INTRODUCTION: A NEW ERA IN MEDICINE

Advances in biotechnology and artificial intelligence (AI) are expanding scientists’ ability to discover new therapeutic targets and innovate new treatment modalities for more precise and effective interventions with fewer side effects. In short, a revolution within the field of medicine is taking shape before our eyes, made visible in three trends:

Biologics Surge: Reflecting the rapid adoption of biotechnology for new treatments, the number of biologic drugs approved by the FDA has nearly tripled since 2010.

Precision Medicine: New biological modalities like CRISPR—methods that use natural body processes to help diagnose or treat illness—can reduce off-target effects by 60%, a vast improvement over traditional small-molecule drugs.

Three concurrent scientific dynamics undergird those trends:

- The shift from chronic treatments to curative therapies;

- The integration of artificial intelligence into drug discovery;

- Revolutionary advancements in multiomics for early disease detection and personalized medicine.

The next sections discuss each of those dynamics in turn.

FROM CHRONIC TREATMENTS TO CURATIVE THERAPIES

Historically, the pharmaceutical industry has been structured around the chronic management of diseases. Drugs were developed, brought to market, and sold to growing patient populations, generics eventually entering the market and driving prices down. Now, a healthcare paradigm shift is taking shape in which a single treatment might cure a disease and eliminate the need for ongoing care. Curative therapies like CRISPR Therapeutics’ (CRSP) Casgevy, currently approved in the UK, Europe, and the United States, are able to treat blood disorders such as sickle cell disease and beta thalassemia with a single treatment, potentially curing the disease.

The UK and US have underwritten Casgevy at $2.2 million per patient, for example, which, though seemingly exorbitant, actually represents a significant cost-saving for healthcare systems by avoiding lifelong maintenance treatments and their associated medical expenses. In diseases like sickle cell anemia, where only 10% of lifetime expenses are medication-related and the remaining 90% burden the healthcare system, a curative therapy shifts the entire cost dynamic. Insurers now pay upfront for the cure; no competitive pricing pressure ensues, because once a patient is cured, they are no longer part of the patient population.

This new model differs profoundly from traditional drug commercialization by absorbing the patient population before patent and exclusivity cliffs, making first-in-class drugs increasingly valuable. As CRISPR and other gene-editing technologies advance, we expect to see similar breakthroughs in diseases with larger patient populations, such as cardiovascular conditions and diabetes. Our research suggests that Intellia Therapeutics (NTLA) is closest to reaching the first-ever in-vivo gene-editing approval1 around its therapy for Hereditary angioedema,2 likely in 2026. Its impact on the quality of life can be profound!3

Key Points

- Cost of Chronic Care: Chronic disease management costs account for 90% of the $3.8 trillion spent on healthcare in the United States annually.

- Cure Cost Efficiency: CRISPR-based cures, despite high upfront costs, can reduce by 75% total lifetime treatment costs for certain diseases.

THE INTEGRATION OF ARTIFICIAL INTELLIGENCE INTO DRUG DISCOVERY

The integration of AI into drug discovery is reshaping the pharmaceutical landscape. AI is transforming drug discovery from a linear, labor-intensive process to a highly efficient, data-driven endeavor. Companies like Recursion Pharmaceuticals (RXRX) and Absci (ABSI) are at the forefront of this transformation, both utilizing AI to automate and accelerate the identification and development of new drugs. Interestingly, “Big Pharma” companies are not the innovators in this field; they are following innovation through partnerships. Players like Recursion should be poised to hold the dominant positions in the space.

Recursion has reduced the cost and time of drug development by leveraging AI to run millions of experiments simultaneously, an approach that speeds up the discovery process and reduces the risk of failure by allowing researchers to focus on the most promising candidates early on. Recursion’s recent merger with Exscientia, a leader in AI-driven chemistry, further enhances its ability to bring first-in-class and best-in-class drugs to market more quickly and less expensively.

Another great example of AI-drug discovery integration, Absci’s "zero-shot"4 approach to antibody development exemplifies the power of AI in drug discovery. By predicting the best design for a new antibody without the need for extensive trial and error, Absci can shorten the drug development timeline and reduce costs significantly, improving patient outcomes by bringing effective treatments to market more quickly while benefiting investors through faster returns on investment. As it has improved its efficiencies, Absci also has achieved increased efficacy relative to incumbents. In their seminal paper on "zero-shot," Absci identified five antibody candidates that demonstrated superior performance compared to the current market leader in antibody-based drugs targeting human epidermal growth factor receptor (HER2) in breast cancer.

Key Points

- Cost Reduction: AI-driven drug discovery platforms like Recursion could reduce the cost of drug development from $2.6 billion to as low as $1 billion, a game-changing 60%.

- Time Efficiency: AI has the potential to cut drug discovery timelines by 50%, bringing new therapies to market in 5-7 years instead of the traditional 10-15 years.

MULTIOMICS AND THE FUTURE OF CANCER DETECTION AND TREATMENT

Multiomics integrates diverse biological data sources from:

- Genomics, the study genes

- Proteomics, the study of proteins

- Metabolomics, the study of small molecules called metabolites

Integrating data from such diverse sources transforms the landscape of cancer detection and treatment while advancing our understanding of various other diseases, revolutionizing the detection and treatment of cancer and beyond.

Liquid biopsies that sample blood or bodily fluid to check for signs of illness, without the need for invasive procedures or surgery, are supplementing traditional cancer monitoring methods that rely on imaging. The newer methods enable earlier and more accurate detection of minimal residual disease (MRD), those illnesses in the body that linger after treatment.

Companies like Natera (NTRA) and Guardant Health (GH) are pioneering this space with non-invasive tests that can detect cancer recurrence before it becomes apparent clinically. Natera’s Signatera test, for example, already has a 70% market share in the MRD space and is capable of identifying residual cancer cells long before they would be visible on a scan. Similarly, Guardant’s liquid biopsy tests are being used to monitor existing cancers and as primary screening tools for colorectal cancer, offering a less invasive alternative to traditional methods like colonoscopies. Now, doctors can discover cancer before it has grown enough to show up in traditional methods.

Now, doctors can detect cancer at an earlier stage than is possible by traditional methods. For instance, Personalis (PSNL) can detect specific biomarkers to identify breast cancer up to 15 months before it becomes visible through imaging techniques.

These technologies have profound implications. By shifting cancer detection from a reactive to a proactive and predictive approach, healthcare practitioners can improve survival rates drastically while reducing the overall financial burdens on the healthcare systems. Our research suggests that the widespread adoption of these innovative diagnostic tools could grow the market for MRD testing alone from $10 billion today to $120 billion over the next business cycle.

In addition to the difference it is making for early detection, artificial intelligence also is improving diagnostics. Tempus AI (TEM), for example, is revolutionizing personalized medicine through its multimodal data platform, integrating genomic, clinical, and imaging data to provide comprehensive insights into patient care. By leveraging its vast dataset—50 times larger than the previous largest oncology dataset—Tempus AI enables more accurate diagnoses, better treatment decisions, and improved patient outcomes. The platform's ability to analyze complex biological data at scale not only enhances the precision of medical interventions but also creates a network effect in which the more data it collects, the more valuable it becomes, the more it benefits patients and healthcare providers alike.

Lastly, our research suggests that companies will position themselves strategically as providers addressing the multiomic revolution. Twist Bioscience (TWST) specializes in manufacturing DNA-based products that are critical for applications like liquid biopsy and MRD testing, its products already used in over 65% of liquid biopsy tests conducted globally. Twist's synthetic DNA is used to create oligonucleotides, minute pieces of genetic material that are essential for detecting circulating tumor DNA in blood samples. This capability is a key component of advanced liquid biopsy techniques.

Its technology also supports other areas of genomics research, including antibody screening and gene editing, making it an indispensable player in the biotech industry. By offering highly customizable and scalable DNA synthesis at a lower cost—10 times lower than traditional methods—Twist enables researchers and companies to accelerate their development of new diagnostics and treatments, driving the next generation of personalized medicine.

Key Points

- Survival Rates: Early detection of colorectal cancer via liquid biopsy can improve 5-year survival rates from 14% to over 90%.

- Adoption Rates: Approximately 65% of US medical centers utilize AI-enhanced liquid biopsy technologies, signaling widespread adoption in clinical practice.

HOW TO CAPTURE THESE ADVANCEMENTS IN YOUR INVESTMENT PORTFOLIO

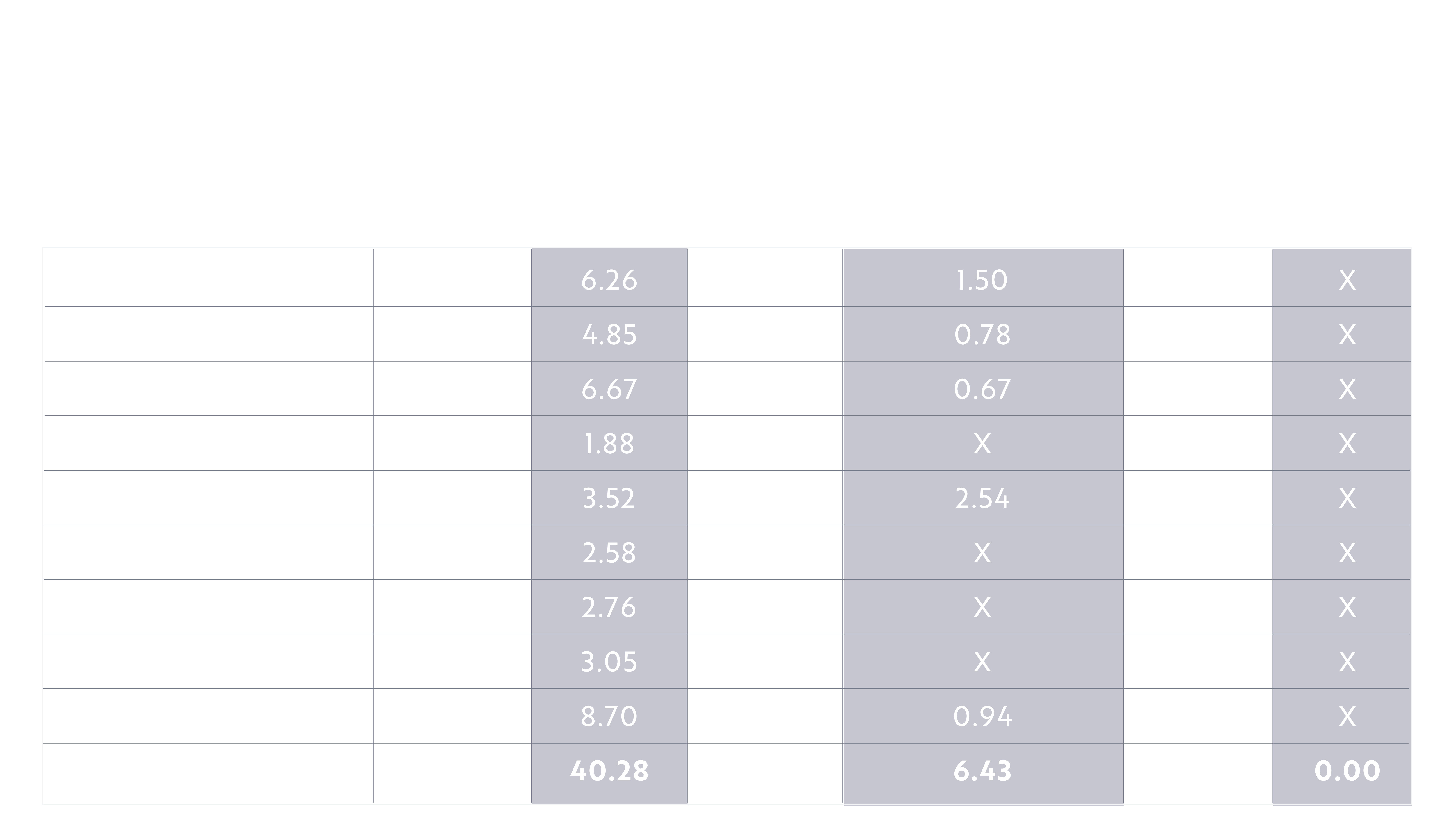

Technological innovations are making early detection and precision medicine the new standard of care. Remarkably, the companies leading the race in these fields are relatively absent from the healthcare investment benchmarks; as a result, they are not well-represented in many investor portfolios. With an active share of 95% relative to the S&P 500 Healthcare Index, ARK seeks to provide investors a portfolio solution that gives them exposure to these rapidly unfolding, game-changing developments: the ARK Genomic Revolution ETF (ARKG).

Source: Morningstar as of 9/30/2024.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs' prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

Past performance is not indicative of future performance.

The S&P 500® Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the U.S. stock market. The MSCI World Index represents large and mid-cap equity performance across 23 developed markets countries. Returns shown for the MSCI World Index are net of foreign withholding taxes applicable to U.S. investors. The Health Care Select Sector Index is a benchmark that tracks the performance of healthcare companies in the S&P 500 Index. The S&P Biotechnology Select Industry Index represents the biotechnology sub-industry portion of the S&P Total Markets Index (S&P TMI). The S&P TMI tracks all the U.S. common stocks listed on the NYSE, AMEX, NASDAQ National Market and NASDAQ Small Cap exchanges.

Securities in ARKG’s portfolio will not match those in any index. The actively managed ETF is benchmark agnostic and corresponding portfolios may have significant non-correlation to any index. Index returns are generally provided as an overall market indicator. You cannot invest directly in an index. Although reinvestment of dividend and interest payments is assumed, no expenses are netted against an index’s returns. Index performance information was furnished by sources deemed reliable and is believed to be accurate, however, no warranty or representation is made as to the accuracy thereof and the information is subject to correction.

An investment in an ARK ETF is subject to risks and you can lose money on your investment in an ARK ETF. There can be no assurance that the ARK ETFs will achieve their investment objectives. The ARK ETFs’ portfolios are more volatile than broad market averages. The ARK ETFs also have specific risks, which are described in the ARK ETFs' prospectuses.

ARK Investment Management, LLC is the investment adviser to the ARK ETFs.

Foreside Fund Services LLC, distributor.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Conducted with living organisms in their normal, intact state – i.e., in the body.

A condition in which the lack of a special protein in the blood causes parts of the body swell up suddenly.

Coddington, M. 2024. “Breaking the Chains: How CRISPR Gene Therapy Gave Victoria Gray a New Life.” Biopharma.

A method that involves designing antibodies to bind to specific targets without using any training data of antibodies known to bind to those specific targets.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.