Click here to download the PDF version.

Broad-based global equity indexes1 ended the quarter lower as a shift in investor sentiment created volatility, tempering early optimism about potential tax cuts and deregulation, including more accommodative policies on mergers and acquisitions. As the quarter progressed, concerns about tighter financial conditions and economic crosscurrents weighed more heavily on markets. In ARK’s view, structural policy shifts supporting innovative breakthroughs in autonomous mobility, multiomics, and digital assets should withstand and ultimately overwhelm economic uncertainty and near-term volatility.

ARK’s research suggests that a series of rolling recessions2 began in the spring of 2022, when the U.S. Federal Reserve (Fed) tightened monetary policy and raised interest rates by 22-fold in little more than a year. Our research also suggests that a loss of pricing power will force corporations to curb employment, extending the pressure on growth. That said, the Five Innovation Platforms3 around which ARK has centered its research and investing could play an outsized role in pulling the economy out of the rolling recession, potentially salvaging corporate margins as inflation gives way to deflation in many sectors over the next few years. Supporting our perspective are the following indicators:

- In the early days of the pandemic, autos accounted for roughly one-third of the inflation spike. Now, while above historical trend, used car prices have dropped 22% from their peak.4 That said, in March, auto sales surged to 17.7 million units at an annualized rate—surpassing the 16.2 million expected—perhaps because of preemptive buying ahead of anticipated tariffs. In our view, this temporary burst in activity will lead to much lower sales in the second quarter.

- Housing metrics like housing starts and affordability also are sending troubling signals. At 4.3 million units, the number of existing home sales is not far above levels last seen during the global financial crisis.5 Simultaneously, a record number of apartment units under construction will soon be for sale, suggesting that rents could push inflation into much lower-than-expected territory.

- Underscoring the widespread weakness in economic activity, Walmart shocked the market by lowering its fiscal 2026 revenue growth guidance to 3-4% on a constant currency basis, approximately 30% below the 5% gain it recorded in fiscal 2025.

- As measured by the National Federation of Independent Business (NFIB), based on expectations of deregulation and lower tax rates after the US presidential election, small business optimism rebounded from levels not seen since the 2008–09 financial crisis but now is backtracking in the wake of renewed economic uncertainty around tariffs. Noncorporate firms, which account for the majority of jobs created, are currently generating only ~80% of the net income of larger corporations—the lowest ratio since records began in 1959—raising concerns about the durability of the labor market recovery.

- Growth in M26 was negative on a year-over-year basis from December 2022 through March 2024 and, at 3.9%, is still weak by historical standards. Should the correlation between the Consumer Price Index (CPI)7 and 18-month leading M2 growth hold steady, CPI could fall below 2% year-over-year, potentially turning negative, as it did in 2014, 2015, and 2020.

- The ratio of the Commodity Research Bureau (CRB) Metals price index to the gold price index has dropped below its lows during the Global Financial Crisis (GFC) in 2008-2009 and the COVID crisis. Until the Fed started raising rates in 2022, the correlation between this ratio and long-term interest rates was high. If this relationship were to revert to normal, interest rates could collapse, or metals prices could rise significantly, or some combination of both. Given the fear associated with a potential tariff war, interest rates are likely to decline more than metals prices will increase.

- After a period of historically low high-yield spreads8 suggesting complacency around credit or deflationary risks, spreads have begun to widen noticeably, signaling potential stress in the credit markets. While previously abundant liquidity in private equity and credit may have distorted the pricing of risk in the search for yield, the recent widening suggests that spreads are beginning to reflect underlying credit fundamentals.

- Signaling recession in July 2024, the employment report triggered the Sahm Rule, as the three-month moving average of the U.S. unemployment rate rose 50 basis points9 above its lowest point in the last 12 months, historically an indicator that the economy has been in recession for three months. Underscoring labor market weakness, for the twelve months ended March 2024, the Bureau of Labor Statistics revised employment down by 818,000, the largest downward revision since 2009, taking the average growth in monthly payrolls down from 242,000 to 174,000 jobs per month. Although the Sahm Rule no longer is signaling outright recession, quit rates have reversed sharply since the post-COVID “Great Resignation” and are now down to 2.0%, just off their lowest level since the 2020 COVID lockdown, a signal that confidence in labor market opportunities is diminishing.

- The consumer often is the last leg in a rolling recession. As measured by the University of Michigan, sentiment deteriorated across all income levels in March, with high-income households seeing the steepest drop—narrowing the confidence gap between high- and low-to-middle income earners, suggesting broad-based consumer concerns.

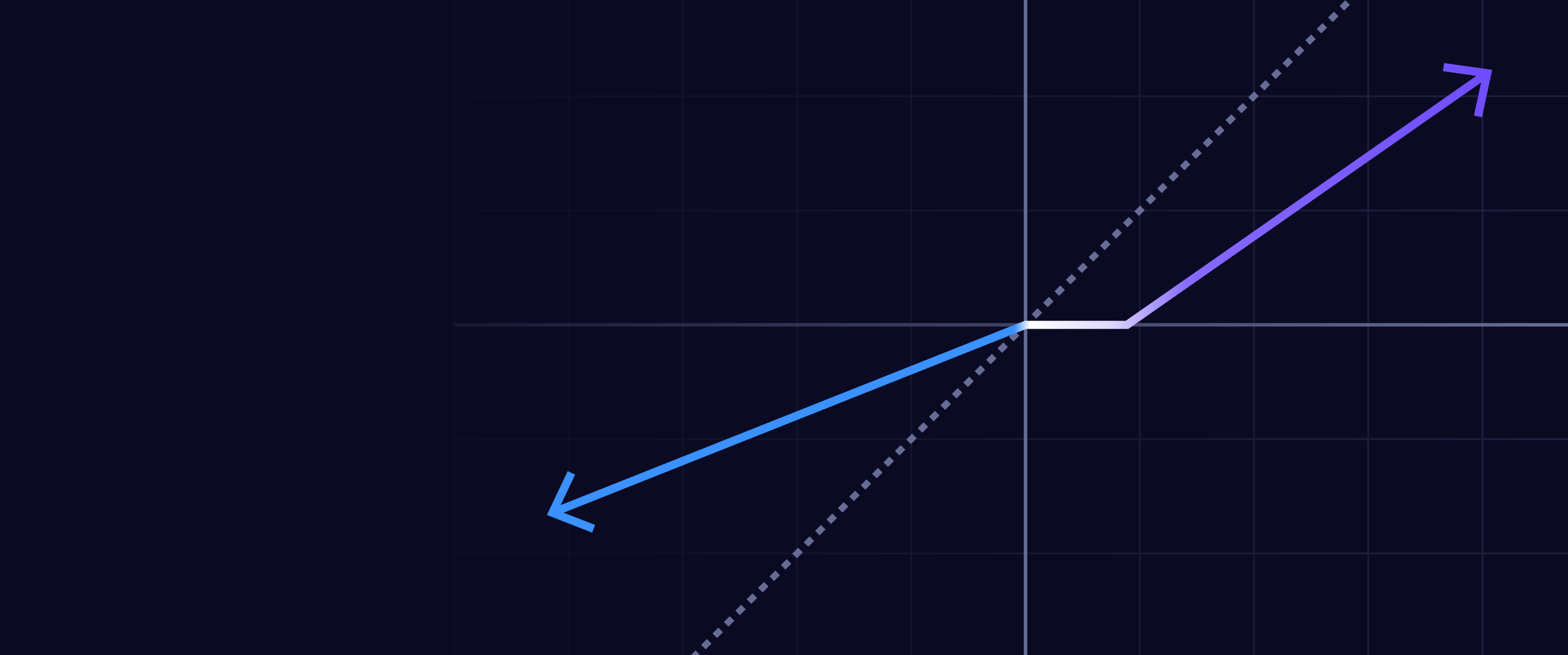

While the Fed focused on raising interest rates to squelch inflation, the bond market was signaling deeper trouble, as the yield curve inverted from +159 basis points9 in March 2021 to -108 in July 2023—levels last seen in the early 1980s—only to reverse into a bear steepening phase in 2024, suggesting that both growth and inflation might undershoot expectations. Since geopolitical turmoil, inventory hoarding, and government spending spurred a year-over-year spike in inflation to 9.1% in 2022, consumer-based inflation as measured by the CPI has dropped to 2.8%, aided by good, bad, and cyclical deflationary forces. Around the time the Fed paused rate hikes, ChatGPT highlighted the kind of transformative innovation likely to turbocharge the deflation in prices. During the next five to ten years, disruptive technologies—spanning robotics, energy storage, AI, blockchain, and multiomics sequencing—are likely to converge, potentially jumpstarting powerful waves of both real growth and price deflation that will reshape the macroeconomic landscape.

Meanwhile, last year the equity market reached a record-breaking level of concentration, suggesting that diversified exposure to the AI revolution, particularly software applications underrepresented in broad-based benchmarks, could drive value creation over our investment horizon. In our view, history will show that inflation—initially triggered by supply shocks—was transitory and evolved into disinflation, then ultimately deflation. Consequently, interest rates are likely to surprise on the low side of expectations, ultimately broadening the equity rally from a narrow subset of stocks and reinforcing the need for diversified AI and other investments. If ARK is correct that the most important AI investment opportunities are associated with “disruptive innovation,” then the winners and losers are likely to be surprising, resulting in a more diverse set of winners to which current equity market concentration should give way.

During the first quarter of 2025, six of ARK's actively managed ETFs underperformed the broad-based global equity indexes.

The ARK Autonomous Technology and Robotics ETF (ARKQ) underperformed broad-based global equity indices during the quarter. Among the top detractors were Tesla (TSLA) and Teradyne (TER). Shares of Tesla detracted from performance during the quarter amid concerns about slowing electric vehicle (EV) sales linked to economic weakness and Elon Musk's political activities. After reporting first-quarter sales in early April, however, the decline seemed more consistent with the required factory downtime associated with the Model Y refresh launch. Meanwhile, Tesla rolled out full self driving-like smart driving features in China and announced that it will commercialize a robotaxi service in Austin in June. Shares of Teradyne detracted from performance during the quarter despite better-than-expected earnings early in the period, as continued softness in its semiconductor testing segment persisted. In March, the company lowered its second-quarter revenue guidance from 5% growth to down 5% sequentially, at the mid-point, citing potential impacts from tariffs and trade restrictions on its semiconductor testing business. Nonetheless, management reaffirmed Teradyne’s multi-year outlook.

Among the top contributors were Kratos Defense & Security (KTOS) and Elbit Systems (ESLT). Shares of Kratos Defense & Security Solutions contributed to performance during the quarter after the company won several defense contracts, the most notable of which was a five-year U.S. Department of Defense MACH-TB (Multi-Service Advanced Capability Hypersonic Test Bed) 2.0 contract worth up to $1.45 billion—the largest in the company's history. Shares of Elbit Systems contributed to performance during the quarter after the company announced several multi-million-dollar awards for advanced defense solutions. In March, the company reported better-than-expected fourth-quarter results and a record backlog, highlighting its European subsidiaries.

The ARK Next Generation Internet ETF (ARKW) underperformed broad-based global equity indices during the quarter. Among the top detractors were Tesla (TSLA), for the reasons discussed above, and Coinbase (COIN). Shares of Coinbase detracted from performance this quarter amid a broad-based risk-off associated with fears of the impact of Trump's trade tariffs. Relative to the price of bitcoin, Coinbase suffered because of rising competition not only from peers like Robinhood but also from traditional financial institutions gearing up to enter the crypto markets. Coinbase reported strong fourth-quarter earnings, highlighted by revenue growth of 143% year-over-year.

Among the top contributors were Robinhood (HOOD) and Palantir (PLTR). Shares of Robinhood contributed to performance this quarter after the company reported strong fourth-quarter earnings, including 115% revenue growth year-over-year. Then, Morgan Stanley added Robinhood to its 2025 Financials Top Picks. Robinhood also launched a Prediction Markets Hub for US retail traders and announced that it is expanding into Banking and Advisory Services. Shares of Palantir Technologies contributed to performance after the company reported10 a strong fourth quarter, as revenue growth accelerated to 36% year-over-year, with US commercial and government up by 64% and 45%, respectively. For 2025, management projected that revenues would increase 31% at the midpoint of guidance. Importantly, management noted that while large language models will commoditize rapidly, Palantir‘s platform will add value by unifying data, applications, and processes to enable reliable, production-grade tools that operate on top of inexpensive but powerful models. Later in the quarter, it hosted its sixth AIPCon event, which showcased new customers increasing productivity with Palantir‘s platform, in particular bolstering its position in healthcare and defense with new partnerships with R1, L3Harris, and the U.S. Army.

The ARK Genomic Revolution ETF (ARKG) underperformed broad-based global equity indices during the quarter. Among the top detractors were Recursion Pharmaceuticals (RXRX) and 10x Genomics (TXG). Shares of Recursion Pharmaceuticals detracted from performance after the company announced disappointing fourth-quarter and full-year 2024 results during a macroeconomic-related broad-market selloff. Shares of 10X Genomics detracted from performance this quarter after the National Institute of Health (NIH) announced that it will limit funding for "indirect" research and development expenses—including overhead, facility, maintenance, and new equipment costs—for medical research and development grants. The decision follows11 a directive from the Trump Administration.

Among the top contributors were Guardant Health (GH) and Tempus AI (TEM). Shares of Guardant Health contributed to performance this quarter after the company announced12 that the Centers for Medicare & Medicaid Services (CMS) approved “Advanced Diagnostic Laboratory Test (ADLT)” status for its Shield™ blood test that screens for colorectal cancer (CRC), with costs reimbursed up to $1,495 per test during the initial nine-month ADLT period beginning April 1, 2025. Shares of Tempus AI contributed to performance this quarter after the company announced13 the national rollout of Olivia, its AI-enabled concierge app designed to assist patients in managing their healthcare more efficiently.

The ARK Fintech Innovation ETF (ARKF) underperformed broad-based global equity indices during the quarter. Among the top detractors were Coinbase (COIN), for the reasons discussed above, and Block (XYZ). Shares of Block detracted from performance this quarter amid a broad market sell-off associated with fears of Trump's trade tariffs. The company reported14 fourth-quarter results, including lower-than-expected revenue growth of 4% year-over-year but Gross Payment Volume (GPV) growth accelerating on its merchant platform from 8% to 10% year-over-year. Block also changed its ticker to “XYZ” to underscore the company's digital wallet ecosystem, including well-known brands like CashApp, Square, and Afterpay.

Among the top contributors were Robinhood (HOOD) and Palantir (PLTR), for the reasons discussed above.

The ARK Space Exploration & Innovation ETF (ARKX) underperformed broad-based global equity indices during the quarter. Among the top detractors were Teradyne (TER), for reasons discussed above, and Rocket Lab (RKLB). Shares of Rocket Lab USA detracted from performance during the quarter following the release of a report alleging a delay of one to two years in the company’s Neutron rocket launch timeline. Later, when it reported fourth-quarter earnings, the company did delay Neutron’s debut from “mid-2025” to the “second half of 2025”. Rocket Lab also unveiled “Flatellite,” a low-cost satellite designed for mass production as part of its strategy to become an end-to-end space platform.

Among the top contributors were Kratos Defense & Security (KTOS), for the reasons discussed above, and Thales (HO FP). Shares of Thales contributed to performance during the quarter, benefiting from a broad-based rally15 among European defense stocks fueled by expectations that Europe will increase military spending as the US pulls some of its support. Notably, Thales received16 an order worth up to $2 billion from the British Ministry of Defense for air defense missiles to support Ukraine.

Invested in the highest conviction names in the Funds discussed above, the ARK Innovation ETF (ARKK) underperformed broad-based global equity indices during the quarter. Among the top detractors were Tesla (TSLA) and Coinbase (COIN), for reasons discussed above. Among the top contributors were Robinhood (HOOD) and Palantir (PLTR), for reasons discussed above.

Among ARK’s self-indexed ETFs, the ARK Israel Innovation Technology ETF (IZRL) outperformed the S&P 500 index but lagged the MSCI World Index, and The 3D Printing ETF (PRNT) underperformed the broad-based global equity indices.17

Shares of Valens Semiconductor (VLN) were the largest detractor from IZRL’s performance, even though the company announced a $15 million share repurchase program, better-than expected fourth-quarter earnings, and first quarter guidance. While most of the company-specific news was positive, most semiconductor companies faced challenges in response to competitive AI developments from China and concerns about the impact of Trump’s tariffs and export restrictions. Shares of Bet Shemesh Engines (BSEN IT) were the largest contributor to IZRL’s performance as part of a broad-based rally in Israeli defense stocks based on increased spending in Europe.

Shares of Xometry (XMTR) were the largest detractor from PRNT’s performance after the company reported better-than-expected earnings results but softer performance across supplier services and marketplace metrics that reflected ongoing weakness in US manufacturing and the impact of non-core service wind-downs. Management also guided for near-term gross margin pressure associated with global sourcing investments and ongoing trade and tariff uncertainty. Shares of Faro Technologies (FARO) were the largest contributor to PRNT’s performance after the company reported better-than-expected earnings associated with strategic initiatives to improve operational efficiency and profitability. The company also guided first-quarter revenue slightly above consensus expectations.

Broad-based global equity indexes are defined as the S&P 500 Index and the MSCI World Index.

A type of recession that affects different sectors of the economy at different times—not simultaneously.

ARK’s Five Innovation Platforms are Artificial Intelligence, Robotics, Energy Storage, Multiomic Sequencing, and Blockchain Technology.

Manheim Used Vehicle Value Index. Data as of March 2025.

National Associate of Realtors. Data as of February 2025.

M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.

The Consumer Price Index (CPI) measures the average change in prices over time that consumers pay for a basket of goods and services, often used to assess inflation.

High yield spreads represent the difference in yields between high-yield (junk) bonds and safer, investment-grade bonds, reflecting the risk premium investors demand for taking on more credit risk.

A basis point (bp) is a unit of measurement used to quantify the change between two percentages. It is equal to 1/100th of 1%, or 0.01%.

Palantir. 2025. “Palantir Reports Q4 2024 Revenue Growth of 36% Y/Y, U.S. Revenue Growth of 52% Y/Y; Issues FY 2025 Revenue Guidance of 31% Y/Y Growth, Eviscerating Consensus Estimates.”

Bobic, I. 2025. “Trump Administration Orders 'Catastrophic' Funding Cuts For Science Research.” HuffPost.

Guardant Health. 2025. “Guardant Health Receives ADLT Status From CMS for Shield Blood Test.”

Tempus. 2025. “Tempus Announces National Launch of Olivia, its AI-enabled Personal Health Concierge App for Patients.”

Block. 2025. “Q4 2024 Shareholder Letter.”

McCabe, C. 2025. “European Defense Stocks Surge After Leaders Aim to Broker Ukraine Peace Plan.” The Wall Street Journal.

UK Ministry of Defence. 2025. “Historic £1.6bn deal provides thousands of air defence missiles for Ukraine and boosts UK jobs and growth.” Gov.UK.

IZRL underperformed its benchmark, ARK Israel Innovation Index. PRNT underperformed its benchmark, The Total 3-D Printing Index.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.