Are Your Healthcare Investments Fit for the Future?

This is a guide for investors reassessing their healthcare allocations—or building new healthcare positions—at what we believe is a pivotal moment for medical innovation. By unpacking the key layers of the emerging multiomics landscape—from high-throughput data generation to AI-powered diagnostics and next-generation therapies—we aim to help investors evaluate whether your portfolio is positioned to capture the transformational investment opportunities ahead. Understanding the transformation of traditional healthcare is a crucial step in distinguishing between investment funds that passively track the sector and those poised to benefit from the value creation that will occur at the intersection of AI, big data, and multiomics. ARK’s research suggests that these are the foundational technologies set to define how our generation detects, treats, and ultimately cures disease. The transformation is happening now.

Table of Contents

- Investment Thesis

- The Multiomics Flywheel

- ARK Genomic Revolution ETF (“ARKG”): Positioning Your Portfolio to Capture the Future of Medicine

- (3.1) Why ARKG Is Overweight Gene Editing

- (3.2) Why ARKG Is Overweight AI-Driven Biotech

- (3.3) Why ARKG Is Overweight Big Biological Data

- (3.4) Why ARKG Is Underweight Traditional Pharma And Legacy Biotech

- Our Unwavering Focus

- Fund Overview

1.0 Investment Thesis

Our healthcare system has been a sick care system for decades, desperately trying to treat disease after it manifests instead of preventing it in the first place. But a revolution shaped by “P4 medicine”—Preventive, Predictive, Personalized, and Participatory—is transitioning our system from reactive to proactive care.

The ascendance of big data science at its core, the convergence of multiomics tools, artificial intelligence, and precision medicine is transforming healthcare into a data-driven discipline. The AI-powered transformation enables applications that range from early diagnostics to drug discovery to reliable curative therapies. These capabilities are expected to reshape fundamentally how we detect, treat, and prevent disease.

The transformation in how we detect, treat, and prevent disease powers the investment thesis of the ARK Genomic Revolution ETF (ARKG).

.png)

2.0 The Multiomics Flywheel

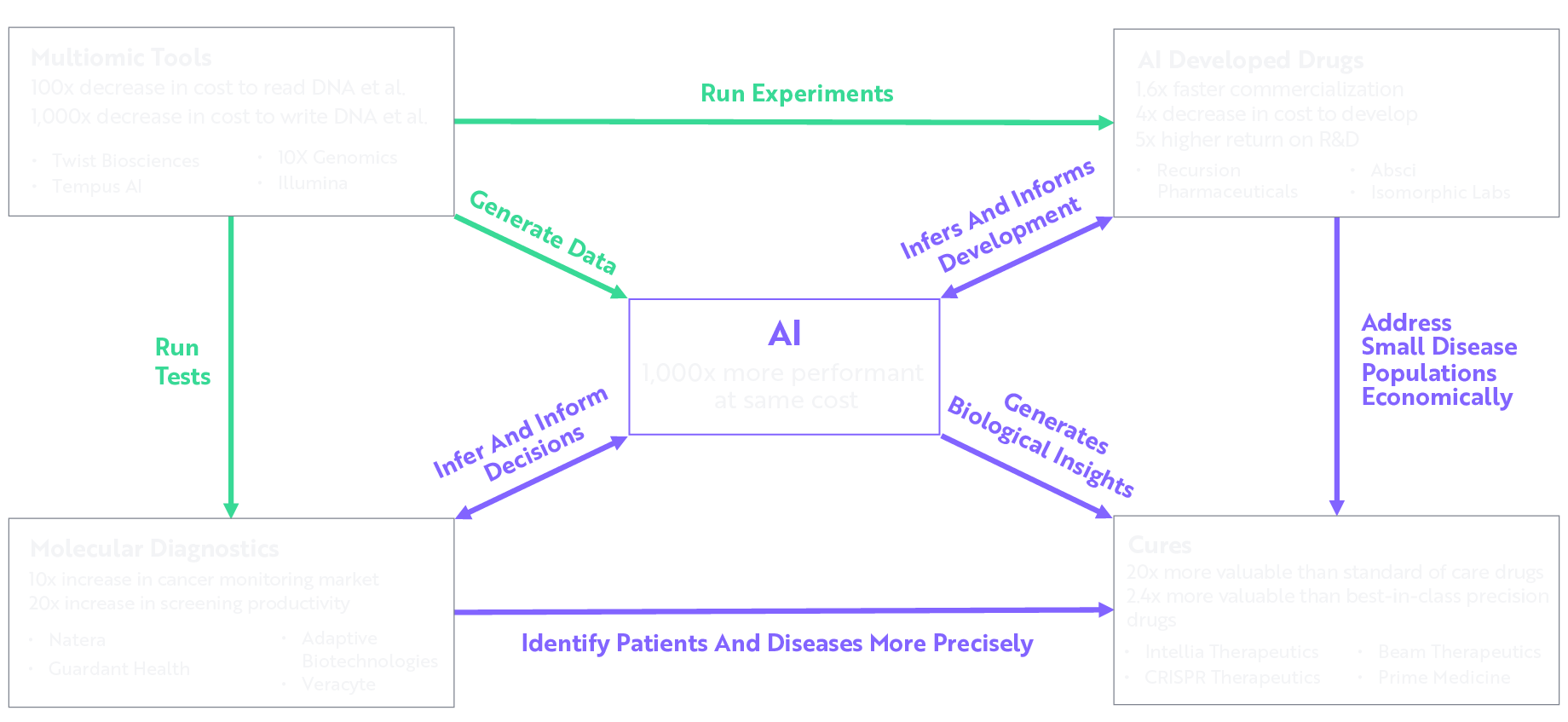

ARK’s proprietary Multiomics Flywheel blueprint illustrates how AI is powering a self-reinforcing loop that accelerates every aspect of multiomics—from generating biological data, to diagnosing diseases, to developing new drugs and cures, as shown below.1

*The multiomics performance statistics provided above represent ARK’s research-based forecasts for 2030, which may not be realized. The companies listed represent companies that are currently working toward achieving the forecasted results, but the list does not include all companies that may be pursuing the same goals, and which may do so more successfully. The companies listed may or may not be held in ARK portfolios. The information provided should not be used as the basis for any investment decision, and it should not be assumed that an investment in any of the companies listed was or will be profitable. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

*The multiomics performance statistics provided above represent ARK’s research-based forecasts for 2030, which may not be realized. The companies listed represent companies that are currently working toward achieving the forecasted results, but the list does not include all companies that may be pursuing the same goals, and which may do so more successfully. The companies listed may or may not be held in ARK portfolios. The information provided should not be used as the basis for any investment decision, and it should not be assumed that an investment in any of the companies listed was or will be profitable. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

How Does the Flywheel’s Self-Reinforcing Momentum Work?

Step 1: Multiomic tools are generating massive amounts of data (Chart Top Left)

- Advances in genomics, transcriptomics, and proteomics (together known as “multiomics”) have reduced the cost of reading and writing DNA by orders of magnitude.

- Companies like Twist Bioscience, Tempus AI, 10X Genomics, and Illumina are developing increasingly powerful tools to sequence and analyze DNA faster and more cost-effectively.

- These tools enable scientists to run more experiments at unprecedented speeds, accelerating our ability to read biology and collect data, thereby creating a virtuous cycle of discovery.

Outcome: The fundamental challenge in healthcare is that biology is an inherently complex system. Without rich, high-quality data, even the most sophisticated AI cannot deliver meaningful insights or solutions. Now we can generate vast amounts of data, the essential foundation for AI to work its magic.

Step 2: AI processes and analyses the data (Chart Center)

- AI has become the engine that ingests vast amounts of genomic, proteomic, and other multiomics data, transforming raw biological information to actionable insights for researchers.

- With AI now 1000x more performant at the same cost as a human,2 it can:

- Recognize disease patterns with greater speed and accuracy.

- Identify potential drug targets faster and more cost-effectively than any human.

- Predict molecular interactions at the atomic level, dramatically accelerating drug discovery.

Outcome: By transforming raw biological data into actionable insights, AI establishes the foundation for earlier, more precise diagnostics and higher-probability drug discovery.

Step 3: AI-powered molecular diagnostics identifies patients more precisely (Chart Bottom Left)

- AI-powered molecular diagnostics is transforming early disease detection and enabling precise patient stratification on individual biological profiles.

- In areas like cancer screening, molecular diagnostics has achieved a 10x-20x improvement in efficiency,3 significantly enhancing both speed and accuracy.

- Companies like Natera, Guardant Health, Adaptive Biotechnologies, and Veracyte are leading the development of next-generation molecular diagnostic tools.

Outcome: Now we can catch diseases earlier and match patients to the most effective treatments with greater precision, improving patient outcomes and reducing unnecessary interventions.

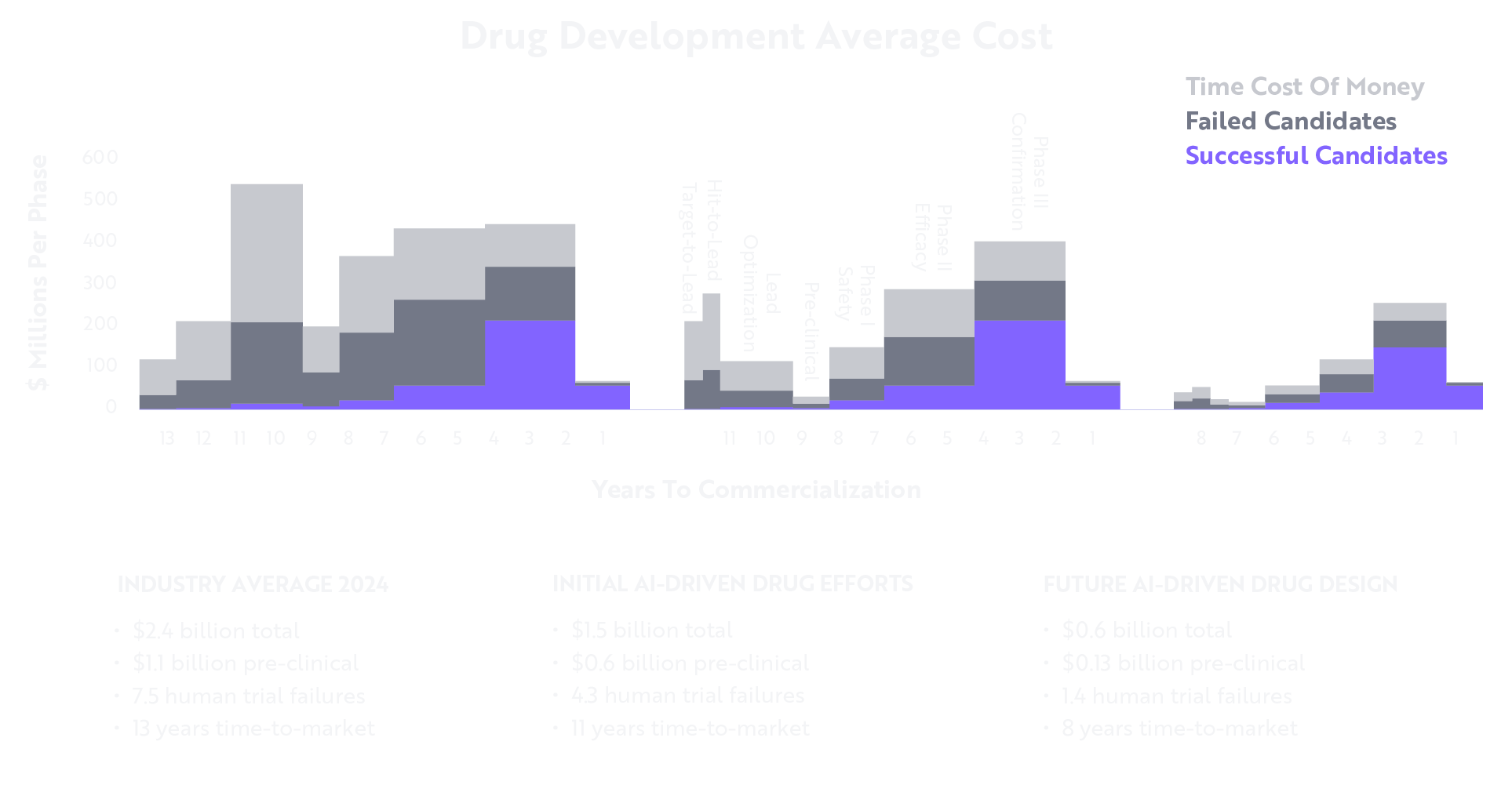

Step 4: AI accelerates drug development (Chart Top Right)

- AI leverages data from multiomics tools and diagnostics to design more effective drugs, delivering results with higher success rates more quickly and less expensively.

- The process then drives:

- Companies like Recursion Pharmaceuticals, Absci, and Isomorphic Labs are at the forefront of this AI-driven transformation in pharmaceutical development.

Outcome: AI’s transformation of drug development into a faster, smarter, and more cost-effective process unlocks the potential for scalable innovation and a higher probability of delivering life-saving therapies.

Step 5: Next-generation cures become possible (Chart Bottom Right)

- AI-driven drug discovery is unlocking the potential of gene-editing therapies and advancing precision medicine into new frontiers.

- Gene-editing pioneers like Intellia Therapeutics, CRISPR Therapeutics, Beam Therapeutics, and Prime Medicine are developing new curative treatments.

- These next-generation therapies are:

Outcome: AI and multiomics are reshaping medicine, making personalized, curative treatments feasible at scale.

The Self-Reinforcing Loop: AI + Multiomics = The Future of Medicine

The cycle continues:

- Multiomic tools generate better, less expensive, and larger biological data sets.

- AI processes those data to make sense of complex biological systems.

- AI-powered diagnostics detect diseases earlier and more precisely.

- AI accelerates drug discovery, reduces costs, and increases success rates.

- AI-driven cures emerge, offering next-generation treatments.

- Breakthroughs in drugs and diagnostics lead to more data, which feed back into AI and multiomic tools, improving the entire system.

This self-reinforcing system is transforming medicine—making faster, less expensive, and more precise diagnostics, AI-driven drug design, and once-impossible cures a scalable reality.

.png)

3.0 ARK Genomic Revolution ETF (ARKG): Positioning Your Portfolio for the Future of Medicine

ARK’s Multiomics Flywheel illustrates how AI, big data, and multiomics are transforming healthcare. Unfortunately, many healthcare and biotech funds remain tied to legacy approaches, investing in companies built on slow, trial-based R&D that either outsources AI capabilities or manages innovation through acquisitions. ARK’s research suggests that those companies will face mounting risks as medicine and healthcare become data-driven disciplines.

Key Message 1: ARKG is built for this future.

ARK invests in the innovators driving the next era of healthcare. Guided by our Multiomics Flywheel framework, ARKG provides targeted exposure to the technologies and companies leading this transformation across diagnostics, drug development, and next-generation therapies.

We believe investors should be asking:

- Does my current healthcare or biotech fund have a clear strategy to capture this future?

- Is my fund manager actively positioning me to reap benefits from the rise of AI, big data, and multiomics; or are they trapped in the past?

We believe that ARKG is highly differentiated from conventional healthcare, biotech and genomics funds. For example, ARKG is overweight gene editing. Why? Gene editing is expanding rapidly beyond rare genetic disorders into large markets like cardiovascular disease, cancer, and metabolic disorders. While many still perceive CRISPR as a niche technology with constrained use cases, companies like Vertex, in partnership with CRISPR Therapeutics, are demonstrating its potential to address numerous diseases affecting millions of patients.

Below, we outline the core pillars that differentiate ARKG from conventional healthcare, biotech, and genomics funds.

3.1 Why ARKG Is Overweight Gene Editing

Applications for gene editing are expanding, and so are its markets. While Vertex and CRISPR Therapeutics have demonstrated their curative potential in treating sickle cell disease and beta-thalassemia, their ambitions extend much further, and cardiovascular applications should be next in line.

The therapies offer the prospect of one-time cures, replacing chronic treatment regimens and introducing entirely new pricing models that could redefine healthcare economics.

Key Message 2: ARKG invests across the full gene-editing spectrum to capture growth.

Expanding Applications, Expanding Markets

Vertex and CRISPR Therapeutics have already shown curative potential in sickle cell disease and beta-thalassemia. Their ambitions, however, extend further, with cardiovascular applications expected to follow.

These therapies offer the prospect of one-time cures, replacing chronic treatment regimens and introducing entirely new pricing models that could redefine healthcare economics.

Comprehensive Exposure to Next-Generation Gene Editing

- CRISPR Therapeutics: A leader in Cas9-based gene editing, advancing multiple clinical programs.

- Intellia: A pioneer of in-vivo CRISPR trials, enabling direct therapeutic applications within the body.

- Beam Therapeutics: A developer of base-editing technology, offering greater precision with fewer off-target effects.

- Prime Medicine: A leader in prime editing, a versatile gene-editing platform with broad therapeutic potential. ARKG is one of the few major genomics funds providing exposure to Prime Medicine; many competitors offer none.

Why This Matters

Gene editing is evolving from treating rare diseases to addressing widespread conditions, significantly expanding the total market opportunity. Many competitor funds remain underweight in this space or are focused solely on first-generation CRISPR technologies, overlooking the shift toward advanced base- and prime-editing platforms.

Key Message 3: ARKG offers investors the most comprehensive exposure to the full evolution of gene editing.

3.2 Why ARKG Is Overweight AI-Driven Biotech

AI is revolutionizing drug discovery by replacing traditional trial-and-error research with computational modeling, machine learning, and automation. The shift is accelerating drug pipelines, reducing costs and increasing success rates. Despite this structural change, many healthcare and biotech funds remain anchored to legacy development models with limited AI integration.8

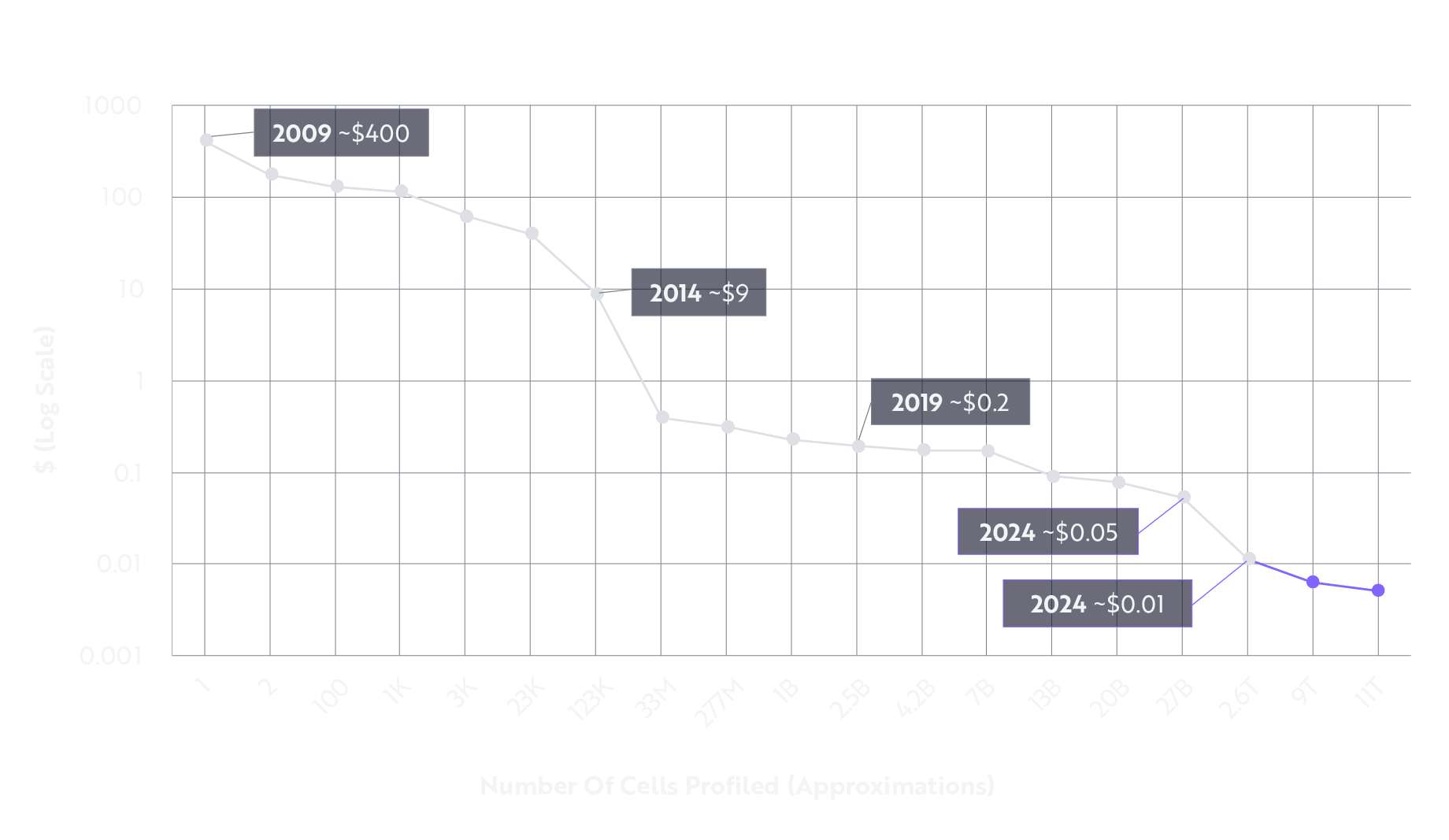

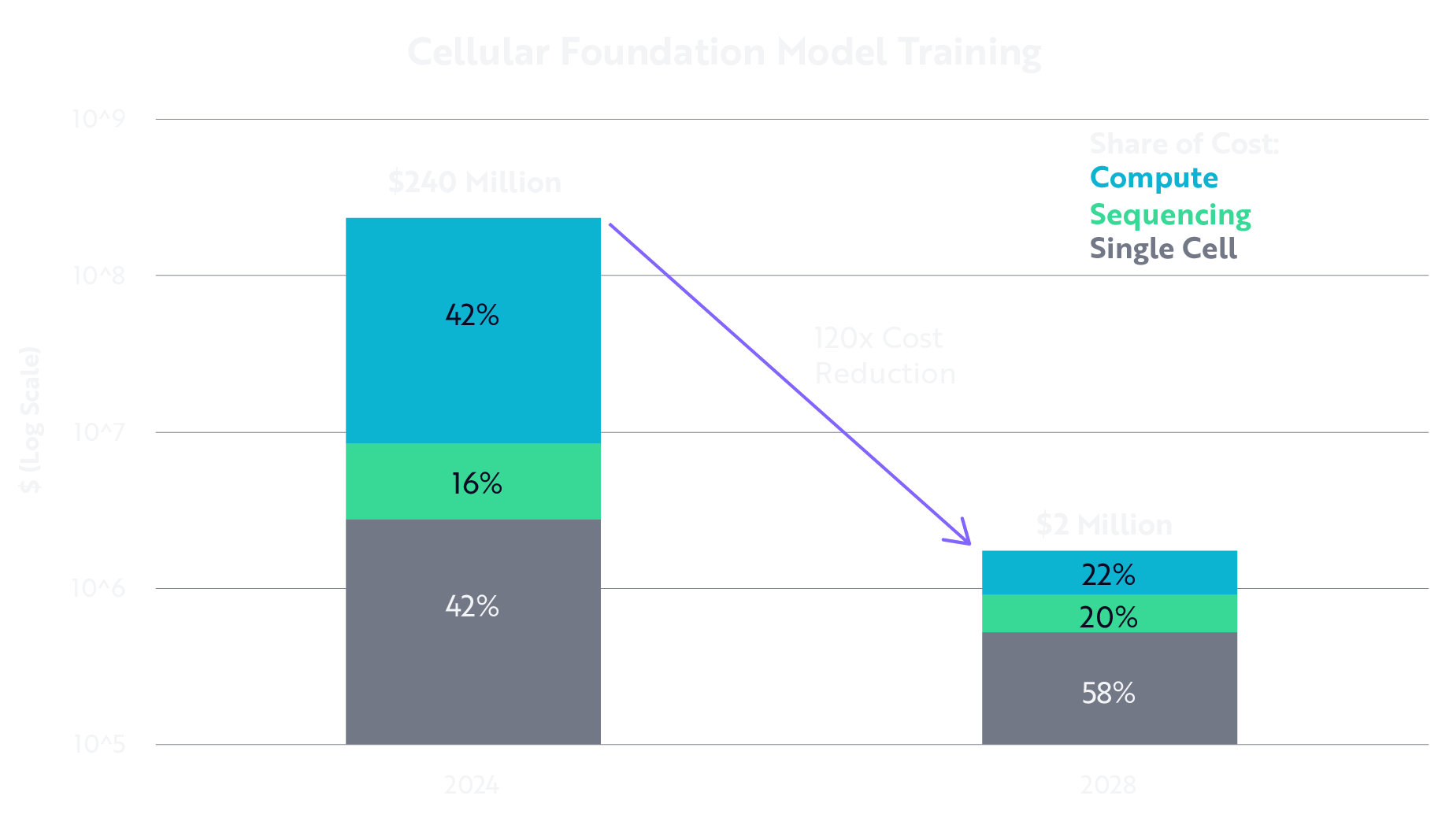

The charts below illustrate how AI is transforming the economics of drugs development. According to our research, trillion-cell experiments are feasible now that single-cell sequencing costs have dropped to $0.01 per cell. Virtual cell foundation models are likely to become the killer AI application in drug discovery and precision medicine. By 2028, virtual cell costs could drop ~120x, as shown below, and companies like 10x Genomics and Scale Bio are leading the way.9

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including Tang et al. 2009, Jovic et al. 2022, Ding et al. 2020, and Rood et al. 2024 as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Key Message 4: ARKG invests in the companies driving AI-led breakthroughs in biotechnology.

AI Tools and Platforms

- Recursion: Combines robotic automation and machine learning to conduct millions of cellular experiments, generating proprietary datasets that enhance drug discovery efficiency.

- Schrödinger: Develops physics-based computational simulations to optimize molecular structures, significantly reducing reliance on laboratory testing.

- Absci: Focuses on biologics, using deep learning for protein engineering to accelerate drug candidate identification.

These platforms leverage data, automation, and AI to make their business models inherently more scalable than traditional biotech firms.

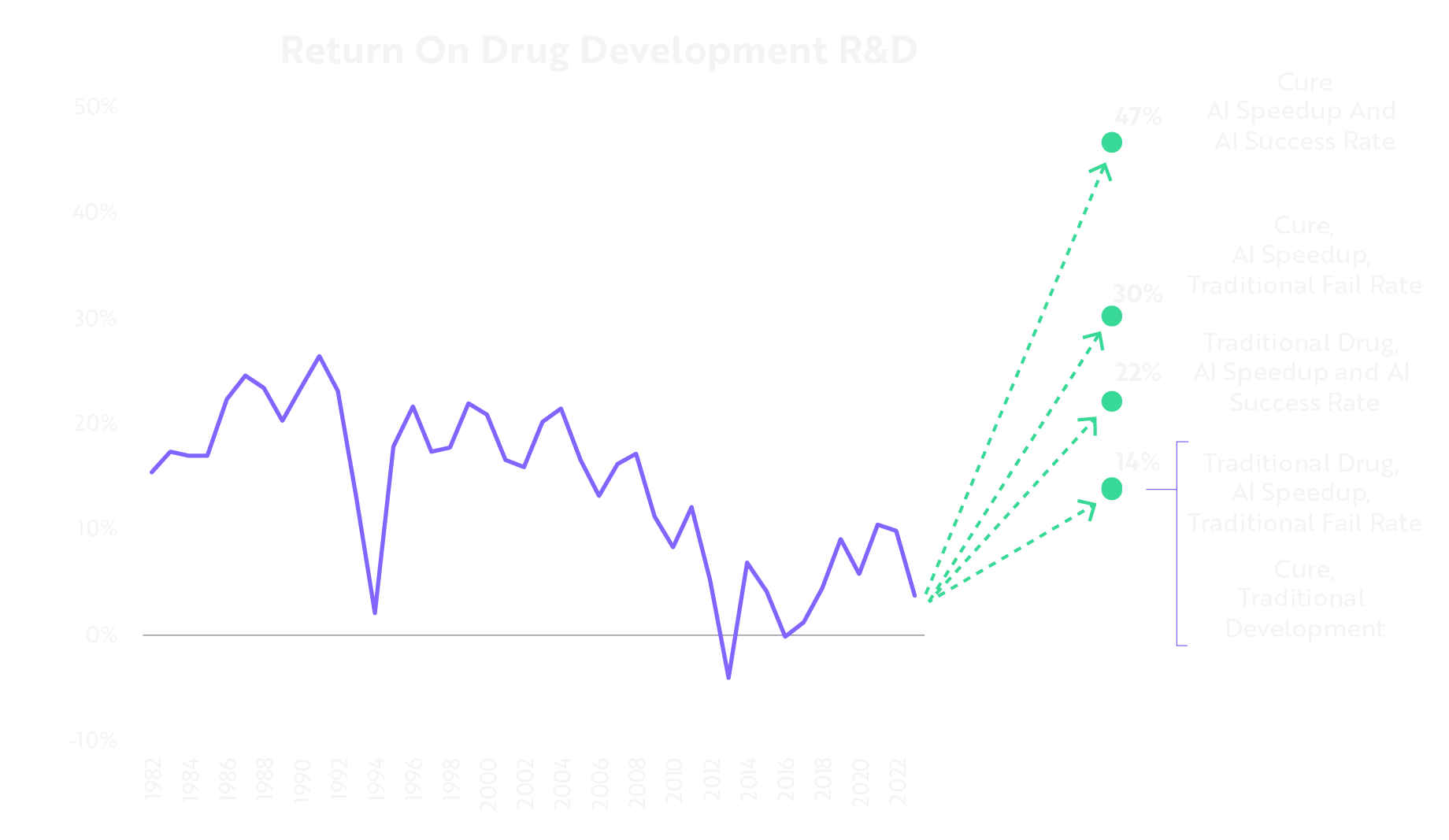

The charts below illustrate how AI is transforming the economics of drug development. Biotech valuations include little-to-nothing for the preclinical and Phase 1 stages of development, but increasingly they are likely to incorporate the higher probability of longer patent lives. AI-driven drug development could reduce time-to-market nearly 40% from 13 years to 8 years, while reducing total drug costs 4-fold, from $2.4 billion to $0.6 billion, as shown below.

Note: 10% discount rate, 2024 dollars. For initial AI-driven drug efforts, assumes 70+% failure reduction in phase I that moderates to 20% in phase II and phase III. For future AI-driven drug design, assumes demonstrated 70+% reduction in phase I failure rates that moderates to a 50% failure reduction in phase II and 25% failure reduction in phase III. Assumes that pre-clinical efficiency is similar to what Absci has indicated is achievable. Also assumes that licensing timeframe reduces to 12 months from 18 months for future drugs. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Strategic Big Pharma: Betting on In-House AI

While many large pharmaceutical companies depend on external AI partnerships, ARKG prioritizes those developing AI expertise internally, ensuring control over their innovation pipelines. Companies like Regeneron, Amgen, and Roivant distinguish themselves through proprietary datasets and internal AI-driven research and development, using genomic data to train predictive models and streamline drug development. Firms like Roche, Genentech, AstraZeneca, and Novo Nordisk balance external collaborations with meaningful internal AI investment.

Why This Matters

AI-driven drug discovery represents a fundamental shift in biotechnology, favoring companies that control both their data and the AI tools that harness it. Many competitor funds overlook these AI-native platforms and continue to favor established incumbents, missing the convergence of AI, automation, and data that is accelerating innovation.

Key Message 5: ARKG provides concentrated exposure to the companies at the forefront of this transformation.

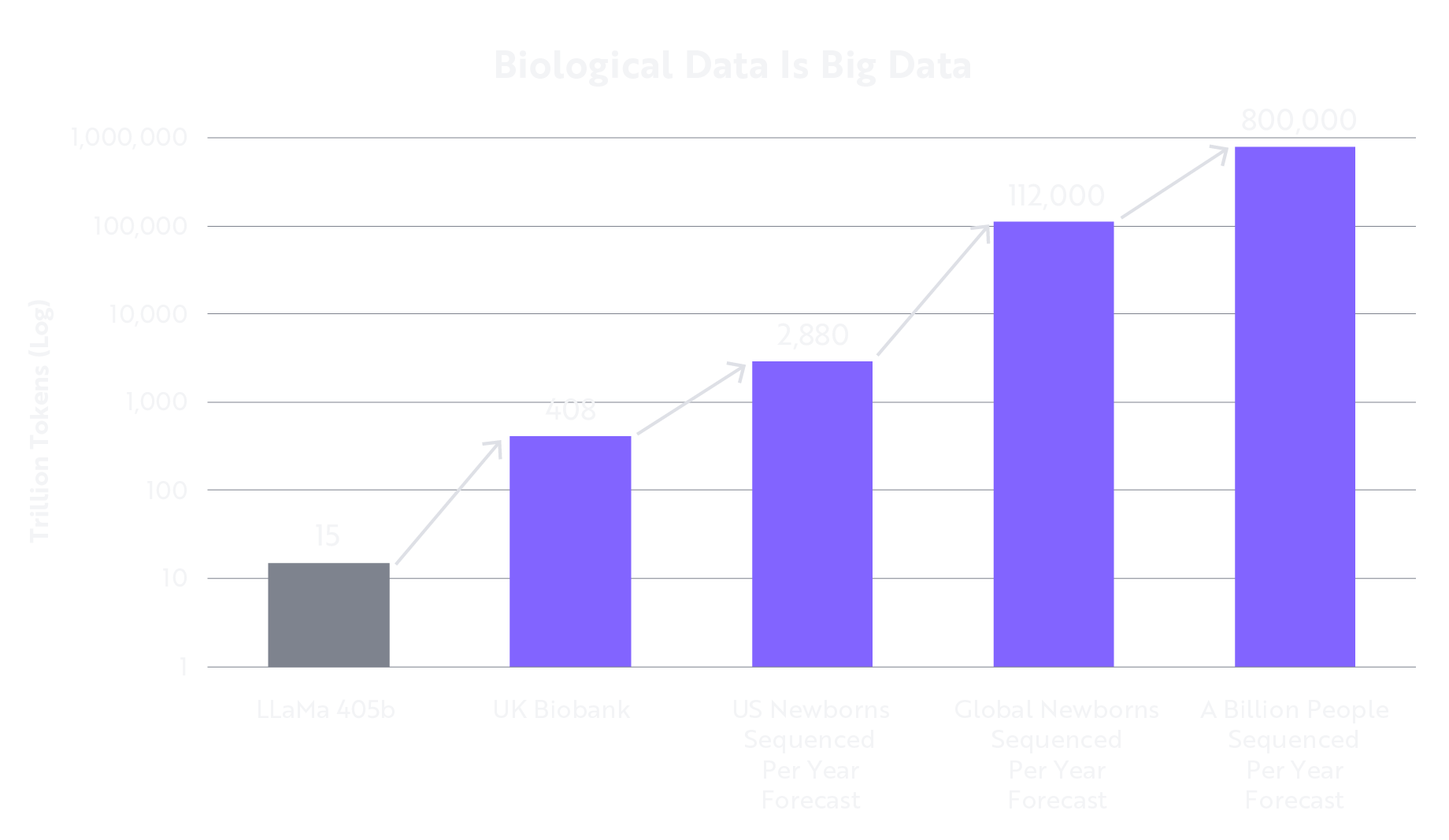

3.3 Why ARKG Is Overweight Big Biological Data

While every biotech company eventually will claim to be AI-driven, AI is only as powerful as the data on which it is trained. The true competitive advantage lies in owning and generating proprietary biological data at scale. Companies that run high-throughput experiments, create vast multimodal datasets, and use automation to refine AI models will lead the next phase of drug discovery and precision medicine, moving from automated discovery toward autonomous discovery, as shown below.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including UK Biobank as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including UK Biobank as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Key Message 6: ARKG invests in companies that combine AI, deep biological data, and automation to create self-reinforcing cycles of innovation.

Data Ownership is Fundamental

AI delivers meaningful results only when paired with proprietary data. Among large pharmaceutical companies, Amgen and Regeneron stand out because of their extensive genomic and experimental datasets, which provide a durable advantage over peers reliant on third-party data sources. Tempus AI has built the largest cancer-focused multimodal dataset, integrating genomic, transcriptomic, and clinical data to power AI-driven diagnostics and personalized medicine.

AI-Driven Molecular Diagnostics: Advancing Early Detection

Companies like Natera, Guardant Health, and Adaptive Biotechnologies leverage AI-powered multiomics to transform cancer screening and disease monitoring, significantly improving detection rates. Veracyte enhances diagnostic scalability by combining automation with AI, increasing screening productivity by up to twenty times.

Platform and Automation: Toward the Self-Driving Laboratory

Recursion conducts millions of cellular experiments that directly inform machine learning models, enabling drug discovery at scale. Quantum-Si advances protein sequencing technology, adding a critical layer of high-resolution biological data to fuel AI-driven insights.

Higher Returns Through Continuous Feedback Loops

Companies that integrate automation, AI, and proprietary datasets benefit from continuous feedback loops, enabling them to:

- Identify novel drug targets more rapidly.

- Reduce research and development costs through automated experimentation.

- Shorten time-to-market, generating superior long-term returns.

Why This Matters

As biotech firms increasingly market themselves as AI-driven, true differentiation will come from data ownership and integration. Most competitor funds allocate to companies that utilize AI but lack control over the proprietary data required to maximize its potential. AI-powered diagnostics are reshaping early disease detection, yet many funds remain underweight in this critical area of innovation.

Key Message 7: ARKG focuses on companies that own both the data and the discovery process, positioning investors to benefit from the full value of AI-driven healthcare.

3.4 Why ARKG Is Underweight Traditional Pharma And Legacy Biotech

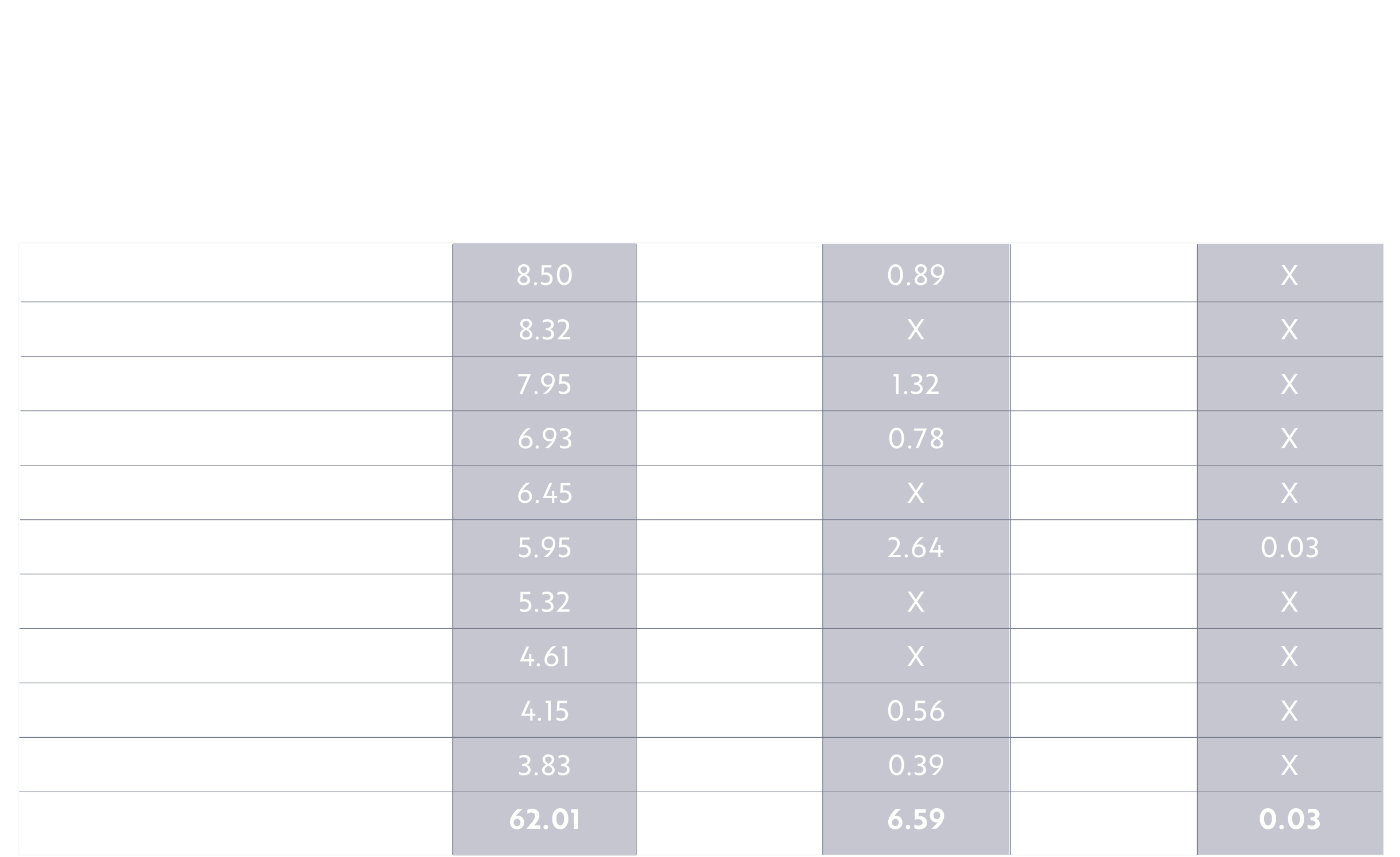

Many competitor funds remain concentrated in large-cap pharmaceutical companies and legacy biotech, despite the fundamental shift driven by AI, automation, and multiomics. Traditional healthcare firms risk falling behind as medicine becomes increasingly data-driven and innovation-led, as shown below.10

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Key Message 8: ARKG actively avoids exposure to legacy pharma and off-theme sectors, maintaining focus on the true drivers of healthcare innovation.

Avoiding the Legacy Biotech Trap

Numerous healthcare and biotech funds are heavily weighted toward large-cap companies like Pfizer, AbbVie, and Novartis—firms often centered on incremental improvements rather than transformative breakthroughs.

Our Contrarian Take

Large pharmaceutical companies generate stable cash flows but frequently lack internally driven innovation, relying on acquisitions to sustain their pipelines. This merger and acquisition model often results in paying premiums for externally developed drugs and technologies, capturing only a fraction of the value compared to companies that own their AI platforms, data, and next-generation tools. As AI-first platform companies emerge, a new trend is developing. Some firms, like Recursion, acquired CytoReason, however, illustrating that platform players aren’t acquisition targets only for big pharma. Indeed, while large pharmaceutical companies excel at integrating individual assets, they are less effective at leveraging entire AI-driven platforms.

Avoiding Thematic Drift

Competitor Overexposure: Many so-called genomics or biotech funds dilute their thematic focus by allocating to unrelated sectors, including:

- Medical devices and equipment companies like Medtronic, Dexcom, and Stryker. These are important businesses but are not advancing multiomics or AI-led healthcare.

- Healthcare services and insurance providers like UnitedHealth, Elevance, and Cencora, which have limited connection to genomic or data-driven innovation.

Why This Matters

Traditional healthcare defensives offer limited upside in an era defined by rapid technological disruption. Many competitor funds continue to mirror broad biotech indices, tracking outdated models instead of positioning for the future of medicine.

Key Message 9: Not all biotech or genomics ETFs are created equal. ARKG ensures that investors avoid legacy incumbents and stay aligned with the innovators driving the next generation of healthcare.

4.0 ARK’s Unwavering Focus

ARKG’s strategy is built on a disciplined thematic focus, targeting the key areas driving the genomic revolution:

- Gene-editing companies pioneering curative therapies.

- AI-driven drug discovery platforms accelerating research and development breakthroughs.

- Multiomics platforms generating high-quality biological data.

- Next-generation diagnostics integrating AI and automation for earlier, more precise detection.

Unlike many funds that drift toward large-cap pharmaceutical indices or healthcare services, ARKG maintains pure exposure to the most disruptive innovators in genomics and precision medicine. Where exposure to large pharmaceutical companies exists, it is driven by their partnerships and leadership in gene editing and AI-driven drug discovery, ensuring alignment with our core thematic convictions.

A robust thematic genomics fund should not simply hold the largest names in biotech. It should actively position for the breakthroughs that will define the future of medicine—including curative therapies.11

5.0 ARKG Fund Overview

The ARK Genomic Revolution ETF offers targeted exposure to companies driving the next wave of innovation in AI-powered biotechnology, gene editing, multiomics, and precision medicine. Healthcare is undergoing a fundamental shift—moving from reactive, standardized treatments toward AI-driven drug discovery, early disease detection, and curative therapies. ARKG is designed to capture this transformation.

Key Differentiators

- High-Conviction, Actively Managed Portfolio: A concentrated selection of 30 to 60 companies, chosen for thematic purity, scientific leadership, and long-term value creation.

- Focused on AI-Driven Healthcare Innovation: Investing in companies at the forefront of AI-powered drug discovery, AI-enhanced diagnostics, and AI-native biotech platforms.

- Minimal Exposure to Legacy Pharma and Biotech: Avoiding large-cap pharmaceutical firms and legacy biotech that rely on acquisitions and risk underperformance in an AI-driven healthcare landscape.

- Comprehensive Multiomics Coverage: Exposure across genomics, proteomics, and transcriptomics—the core pillars underpinning next-generation medicine, often overlooked by traditional biotech funds.

Unlike competitor funds that remain overweight in large-cap pharmaceutical companies and legacy biotech, ARKG focuses exclusively on the true disruptors redefining medicine through AI, automation, and biological data.

Source: Morningstar, as of April 30, 2025.

Source: Morningstar, as of April 30, 2025.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK Fund before investing. This and other information are contained in the ARK ETFs’ prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

An investment in an ARK Fund is subject to risks and you can lose money on your investment in an ARK Fund. There can be no assurance that the ARK Funds will achieve their investment objectives. The ARK Funds’ portfolios are more volatile than broad market averages. The ARK Funds also have specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Funds’ prospectuses.

The principal risks of investing in ARKG: Equity Securities Risk. The value of the equity securities the Fund holds may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Health Care Sector Risk. The health care sector may be adversely affected by government regulations and government health care programs, restrictions on government reimbursements for medical expenses, increases or decreases in the cost of medical products and services and product liability claims, among other factors. Many health care companies are heavily dependent on patent protection and intellectual property rights and the expiration of a patent may adversely affect their profitability. Biotechnology Company Risk. A biotechnology company’s valuation can often be based largely on the potential or actual performance of a limited number of products and can accordingly be greatly affected if one of its products proves, among other things, unsafe, ineffective or unprofitable. Biotechnology companies are subject to regulation by, and the restrictions of, the U.S. Food and Drug Administration, the U.S. Environmental Protection Agency, state and local governments, and foreign regulatory authorities. Pharmaceutical Company Risk. Companies in the pharmaceutical industry can be significantly affected by, among other things, government approval of products and services, government regulation and reimbursement rates, product liability claims, patent expirations and protection and intense competition. Detailed information regarding the specific risks of ARKG can be found in the ETF’s prospectus. Additional risks of investing in ARKG include Foreign Securities Risk, Information Technology Sector Risk, equity, market, management and non-diversification risks, as well as fluctuations in market value and NAV. Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Additional risks of investing in ARK ETFs include market, management and non-diversification risks, as well as fluctuations in market value NAV. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

To view the top ten holdings for ARKG click here.

ARK Investment Management LLC is the investment adviser to the ARK Funds.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC. 2025. “Big Ideas 2025.”

ARK Investment Management LLC. 2025. “Big Ideas 2025.”

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including Tang et al. 2009, Jovic et al. 2022, Ding et al. 2020, and Rood et al. 2024 as of December 31, 2024, which may be provided upon request. See Tang, F. et al. 2009. “mRNA-Seq Whole-transcriptome Analysis of a Single Cell.” Nature Methods. Jovic, D. et al. 2022. “Single-cell RNA Sequencing Technologies and Applications: A Brief Overview.” Clinical and Translational Medicine. Ding, J. et al. 2020. “Systematic Comparison of Single-cell and Single-nucleus RNA-sequencing methods.” Nature Biotechnology. Rood, J. et al. 2024. “Toward a Foundation Model of Causal Cell and Tissue Biology with a Perturbation Cell and Tissue Atlas.” Cell.

Wright’s Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. See Winton, B. 2019. “Moore’s Law Isn’t Dead: It’s Wrong—Long Live Wright’s Law.” ARK Investment Management LLC. Note: The companies mentioned are examples of companies developing virtual cell models, but the list does not include all companies that may be developing these models, and which may do so more successfully. The information provided should not be used as the basis for any investment decision, and it should not be assumed that an investment any of the companies mentioned was or will be profitable.

ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.