Click here to download the PDF version.

The S&P 500 Index appreciated in the fourth quarter after the US election raised expectations for reduced regulatory and tax burdens. In ARK's view, the most significant near-term government actions—including deregulation, the Department of Government Efficiency’s (D.O.G.E.) efforts to increase government efficiency, a change in the Securities and Exchange Commission’s (SEC) attitude toward digital assets, and the Federal Trade Commission’s (FTC) more open stance to mergers and acquisitions (M&A)—will create profound opportunities for innovation, particularly in autonomous mobility, multiomics, and digital assets.

While the consensus forecast is for a soft landing, ARK still expects that a loss of pricing power will force corporations to curb employment, perpetuating the rolling recession1 that began in the spring of 2022 when the U.S. Federal Reserve (Fed) started hiking interest rates by 22-fold in little more than a year’s time. In our view, the Five Innovation Platforms2 around which ARK has centered its research and investing could play an outsized role in pulling the economy out of this rolling recession, salvaging corporate margins as inflation gives way to deflation in many sectors during the next few years.

ARK’s research suggests that the economy has been undergoing rolling recessions. Supporting that point of view are the following indicators:

- In the early days of the pandemic, autos accounted for roughly one-third of the inflation spike. Now, used car prices have dropped 20% below peak prices but remain well above historical trend, signaling the potential for further deflation.3 Sales of new autos have yet to return to their pre-COVID 17.5-million-unit rate.

- Housing metrics including housing starts and affordability also are sending troubling signals. At 4.1 million units, the number of existing home sales is not far above levels last seen during the global housing crisis.4 Simultaneously, a record number of apartment units under construction will be making it to market, suggesting that rents could push inflation into much lower-than-expected territory over time.

- Underscoring the widespread weakness in economic activity, many global company bellwethers reported declines in revenues on a year-over-year basis in their most recent quarters: Texas Instruments (-8.4%), FedEx (-0.9%), Kraft-Heinz (-2.8%), Cisco (-5.6%), Caterpillar (-4.2%), and Procter & Gamble (-0.6%). As measured by Bloomberg, the S&P 500's average gross margin has declined from 35.0% in the five years prior to COVID to 33.9% in the fourth quarter of 2024. In our view, that setback will intensify until the Fed cuts interest rates significantly and/or companies harness innovation like artificial intelligence aggressively, not only to drive productivity growth but also to create new products and services that replace legacy solutions. To limit the damage to margins in the interim, companies that hoarded employees during post-COVID labor shortages are likely to lay them off during the next year, further allaying the Fed’s concern about underlying inflation. Indeed, the number of unemployed permanent employees has increased 723,000, or 62%, to 1,893,000 since September 2022.5 As a result, nominal activity could weaken beyond the recent soft spots associated with housing, autos, capital spending, and other big-ticket purchases, forcing more price cuts and margin compression.

- As measured by the National Federal of Independent Business (NFIB), small business optimism recently plummeted to recessionary levels not seen since the 2008–09 financial crisis—though a notable recent spike in optimism, likely tied to the potential for deregulation associated with the results of the 2024 election, has emerged. Corroborating the positive sentiment change, future new orders, which measure sentiment about future business activity, increased following a surge in optimism among manufacturers since October. That said, noncorporate (small) firms, which drive most job creation, currently generate only ~80% of larger corporations’ net income, the lowest ratio since records began in 1959, raising concerns about the potential for a weaker labor market.

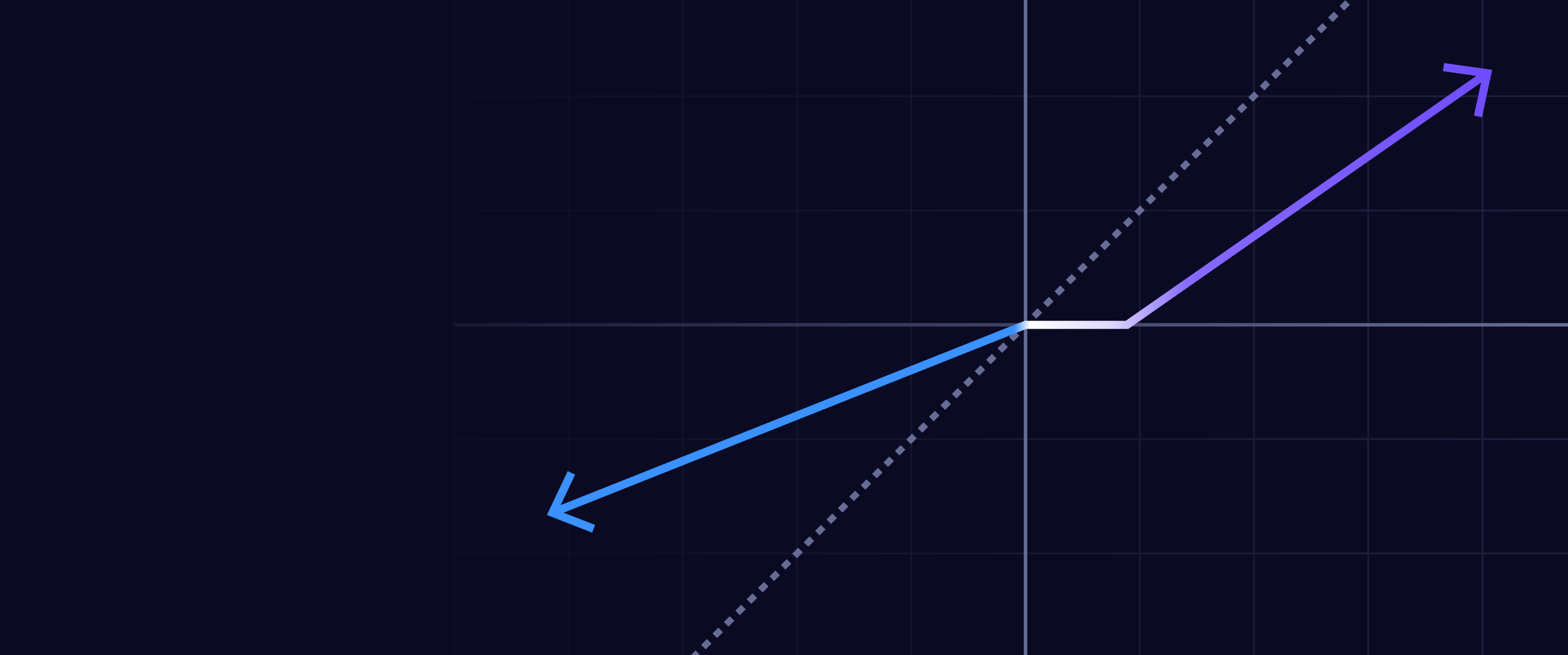

- M26 growth turned negative on a year-over-year basis from December 2022 through March 2024 and, at 3.7%, is still weak by historical standards. Should the correlation between the Consumer Price Index (CPI)7 and 18-month leading M2 growth hold steady, CPI could fall below 2% year-over-year, and potentially negative this year, as it did in 2014, 2015, and 2020.

- The ratio of the Commodity Research Bureau (CRB) Metals price index to the gold price index has dropped below its lows during the Global Financial Crisis (GFC) in 2008-2009 and the COVID crisis. Until the Fed started raising rates in 2022, the correlation between this ratio and long-term interest rates has been very high. If this relationship were to revert to normal, interest rates could collapse, or metals prices could rise significantly, or some combination of both. Thus far, interest rates seem to be holding sway.

- Current high-yield spreads8 are remarkably narrow compared to long-term averages, indicating that credit markets do not perceive credit or deflationary risks. Perhaps abundant liquidity in private equity and credit is chasing yield and distorting spreads, masking the underlying risks.

- Signaling recession in July, the employment report triggered the Sahm Rule, as the three-month moving average of the U.S. unemployment rate rose 50 basis points above its lowest point in the last 12 months, historically an indicator that the economy has been in recession for three months. Underscoring labor market weakness, for the twelve months ended March 2024, the Bureau of Labor Statistics revised employment down by 818,000, the largest downward revision since 2009, taking the average growth in monthly payrolls down from 242,000 to 174,000 jobs per month. Although the Sahm Rule no longer is signaling outright recession, quit rates have reversed sharply since the post-COVID “Great Resignation” and are now down to 1.9%, the lowest since the 2020 COVID lockdown, a signal that confidence in labor market opportunities is diminishing.

While the Fed focused on raising interest rates to squelch inflation, the bond market was signaling deeper trouble, as the yield curve inverted from +159 basis points9 in March 2021 to -108 in July 2023—levels last seen in the early 1980s—only to reverse into a bear steepening phase in 2024, suggesting that both growth and inflation might undershoot expectations. After geopolitical turmoil, inventory hoarding, and government spending spurred a year-over-year spike in CPI inflation to 9.1% in 2022, it has dropped to 2.5% since then, aided by good, bad, and cyclical deflationary forces. Around the time the Fed paused rate hikes, ChatGPT highlighted the kinds of transformative innovation likely to turbocharge that deflationary trend. Over the next five to ten years, disruptive technologies—spanning robotics, energy storage, AI, blockchain, and multiomics sequencing—are likely to converge, potentially jumpstarting powerful waves of growth that will reshape the macroeconomic landscape.

Meanwhile, in 2023, the equity market reached a record-breaking level of concentration, suggesting that diversified exposure to the AI revolution, particularly software applications underrepresented in broad-based benchmarks, could drive value creation over our investment horizon. In our view, history will show that inflation—initially triggered by supply shocks—was transitory and evolved into disinflation, then ultimately deflation. Consequently, interest rates are likely to surprise on the low side of expectations, broadening the equity rally from a narrow subset of stocks and reinforcing the need for diversified AI investments. If ARK is correct that the most important AI investment opportunities are associated with “disruptive innovation,” then the winners and losers are likely to be surprising, resulting in a more diverse set of winners to which current equity market concentration should give way.

During the fourth quarter of 2024, five of ARK's six actively managed ETFs outperformed the broad-based global equity indexes.10

The ARK Autonomous Technology and Robotics ETF (ARKQ) outperformed broad-based global equity indices during the quarter. Among the top contributors were Tesla (TSLA) and Rocket Lab (RKLB). Shares of Tesla contributed to the fund's performance after the company reported better-than-expected third-quarter profitability, thanks to record low vehicle costs. Later in the quarter, the US election results prompted several Wall Street analysts to upgrade the stock. Tesla benefited from Elon Musk's involvement in the Trump administration, which analysts cited as a potential tailwind for the company. Analysts also highlighted the potential for regulatory changes around autonomous vehicles which could benefit Tesla. The release of Tesla's Full Self-Driving (FSD) v13.2 software further strengthened confidence in its planned deployment of ride-hailing in 2025. Shares of Rocket Lab contributed to the fund's performance after the company reported better-than-expected third-quarter results and guided for record-breaking fourth-quarter revenue, thanks to the increased launch cadence of its small-lift Electron rocket. Management affirmed that Rocket Lab not only remains on track to complete its first flight in mid-2025 but also has secured a multi-launch contract for its medium-lift Neutron rocket in mid-2026.

Among top detractors were AeroVironment (AVAV) and Advanced Micro Devices (AMD). Shares of AeroVironment detracted from the fund's performance after the company reported a slowdown in second-quarter revenue growth and lower-than-expected earnings, driven largely by lower demand from Ukraine. The company also announced a $4.1 billion acquisition of BlueHalo, a leading provider of advanced defense and space technologies that should expand its total addressable market significantly. Additionally, the U.S. Government Accountability Office (GAO) denied a protest challenging the U.S. Army’s sole-source $990 million contract for AeroVironment’s Switchblade systems. Shares of Advanced Micro Devices detracted from fund performance after the company reported its third-quarter earnings. Topline revenue growth accelerated to 18% year-over-year from 9% last quarter, thanks to 122% year-over-year growth in its Data Center segment. Management stated that persistent AI-driven demand propelled the company’s GPU sales to a level equal to its CPU sales. Nonetheless, full-year estimates for revenue generally, and GPU sales specifically, did not surpass heightened expectations, likely pressuring share price. AMD also announced a partnership with Intel to promote the flexibility and compatibility of chips based on the x86 instruction set architecture. Finally, it invested in Vultr, a GPU cloud startup, positioning AMD as their primary hardware provider.

The ARK Next Generation Internet ETF (ARKW) outperformed broad-based global equity indices during the quarter. Among the top contributors were Tesla (TSLA), for the reasons discussed above, and the ARK 21Shares Bitcoin ETF (ARKB). Shares of the ARK 21Shares Bitcoin ETF contributed to the fund after Donald Trump won the US Presidential election, spurring cryptocurrency markets and pushing the price of bitcoin to an all-time high of ~$108,000. Investors seem confident that Trump’s pro-crypto stance will foster a more favorable regulatory environment for cryptocurrency-related companies.

Among the top detractors were Advanced Micro Devices (AMD), for the reasons discussed above, and MercadoLibre (MELI). Shares of MercadoLibre detracted from the fund after the company reported third-quarter earnings, including strong revenue growth but lower-than-expected margins. Local currency revenues increased 103% on a year-over-year basis while operating margins dropped 740 basis points because of provisions for bad debt and significant investments in shipping logistics. Furthermore, J.P. Morgan downgraded the stock in response to short-term pressures on earnings as the company scales up its credit card business.

The ARK Genomic Revolution ETF (ARKG) underperformed broad-based global equity indices during the quarter. Among the top detractors were Intellia Therapeutics (NTLA) and CareDx (CDNA). Shares of Intellia Therapeutics detracted from fund performance after the company released data from its Phase 2 trials for NTLA-2002, an in-vivo CRISPR-Cas9 therapy for hereditary angioedema (HAE). With no serious adverse side-effects, NTLA-2002 at the 50mg dose level reduced mean monthly attack rates by 77% and 81% during weeks 1-16 and 5-16, respectively, compared to the placebo. Importantly, eight of eleven patients had no attacks. According to management, the three patients who self-reported attacks are likely to report fewer attacks once the study is unblinded and they know whether they are on NTLA-2002, as happened after Intellia released Phase 1 results. That said, some investors are concerned that the three patients’ results are signaling that NTLA-2002 is not a cure, a view with which we disagree completely. Shares of CareDx detracted from fund performance after the company released preliminary results for the third quarter. Revenue increased 23%, surpassing analysts’ expectations, but investors seemed dismayed by the company’s reticence to provide full-year guidance or to host a Q&A session.

Among the top contributors were Quantum-SI (QSI) and Butterfly Network (BFLY). Shares of Quantum-Si contributed to fund performance after the company announced a collaboration with NVIDIA to develop its new Proteus proteomics platform and advance Quantum-Si’s amino acid binders and aminopeptidases using NVIDIA AI‘s accelerated computing. It also moved back into compliance with the Bid Price Requirement to remain on the Nasdaq. Shares of Butterfly Network contributed to fund performance after the company reported a strong third quarter in which revenue grew 33% on a year-over-year basis, thanks to the recently launched next-generation iQ3 probe’s higher selling price and increased both enterprise software revenue and full-year 2024 revenue guidance.

The ARK Fintech Innovation ETF (ARKF) outperformed broad-based global equity indices during the quarter. Among the top contributors were Coinbase (COIN) and SoFi Technologies (SOFI). Shares of Coinbase contributed to the fund after Donald Trump won the US Presidential election, causing a surge in cryptocurrency markets during which the price of bitcoin hit an all-time high of ~$108,000. Investors believe Trump’s pro-crypto stance could foster a more favorable regulatory environment for cryptocurrency-related companies. While Coinbase reported 81% revenue growth year-over-year, missing Wall Street expectations by ~10%, the company continues to find success with Base, its blockchain scaling solution, which became the most used network for stablecoin transfers during the quarter. Shares of SoFi Technologies contributed to the fund after the company reported strong third-quarter earnings, including adjusted net revenue growth of 30% year-over-year, surpassing Wall Street expectations by ~9%. The company also entered into a $2 billion agreement with Fortress Investment Group to expand SoFi's loan platform.

Among the top detractors were MercadoLibre (MELI), for the reasons discussed above, and NU Holdings (NU). Shares of NU Holdings detracted from the fund after the company reported third-quarter earnings, including revenue growth of 56% on a year-over-year basis that beat Wall Street expectations. Some analysts highlighted net interest margins, which dropped ~140bps quarter-over-quarter, because of higher funding costs in Mexico & Colombia and lower credit card yields.

The ARK Space Exploration & Innovation ETF (ARKX) outperformed broad-based global equity indices during the quarter. Among the top contributors were Rocket Lab (RKLB), for reasons discussed above, and Archer Aviation (ACHR). Shares of Archer Aviation contributed to the fund's performance for several reasons. The company completed its state-of-the-art manufacturing facility in Georgia, enhancing its production capabilities, and announced a defense partnership with Anduril Industries to develop next-generation aircraft, signaling its entry into the defense market. Archer also raised $430 million in equity, strengthening its balance sheet to support future growth initiatives.

Among the top detractors were AeroVironment (AVAV), for reasons discussed above, and Teradyne (TER). Shares of Teradyne detracted from the fund's performance despite better-than-expected third-quarter results. Management gave a cautious outlook based on challenges in the automotive and industrial markets. Notably, later in the quarter, J.P. Morgan upgraded the stock, citing the company's favorable positioning in the markets for ASICs, memory and mobility.

Invested in the highest conviction names in the Funds discussed above, the ARK Innovation ETF (ARKK) outperformed broad-based global equity indices during the quarter. Among the top contributors were Tesla (TSLA), for the reasons discussed above, and Palantir (PLTR). Shares of Palantir Technologies contributed to fund performance after the company reported a fifth consecutive quarter of acceleration in revenue growth to 30% year-over-year, thanks to US commercial revenue growth of 54% and US government revenue growth of 40%. Palantir also announced plans to relist on the Nasdaq exchange and disclosed new partnerships with Anthropic and Amazon Web Services (AWS) to provide AI models to US intelligence and defense agencies. Partnered with L3Harris Technologies and Booz Allen Hamilton, Palantir also secured a significant army contract to drive technology development and defense mission innovation with plans to form a consortium with other tech groups, including Anduril, SpaceX, and OpenAI, to bid for Pentagon contracts.

Among the top detractors were Intellia Therapeutics (NTLA), for reasons discussed above, and 10X Genomics (TXG). Shares of 10X Genomics detracted from fund performance after the company released preliminary third-quarter results, including a 1% decline in revenue year-over-year, driven primarily by a 46% drop in instrument sales that management attributed in part to cautious capital spending, especially in North America. In the Americas, revenue fell 11% year-over-year, because of unexpected disruptions associated with a sales force realignment and shifts in the company’s commercial strategy. Historically focused primarily on research, 10X is evolving its strategy to focus on larger and less budget-constrained pharma and biotech companies. Importantly, EMEA revenue and APAC revenue increased 18% and 15% year-over-year, respectively, and global consumable and services revenue increased 10% and 48% year-over-year, respectively, suggesting that competition was not the primary factor behind the third-quarter shortfall.

Among ARK’s self-indexed ETFs, the ARK Israel Innovation Technology ETF (IZRL) outperformed the broad-based global equity indices, and The 3D Printing ETF (PRNT) outperformed the MSCI World Index but lagged the S&P 500 Index.11

Shares of Similarweb (SMWB) were the largest contributor to IZRL’s performance after the company reported better-than-expected third-quarter earnings, its fourth-quarter and full-year guidance narrowly surpassing consensus estimates. SimilarWeb CEO, Roni Al-Dor, said that the company anticipates low single-digit revenue growth in 2025. Needham and Goldman Sachs initiated coverage of Similarweb with buy ratings. Shares of Sapiens International (SPNS) were the largest detractor from IZRL’s performance after the company reported its third-quarter earnings and lowered full-year guidance by 1.6%.

Shares of Xometry (XMTR) were the largest contributor to PRNT’s performance after the company reported better-than-expected third-quarter earnings highlighted by record-setting revenue, highlighted by 24% growth in its AI-driven marketplace. Additionally, the company expanded its gross margin to a record 33.6%, citing its partnership with Google Cloud and international growth initiatives as key contributors. Shares of Desktop Metal (DM) were the largest detractor from PRNT’s performance, given the significant financial struggles associated with its ongoing acquisition by Nano Dimension. Desktop Metal’s legal action against Nano Dimension for breach of the merger agreement weighed further on the stock's performance.

A type of recession that affects different sectors of the economy at different times, rather than simultaneously.

ARK’s Five Innovation Platforms are Artificial Intelligence, Robotics, Energy Storage, Multiomic Sequencing, and Blockchain Technology.

Manheim Used Vehicle Value Index. Data as of December 2024.

National Associate of Realtors. Data as of November 2024.

U.S. Bureau of Labor Statistics. Data as of November 2024.

M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.

The Consumer Price Index (CPI) measures the average change in prices over time that consumers pay for a basket of goods and services, often used to assess inflation.

High yield spreads represent the difference in yields between high-yield (junk) bonds and safer, investment-grade bonds, reflecting the risk premium investors demand for taking on more credit risk.

A basis point (bp) is a unit of measurement used to quantify the change between two percentages. It is equal to 1/100th of 1%, or 0.01%.

Broad-based global equity indexes are defined as the S&P 500 Index and the MSCI World Index.

IZRL underperformed its benchmark, ARK Israel Innovation Index. PRNT underperformed its benchmark, The Total 3-D Printing Index.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.