During the third quarter, broad-based global equity indexes – as measured by the S&P 500 and MSCI World – were roughly flat as macro headwinds hurt consumer and investor confidence. The market reacted to fears of an economic slowdown after a rise in the Delta variant of the coronavirus, supply chain shortages, and a government crackdown in China. The US Senate passed a $1 trillion “physical infrastructure bill” after months of negotiations but intra-party tensions among House Democrats are jeopardizing it along with the $3.5 trillion “social infrastructure bill”. With midterm election campaigns in the early stages, the narrow majorities in both Houses of Congress are likely to prevent the passage of unpopular and onerous tax measures. The 10-year Treasury bond yield finished the quarter at 1.49%, roughly unchanged from June and below the 1.74% peak posted at the end of March. ARK still believes that the bond market is not corroborating the fears of inflation that have been dominating headlines. Meanwhile, monetary policy is likely to remain benign in its impact on equity markets, particularly if ARK’s outlook for an inventory correction and lower inflation is correct.

In ARK’s view, inflation fears have been overblown and are likely to give way to the risks of deflation. Thanks to both the base effect of collapsing prices during the coronavirus crisis last year and to supply chain bottlenecks that could be causing businesses to double- and triple-order supplies this year, inventories have been building, perhaps not in stores or on dealer lots but in households and garages. During the next six months, if economic growth were to disappoint in response to higher oil prices, lower confidence, and China’s crackdown on technology and financial services, global consumption could hit an air pocket, causing a collapse in commodity prices. Already, lumber and iron ore prices have dropped ~50% from their respective peaks this past spring. Oil remains an outlier, its price surpassing a high point hit in 2018 as environmental, social, and governance (ESG) mandates influence corporations to shift capital spending from fossil fuels to renewables. That said, the rise in oil prices seems to be accelerating the share shift away from gas-powered cars to electric vehicles (EVs). While well-established auto manufacturers are blaming chip shortages for year-over-year revenue declines, our research shows EV manufacturers, requiring 3-5 times more chips per car produced, are generating significant growth.

According to our analysis, two secular sources will exacerbate the shift from inflation to deflation, one good and another bad for economic activity. Innovation is the source of good deflation, as learning curves cut costs, increase productivity, and create exponential growth opportunities. Yet, instead of investing to capitalize on these opportunities, we believe many companies have catered to short-term oriented shareholders who demand results “now” and have leveraged their balance sheets to buy back stock, bolster earnings, and increase dividends. Facing the disintermediation and disruption associated with aging products and services, they could be forced to cut prices to service bloated debt, resulting in the kind of deflation that hurts economic activity.

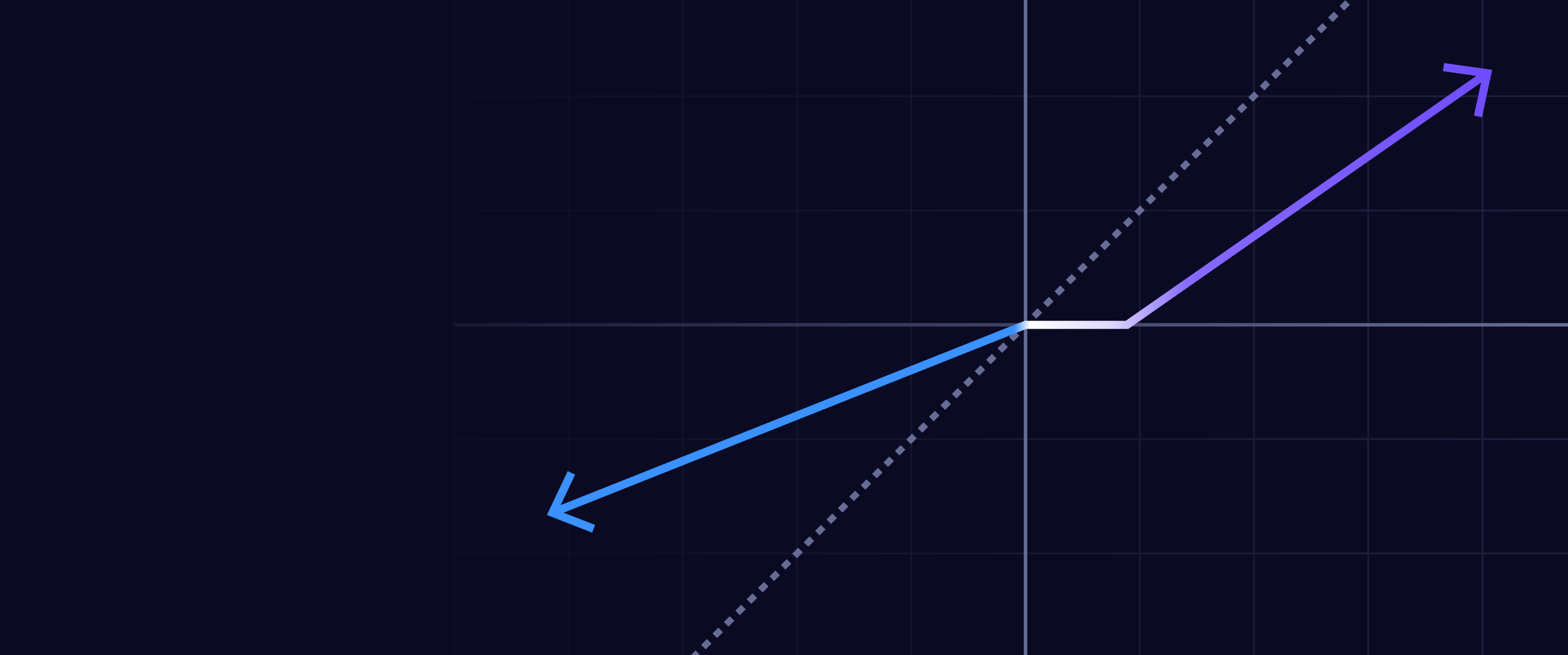

If ARK is correct that the risk to the outlook is deflation, not inflation, then during the next five years nominal GDP growth is likely to be much lower than expected, suggesting that scarce double-digit growth opportunities will be rewarded accordingly. Growth stocks in general and innovation-driven stocks in particular could be the prime beneficiaries. In ARK’s view, the coronavirus crisis transformed the world significantly and permanently, suggesting that many innovation-oriented stocks will be productive holdings during the next five to ten years.

During the quarter, conflicting economic indicators created a tug-of-war at times between growth and value stocks and added some momentum to defensive sectors like consumer staples and health care. As discussed above, ARK believes that investors are beginning to focus on inventories built not at the company level but in consumer households during the coronavirus crisis. Once the household inventory accumulation is better understood, fears could shift from inflation to deflation and sluggish growth rates.

Among the largest beneficiaries of the rotation toward cyclicals during the past nine to twelve months are two sectors that ARK believes will be disrupted the most by innovation during the next five years: Energy and Financial Services. In ARK’s view, autonomous electric vehicles and digital wallets, including cryptocurrencies and the decentralized financial services (DeFi) associated more broadly with blockchain technologies, will disrupt and disintermediate both Energy and Financial Services significantly during the next five years.

Relative to the S&P 500 and the MSCI World Index, ARK’s five actively managed ETFs and two self-indexed ETFs underperformed during the third quarter.

To read a summary of ARK’s biggest contributors and detractors, please see below.

The ARK Autonomous Technology and Robotics ETF (ARKQ) underperformed the broad-based market indexes during the quarter. Among the top detractors were Kratos Defense & Security (KTOS) and Baidu (BIDU). KTOS detracted from performance despite announcing a number of client contracts during the quarter. Investors focused their concern on comments from a Brigadier General on the US Air Force Life Cycle Management Cycle team that suggested potential delays in the government’s deeming Skyborg a program of record. ARK believes that Kratos is well-positioned to be a leader in the burgeioning market for military drones. Shares of Baidu sold off after the Chinese government cracked down on technology-focused companies with access to sensitive data.

Among the top contributors were Tesla (TSLA) and Unity Software (U). Tesla appreciated after beating both top- and bottom-line expectations during the second-quarter based on particularly strong momentum in electric car sales in China. Additionally, during its inaugural artificial intelligence (AI) Day, Tesla showcased its best-in-class training computer and groundbreaking progress in autonomous driving. Unity Software contributed to performance following a second-quarter report that exceeded revenue and profit expectations and guidance. Unity also acquired OTO, an AI-focused platform that could create safer gaming environments involving both voice and text chat.

The ARK Next Generation Internet ETF (ARKW) underperformed the broad-based market indexes during the quarter. Among the top detractors were Skillz (SKLZ) and Roku (ROKU). While competition in the mobile gaming space hurt its earnings, we believe Skillz’s revenue growth has been impressive, highlighting its potential as a primary gaming ecosystem in which pro eSports players and enthusiasts engage with casual players in 1v1 competitions. Roku declined after reporting second quarter earnings because the reopening of the economy caused slower than expected user growth. ARK maintains high conviction that Roku is well-positioned to capitalize on the shift from linear TV to connected TVs and streaming.

Among the top contributors were Tesla (TSLA) and Unity Software (U), for reasons discussed above.

The ARK Genomic Revolution ETF (ARKG) underperformed the broad-based market indexes during the quarter. Among the top detractors were Teladoc Health (TDOC) and Fate Therapeutics (FATE). Teladoc Health seems to have underperformed because of investor fears that its top-line growth will continue to slow down in a post-pandemic world, especially as other virtual care companies emerge as potential competitors. Investors also seem to be waiting for evidence that Teledoc is integrating with recently acquired Livongo successfully. In our view, the pandemic has accelerated the secular shift towards virtual care, a trend in which Teladoc is best positioned among telemedicine providers to benefit thanks to its channel access, service offerings, geography, and data advantage. Fate Therapeutics traded down sharply after announcing data from its “Natural Killer” cell programs in August. Investors seemed concerned about the durability of response, but ARK believes that the data is comparable to, if not better than, the results from autologous CART cell therapies. Additionally, the company published exciting preclinical results from its in vivo candidate showing strong anti-tumor activity. Roughly 90% of cancers in the US are solid tumors, and NK cell therapies could have greater promise than CART cell therapy in addressing solid tumors.

Among the top contributors were Arcturus Therapeutics (ARCT) and Regeneron Pharmaceutical (REGN). Arcturus Therapeutics appreciated after Sanofi (SNY) announced that it will acquire Translate Bio (TBIO), an mRNA therapeutics company focused on rare diseases. Also contributing to its outperformance, Arcturus struck a deal to manufacture vaccines for new SARS-CoV-2 variants in Singapore and Vietnam. Meanwhile, Regeneron surpassed earnings expectation for the second-quarter, as demand for its COVID-19 antibody cocktail increased, perhaps in response to a World Health Organization (WHO) recommendation.

Among the top contributors were Intellia Therapeutics (NTLA) and CareDx (CDNA). Intellia Therapeutics made history by presenting the first data of a CRISPR Cas9 in vivo gene editing therapy in patients with Hereditary Transthyretin Amyloidosis (hATTR). Until now, patients with hATTR faced limited treatment options. Intellia’s data highlighted that editing the TTR gene could result in a one-time treatment, eliminating the need for chronic therapy, signifying that one-time cures are possible. CDNA responded positively to CareDx’s acquisition of Transplant Hero, a mobile application provider focused on the needs of transplant patients. CareDx is modernizing transplant medicine with deep genomics expertise, machine learning, and longitudinal patient management.

The ARK Fintech Innovation ETF (ARKF) underperformed the broad-based market indexes during the quarter. Among the top detractors were Zillow Group (Z) and Pinterest (PINS). Zillow posted strong second-quarter revenue growth and gross profit margins but missed on earnings. Also pressuring the stock were fears of a housing market slowdown in response to higher mortgage rates. Pinterest reported a sequential decrease in monthly active users (MAUs) on its platform. Although MAUs did drop 24 million sequentially to 454 million, Pinterest also reported a 125% year-on-year increase in revenue and higher-than-consensus metrics across revenue, average revenue per user (ARPU), and earnings. Although ARK believes post-COVID reopening dynamics might have contributed to lower user retention, continued growth in its mobile user base highlights Pinterest’s high level of engagement in a mobile-first world. Pinterest is a social media platform that encourages users to discover items of interest or sources of inspiration from each other, suggesting that it could become a prime beneficiary of any shift toward social commerce.

Among the top contributors were Sea (SE) and LendingClub (LC). Sea rallied after the company posted a strong second-quarter featuring stronger than expected top- and bottom-line growth and higher full-year guidance. In Southeast Asia and Taiwan, Shopee (owned by Sea) ranked first in the Shopping category by average monthly active users and total time spent in-app on Android for the first quarter of 2021. LendingClub traded up after it released second-quarter earnings that surpassed consensus expectations dramatically, thanks to a 93% sequential revenue growth rate driven by higher origination fees and net interest income.

The ARK Space Exploration & Innovation ETF (ARKX) underperformed the broad-based market indexes during the quarter. Among the top detractors were JD Logistics (2618 HK) and Kratos Defense & Security (KTOS). Chinese stocks, particularly those associated with technology-enabled companies, sold off broadly after the central government cracked down on companies with sensitive personal and other data. ARK believes that JD Logistics should benefit from China’s focus on “common prosperity”, including autonomous technology like with drones and last-mile delivery robots. Kratos Defense & Security detracted from performance for reasons discussed above.

Among the top contributors were Unity Software (U) and Netflix (NFLX). Unity Software contributed to performance for reasons discussed above. Netflix missed second-quarter subscription expectations but debuted another viral show, Squid Game. The global success of this South Korean program could be a tailwind for Netflix’s international growth as more users gain access to broadband services.

With some of the highest conviction names from the Funds discussed above, the ARK Innovation ETF (ARKK) underperformed the broad-based indexes during the quarter. Among the top detractors were Roku (ROKU) and Zoom Video Communications (ZM). Roku detracted from performance for reasons discussed above. Zoom detracted from performance following an earnings report that pointed to a deceleration in the growth of its core Meetings product in the SMB/individual segment. That said, revenues increased a better than expected 54% on a year-over-year basis against a blistering 355% surge during the depths of the coronavirus crisis last year. Moreover, the number of Zoom customers with more than 10 employees increased 36%. Meanwhile, with roughly two million seats, Zoom Phone appears to be gaining momentum. While higher churn from lower-end markets is not surprising as the global economy reopens, ARK believes that Zoom is likely to overcome the slowdown with share gains in the massive enterprise communications space as it evolves what appears to be the most technologically advanced offering for video conferencing and PBX. Zoom is a leader in cloud communications, providing solutions for video conferencing, voice, and chat worldwide.

Among the top contributors were Tesla (TSLA) and Unity Software (U), for reasons discussed above.

ARK’s self-indexed ETFs, The 3D Printing ETF (PRNT) and the ARK Israel Innovation Technology ETF (IZRL), depreciated during the quarter. PRNT underperformed relative to the broad-based market indexes. 3D Systems (DDD) was the largest detractor despite its new production-grade acrylate resin announcement. The new, tougher material will enable large-scale additively manufactured parts capable of withstanding long-term mechanical use. Straumann Holding (STMN) was the top contributor. The company reported first-half earnings with revenue growth of roughly 63% year-over-year. The company produces 3D printers for dental laboratories. Additionally, Straumann previously acquired ClearCorrect, a competitor to Align (ALGN) that uses 3D printed molds to create dental aligners.

As for IZRL, Nano Dimensions (NNDM) was the largest detractor, pressured by a continued correction after its previous surge last spring. ARK believes Nano Dimension will enable new form factors not possible previously with traditional printed circuit boards (PCBs). Inmode (INMD) was the top contributor after Inmode not only delivered better than expected revenues, earnings, and guidance, but also launched new body contouring technology EvolveX and announced a 2:1 share split. Inmode focuses on plastic surgery and designs, develops, manufactures, and markets minimally-invasive aesthetic medical products based on its proprietary radiofrequency assisted lipolysis and deep subdermal fractional radiofrequency technologies.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.