INTRODUCTION

Artificial Intelligence (AI) is reshaping industries, and we believe it could be a long-term growth driver more impactful than the internet. During the second quarter, ChatGPT captured the imagination of businesses and consumers, unleashing excitement that sparked a rally in mega-cap technology stocks. Seemingly, many investors assumed that benchmark-heavy incumbents that came of age during the internet revolution would benefit disproportionately from the AI revolution as well.

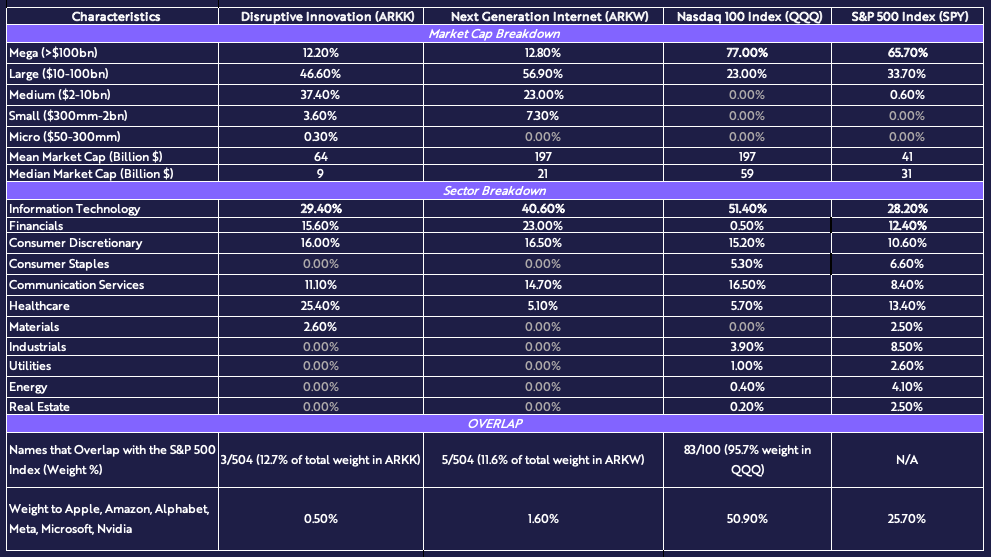

Since 2014, with tech-specific domain expertise, ARK analysts have focused on the industries, companies, and stocks that ARK believes are likely to be prime beneficiaries of the AI revolution. Given ARK analysts’ understanding of hardware, software, and applications, ARK portfolios offer significant exposure to the AI opportunity. While the S&P 500 Index[1] and the Nasdaq 100 Index[2] offer ample access to mega-cap technology stocks, we believe non-benchmark names are likely to accrue more value from AI over time.

This paper explores the potential merits of investing in AI-driven opportunities that are not in broad-based benchmarks like the S&P 500 Index and Nasdaq 100 Index and highlights how the rally in broad-based benchmarks this year could be the precursor of a more comprehensive and productive mega trend.

1. THE RECENT AI-DRIVEN RALLY IN MEGA-CAP NAMES

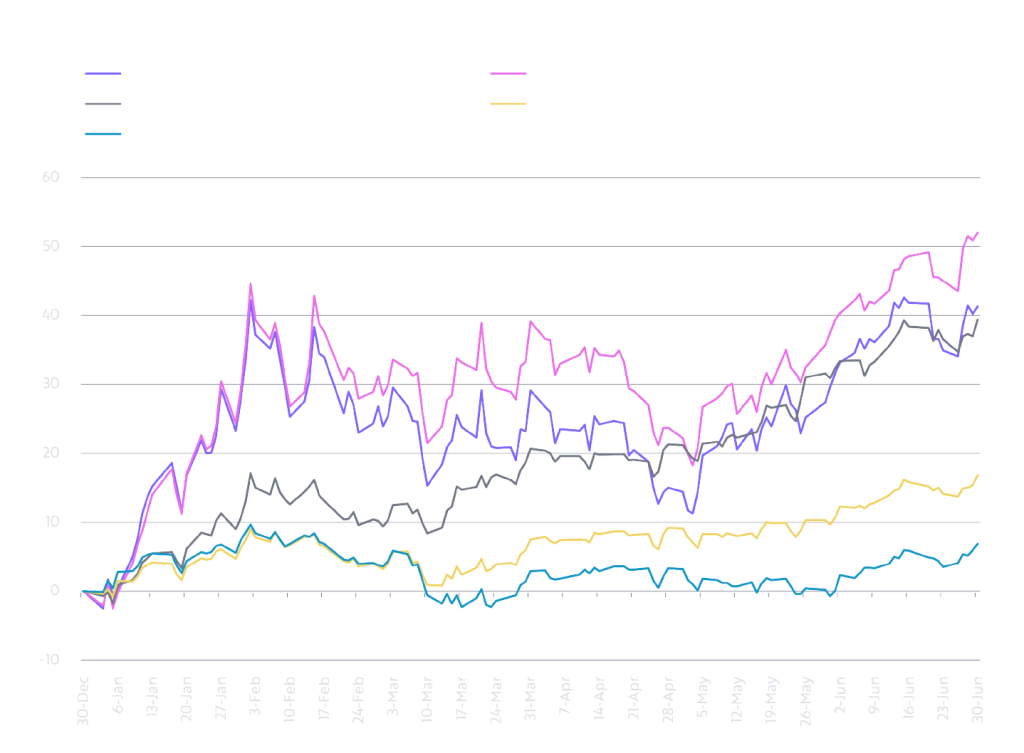

While disruptive innovation-based strategies rebounded and outperformed broader equity indices during the first quarter, market-cap weighted benchmarks with outsized exposures to mega-cap technology stocks took off in the second quarter. As of June 30, for example, Apple, Microsoft, Alphabet, Nvidia, Meta Platforms, and Amazon constituted 51.0% of the Nasdaq 100 Index’s market-cap, as represented by the QQQ, but accounted for 68.8% of its 39.4% rally year-to-date.[3] Removing those mega-cap names[4] and normalizing the weight of the remaining holdings, the Nasdaq 100 would have returned not 39.4%, but 27.9%.

Just as striking, the market-cap-weighted S&P 500 Index, as represented by the SDPR S&P 500 ETF (SPY), returned 16.8% while the equal-weighted version, as represented by the Invesco S&P 500 Equal Weighted ETF (RSP), returned 6.9%—a clear sign that mega-cap exposures have been carrying performance, as shown in the chart below.

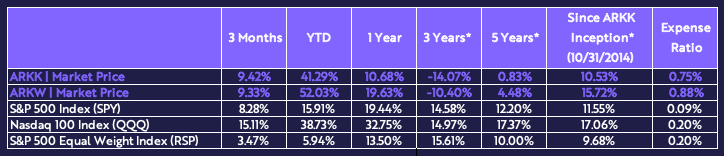

Despite minimal overlap with “big tech” stocks and relatively high exposure to health care and smaller-cap stocks, the ARK Innovation ETF (ARKK) Disruptive Innovation strategy has outperformed the Nasdaq 100 Index (QQQ), as shown below.[5] Through mid-year, ARKK returned 41.3% while the Next Generation Internet ETF (ARKW) returned 52.0%. In our view, their outperformance suggests that the rally favoring innovation is broadening out, a healthy signal that could call into question the “big tech” valuations that benefited from a crowding in to “safe” benchmark stocks.

Source: ARK Investment Management LLC, 2023. Based on data from YCharts and Bloomberg as of June 30, 2023. Past performance does not guarantee future results. The returns shown are net of the ETF’s expenses but do not reflect the payment of any brokerage commissions or brokerage costs incurred as a result of buying or selling fund shares and do not reflect the deduction of taxes to which an investor would be subject as a result of owning or selling shares of the fund. If they did, the returns would be lower than those shown. The ARK ETFs are actively managed, meaning they do not adhere strictly to the composition of an index and may invest in securities that are not included in an index. In contrast, the Invesco and SPDR ETFs are passively managed, meaning the composition of their portfolios closely track an index.[6]

*Annualized performance has been represented for periods longer than one year

For NAV performance figures for ARKK and ARKW, as well as other datapoints, please visit click here and navigate to ARKK and ARKW respectively.

Source: ARK Investment Management LLC, and Bloomberg, as of June 30, 2023. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares when redeemed may be worth more or less than the original cost. For the Fund’s most recent month end performance, please visit www.ark-funds.com or call 1-800-679-7759. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

2.POTENTIAL RISKS IN MEGA-CAP INCUMBENTS

While they have benefited disproportionately from the AI boom thus far, our research suggests that many of the blue-chip, mega-cap stocks are sporting high relative valuations[7] and are, themselves, at risk of disruption.[8]

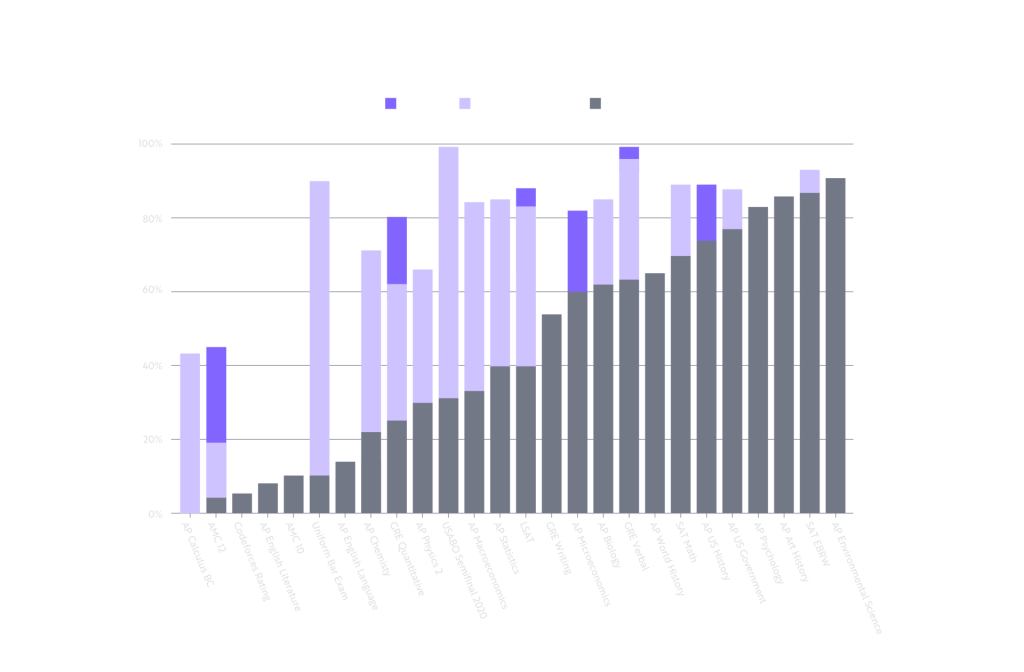

Concentrated Exposures to Mega-Cap Names: From a portfolio management perspective, investing in the well-known benchmarks exposes investors to concentrated risk in a few well-known companies whose fortunes heavily influence their overall performance. In contrast, given AI’s rapid and enormous advances, more diversified disruptive innovation strategies offer exposures across a range of smaller-cap non-benchmark stocks, mitigating—if not offsetting—the risks associated with holding big positions in a few mega-cap names in various indices, as shown below.[9] That said, active selection of smaller-cap securities is important, as these names often carry potential risks like higher volatility, lower liquidity, and business failure given earlier lifecycles.

Source: ARK Investment Management LLC, 2023. Based on data from Bloomberg as of June 30, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. ARK ETF holdings and characteristics are subject to change.

High Relative Valuations: Many mega-tech stocks are selling at relatively high valuations—in our view the result of investors checking-the-box and adding to well-known indices for quick exposure to AI.[10] Nvidia (NVDA), for example, is trading at a price-to-sales multiple of 40.5x[11] because of its dominant position as a provider of chips—the “picks and shovels”—for deep learning workloads. In 2014, when NVDA, split-adjusted, was selling AT $5, ARK increased an existing position in NVDA significantly based on research on autonomous vehicles.[12] Since inception in September 2014, NVDA was the fourth largest contributor to ARKK’s performance after Tesla (TSLA), Grayscale Bitcoin Trust (GBTC), and Invitae (NVTA), and the third and second largest contributor to the ARK Autonomous Technology & Robotics ETF (ARKQ) and the ARK Next Generation Internet ETF (ARKW), respectively. While we believe Nvidia is likely to remain a prime enabler and beneficiary of continued breakthroughs in AI, many other potential beneficiaries are not well understood, may sell at much lower valuations, and potentially could deliver significant revenue and earnings surprises on the high side of expectations.

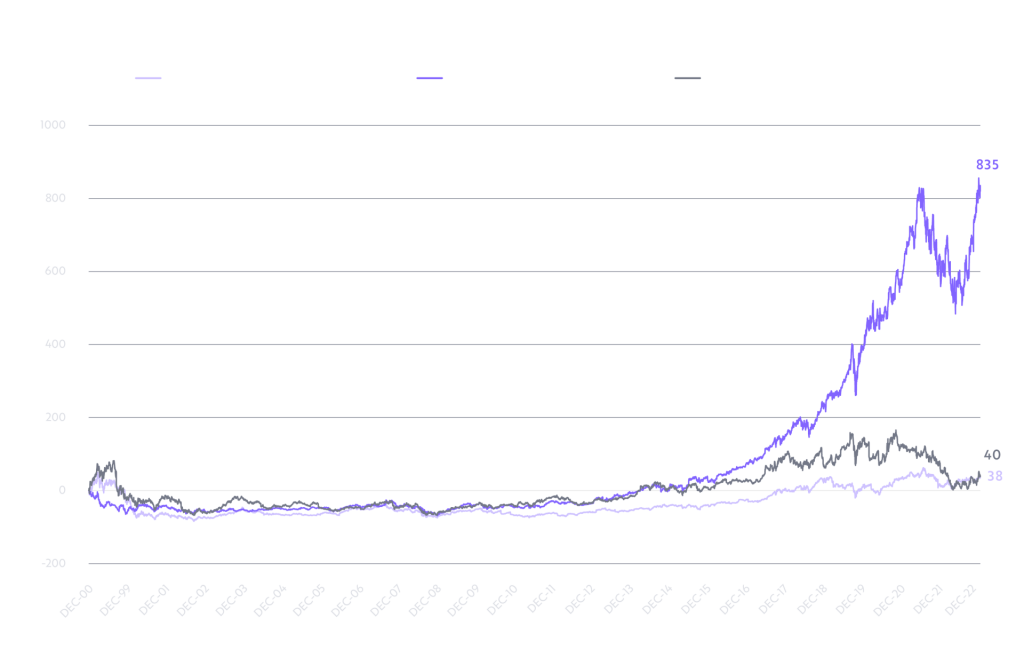

Historically, when technology hardware companies have sold above 25-times trailing twelve-month revenue, subsequent returns have suffered. Cisco Systems (CSCO) is a good case in point. After growing revenues approximately 20-fold and 10-fold from 1990 to 1994[13] and 1994 to 2000, respectively, CSCO peaked at 61x trailing twelve-month revenues in early 2000.[14] Since the turn of the century through June 30, 2023, CSCO’s annualized total return has averaged 1.4% compared to 7.0% for both the Nasdaq 100 Index (as determined by QQQ) and the S&P 500 Index (as determined by SPY).[15]

Typically, software companies command higher multiples than hardware companies, thanks to higher, less cyclical growth and margins. CSCO was a terrific performer during the 1990s but, in retrospect, investors should have redeployed some, and eventually all, of that capital as personal computers boomed, benefiting Wintel—both software (Microsoft’s Windows) and hardware (Intel)—as shown below.[16] Also, important to note relative to the dawn of the internet age at the end of 1994, CSCO accounted for only 2.5% of the S&P’s Information Technology (IT) sector and just 0.2% of the overall S&P 500 Index. Today, NVDA accounts for 4.7% of the S&P’s Information Technology (IT) sector and 2.8% of the overall S&P 500 Index (as well as 6.9% of the Nasdaq 100 Index).

Source: ARK Investment Management LLC, 2023. Based on data from Y-Charts. Data through June 30, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Compared to NVDA, many AI potential beneficiaries in ARK’s portfolios are valued more attractively, as shown in the table below. TSLA, for example, trades at 9.6x sales but in our view could be the largest AI beneficiary—and is the largest AI exposure across our strategies given the $8-10 trillion revenue opportunity and SaaS-like margins—that, according to our research, autonomous taxi platforms will deliver globally around the turn of the decade.

Source: ARK Investment Management LLC, 2023. Based on data from Bloomberg as of June 30, 2023. Price-to-sales multiple represents the current price per share of a company’s stock divided by the last twelve-month sales per share. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Product Disruption: Widely held mega-cap companies in general have enjoyed substantial growth over the past decade but could be reaching a level of market saturation that may stunt future growth prospects. Based on the ~70% decline per year in AI training costs,[17] our research suggests that smaller, more focused companies with visionary management teams, broad-based distribution, and proprietary data could be important beneficiaries. While mega-cap companies will allocate significant resources to AI, their innovation efforts are likely to be diffused across projects and divisions focused on older technologies, often the reason that large companies have missed subsequent waves of innovation. They also could face political obstacles associated with privacy and anti-trust considerations. Intel missed the technology transition, for example, from personal computers to mobile computing and mobile phones.

Our research suggests that AI could disrupt the once reliable, cash-cow businesses of large market incumbents. OpenAI’s ChatGPT could threaten Apple and Alphabet by disrupting the App Store and Google Search, respectively. OpenAI’s product plugins for ChatGPT enable chatbots to interact with external data and services: they can search for real-time information on the web, order groceries from local stores, and book flights, hotels, or rental cars at the lowest prices anywhere in the world. Who needs special purpose apps when a general-purpose interface can provide answers across the open web? In other words, large language models could become operating systems, giving developers a way to avoid the 15-30% platform tax that dominates Apple’s recurring revenue stream. Google’s revenue also hinges on consumers and businesses searching and moving from website to website. Now, consumers and businesses can harness ChatGPT with plugins to get answers free of advertising, putting Google’s primary revenue driver at risk.

In other words, tech’s center of gravity is shifting dramatically. Large language models are presenting super-exponential growth opportunities that could leave mega-cap tech companies flat-footed.

3. THE NEXT WAVE IN AI VALUE ACCRUAL

In response to ChatGPT, Nvidia’s (NVDA) powerful stock rally during the past few months gave us an opportunity to describe ARK’s portfolio positioning around AI based on three factors:

- Productivity: Generative AI can deliver astounding productivity gains across industries.

- AI Hardware Demand: Generative AI requires new hardware stacks.

- AI Software Pull-Through: Hardware investment precedes the much larger monetization of AI software.

Productivity: Generative AI applications are boosting productivity dramatically across a spectrum of job classifications. Large language models, for example, are transforming software development, according to a Github study[18] illustrating that its Copilot coding assistant increases the job satisfaction associated with coding and reduces the time required by 55% to complete software development. Suggesting that this kind of productivity gain will scale across industries, GPT-4[19] scores in the 90th percentile on the Uniform Bar Exam, 9X better than two-year-old GPT-3.5, as shown below.

Source: OpenAI. 2023. “GPT-4.” https://openai.com/research/gpt-4. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

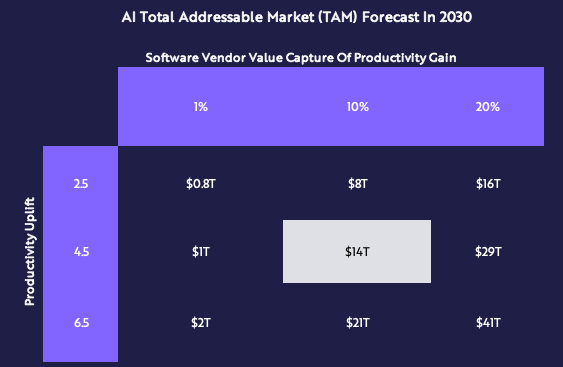

According to our research, artificial intelligence software could boost the productivity of knowledge workers roughly four-fold globally by 2030. On a knowledge worker wage base of $32 trillion, global productivity could lower costs by nearly half, as shown below.

Note: Product Uplift represents 2.5X, 4.5X, and 6.5X. For example, 2.5X would be an increase of 150%. Source: ARK Investment Management LLC, 2023. Based on data from “Big Ideas 2023”—Ark Investment Management LLC, 2023. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

AI Hardware Demand: The generative AI revolution requires new infrastructure investment in AI accelerators purpose-built for neural network workloads that run at scale. ARK research suggests that the spending on AI-driven data centers will rise 53% at an annual rate, from $18.8 billion in 2021[20] to $937 billion, by 2030, and at a 44% rate between 2025 and 2030, a potential boon for chip manufacturers such as NVIDIA.

As validated by NVIDIA’s recent guidance for the July quarter, the accelerated growth is starting with AI hardware. Not as well understood, however, is the competition that NVIDIA might face over the next 3-5 years. Horizontal chip companies like Advanced Micro Devices are entering the market while Amazon, Microsoft, and Google are developing their own hardware for training and inference workloads. Competition also will evolve from more special purpose vertical integration strategies tailored to particular use cases like Tesla’s Dojo[21] and Meta’s MTIA.[22] In June 2023, for example, Tesla forecast[23] that its AI training capacity would ramp more than 20-fold from 4.5 exaflops disclosed during AI Day in 2022 to 100 exaflops in the fourth quarter of 2024. In our view, while NVIDIA will continue to grow rapidly, horizontal and vertical competitors are well-armed to provide competition that financial industry models do not seem to be incorporating.

AI Software Pull-Through: According to our research, every dollar spent on AI hardware could support up to $21 of software revenue over its useful life.[24] In what could become “winner takes most” opportunities, companies with proprietary data, distribution advantages, and strong leadership should be best positioned to capitalize on the productivity gains and new markets created by artificial intelligence.

4. AI’S SLEEPER WAVE

Based on our research, ARK’s strategies offer promising exposures to artificial intelligence that do not seem to have hit quantitative research screens. Among the examples of high-conviction names in several of our public equity strategies, including the ARK Disruptive Innovation Strategy (ARKK) and the ARK Next Generation Internet Strategy (ARKW), are the following:

UiPath. UiPath Inc. provides an end-to-end automation platform with a range of robotic process automation (RPA) solutions across all industries. The platform aims to enable even non-technical end-users to create application-specific automation with little-to-no coding skills. The company also focuses on emulating human behavior by leveraging both artificial intelligence/machine learning (AI)/ML) and application programming interfaces (APIs).[25] Our research suggests that other companies in this space rely too heavily on API’s that are far-removed from natural human behavior and decision making. UiPath’s emphasis on low-code no-code interfaces emphasizes flexibility, scalability, and ease, as well as low learning curves requiring no proprietary AI/ML models or changes to the customer’s infrastructure. We maintain high conviction in UiPath’s ability to integrate Robotic Process Automation (RPA) into many business processes across large enterprises globally.

Twilio. In our view, Twilio is building the leading customer communication platform including core messaging APIs and a suite of software products. Based on its Flex contact center software product and Segment, its customer data platform, Twilio seems best positioned to introduce artificial intelligence into customer communication channels. With significant data assets across billions of business-to-consumer interactions, Twilio can train artificial intelligence models to service a wide range of use cases and verticals. Over time, its application software revenue should increase its gross margins. ARK has long-term conviction in Twilio and values the company’s potential to power modern enterprise-to-customer communications as mobile phone adoption grows globally. Twilio’s consumption-based pricing model allows customers to dial spend up or down easily, so macroeconomic conditions have depressed margins recently. As budgets normalize, we believe Twilio should benefit significantly from the AI opportunity.

The ARK Venture Fund, a closed-end interval fund, invests in several exciting private AI companies, among them Replit, MosaicML, and Anthropic,[26] as discussed below:

Replit. Replit is a modern browser-based coding platform with an embedded AI coding assistant used by millions of developers globally. Bounty, a marketplace for coding projects, recently launched the product. Based in San Francisco, Replit was co-founded in 2016 by programmers Amjad Masad, Faris Masad, and designer Haya Odeh. In our view, coding is the next frontier for collaborative tools, after Google Docs and Figma in writing and design. We believe Replit’s architecture, language support, and community put it in a strong position to lead the collaborative software development movement.

MosaicML. MosaicML provides infrastructure and software tools that enable customers to train large-scale artificial intelligence models more efficiently than large language models. Serial entrepreneur CEO Naveen Rao founded and led Nervana Systems, a deep learning startup that Intel acquired for $400 million in 2016. Rao then served as Intel’s Corporate Vice President and General Manager of AI before founding Mosaic. Currently, training neural networks is inefficient, complex, and requires deep domain expertise. Building on its popular MosaicML composer open-source project, the MoasicML Cloud abstracts away the complexity of resource orchestration and applies a variety of acceleration methods to improve the efficiency of training neural networks. As an AI training software layer between customers and compute resources, we believe MosaicML is likely to capture a significant share of AI compute spend. To note, in June, Databricks announced that it will pay $1.3 billion to acquire MosaicML, representing an approximate 5x return on this name since its addition to our Venture Fund as the first investment in September 2022.

Anthropic. Anthropic is an AI startup co-founded by Dario Amodei, the former VP of Research at OpenAI. The company is conducting research and building AI products that put safety first. Claude, its first product, is a general-purpose large language model that leverages Anthropic’s research on Constitutional AI to “align” the model and prevent abuse. While some companies might train their own AI models on proprietary data, others are likely to leverage a combination of proprietary and third-party models. In our view, Anthropic’s research on alignment positions it for success as a third-party model provider.

CONCLUSION

Investment vehicles that track broad-based indices have provided investors with easy-to-access, diversified exposures historically. In our view, the rapidly evolving AI landscape is likely to disrupt major segments of the broad-based benchmarks. AI training costs have been declining at an average rate of 70%, roughly 3x, per year.[27] In our view, common benchmarks may not be capturing effectively this potential opportunity set. As such, it may be prudent to complement, hedge, or diversify core benchmark exposures by investing in alternative exposures. ARK Invest’s strategies, such as the Disruptive Innovation ETF (ARKK) and Next Generation Internet ETF (ARKW), should position investors to avoid the concentration risk associated with large benchmarks, tap into sleeper AI opportunities, and leverage the focus and agility of smaller companies. Around the corner of the benchmarks, investors have a potential opportunity to position themselves to reap gains from the growth of artificial intelligence. For more information, please visit ark-funds.com for a list of each ETFs holdings, including the technology exposures in ARK’s various strategies.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK Fund before investing. This and other information are contained in the ARK ETFs’ and ARK Venture Fund’s prospectuses, which may be obtained by visiting www.ark-funds.com and www.ark-ventures.com, respectively. The prospectus should be read carefully before investing.

An investment in an ARK Fund is subject to risks and you can lose money on your investment in an ARK Fund. There can be no assurance that the ARK Funds will achieve their investment objectives. The ARK Funds’ portfolios are more volatile than broad market averages. The ARK Funds also have specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Funds’ prospectuses.

The principal risks of investing in the ARK Funds include:

Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Equity Securities Risk. The value of the equity securities the ARK Funds hold may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those as¬sociated with investments in U.S. securities. Health Care Sector Risk. The health care sector may be affected by government regulations and government health care programs. Consumer Discretionary Risk. Companies in this sector may be adversely impacted by changes in domestic/international economies, exchange/interest rates, social trends and consumer preferences. Industrials Sector Risk. Companies in the industrials sector may be adversely affected by changes in government regulation, world events, economic conditions, environmental dam¬ages, product liability claims and exchange rates. Information Technology Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins.

Financial Technology Risk. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. Fintech Innovation Companies may not be able to capitalize on their disruptive technologies if they face political and/or legal attacks from competitors, industry groups or local and national governments. Blockchain technology is new and many of its uses may be untested. Blockchain and Digital commodities and their associated platforms are largely unregu-lated, and the regulatory environment is rapidly evolving. As a result, companies engaged in such blockchain activities may be exposed to adverse regulatory action, fraudulent activity or even failure. Communications Sector Risk. Companies is this sector may be adversely affected by potential obsolescence of products/services, pricing competition, research and development costs, substantial capital require¬ments and government regulation.

Cryptocurrency Risk. Cryptocurrency (notably, bitcoin), often referred to as ‘‘virtual currency’’ or ‘‘digital currency,’’ operates as a decentralized, peer-to-peer financial exchange and value storage that is used like money. Some of the ARK actively managed Funds may have exposure to bitcoin, a cryptocurrency, indirectly through an investment in the Bitcoin Investment Trust (‘‘GBTC’’), a privately offered, open-end investment vehicle. Cryptocurrency operates without central authority or banks and is not backed by any government. Even indirectly, cryptocurrencies may experience very high volatility and related investment vehicles like GBTC may be affected by such volatility. As a result of holding cryptocurrency, the Fund may also trade at a significant premium to NAV. Cryptocurrency is also not legal tender. Federal, state or foreign governments may restrict the use and exchange of cryptocurrency, and regulation in the U.S. is still developing. Cryptocurrency exchanges may stop operating or permanently shut down due to fraud, technical glitches, hackers or malware. Leverage Risk. The use of leverage can create risks. Leverage can increase market exposure, increase volatility in the Fund, magnify investment risks, and cause losses to be realized more quickly.

Additional risks of investing in ARK ETFs include market, management and non-diversification risks, as well as fluctuations in market value NAV. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

The ARK Venture Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. You should not expect to be able to sell your Shares in the ARK Venture Fund other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

Index Descriptions: The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. The Nasdaq 100 Index is a stock market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

ARK Investment Management LLC is the investment adviser to the ARK Funds.

Foreside Fund Services, LLC, distributor.

The S&P 500® Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the US stock market.

The NASDAQ-100 Index is a stock market index that includes 100 of the largest, most actively traded, non-financial companies listed on the Nasdaq Stock Market.

As represented by the Invesco QQQ ETF (QQQ) that passively tracks the index.

In this analysis we removed the following names: Amazon, Apple, Alphabet, Meta Platforms, Microsoft, and Nvidia.

ARKK also has diversified exposure to life sciences companies that industry headwinds like the Inflation Reduction Act have affected adversely.

Objectives, risks, fees, and other characteristics will vary for the funds represented in the chart and table. ARKK is an actively managed Exchange Traded Fund (ETF) that seeks long-term growth of capital. It seeks to achieve this investment objective by investing under normal circumstances primarily (at least 65% of its assets) in domestic and foreign equity securities of companies that are relevant to ARKK’s investment theme of disruptive innovation. ARK defines ‘‘disruptive innovation” as the introduction of a technologically enabled new product or service that potentially changes the way the world works. The fund was incepted in in October 2014 and currently has approximately $8.0bn in AUM. ARKW is an actively managed ETF that seeks long-term growth of capital by investing under normal circumstances primarily (at least 80% of its assets) in domestic and U.S. exchange traded foreign equity securities of companies that are relevant to the Fund’s investment theme of next generation internet. The Adviser believes companies within this ETF are focused on shifting technology infrastructure to the cloud, enabling mobile, internet-based products and services, new payment methods, big data, artificial intelligence, the internet of things, and social media. The fund was incepted in September 2014 and currently has approximately $1.4bn in AUM. The SPDR® S&P 500® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index (the “Index”). The S&P 500 Index is a diversified large cap U.S. index that holds companies across all eleven GICS sectors. Launched in January 1993, SPY was the very first exchange traded fund listed in the United States. It currently has over $400bn in AUM. Invesco QQQ is an exchange-traded fund based on the Nasdaq-100 Index®. The Fund will, under most circumstances, consist of all of stocks in the Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The fund was incepted in March of 1999 and currently has over $200bn in AUM. The Invesco S&P 500® Equal Weight ETF (Fund) is based on the S&P 500® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index equally weights the stocks in the S&P 500® Index. The fund was incepted in April 2003 and currently has over $40bn in AUM. These funds are subject to risks associated with ETFs and the equity markets, including daily volatility, liquidity, and other associated risks. In addition, the risk profile for each fund will differ given that each fund has its own objective, as outlined above. Please visit the prospectuses for the individual funds to learn more about potential risks.

In this context, valuation represents the process of estimating the current (or projected) value of a company in the public equity markets. There are many ways to value a company, including common ratios like price to sales.

ARK’s investment process reflects our belief that true disruptive innovation causes rapid cost declines, increases demand, cuts across sectors and geographies, and spawns further innovation—all of which stimulates growth over extended time horizons. This disruption can impact incumbent companies’ existing business models.

Readers may visit ark-funds.com to review the Technology Breakdown composition within ARK’s funds, which is a better representation than Sector Breakdown in terms of how ARK researches and invests in technology.

By “check-the-box” we refer to the practice in which investors, whether fund managers, financial advisors, or others, purchase shares of commonly held index names in an effort to align with the weights of an index.

Data from Bloomberg, as of June 30, 2023.

ARK invested in NVDA in 2014 upon the inception of our flagship strategy (ARKK), based on the company’s leadership in designing gaming chips. In 2015, we increased our position in NVDA when its market cap was less than $10bn, because we understood the potential use of GPUs for autonomous driving and deep learning—two considerations that the market underappreciated at the time. As a result, ARK and our investors experienced meaningful material gains from NVDA over time, as the stock was the fourth largest contributor to ARKK’s performance since its inception in 2014 through May 31, 2023. We continue to believe that Nvidia will be a direct beneficiary of the explosive interest in generative AI based on its accelerated computing hardware products. The company also should benefit further from sequential growth in its Gaming segment now that an inventory build-up in the channel has eased. Due to its unique hardware and software stack, we expect its leadership to continue and hold the stock in some of our specialized portfolios.

1994 can be considered the dawn of the internet age.

Source: Bloomberg.

Source: Bloomberg. Total Return includes the reinvestment of dividends. The Price Return (excluding the reinvestment of dividends) for CSCO paints a starker picture: CSCO returned a cumulative -3.4% over the same period compared to the S&P 500 Index’s return of 202.9% and the Nasdaq 100 Index’s return of 309.4%.

Source: Y-Charts. Data through June 30, 2023.

Sources: ARK Investment Management LLC. 2023. “Big Ideas—Artificial Intelligence.” https://ark-invest.com/big-ideas-2023/artificial-intelligence; Venigalla, A. et al. 2022; Li, C. 2020. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Kalliamvakou, E. 2022. “Research: quantifying GitHub Copilot’s impact on developer productivity and happiness.” GitHub. https://github.blog/2022-09-07-research-quantifying-github-copilots-impact-on-developer-productivity-and-happiness/

OpenAI. 2022. https://openai.com/research/gpt-4

Morgan, T. P. 2023. “Software Eats The World, And AI Eats Software.” The Next Platform. www.nextplatform.com/2023/03/08/software-eats-the-world-and-ai-eats-software/

Lambert, F. 2021. “Tesla unveils Dojo supercomputer: world’s new most powerful AI training machine.” Electrek. https://electrek.co/2021/08/20/tesla-dojo-supercomputer-worlds-new-most-powerful-ai-training-machine/?utm_campaign=Sunday%20Newsletter&utm_medium=email&_hsmi=260384708&_hsenc=p2ANqtz-9n6tuM15F5tpxOIUdZ_ZeDmI6BF0vIt3TOpWdgvrCHW4XEM5pBYcnAksIL9sDiy8w2VYSPbf5iEq1-6Ut-KqM0tQ4hag&utm_content=260384708&utm_source=hs_email

MetaAI. 2023. “MTIA v1: Meta’s first-generation AI inference accelerator.” https://ai.facebook.com/blog/meta-training-inference-accelerator-AI-MTIA/?utm_campaign=Sunday%20Newsletter&utm_medium=email&_hsmi=260384708&_hsenc=p2ANqtz-9BEj_KZg-5Zi_iTga0qpVVAdbvZPWdWvVlHJdCM6JDn0yO4kDxghGgOpnBtg3l6OktKqJ8CAaDAzyuI6OQU2Dj3kFpTQ&utm_content=260384708&utm_source=hs_email

For more details on Tesla’s forecast update, see Downing, F. 2023. “Tesla forecasts ramping up to 100 exaflops of AI training capacity by Q4 2024.” Twitter. https://twitter.com/downingARK/status/1671987717553389568?cxt=HHwWgICw2Y7-i7QuAAAA

This estimate assumes that AI software vendors can achieve a 75% gross margin deployed on public cloud infrastructure, and that public clouds operate at a 50% gross margin, with a 4-year average server life.

An application programming interface (API) is a type of software interface that provides the means for two or more computer programs to communicate with each other.

Winton, B. 2023. “ARK Venture Commentary, 5/23/2023.” ARK Investment Management LLC. https://ark-ventures.com/newsletters/ark-venture-commentary-5-23-2023/

ARK Investment Management LLC. 2023. “Big Ideas—Artificial Intelligence.” https://ark-invest.com/big-ideas-2023/artificial-intelligence/

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.