETF

The investment opportunities that flow from the magnitude of today’s disruptive innovation are often unrecognized or misunderstood by traditional investors. Many market participants focus on conventional growth and value investing strategies, overlooking the potential long-term transformational impact that innovation-driven companies can have on the economy. We believe that investing in disruptive innovation will outperform broad-based market benchmarks significantly over the course of a full market cycle.

The ARK Innovation ETF (ARKK) is an actively managed exchange-traded fund (ETF) designed to invest in companies at the forefront of disruptive innovation—namely, public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics (see chart below). We believe the ARK Innovation ETF is the closest thing to venture capital in the public equity markets, making it a compelling option for investors looking to gain exposure to cutting-edge market trends and technological advancements. Moreover, the low correlation of relative returns to traditional growth and value strategies provides potential diversification benefits, making the ARK Innovation ETF an attractive option for investors seeking to complement their existing portfolios with exposure to forward-looking themes.

Source: ARK Investment Management LLC, Information as of December 31, 2024.

Through active management, the ARK Innovation ETF adapts to evolving technologies and changing markets, positioning investors for potential growth as new ideas reshape industries. While innovation-focused portfolios can be volatile, they can also create valuable, long-term opportunities, and their risk can be properly managed with strategic allocation strategies well-understood by ARK.4 We believe that forward-thinking investors can benefit from exposure to pioneering companies driving global change. Ultimately, the ARK Innovation ETF offers a unique chance to invest in the transformations that may redefine economies.

To learn more about the ARK Innovation ETF please watch our Fund In Focus – ARKK video.

Ready to Invest?

We encourage investors to work with a chosen financial professional to explore the potential benefits of incorporating an innovation-based strategy, such as the ARK Innovation ETF. We would be delighted to provide additional, high-level information for investor review in collaboration with their trusted financial professional. Please reach out for more information. Discover more about the ARK Innovation ETF here.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK Fund before investing. This and other information are contained in the ARK ETFs’ prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

An investment in an ARK Fund is subject to risks and you can lose money on your investment in an ARK Fund. There can be no assurance that the ARK Funds will achieve their investment objectives. The ARK Funds’ portfolios are more volatile than broad market averages. The ARK Funds also have specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Funds’ prospectuses.

The principal risks of investing in the ARK Funds include:

Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Equity Securities Risk. The value of the equity securities the ARK Funds hold may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Health Care Sector Risk. The health care sector may be affected by government regulations and government health care programs. Consumer Discretionary Risk. Companies in this sector may be adversely impacted by changes in domestic/international economies, exchange/interest rates, social trends and consumer preferences. Industrials Sector Risk. Companies in the industrials sector may be adversely affected by changes in government regulation, world events, economic conditions, environmental damages, product liability claims and exchange rates. Information Technology Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins.

Additional risks of investing in ARK ETFs include market, management and non-diversification risks, as well as fluctuations in market value NAV. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

To view the top ten holdings for ARKK click here.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. Nominal GDP is a measure of economic output that uses current prices and does not adjust for inflation. Real GDP is an economic metric that is used to describe the economic output of a country within a specific year. It reflects the value of all goods and services produced while factoring inflation into its calculation.

Growth investing is a stock-buying strategy that looks for companies that are expected to grow at an above-average rate compared to their industry or the broader market. Growth investors tend to favor smaller, younger companies poised to expand and increase profitability potential in the future.

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively search for stocks they think the stock market is underestimating.

ARK Investment Management LLC is the investment adviser to the ARK Funds.

Foreside Fund Services, LLC, distributor.

Neural networks are a type of artificial intelligence (AI) that uses a network of interconnected nodes to process data. They are a machine learning (ML) process called deep learning.

To learn more about the economics of the historical points noted below, investors should read Winton, B. 2024. “Platforms Of Innovation: How Converging Technologies Should Propel A Step Change In Economic Growth.” ARK Investment Management LLC. https://www.ark-invest.com/white-papers/platforms-of-innovation

We use GPT 4 prompting to survey a comprehensive list of general purpose technologies using the identification framework detailed in https://core.ac.uk/download/pdf/85004244.pdf. Where available, we sample academic literature to assess attributable economic impact. We feed GPT-4 a scoring rubric to assess technology-by-technology impacts. The directly measured impact is matched against the scoring to tune all scores to produce technology-by-technology estimates of economic impact (even when direct measures of economic impact are unattainable). Consistent with GPT theory, these technologies are assumed to go through a period of investment where economic impact is negative before productivity advances begin to realize into economic data. A more complete detailing of this methodology is forthcoming.

Investors can learn much more about ARK’s approach to strategic allocation in Hartman-Boyce et al. 2025.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.