Click here to download the PDF version.

Broad-based global equity indexes1 pushed higher as the markets digested and weighed the tradeoffs between tariffs, labor weakness, and geopolitical uncertainty, on one hand, versus deregulation, tax incentives, and Federal Fund Rate cuts, on the other. In our view, the innovation space is not only recovering but also being revalued. Headwinds that once pressured disruptive technologies are shifting into structural tailwinds, supported by broadening market participation, favorable policy shifts around crypto, AI, and healthcare, and potential fiscal catalysts like depreciation relief associated with OB3 (The One Big Beautiful Bill). OB3 could position the United States among the most tax-competitive economies globally, improving returns on invested capital (ROIC) and attracting meaningful foreign direct investment. Counter to conventional wisdom, a stronger dollar would reinforce surprises on the low side of inflation expectations, pushing interest rates lower and creating a supportive macro backdrop for both risk assets and innovation-led growth.

Bolstering that scenario, President Trump’s pro-growth policies combined with transformative breakthroughs across artificial intelligence, robotics, energy storage, blockchain, and multiomics sequencing could catalyze a new wave of productivity gains and accelerate economic growth, potentially benefiting innovators whose contributions have not been reflected in benchmark-heavy indexes.

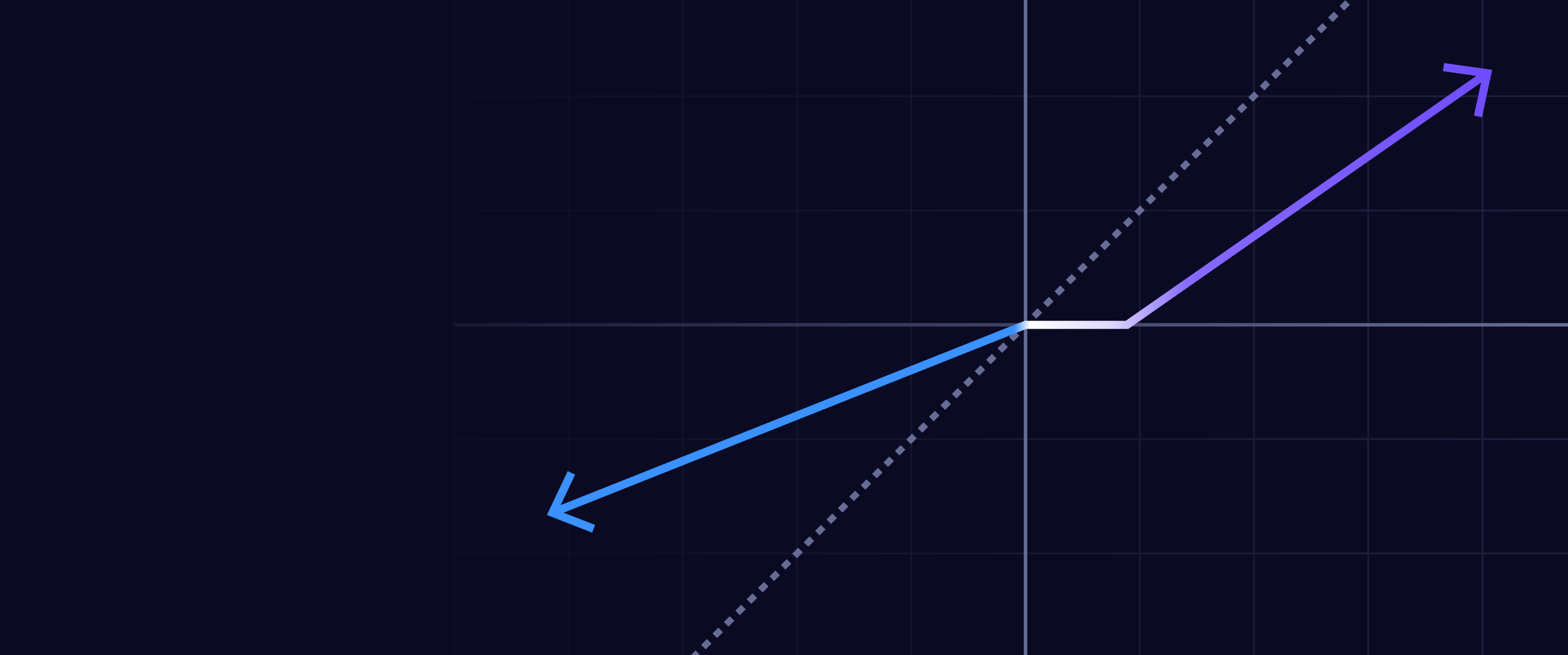

ARK’s research suggests that a rolling recession2 began in the spring of 2022, when the U.S. Federal Reserve (Fed) tightened monetary policy and raised interest rates by 22-fold in little more than a year. Our research also suggests that a loss of pricing power will force corporations to curb employment growth and harness new technologies to increase productivity and protect margins. The Five Innovation Platforms3 around which ARK has centered its research and investing could play an outsized role in pulling the economy out of the rolling recession, potentially salvaging corporate margins as inflation gives way to deflation in many sectors over the next few years. Supporting our perspective are the following indicators:

- Despite historically strong demand for homes, buying activity has been constrained by near record low affordability. At 4.8 million units, new and existing home sales volume has collapsed 34% from its peak in 2022 to levels last seen during the 2008-2009 recession in response to the Federal Reserve’s rapid rate hikes in 2022 and 2023.4 Meanwhile, single-family home inventory has climbed to roughly 490,000 homes, nearing the August 2006 peak of 570,000 which preceded the housing collapse in 2008-2009.5 Although hesitant to cut prices, many builders are offering incentives like mortgage rate buydowns. If the Fed continues to lower rates, housing could rebound sharply, creating a powerful multiplier of activity to support the broader economy.

- Signaling recession in July 2024, the employment report triggered the Sahm Rule, as the three-month moving average of the US unemployment rate rose 50 basis points6 above its lowest point in the last 12 months, historically an indicator that the economy has been in recession for three months. Underscoring labor market weakness, the Bureau of Labor Statistics issued a historic downward revision of 911,000 to nonfarm payrolls for the 12 months ending in March, the largest such revision since 2000. Corroborating this evidence of labor softness, as measured by the Conference Board, the gap has widened between respondents saying jobs are “plentiful” and those saying they are “hard to get”, signaling that jobs are becoming increasingly difficult to find. The quit rate also has declined to 1.9%, a post-COVID low, suggesting that workers are less confident about switching jobs. Moreover, the average duration of unemployment has been rising since early 2023 and now stands at 24.5 weeks, underscoring persistent cooling in labor market conditions.

- In the early days of the pandemic, autos accounted for roughly one-third of the inflation spike. Now, while used car prices remain elevated relative to historical norms, they have dropped 19% from their pandemic peak, signaling deflationary pressures in the sector.7 That said, auto sales surged above 17 million units (seasonally adjusted annual rate) in March and April—seemingly because of preemptive buying ahead of anticipated tariffs—before dropping to 16.4 million units in September.8 In our view, front-loading activity may have pulled demand forward, portending softer sales during the second half of the year.

- As indicated by the PMI (Purchasing Managers Index), still below 50, manufacturing has been contracting since November 2022, and despite the AI-related spending boom on data centers and power plants beginning in late 2022, the non-manufacturing index fell to 50—the dividing line between growth and contraction—indicating that momentum in the broader economy has stalled.

- May was the first month since 2007 in which the ISM Services Prices Paid Index hit a two-year high while the New Orders index fell to a two-year low. This divergence signals that rising input costs amid weakening demand are putting downward pressure on profit margins, often a harbinger of recession.

- Often, the consumer represents the last leg of a rolling recession. As measured by the University of Michigan, consumer confidence among high-income earners has capitulated, falling to the 2008-09 levels at which low- and middle-income earners have been mired since the Fed raised rates in 2022.

While the Fed focused on raising interest rates to squelch inflation, the bond market has been signaling deeper trouble, as the yield curve inverted from +159 basis points in March 2021 to -108 basis points in July 2023—levels last seen in the early 1980s—only to reverse into a bear steepening phase in 2024, suggesting that both growth and inflation might undershoot expectations. Supply shocks, geopolitical turmoil, inventory hoarding, and government spending spurred a year-over-year spike in inflation to 9.1% in 2022, as measured by consumer price index (CPI). Since then, inflation decelerated but then entered the 2.5-3.0% range, aided by good, bad, and cyclical deflationary forces. While inflation has stabilized at a lower level than many expected, the other side of the Fed’s dual mandate, labor, has weakened, prompting a 25 basis point rate cut in September and fueling expectations for continued easing in the months ahead.

While many economists now expect a period of prolonged slow growth, our research suggests that the rolling recession that has been in place for the past three years should end with clarity on tariff, tax, regulatory, and monetary policies during the next three to six months. If the recent tariff turmoil results in freer trade, as tariffs and non-tariff barriers come down in tandem with declines in other taxes, regulations, and interest rates, then real gross domestic product (GDP) growth and productivity could surprise on the high side of expectations at some point during the second half of this year.

Innovation tends to gain traction during tumultuous times: when consumers and businesses are concerned about the future, they are willing to change the way they do things. Inertia gives way to better, less expensive, faster, more productive, and more creative ways of living and working. During the current turbulent transition in the US, consumers and businesses are likely to accelerate the shift to technologically enabled innovation platforms including artificial intelligence, robotics, energy storage, blockchain technology, and multiomics sequencing.

During the third quarter of 2025, ARK's six actively managed ETFs outperformed the broad-based global equity indexes.

The ARK Autonomous Technology and Robotics ETF (ARKQ) outperformed broad-based global equity indices during the quarter. Among the top contributors were Kratos Defense & Security (KTOS) and Tesla (TSLA). Shares of Kratos traded up during the quarter, outperforming a broad-based rally in defense stocks amid rising geopolitical tensions and recent US policy changes on drone production and export rules. The company reported better-than-expected second-quarter earnings and raised its full-year guidance, thanks to accelerating revenue growth in the government solutions segment, driven by defense tailwinds. Shares of Tesla appreciated during the quarter, rebounding from an initial sell-off associated with Elon Musk’s warning of a potentially difficult few quarters before autonomy scales. The stock recovered as the company signed a $4.3 billion battery deal with LG, initiated robotaxi operations in Austin and the Bay Area, proposed Musk’s $1 trillion pay package, and disclosed his purchase of nearly $1 billion of stock, his first and largest purchase in more than five years.

Among the top detractors were Iridium Communications (IRDM) and Archer Aviation (ACHR). Shares of Iridium Communications detracted from performance during the quarter after the company reported second-quarter earnings and cut fiscal-year service revenue guidance from 5-7% to 3-5%. While Starlink has impacted its maritime broadband segment sooner than expected, the broadband segment represents less than 10% of Iridium’s business. Shares of Archer Aviation struggled for two reasons. The company faced litigation alleging that its special purpose acquisition company (SPAC) sponsors overstated development timelines, a distraction unrelated to business progress in our view. Later in the quarter, a broad-based pullback in electric vertical take-off and landing (eVTOL) stocks weighed on the shares, while Archer achieved a key milestone, with a 51-mile, 31-minute flight in FAA-controlled airspace.

The ARK Next Generation Internet ETF (ARKW) outperformed broad-based global equity indices during the quarter. Among the top contributors were Tesla (TSLA), for the reasons discussed above, and Robinhood (HOOD). Shares of Robinhood contributed to fund performance after the company reported strong second-quarter earnings, including revenue growth of 45% year-over-year that beat expectations. Robinhood also disclosed strong product velocity during its annual HOOD Summit, a dedicated event for active traders. Summit highlights included the launch of Robinhood Social with verified live trades, as well as upgrades to Robinhood Legend with short selling, custom indicators, and futures. Robinhood also announced the debut of the Robinhood Ventures Fund I, designed to give retail investors access to private companies, and expanded its prediction markets hub, surpassing 4 billion in cumulative contract volume, thanks to new Pro and College Football markets. Finally, S&P 500 added Robinhood to its broad-based index during the quarter.

Among the top detractors were Circle Internet Group (CRCL) and The Trade Desk (TTD). Shares of Circle Internet Group traded down this quarter as expected rate cuts weighed heavily on investor sentiment by threatening to reduce Circle’s primary revenue source, as intensifying competition from both traditional financial institutions and crypto-native issuers added further pressure. Despite those headwinds, Circle announced meaningful strategic initiatives during the quarter, including expanded ecosystem integrations, the launch of its own ARC layer-1 blockchain, and deeper moves into the payments sector. Shares of The Trade Desk struggled this quarter after the company reported that revenue growth decelerated from 25% on a year-over-year basis in the first quarter to 19% in the second quarter, with guidance that third quarter growth would decelerate further to 14%. Finally, the company announced that Laura Schenkein, its Chief Financial Officer, will step down after more than a decade of service, to be succeeded by Alex Kayyal, a current board member with extensive leadership experience in the technology and investment sectors.

The ARK Genomic Revolution ETF (ARKG) outperformed broad-based global equity indices during the quarter. Among the top contributors were CRISPR Therapeutics (CRSP) and Tempus AI (TEM). Shares of CRISPR Therapeutics appreciated after the company announced progress not only in its Casgevy launch but also that the Phase 1 clinical data for its in vivo gene-editing therapy for cardiovascular disease was selected for an oral presentation at a medical conference in November. Shares of Tempus AI rallied after the company reported positive second-quarter results, including revenue growth of ~90% year-over-year and the acquisition of AI-powered digital pathology company, Paige. Additionally, the company received FDA clearances for its AI-powered cardiac imaging platform and for its RNA-based in vitro diagnostic device, a tool intended to support drug development programs.

Among the top detractors were Twist Bioscience (TWST) and CareDx (CDNA). Shares of Twist Bioscience fell after the company reported that its revenue growth during the second quarter slowed from 23% to 18% year-over-year after a well-telegraphed $5 million drop in next-generation sequencing (NGS) revenues as a top 10 customer transitioned from validation to commercial deployment. Investors also reacted to a deceleration in the revenue growth of the company’s SynBio segment from 21% to 7% year-over-year—based on a tough comparison against a large one-time customer order in 2024. In our view, both headwinds should normalize as new accounts ramp and recurring revenue strengthens into 2026. Shares of CareDx traded down after Medicare published a Local Coverage Determination related to molecular testing for solid organ transplant rejection on its Medicare Coverage Database.9 The draft policy would continue coverage for molecular diagnostic testing instead of tissue biopsies for kidney, heart, and lung transplant patients, but would cap the number of reimbursable surveillances following transplants and introduce a “one molecular test per encounter” rule, raising questions about the reimbursement of combined offerings—such as CareDx’s HeartCare including both AlloMap and AlloSure. The likely impact to reimbursement in the near-term is uncertain, as the policy was in draft form and open for public comment through August 31, 2025, with the potential for modifications.

The ARK Fintech Innovation ETF (ARKF) outperformed broad-based global equity indices during the quarter. Among the top contributors were Robinhood (HOOD), for the reasons discussed above, and Shopify (SHOP). Shares of Shopify appreciated this quarter after the company reported strong second-quarter earnings, including higher-than-expected growth in both Gross Merchandise Value (GMV) and revenue at 31% on a year-over-year basis. Management emphasized Shopify’s ongoing efforts to develop agentic commerce infrastructure, signaling a long-term commitment to platform innovation and merchant enablement.

Among the top detractors were Circle Internet Group (CRCL), for the reasons discussed above, and Toast (TOST). Shares of Toast traded down after the company reported second-quarter earnings, including Gross Payment Volume (GPV) and revenue growth of 23% and 25% year-over-year, respectively. Importantly, net location ads came in at the lower end of analysts' expectations.

The ARK Space Exploration & Innovation ETF (ARKX) outperformed broad-based global equity indices during the quarter. Among the top contributors were Kratos Defense & Security (KTOS), for the reasons discussed above, and Rocket Lab (RKLB). Shares of Rocket Lab appreciated during the quarter after the company reiterated its second-half launch target for its medium-lift Neutron rocket during second-quarter earnings. Toward quarter-end, the stock pulled back from all-time highs after the company registered a $750 million at-the-market (ATM) equity offering.

Among the top detractors were Iridium Communications (IRDM) and Archer Aviation (ACHR), for the reasons discussed above.

Invested in the highest conviction names in the Funds discussed above, the ARK Innovation ETF (ARKK) outperformed broad-based global equity indices during the quarter. Among the top contributors were Tesla (TSLA) and Robinhood (HOOD), for the reasons discussed above. Among the top detractors were Circle Internet Group (CRCL) and Twist Bioscience (TWST), for the reasons discussed above.

Among ARK’s self-indexed ETFs, the ARK Israel Innovation Technology ETF (IZRL) and The 3D Printing ETF (PRNT) underperformed the broad-based global equity indices.10

Shares of Monday.com (MNDY) were the largest detractor from IZRL’s performance after the company reported second-quarter results that exceeded revenue and earnings expectations but were overshadowed by cautious third-quarter revenue guidance. Shares of Aryt Industries (ARYT) were the largest contributor to IZRL’s performance after the company posted better-than-expected half-year results. Revenue grew more than 400% thanks to large Ministry of Defense orders amid heightened demand during the Israeli conflict. Management noted that Aryt’s order book has expanded to NIS 1.3 billion but warned that such growth might not be sustained.

Shares of BICO Group (BICO) were the largest detractor from PRNT’s performance after the company reported weaker-than-expected earnings. The company disclosed a steep revenue decline and significant challenges in its Lab Automation segment, citing project delays, fewer new contract starts, and broader macro headwinds that are weighing on capital spending in the life sciences sector. Shares of 3D Systems (DDD) were the largest contributor to PRNT’s performance after the company reported better-than-expected earnings, thanks to operational efficiency initiatives. Later in the period, the company announced a $7.65 million U.S. Air Force contract for a large-format Metal 3D Printer Advanced Technology Demonstrator, underscoring the growing adoption of its advanced manufacturing solutions.

Broad-based global equity indexes are defined as the S&P 500 Index and the MSCI World Index.

A type of recession that affects different sectors of the economy at different times—not simultaneously.

ARK’s Five Innovation Platforms are Artificial Intelligence, Robotics, Energy Storage, Multiomic Sequencing, and Blockchain Technology.

National Association of Realtors. Data as of August 2025.

U.S. Department of Housing and Urban Development. Data as of September 2025.

A basis point (bp) is a unit of measurement used to quantify the change between two percentages. It is equal to 1/100th of 1%, or 0.01%.

Manheim Used Vehicle Value Index. Data as of September 2025.

WARD’s Automotive Group. Data of September 2025.

Medicare Coverage Database. 2025. “MolDX: Molecular Testing for Solid Organ Allograft Rejection.” Centers for Medicare and Medicaid Services.

IZRL underperformed its benchmark, ARK Israel Innovation Index. PRNT underperformed its benchmark, The Total 3-D Printing Index.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.