Broad-based global equity indexes1 appreciated in the second quarter even as the U.S. Federal Reserve (Fed) refrained from committing to the timing and pace of future rate cuts. While the Fed’s rhetoric generally has been hawkish, some members are beginning to part company with the consensus. Chicago Federal Reserve Bank President, Austan Goolsbee, recently stated that the Fed should prepare for rate cuts if inflation continues to fall to 2% on a year-over-year basis.

While the consensus forecast is for a soft landing, ARK still expects that a loss of pricing power will force corporations into employment cutbacks that will perpetuate the rolling recession2 that began in the spring of 2022 when the Fed embarked on a 22-fold increase in interest rates. In response, housing, autos, commercial real estate, and capital spending have capitulated as inventories continue to build. In our view, the Five Innovation Platforms3 around which ARK has centered its research and investing could play an outsized role in pulling the economy out of recession, salvaging corporate margins as inflation gives way to deflation in many sectors during the next few years.

Rolling recessions suggest that the Fed should weigh the merits of rate cuts sooner than the “dot plots” have been suggesting. While the Fed still is focused more on the inflation side of its dual mandate than on employment, the Bureau of Labor Statistics (BLS) has revised nonfarm payroll statistics down for thirteen of the last sixteen months, suggesting that the labor market is weakening much faster than government reports have suggested. The last time the BLS revised nonfarm payroll employment down for such a long time was in 2007, right before the Global Financial Crisis (GFC). Supporting this point of view is the following evidence:

- The auto industry faced significant challenges during the COVID-19 pandemic and, while sales did enter a V-shaped recovery in 2021, current unit sales are annualizing at a 15.3 million4 rate, well below the pre-COVID range of 17-18 million units. In the early days of the pandemic, autos accounted for roughly one-third of the inflation spike. Now, used car prices are down 9% year-over-year and 24% below peak prices.5

- Housing metrics like median prices, housing starts, and affordability also are sending troubling signals. At 4.1 million units, the number of existing home sales is not far above levels last seen during the global housing crisis.6 Nationwide, rents are declining roughly -0.7% year-over-year.7 At the same time, a historically high number of apartment units under construction suggests that rents will push inflation into much lower-than-expected territory during the next year.

- Real Gross Domestic Income (GDI)—which should equal real Gross Domestic Product (GDP) over time—suggests that the economy is meaningfully weaker than Real GDP has been depicting. The near-record difference is ~$520 billion.8 Many global company bellwethers are corroborating this weakness, having reported year-over-year revenue declines during the first quarter: 3M (-0.3%), UPS (-5.3%), Kraft-Heinz (-1.2%), Exxon Mobil (-3.9%), Thermo Fisher (-3.4%), Home Depot (-2.3%), Cisco (-12.8%), Texas Instruments (-16.4%), partly because of weakness in the rest of the world.

- After boosting profitability with higher prices during the supply-chain-related bottlenecks in 2021-22, and again as unit growth disappointed in 2023, corporations now seem to be losing pricing power, to the detriment of profit margins. Already, companies like Amazon, Nike, Starbucks, and McDonald’s have launched discount campaigns to win back consumers. As measured by Bloomberg, the S&P 500's gross margin declined from 34.6% on average during the past five years to 33.7% during the second quarter of 2024. In our view, this setback will intensify until the Fed cuts interest rates significantly and unless companies harness innovation like artificial intelligence aggressively, not only to drive productivity growth but also to create new products and services that replace legacy solutions. To limit the damage to margins in the interim, companies that hoarded employees during post-COVID labor shortages are likely to lay them off during the next year—and lower wage gains—further allaying the Fed’s concern about underlying inflation. As a result, nominal activity could weaken beyond the recent soft spots associated with housing, autos, and other big-ticket purchases, forcing more price cuts and margin compression.

- As measured by the National Federation of Independent Business (NFIB), Small Business Optimism in the US is in recession territory, lower not only than that seen during the COVID recession and the saving and loans crisis, but also lower than during the GFC.9 Small businesses are the primary drivers of job creation, so plummeting confidence suggests that the labor market is much weaker than headline figures suggest.

- M210 growth turned negative on a year-over-year basis from December 2022 through March 2024 and, at 0.6%, is still extremely weak by historical standards. While sequential declines seemed natural after the COVID-related surge, continued weakness could be pointing to recession. Additionally, because rising mortgage rates have trapped homeowners in their homes, growth in the velocity of money seems to be slowing down and could exacerbate the impact of declining M2, raising the odds of broad-based price deflation.

- The ratio of the Commodity Research Bureau (CRB) Metals price index to the Gold price index has dropped to lows not seen since the GFC in 2008-2009. Until the Fed started raising rates in 2022, this ratio had been correlated closely with long-term interest rates. If this relationship were to revert to normal, interest rates could collapse, or metals prices could rise significantly, or some combination of both.

- Recently, JOLTS Job Openings have dropped below expectations and then have been revised down. The ratio of job openings to unemployed people has dropped to pre-COVID levels, and JOLTS data, which helps explain a decline in the quit rate.

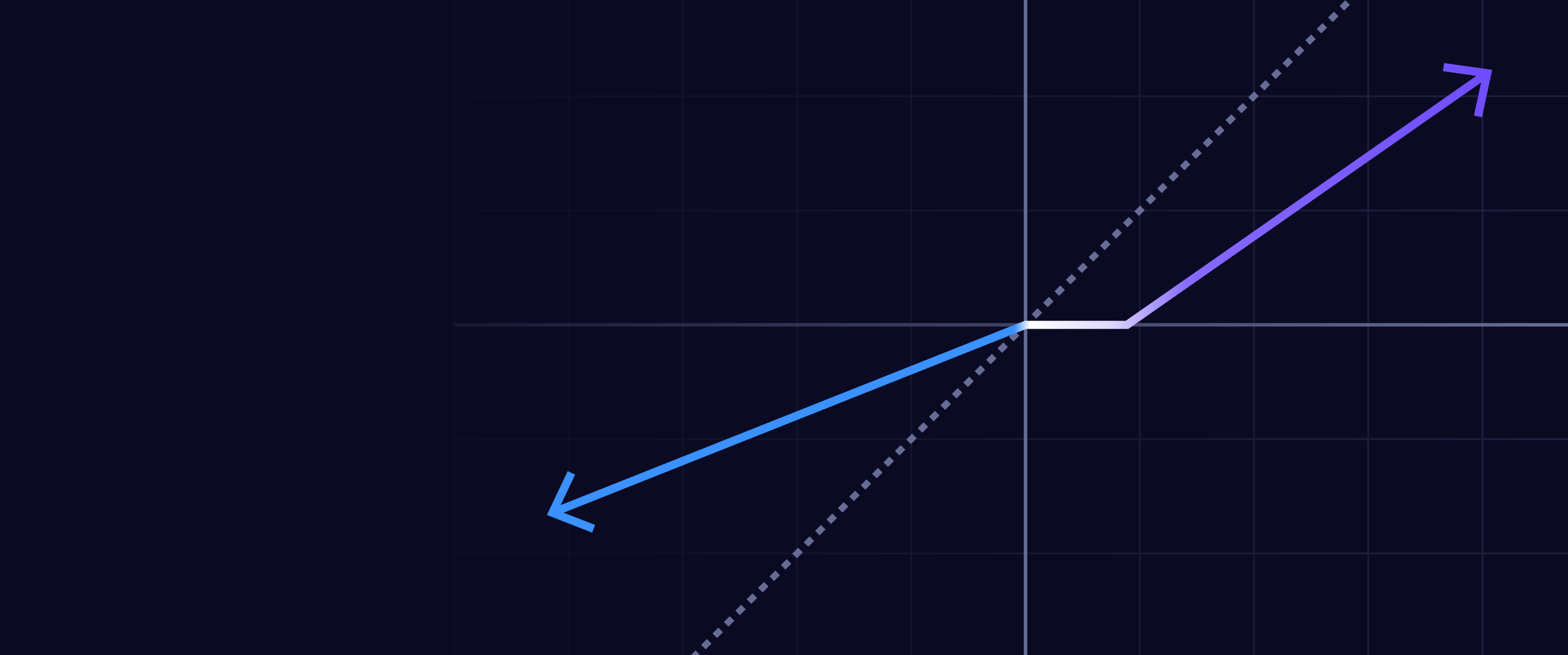

While the Fed is focused on squelching inflation with higher interest rates, the bond market has been signaling trouble ahead. From March 2021 to July 2023, the yield curve11 inverted from +159 basis points to -108 basis points,12 hitting the steepest levels since the early 1980s when the Fed was fighting double-digit inflation. Since July 2023, the yield curve has entered a bear steepening phase, with long-term rates increasing relative to short-term rates, lowering the inversion to -35 basis points,13 still suggesting that both real growth and inflation could surprise on the low side of expectations. The Federal Reserve began increasing interest rates when the year-over-year Consumer Price Index (CPI)—a lagging economic indicator—reached 8.5% on a year-over-year basis in March 2022. Shortly thereafter, geopolitical pressures and inventory hoarding pushed the CPI-based inflation rate to 9.1% on a year-over-year basis. Since then, CPI inflation has dropped to 3.0%,14 thanks to various deflationary forces––good, bad, and cyclical.

The Federal Funds Target Rate surged 22-fold in little more than a year. The deflationary ramifications of current Fed policy already are surfacing through bankruptcies in commercial real estate, both office and multi-family, and could culminate in another round of regional bank failures. If the Fed were to lower interest rates in response, companies sacrificing short-term profitability to invest and potentially capitalize on technologically enabled exponential growth opportunities should be prime beneficiaries.

The Fed paused its tightening moves last summer. At the same time, in the technology realm, ChatGPT began to dramatize the seemingly miraculous breakthroughs that are likely to tip the scales even further toward broad-based deflation. Although creative destruction—the transition from gas-powered vehicles to electric vehicles, for example—could obfuscate the boom associated with AI and other disruptive technologies evolving today, the waves of growth associated with the convergence among the 14 technologies involved in our five major platforms—robotics, energy storage, AI, blockchain technology, and multiomics sequencing—should start moving the needle on macro metrics increasingly and significantly during the next five to ten years.

Meanwhile, the equity market has reached record-breaking levels of concentration, spurring our search for diversified exposure to the AI revolution, particularly software applications that our research indicates are underrepresented in broad-based benchmarks but likely to drive value creation over our investment horizon. In our view, history will show that inflation—initially triggered by supply shocks—was transitory and evolved into disinflation, then ultimately deflation. Consequently, interest rates are likely to surprise on the low side of expectations, broadening the equity rally from a narrow subset of stocks and reinforcing the need for diversified AI investments. If ARK is correct that the most important AI investment opportunities are associated with “disruptive innovation,” then the winners and losers are likely to be surprising, resulting in a more diverse set of winners to which current equity market concentration should give way.

During the second quarter of 2024, ARK’s actively managed ETFs and both indexed ETFs underperformed the broad-based global equity indexes.15

The ARK Autonomous Technology and Robotics ETF (ARKQ) underperformed broad-based global equity indices during the quarter. Among the top detractors from ARKQ’s performance were UiPath (PATH) and Trimble (TRMB). Shares of UiPath detracted from performance during the quarter after the company reported its first-quarter earnings, during which management lowered full-year guidance. Citing sales execution challenges and macroeconomic headwinds, management lowered its expectations for revenue and announced the departure of UiPath’s current CEO, Rob Enslin. Daniel Dines, UiPath’s founder and former CEO, has returned to the role. UiPath faces short-term headwinds, but we believe that generative artificial intelligence will be a tailwind that drives demand for its automation platform, especially as AI agents require deterministic tools to perform complex tasks reliably across enterprise systems. Shares of Trimble traded down after the company delayed filing its 10-Q in response to Ernst & Young (EY) having identified a material weakness in Trimble’s IT controls process for revenue-related systems. Importantly, EY has not withdrawn its audit report on the company's 2023 financial statements. Earlier in the quarter, Trimble finalized its joint venture with AGCO for agriculture and retired over $1 billion in debt related to the Transporeon acquisition.

Among the top contributors were Teradyne (TER) and Tesla (TSLA). Shares of Teradyne rallied as part of a broad market move into semiconductor names. The company reported better-than-expected first-quarter earnings and guided for second-quarter revenue above consensus estimates, supported by greater-than-expected memory and networking demand related to Artificial Intelligence (AI) applications. Shares of Tesla contributed to performance during the quarter. In April, the company reported its first-quarter earnings, highlighting an accelerated product roadmap and emphasizing the importance of its robotaxi network, including ride-hail app renderings in its presentation deck. In June, shareholders re-approved Elon Musk's 2018 pay package during the annual shareholder meeting, and Tesla released Full-Self-Driving (FSD) v12.4 to limited customers, removing the steering wheel nag and enabling limited hands-free driving. At the end of the quarter, the company delivered better-than-expected vehicle numbers and deployed a record 9.4GWh of energy storage products, up 157% year-over-year.

The ARK Next Generation Internet ETF (ARKW) underperformed broad-based global equity indices during the quarter. Among the top detractors from ARKW’s performance were Block (SQ) and UiPath (PATH), the latter for the reasons discussed above. Shares of Block detracted from performance during the quarter as the company continued to face regulatory scrutiny around insufficient KYC/AML practices across Cash App services. Performance also suffered on the back of Apple's annual WWDC (worldwide Developers Conference) event, which included several announcements and enhancements to the Apple Wallet, Apple Pay, and Apple Pay Later, all of which pose incremental competitive threats to Block's Cash App and Afterpay products.

Among the top contributors were Tesla (TSLA), for the reasons discussed above, and Robinhood Markets (HOOD). Shares of Robinhood Markets appreciated, thanks to several developments. In May, Robinhood posted strong first-quarter results on the back of crypto market strength, beating net revenue and EBITDA (earnings before interest, taxes, depreciation and amortization) estimates by 13% and 46%, respectively. At the end of May, Robinhood also announced a $1 billion share repurchase program, to be executed over a period of 2-3 years. Finally, in early June, Robinhood announced its $200M cash purchase of Bitstamp, a cryptocurrency exchange based in Europe with over 50 active licenses and registrations across the EU, UK, US, and Asia.

The ARK Genomic Revolution ETF (ARKG) underperformed broad-based global equity indices during the quarter. Among the top detractors from ARKG’s performance were Ginkgo Bioworks (DNA) and Accolade (ACCD). Shares of Ginkgo Bioworks collapsed after the company reported lower-than-expected revenue and earnings for the first quarter and reduced fiscal-year guidance. Additionally, management announced a new “Lab Data as a Service” business, a restructuring in pricing, with plans to achieve EBITDA breakeven in 2026. With $840M cash and equivalents on its balance sheet, Ginkgo seems positioned to achieve that goal, though execution will be key, leading ARK to adjust portfolio exposure. Shares of Accolade traded down after the company reported fiscal first-quarter earnings that surpassed expectations, but then reduced full-year revenue growth guidance from 18% to 13% and prioritized cash flow generation. Management expects break-even adjusted EBITDA during the fiscal third quarter and significant positive adjusted EBITDA during the fourth quarter, thanks in part to the recognition of a savings performance guarantee (PG).

Among the top contributors were Twist Bioscience (TWST) and CareDx (CDNA). Shares of Twist Bioscience rallied after the company reported strong fiscal second-quarter financial results. Revenue increased 25% year-over-year, thanks to growth in the company’s synthetic biology product line, including Express Gene. Broad-based purchase orders contributed to the 45% increase in orders. Shares of CareDx appreciated after the company reported first-quarter earnings and raised fiscal-year revenue guidance by 11% at the midpoint based on strong financial and operational performance.

The ARK Fintech Innovation ETF (ARKF) underperformed broad-based global equity indices during the quarter. Among the top detractors from ARKF’s performance were UiPath (PATH) and Block (SQ), for the reasons discussed above.

Among the top contributors were Pinterest (PINS) and Robinhood Markets (HOOD), the latter for reasons discussed above. Shares of Pinterest traded up after the company announced strong first-quarter earnings, including an acceleration in revenue growth from 11% to 23% year-over-year, surpassing Wall Street expectations by 6%. Management emphasized broad-based advertiser demand for Pinterest's ad tools, monetization of third-party ad demand via Amazon and Google, and increased engagement from a younger demographic cohort.

The ARK Space Exploration & Innovation ETF (ARKX) underperformed broad-based global equity indices during the quarter. Among the top detractors from ARKX’s performance were UiPath (PATH) and Trimble (TRMB), for the reasons discussed above.

Among the top contributors were AeroVironment (AVAV) and Teradyne (TER), the latter for reasons discussed above. Shares of AeroVironment traded up as part of a broad market rally for defense companies. The U.S. Department of Defense’s Replicator Initiative selected AeroVironment’s Switchblade 600 loitering munitions system (LMS) for Tranche 1, with initial deliveries completed by May. The stock pulled back at the end of the quarter, in part because of increasing concerns about competition in its LMS segment, following a $300 million award to competitor Anduril by the U.S. State Department.

Invested in the highest conviction names in the Funds discussed above, the ARK Innovation ETF (ARKK) underperformed broad-based global equity indices during the quarter. Among the top detractors from ARKK’s performance were UiPath (PATH) and Block (SQ), for reasons discussed above. Among the top contributors were Tesla (TSLA) and Twist Bioscience (TWST), for reasons discussed above.

Among ARK’s self-indexed ETFs, the ARK Israel Innovation Technology ETF (IZRL) underperformed the broad-based global equity indices, and The 3D Printing ETF (PRNT) underperformed the broad-based global equity indices.16

Shares of Perion Networks (PERI) were the largest detractor from IZRL’s performance during the quarter. The company lowered its second-quarter and full-year guidance, with management forecasting full-year revenue of $500M from $600M, at mid-point, following Microsoft's Bing notification to Perion that it would exclude several publishers from its search distribution marketplace. Shares of WalkMe (WKME) were the largest contributor to IZRL’s performance this quarter. Shares rallied after the company announced that SAP is acquiring it for $1.5 billion in an all-cash transaction expected to close during the third quarter of 2024. SAP's CEO, Christian Klein, said the acquisition is intended to increase the pace at which customers can adopt new features, citing "applications, processes, data, and people" as the critical elements of business transformation likely to be bolstered by WalkMe's digital adoption platform.

Shares of Markforged (MKFG) were the largest detractor from PRNT’s performance during the quarter after a federal jury determined that the company must pay $17.34 million to Continuous Composites for patent infringement. Markforged is looking to overturn the verdict. Subsequently, Markforged reported mixed first-quarter results. Shares of HP (HPQ) were the largest contributor to PRNT’s performance during the quarter, trading up after the company reported better-than-expected fiscal second-quarter earnings, thanks to HP’s first increase in PC sales in two years. The company expects its recently announced AI-enhanced PCs, which will be priced on average 5-10% higher than the last generation, to represent ~40-60% of shipments by 2027.

As measured by the S&P 500 and MSCI World.

ARK’s Five Innovation Platforms are Artificial Intelligence, Robotics, Energy Storage, Multiomic Sequencing and Blockchain Technology.

WARD’s Automotive Group. Data as of June 2024.

Manheim Used Vehicle Value Index. Data as of June 2024.

National Associate of Realtors. Data as of May 2024.

Apartment List National Rent Report. Data as of July 2024.

U.S. Federal Reserve Economic Data as of March 2024. GDP is the total market value of all finished goods and services produced within a country’s border within a specific time period, typically a year. GDI is a measure of the total income generated by a country’s economy within a specific time period, typically a year.

National Federation of Independent Business. Data as of May 2024.

M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.

As measured by the difference between yields on the 10-year Treasury bond and the 2-year Treasury note.

An “inversion” means that the long-term Treasury yield is lower than the short-term Treasury yield. The yield difference was +159 basis points on March 29, 2021, and -108 basis points on July 3, 2023. One basis point is equal to 1/100 of a percentage point, or 0.01%.

The yield different was -35 basis points on June 28, 2024.

U.S. Bureau of Labor Statistics. Data as of June 2024.

Broad-based global equity indexes are defined as the S&P 500 Index and the MSCI World Index.

IZRL underperformed its benchmark, ARK Israel Innovation Index. PRNT underperformed its benchmark, The Total 3-D Printing Index.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.