Broad-based global equity indexes[1] appreciated in the second quarter as NVIDIA’s guidance for the second quarter shocked on the high side of expectations, thanks to provocative proofs of concepts from artificial intelligence (AI) generally and ChatGPT specifically. Increased demand for AI hardware is pointing toward a significant acceleration in software revenue growth. As companies develop AI-powered products and services, ARK estimates that software may generate up to $8 of revenue for every dollar spent on AI hardware by 2030. In what could be “winner take most” opportunities, we believe companies with large pools of proprietary data and broad-based distribution should be best positioned to capitalize on AI use cases and reap the potentially dramatic productivity gains associated with generative AI.

Economic data was not as clear-cut. While the labor market seemed resilient, a number of leading indicators were warning of recession.

- With a strong correlation to Gross Domestic Product (GDP), the US Leading Economic Index (LEI) has dropped for 14 consecutive months and now is down 7.9% year-over-year.[2] In 2022, GDP declined for two consecutive quarters, a technical recession. During the last two quarters, Gross Domestic Income (GDI)—which should equal GDP over time—has declined sequentially. The divergence in growth between GDP and GDI is begging the question about future revisions: will GDI be revised up or GDP down. Our view is the latter.

- Based on monthly surveys from the Federal Reserve District Banks of Dallas, New York, Philadelphia, Richmond, and Kansas, manufacturing activity is contracting at an accelerated rate. Corroborating this evidence, new orders in the national Purchasing Managers’ Index are declining.

- According to the Senior Loan Officer Opinion Survey (SLOOS), the willingness of banks to lend is plummeting, often a leading indicator of recession. Borrowing and lending play pivotal roles during economic expansions. The demand for commercial and industrial (C&I) loans is consistent with previous recession levels, and the Bank of America Fund Manager Survey suggests that commercial real estate could be the epicenter of the next financial crisis.

- US consumer sentiment[3] remains at levels last seen during the Global Financial Crisis in 2008-2009 and back-to-back recessions with double-digit inflation and interest rates during the early 1980s. Meanwhile, the personal saving rate has collapsed from 9.3% pre-COVID to 4.6%[4] which, when coupled with historically low consumer sentiment, is pointing toward weakness in consumption growth. Adding to those concerns, the third largest category of non-housing debt, credit card balances have reached a record high level at ~$1 trillion.[5] Because interest rates on credit cards nearly doubled to 20-21% during the past ten years, the burden of credit card debt has intensified. Additionally, student loan payments are slated to resume this October, further pressuring consumer purchasing power.

- In recent months, PIMCO and Brookfield have defaulted on commercial property mortgages across major US cities, a trend exacerbated by the combination of rapid interest rate increases and the lower occupancy rates associated with the shift to remote work environments. Recent trends have hit San Francisco particularly hard, the value of one commercial use building dropping from $300 million to $60 million, or 80%, in four years.[6] Moreover, two of San Francisco’s largest hotels are vacating the city.

Recent economic data and comments from the US Federal Reserve (Fed) appear to have tempered investors’ previous expectations of interest rate declines. Now, interest rate futures are pricing in a slowdown or recession and one or two more rate hikes before interest rates start to decline. Should an economic slowdown evolve into a hard landing, the slope of interest rate declines could steepen.

The Federal Funds Target Rate has surged 21-fold in the last year, a faster pace than all previous tightening cycles—including the one in 1980-1981 that crushed inflation–creating significant strains at regional banking and in commercial real estate. Bank deposits have dropped 4.2% year-over-year, the largest decline since 1948.[7] We believe additional rate hikes will exacerbate this fragile situation.

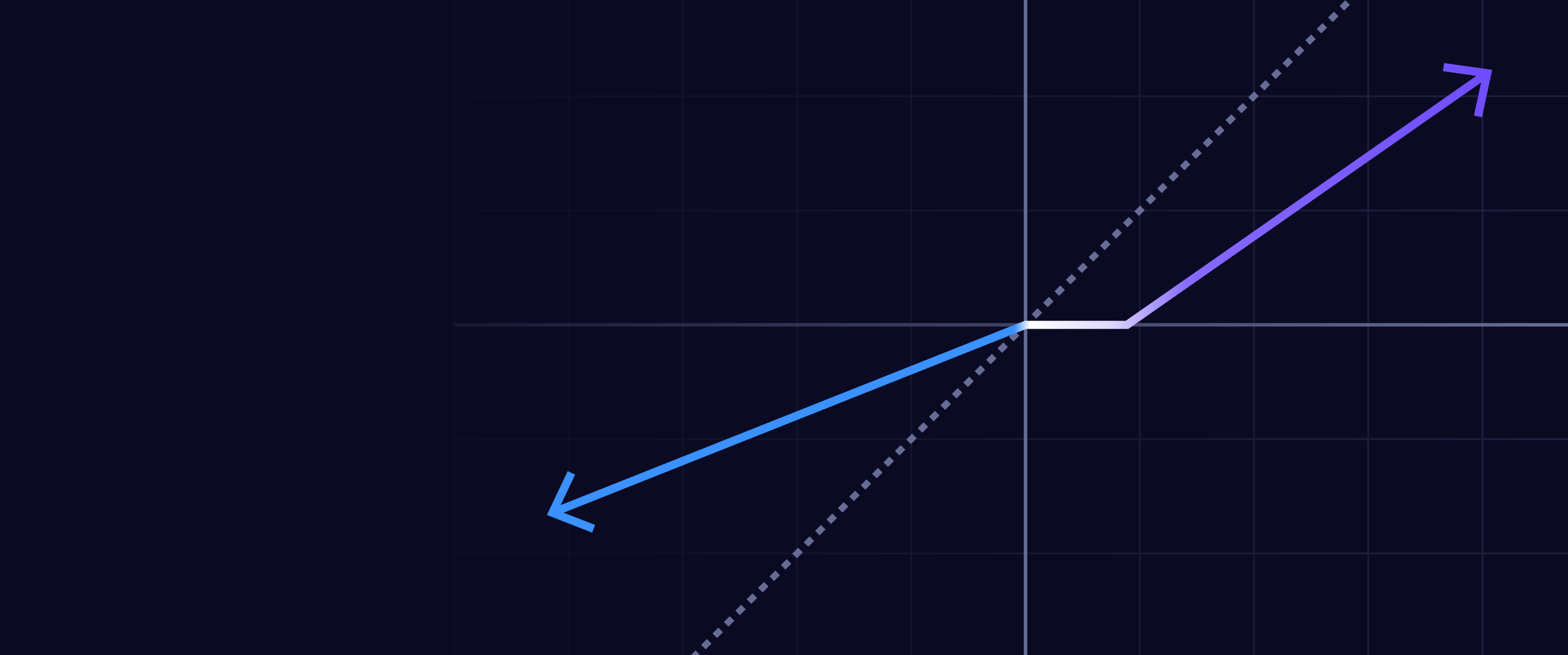

While the Fed is determined to squelch inflation by increasing interest rates, the bond market has been signaling that it could be making a major mistake. Since March 2021, the yield curve[8] has flattened by 265 basis points, inverting from +159 to -106 basis points,[9] the worst inversion since the early 1980s when the Fed was fighting entrenched double-digit inflation. This dynamic suggests that both real growth and inflation could surprise on the low side of expectations. In ARK’s view, the Fed is making decisions based on lagging indicators—employment and headline inflation—and ignoring leading indicators that are telegraphing recession and/or price deflation.

The Federal Reserve began increasing interest rates when the year-over-year Consumer Price Index (CPI)—a lagging economic indicator—reached 8.5% on a year-over-year basis in March 2022. Shortly thereafter, an inflationary surge influenced by geopolitical pressures and inventory hoarding peaked at 9.1% year-over-year. Since then, CPI inflation has dropped to 3.0%,[10] thanks to various deflationary forces––good, bad, and cyclical. Tesla’s CEO Elon Musk[11] and DoubleLine’s CEO Jeff Gundlach[12] have echoed our concerns about the risk of deflation.

Innovation is a potential source of good deflation, as learning curves can cut costs and increase productivity. Yet, we believe many companies have catered to short-term-oriented, risk-averse shareholders, satisfying their demands for profits/dividends “now”. On balance, they have leveraged their balance sheets to buy back stock, bolster earnings, and increase dividends. In so doing, many have curtailed investments and could be ill-prepared for the potential disintermediation associated with disruptive innovation. Saddled with aging products and services, they could be forced to cut prices to clear unwanted inventories and service debt, causing bad deflation.

If we are correct in our assessment that growth, inflation, or both will surprise on the low side of expectations, scarce double-digit growth opportunities should be rewarded accordingly. The adoption of new technologies typically accelerates during tumultuous times as concerned businesses and consumers change their behavior much more rapidly than otherwise would be the case. As a result, stocks of innovation-oriented companies have historically performed better and emerge as new market leaders toward the end of a bear market. We believe the coronavirus crisis and Russia’s invasion of Ukraine have transformed the world significantly and permanently, suggesting that many innovation-driven strategies and stocks could be productive holdings during the next five to ten years.

In our view, the wall of worry bodes well for equities in the innovation space. The strongest bull markets climb walls of worry, a fact that those making comparisons to the tech and telecom bubble seem to forget. No wall of worry existed or tested the equity market in 1999. This time around, the wall of worry has scaled to enormous heights.

During the second quarter of 2023, five of ARK’s actively managed ETFs outperformed relative to the broad-based global equity indexes; one actively managed and one indexed ETF had mixed performance; and one indexed ETF underperformed.[13]

The ARK Autonomous Technology and Robotics ETF (ARKQ) outperformed broad-based global equity indexes during the quarter. Among the top contributors were Tesla Inc. (TSLA) and Nvidia Corp (NVDA). Tesla shares rallied following several events. During its annual shareholder meeting, Tesla announced that co-founder J.B. Straubel would join the Board of Directors. Then, Tesla competitors General Motors, Ford, and Volvo announced that they will adopt the Tesla charging connector and join the Tesla Supercharger network in the coming years. Furthermore, SAE International, the automotive industry body that sets and reviews engineering standards, announced that it would standardize Tesla’s North American Charging Standard connector. Lastly, Tesla reaffirmed its promise to deliver the first Cybertrucks this year. Nvidia shares appreciated after the company announced much better than expected guidance for the second quarter, thanks to demand for data center products in response to breakthroughs in generative AI. Despite a 13% decline in revenue year-over-year during the first quarter, Nvidia guided to second-quarter revenue of $11 billion, nearly $4 billion above the consensus expectation, pointing to 64% year-over-year growth. As the primary provider of accelerated computing hardware for developing and running large language models, NVIDIA should be an early beneficiary of the boom in generative artificial intelligence (AI) that ChatGPT unleashed late last year.

Among the top detractors from ARKQ’s performance were UiPath Inc (PATH) and 3D Systems Corp (DDD). Shares of UiPath depreciated after Wells Fargo downgraded the company to “equal weight” based on concerns about market shifts toward the cloud. That said, UiPath reported strong first-quarter results, including 28% year-over-year growth in annual recurring revenue (ARR), and guided to ~19% full-year ARR growth. UiPath provides a suite of robotic process automation (RPA) products that automate complex processes under specified compliance and governance standards. Shares of 3D Systems declined after the company reported weak first-quarter results, with revenue dropping 8.8% year-over-year, driven primarily by continued weakness in the dental orthodontics market. 3D Systems also is competing to acquire Stratasys.

The ARK Next Generation Internet ETF (ARKW) outperformed broad-based global equity indexes during the quarter. Among the top contributors were Tesla Inc. (TSLA), for reasons discussed above, and Shopify Inc (SHOP). Shares of Shopify appreciated after the company posted first-quarter revenue and earnings that surpassed analysts’ expectations. Shopify also announced that it will sell its logistics business—launched in 2019 with the purchase of warehouse robot startup 6 River Systems—to Flexport, with whom Shopify will continue to partner and in whom it now will have a 13% equity position.

Among the top detractors from ARKW’s performance were PagerDuty Inc (PD) and Roblox Corp (RBLX). Shares of PagerDuty traded down after the company reported earnings with higher-than-expected revenues for the first quarter but lower than expected full-year guidance based on the persistent macro headwinds that are extending sales cycles and limiting seat expansion. In our view, demand for automated incident support software will increase as artificial intelligence (AI) enhances the efficiency and productivity of software developers. Thanks to its proprietary data and early adoption of AI, we believe PagerDuty is positioned to be a prime beneficiary of this trend. Shares of Roblox declined after the company reported lower-than-expected user metrics for the month of March. During its first-quarter earnings call, however, management noted that Roblox’s average daily active users and engaged hours rose 22% and 23% year-over-year, respectively.

The ARK Genomic Revolution ETF (ARKG) outperformed broad-based global equity indexes during the quarter. Among the top contributors were Schrodinger Inc (SDGR) and Exact Sciences Corp (EXAS). Schrodinger specializes in developing computational tools and software for drug discovery and materials science. In the absence of meaningful company-specific news, the stock rallied in tandem with a broad rotation into the beneficiaries of artificial intelligence. Shares of Exact Sciences contributed to performance after the company surpassed revenue and earnings expectations for the first quarter and guided to positive free cash flow during 2023. In addition, Exact’s next-generation Cologuard screening test for colon cancer demonstrated better specificity and sensitivity than Exact’s existing product, so it will seek FDA approval of the new test by the end of this year.

Among the top detractors from ARKG’s performance were Adaptive Biotechnologies (ADPT) and Accolade Inc (ACCD). Shares of Adaptive Biotechnologies declined after the company terminated Chief Operating Officer Mark Adams. Company President, Julie Rubinstein, is absorbing his duties. A pioneer and leader in immune-driven medicine, Adaptive Biotechnologies aims to improve people’s lives by learning from their adaptive immune systems. Shares of Accolade depreciated after the company missed revenue estimates slightly for the first quarter and reported a larger than expected loss in earnings per share after surpassing estimates for the prior four consecutive quarters. Accolade is a data science and software company focused on managing healthcare benefits for employers of all sizes. Its platform integrates population health data, patient outcome data, and provider information to create benefit plans for employers. Given its robust employer partnerships and the strength of its technology platform, we believe Accolade will remain a leader in its space.

The ARK Fintech Innovation ETF (ARKF) outperformed broad-based global equity indexes during the quarter. Among the top contributors were Shopify Inc (SHOP), for reasons discussed above, and DraftKings Inc (DKNG). Shares of DraftKings rose after the company reported positive first-quarter results, including 84% year-over-year revenue growth. In the past year, DraftKings’ share of total wagers in mobile sports betting has increased from 28% to 32%. The company also has taken share in gross gaming revenues (GGR) and, at 26% for the quarter, is leading the industry.

Among the top detractors from ARKF’s performance were MercadoLibre Inc (MELI) and Block Inc (SQ). Shares of MercadoLibre traded down despite reporting better than expected first-quarter results thanks to margin expansion from 6.2% to 11.2% during the past year. We believe MercadoLibre is the best positioned ecommerce and payments company in Latin America. Shares of Block depreciated after a sell-side analyst downgraded the stock on concerns about competition from Toast in its seller business and increasing competition and regulatory scrutiny in its peer-to-peer payments ecosystem, Cash App.

The ARK Space Exploration & Innovation ETF (ARKX) outperformed the MSCI World Index but underperformed the S&P 500 Index during the quarter. Among the top contributors were Joby Aviation (JOBY) and Archer Aviation (ACHR). Shares of Joby Aviation appreciated after the Federal Aviation Administration (FAA) granted the company a Special Airworthiness Certificate enabling tests of its first production prototype in flight—a major milestone for the industry. Joby Aviation is an all-electric vertical take-off and landing (eVTOL) company aiming to commercialize operations by 2025. Shares of Archer Aviation rose after the company reported its first-quarter results and announced former FAA Administrator Billy Nolen as its Chief Safety Officer. Archer remains confident that it has the liquidity required to commercialize its business in 2025. Archer Aviation is an aerospace company aiming to revolutionize mobility with its eVTOL products and services. Our research suggests that an eVTOL service operating at scale should be able to transport individuals from big cities to airports in a fraction of the time and at the same price as taxi rides today.

Among the top detractors from ARKX’s performance were JD Logistics (2618 HK) and Spirit AeroSystems (SPR). Shares of JD Logistics declined on little company-specific news but perhaps investors’ concerns about an economic slowdown in China. In our view, JD Logistics is well-positioned to capture a larger share of supply-chain and fulfillment services in China during the next 5-10 years. Shares of Spirit AeroSystems declined after the company reported revenue that missed analyst expectations in addition to several operational issues: Boeing paused deliveries of some 737 Max planes after Spirit AeroSystems installed parts incorrectly, and Spirit Aerosystems unionized workers voted to strike, suspending factory operations. By the end of the quarter, Spirit ratified a new four-year contract with members of the International Association of Machinists and Aerospace Workers and resumed factory operations.

Invested in the highest conviction names in the Funds discussed above, the ARK Innovation ETF (ARKK) outperformed broad-based global equity indexes during the quarter. Among the top contributors were Tesla (TSLA) and Exact Sciences (EXAS), for the reasons discussed above.

Among the top detractors from ARKK’s performance were Pager Duty (PD), for reasons discussed above, and Zoom Video Communications (ZM). Shares of Zoom declined after an analyst from Citibank focused on increased competition in the enterprise communications space and negative data points suggesting slower growth generally. We maintain conviction in Zoom’s potential to share most of the enterprise communications platform space with Microsoft.

Among ARK’s self-indexed ETFs, the ARK Israel Innovation Technology ETF (IZRL) outperformed the MSCI World Index but underperformed the S&P 500 Index. The 3D Printing ETF (PRNT) underperformed the broad-based global equity indexes.[14] Satixfy Communications Ltd (SATX) was the largest detractor from IZRL’s performance. Shares of Satixfy, a leader in next-generation satellite communication systems based on in-house-developed chipsets, declined after Chief Executive Officer Ido Gur announced that he was leaving the company. The company’s former Chief Commercial Officer, Nir Barkan, returned as acting Chief Executive Officer on June 1. The company has seen several leadership changes since its founder, Yoel Gat, passed away in 2022. Nano-X Imaging Ltd (NNOX) was the largest contributor to IZRL’s performance. Shares of Nano-X Imaging appreciated after the US Food and Drug Administration (FDA) granted the company 510(k) clearance to market the Nanox.ARC X-ray system, which complements conventional radiography with tomographic images of the human musculoskeletal system. Nano-X Imaging is focused on applying its proprietary medical imaging technology to make diagnostic medicine more accessible and affordable. Faro Technologies Inc (FARO) was the largest detractor from PRNT’s performance. Shares of Faro Technologies declined after its President, Michael Burger, announced his retirement. On July 24, Peter Lau will assume the roles of President, Chief Executive Officer, and Board Member. Faro Technologies develops and markets computer-aided devices and software. Xometry (XMTR) was the largest contributor to PRNT’s performance after the company surpassed consensus estimates for the first quarter as revenue increased ~26% on a year-over-year basis, driven primarily by 35% marketplace growth. Xometry is an on-demand industrial parts marketplace based on both 3D printing and traditional technologies.

As measured by the S&P 500 and MSCI World.

The Conference Board. Data as of May 31, 2023.

As of June 30, 2023, measured by the University of Michigan.

Federal Reserve Economic Data. Saving rate was 9.3% as of February 1, 2020, and 4.6% as of May 1, 2023.

Federal Reserve Economic Data as of February 1, 2023.

Wall Street Journal. Published April 27, 2023.

Federal Reserve Economic Data as of June 21, 2023.

As measured by the difference between yields on the 10-year Treasury bond and the 2-year Treasury note.

An inversion means the long-term Treasury yield is lower than the short-term Treasury yield. The yield difference was +159 basis points on March 29, 2021, and -106 basis points on June 30, 2023. One basis point is equal to 1/100 of a percentage point, or 0.01%.

US Bureau of Labor Statistics. Data as of June 30, 2023.

Deflation in the pipeline, heading for the PPI, CPI, PCE Deflator: from post-COVID price peaks, lumber -60%, copper -35%, oil -35%, iron ore -60%, DRAM -46%, corn -17%, Baltic freight rates -79%, gold -17%, and silver -39%.

- Cathie Wood (@CathieDWood) Sep 12, 2022

— Elon Musk (@elonmusk) Sep 14, 2022

Exactly, this is neither subtle nor secret

https://www.cnbc.com/2022/09/13/gundlach-says-buy-long-term-treasuries-as-deflation-is-the-bigger-threat-right-now.html

Broad-based global equity indexes are defined as the S&P 500 Index and the MSCI World Index.

IZRL underperformed its benchmark, ARK Israel Innovation Index. PRNT outperformed its benchmarks, The Total 3-D Printing Index.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.