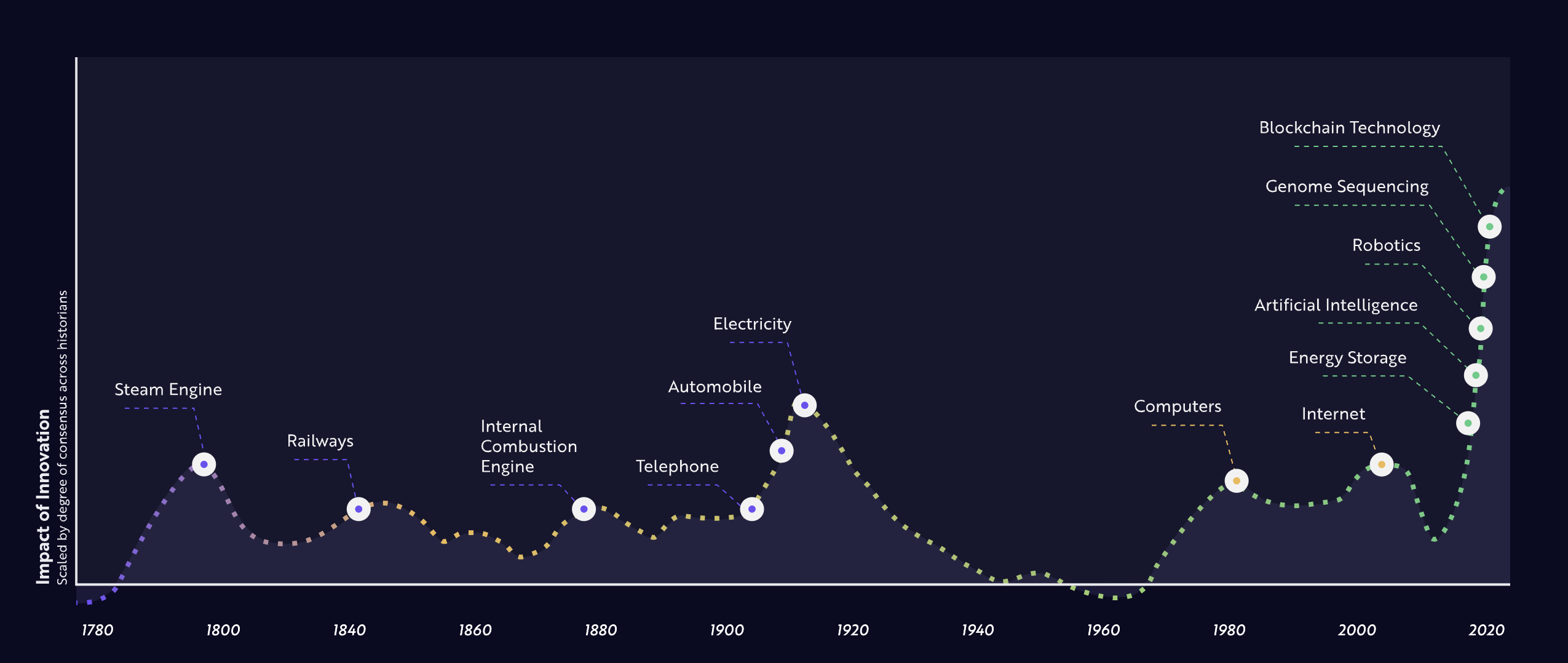

The simultaneous advancement of five major innovation platforms—public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage and robotics—is creating potentially historically unique opportunities for investors. Individually, each platform seems poised to spur significant economic and societal changes and, together, to accelerate the pace of disruptive innovation and creative destruction at a record rate.

To understand the scale of this current innovation revolution, the early 1900s are instructive: the era of electrification, the advent of the telephone, and the rise of the internal combustion engine. While each of those innovations had a profound impact on society, they did not converge as powerfully as are today’s platforms. The speed of today’s technological transformation is unprecedented. We believe that historians will look back on this era as one of technological foment offering unprecedented long-term investment opportunities for both companies and investors.

*ARK created this chart based on the relative impact of an innovation scaled by the degree of consensus between economic historians that a particular innovation should be considered an innovation platform. The underlying data assumes that all innovation platforms follow a characteristic investment and realization cycle of similar duration. The above chart is based on a variety of criteria and assumptions, which might vary substantially, and involve significant elements of subjective judgment and analysis that reflect our own expectations and biases, which might prove invalid or change without notice. It is possible that other foreseeable events that were not taken into account could occur. The impact of the 5 most recent platforms shown are based solely on ARK’s research and analysis and are not based on a consensus view whereas the historical innovation impact reflects the views of the sources listed in addition to ARK’s views. Source: ARK Investment Management LLC, 2018, based on data from Helpman, E. (2010). General Purpose Technologies and Economic Growth. Cambridge, MA: MIT Press; Brynjolfsson, E., & McAfee, A. (2018). The second machine age: Work, progress, and prosperity in a time of brilliant technologies. Vancouver, B.C.: Langara College; Kurzweil, R. (2016). “The Singularity Is Near: When Humans Transcend Biology.” Duckworth.

In the eighties and nineties, investors turned to products tracking the NASDAQ and the NASDAQ 100 Index[1] for exposure to disruptive innovation in the United States. They assumed that those benchmarks would diversify their asset allocation in terms of market capitalizations, growth stocks, and value stocks.

Over time, because of the long-term outperformance and higher market cap weights of large cap technology stocks, the NASDAQ 100 and the S&P 500 Index[2] are looking more like each other Today, the NASDAQ 100 includes many mature companies that, while considered trail blazers 10 to 40 years ago, are not at the forefront of innovation today.

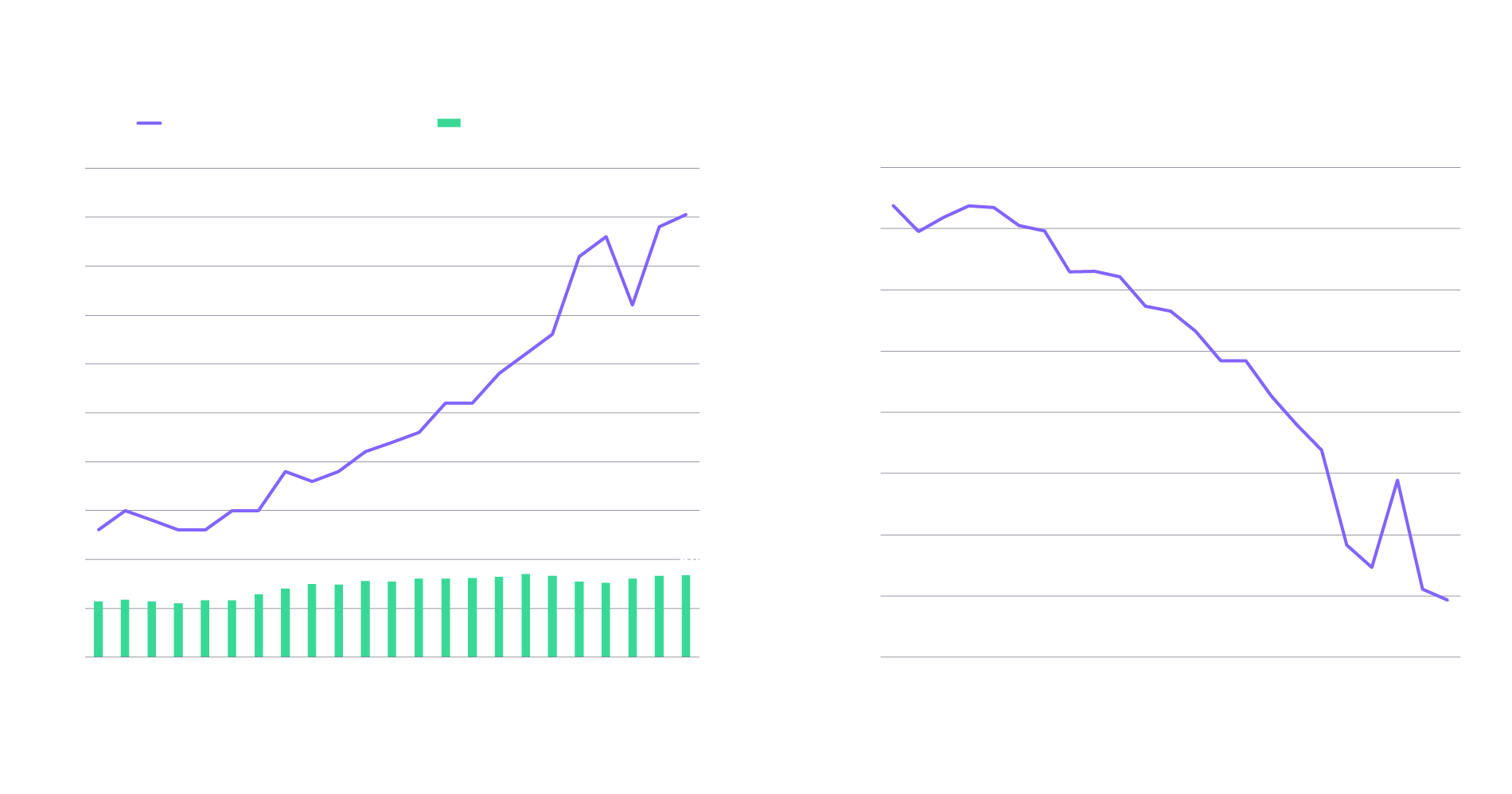

Since 2002, the number of holdings common to the NASDAQ 100 and S&P 500 has increased significantly. As of March 31, 2024, the weight of their shared holdings in the S&P 500 has more than tripled, from ~13% to ~45%. Both held 84 names in common, representing ~94% of the NASDAQ 100’s cumulative weight. Because ~94% of its companies overlap with those in the S&P 500, the NASDAQ 100 now seems to be a concentrated S&P 500 bet, not a differentiated exposure to innovation. To that point, the differentiation between the two indices—"active share”—has decreased from ~87% in December 2002 to ~55% as of March 31, 2024, as shown in the right-hand chart below.

Source: ARK Investment Management LLC, 2024, based on data from Morningstar as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Indexes are unmanaged and are not available for direct investment.

With a heavy concentration in both the NASDAQ 100 and S&P 500, the “Magnificent Seven (Mag Seven)”[3] has dominated recent equity market performance. At ~40% and 29% of the NASDAQ 100 and the S&P 500 weights, respectively, the Mag Seven now could be posing a risk to the benchmarks.[4] While passive investors[5] have benefited from recent Mag Seven performance, they also will be more exposed to business and sentiment shifts, given their lack of diversification. Many active managers face a similar fate. As measured by average weights in the Morningstar US Active Fund Large Growth Category,[6] their exposure to the Mag Seven was 47%, higher than both the NASDAQ 100 and S&P 500, as of March 31, 2024.

Weight of Mag Seven Companies.png)

Source: ARK Investment Management LLC, 2024, based on data from Morningstar as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Indexes are unmanaged and are not available for direct investment.

The increasing similarity between names in the NASDAQ 100 and S&P 500 has implications for the meaning of exposure to “innovation” as an investment opportunity. In our view, while it includes many companies exposed to technology, the NASDAQ 100 is not as focused on the disruptive innovation that we believe will transform the global economy as are alternative and other thematic strategies. ARK's flagship ETF, ARK Innovation ETF (ARKK), is one of those alternative thematic strategies.

ARK selects stocks based not on their weights in tech and other indexes but on the deep research conducted by our innovation specialists who also are sector generalists. In contrast, most traditional asset management research teams are populated with sector or industry specialists, technology only one of them. In our view, technology is permeating every sector, blurring the lines between and among sectors.

In ARK’s open research ecosystem, our analysts’ research is the catalyst for debate and discussion among not only our Portfolio Managers, Chief Futurist, and Chief Investment Strategist but also globally distributed Thought Leaders on social media, many of whom join our brainstorming sessions. Together, we identify underappreciated themes and companies, battle test our top-down and bottom-up models,[7] and debate and discuss stocks that conventional investment analysts often overlook.

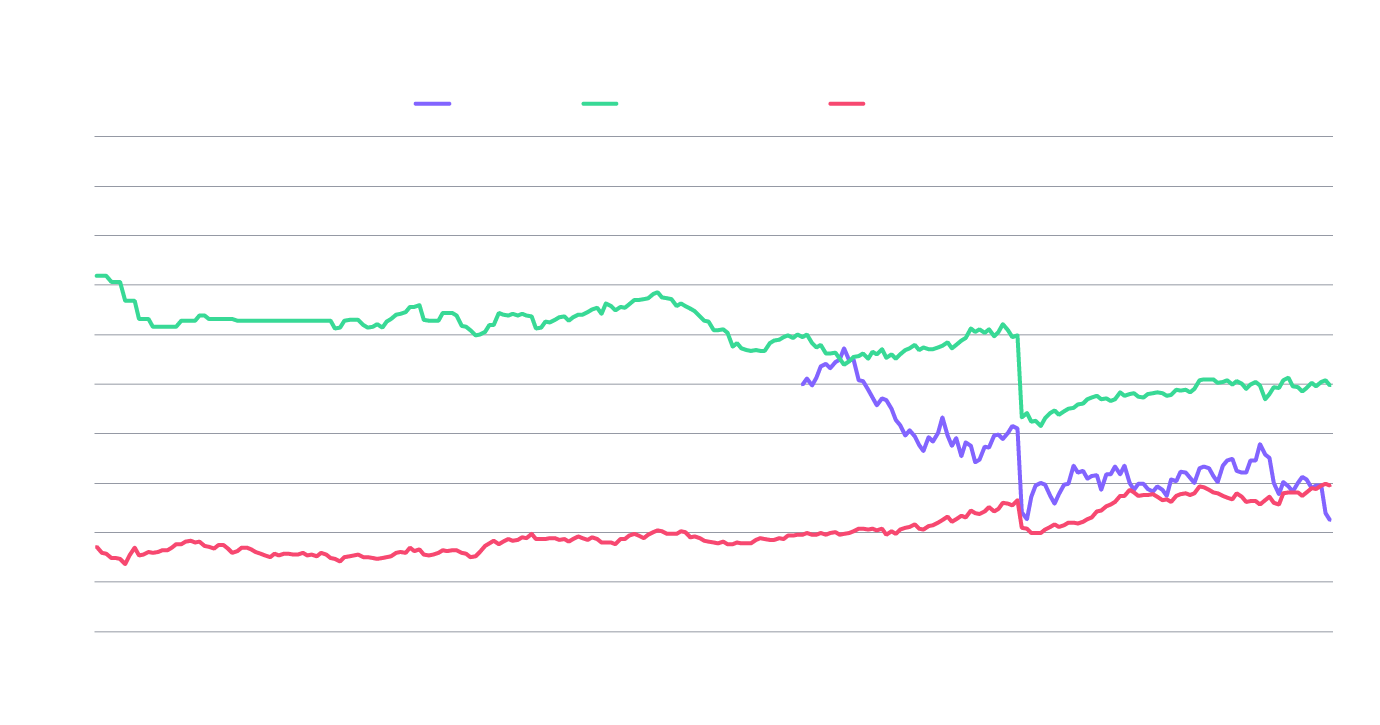

In our view, disruptive innovation will transcend the information technology (IT) sector. At ~50%, IT dominated the NASDAQ 100 as of March 31, 2024, as shown below. In contrast, focused on disruptive innovation impacting a range of sectors, in ARKK’s more diversified exposure—focused on artificial intelligence (AI), robotics, multiomics, energy storage, and blockchain technology—IT has dropped meaningfully since inception (10/31/2014), as shown below. Artificial Intelligence alone is permeating every sector, generating productivity gains that we believe will accelerate across industries during the next five to ten years.

Note: On September 28, 2018, the Telecommunication Services sector was renamed to Communication Services. This change effected some of the most popular tech companies, including Facebook and Alphabet, which explains the significant drop in information technology exposure in 2018. Source: ARK Investment Management LLC, 2024, based on data from Morningstar as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Indexes are unmanaged and are not available for direct investment.

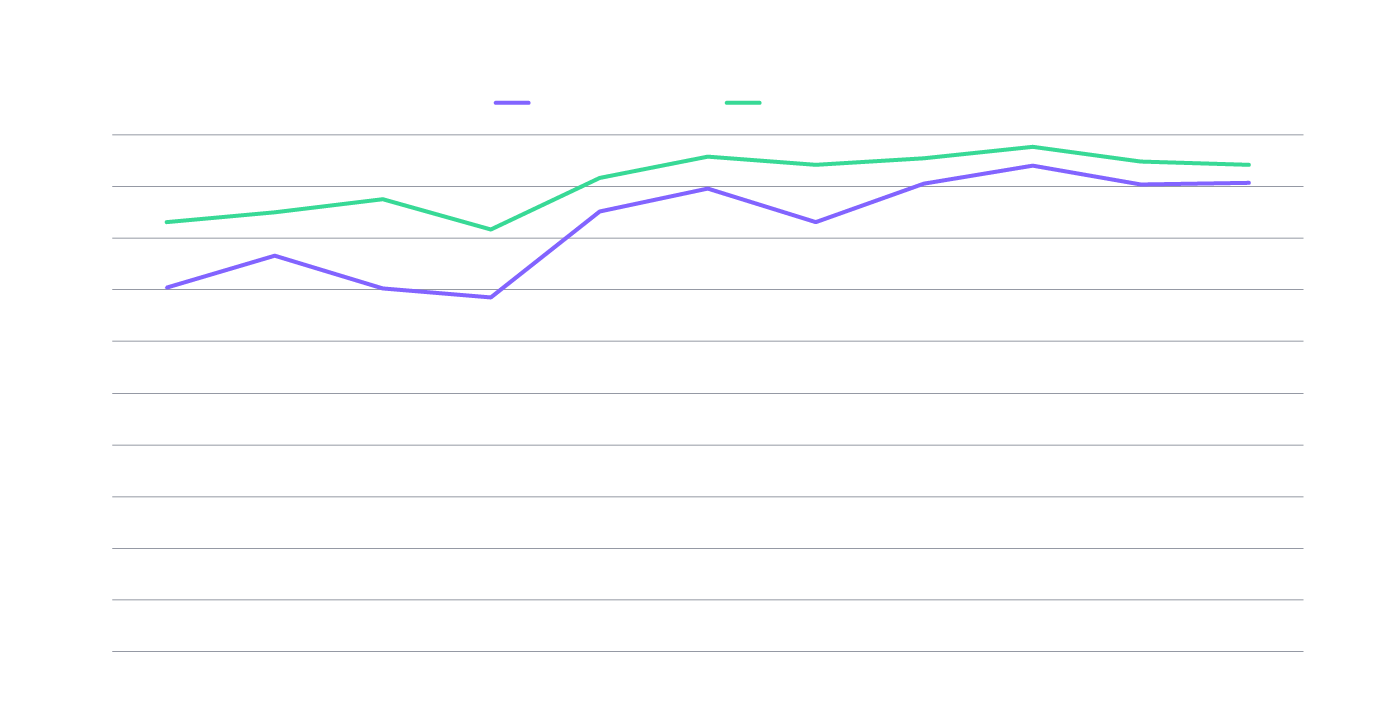

As a result, ARK's unique approach offers investors access to a broader range of potentially transformative opportunities in various industries. Compared to the NASDAQ 100 and the S&P 500, ARKK's active share was ~95% and ~97%, respectively, as of March 31, 2024, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from Morningstar as of March 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Indexes are unmanaged and are not available for direct investment.

While relatively volatile in its early stages, disruptive innovation offers long-term opportunities for potentially exponential, if not super-exponential, growth, as detailed in ARK’s 2024 Big Ideas report. Our long-term focus is central to our strategy. Why? The Federal Funds Target Rate[8] surged 22-fold in little more than a year. Higher interest rates tend to put pressure on long-duration assets, including disruptive innovation companies: higher interest rates increase the discount rate used to calculate the present value of future cash flows,[9] which makes those cash flows less valuable, weighing on the price—a temporary situation. If the Federal Reserve (Fed) were to lower interest rates, companies sacrificing short-term profitability to invest and potentially capitalize on innovation to enable super exponential growth opportunities should be prime beneficiaries.

As mentioned above, in today’s volatile environment, most investors seem to be gravitating toward benchmark holdings. ARK takes a different approach. As other investment strategies sell stocks that are not in their benchmarks, ARK becomes a buyer of earlier stage companies and stocks in which we have highest conviction. Because businesses are typically more willing to change and adopt innovation during difficult times, we believe the companies in the ARKK portfolio are poised to win a higher share of incremental spend, ultimately occupying a more valuable strategic footprint.

Notably, we do not aim to align with any benchmark—ARK is benchmark agnostic—because benchmarks are inherently backward-looking. Instead, we focus on the future, with a minimum five-year time horizon, and sell the larger, liquid, benchmark-like stocks that we purchased during a prior market expansion. Using those proceeds, we purchase off-benchmark, disruptive stocks that have been punished disproportionately. We believe that trading technique accomplishes two things:

- It removes any holdings in which we had lower conviction or increased thesis risk, thereby reducing fundamental risk.

- It positions the portfolio for a stronger recovery during a subsequent market expansion.

On the other hand, during a market expansion period, we broaden and diversify the portfolio by adding larger, more liquid holdings. The new holdings tend to be more benchmark-like, with general innovation exposure, not pure-play innovation exposure. In addition, positions change over time as we manage our strategies actively and as new data points and considerations arise.

In our view, investors seeking to diversify and capitalize on different market opportunities will reap rewards by including innovation-focused funds like ARKK in their portfolios.

As investors navigate the ever-evolving investment landscape, understanding innovation becomes paramount. Importantly, the lion’s share of disruptive innovation is not captured by common indices like the NASDAQ 100 and S&P 500.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs' prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

Past performance is not indicative of future performance.

An investment in an ARK ETF is subject to risks and you can lose money on your investment in an ARK ETF. There can be no assurance that the ARK ETFs will achieve their investment objectives. The ARK ETFs’ portfolios are more volatile than broad market averages. The ARK ETFs also have specific risks, which are described in the ARK ETFs' prospectuses.

The principal risks of investing in the ARK Innovation ETF (ARKK) include: Equity Securities Risk. The value of the equity securities the Fund holds may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Health Care Sector Risk. The health care sector may be adversely affected by government regulations and government health care programs. Communications Sector Risk. Companies is this sector may be adversely affected by potential obsolescence of products/services, pricing competition, research and development costs, substantial capital requirements and government regulation. Information Technology Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Detailed information regarding the specific risks of ARKK ETF can be found in the prospectus. Additional risks of investing in ARKK include equity, market, management and non-diversification risks, as well as fluctuations in market value and NAV.

Shares of ARK ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Certain statements made in this material are strictly beliefs and points of view held by ARK Investment Management LLC and/or ARK ETF Trust and are subject to change without notice. Certain information was obtained from sources that ARK believes to be reliable; however, ARK does not guarantee the accuracy or completeness of any information obtained from any third party. The information provided is for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The information provided is general in nature and should not be considered legal or tax advice. An investor should consult a financial professional, an attorney, or tax professional regarding the investor’s specific situation.

ARK Investment Management, LLC is the investment adviser to the ARK ETFs.

Foreside Fund Services LLC, distributor.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Since its inception in 1985, the Nasdaq 100 Index may be regarded as the world’s preeminent large-cap growth index. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. Source: Nasdaq.

The S&P 500 Index is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

The “Magnificent Seven” includes Apple (AAPL), Alphabet (GOOG), Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).

The ARK Innovation ETF (ARKK) holds the following "Magnificent Seven" stocks in its portfolio as of 3/31/2024: Meta Platforms (1.7%) and Tesla (8.7%). Please refer to www.ark-funds.com for full holdings of the fund.

Passive management is a strategy that aims to equal the returns of an index. Active management involves making buy and sell decisions about the holdings in a portfolio. Investopedia.

The Morningstar US Active Fund Large Growth Category includes actively managed large-growth portfolios that invest primarily in big US companies that are projected to grow faster than other large-cap growth stocks. Stocks in the top 70% of the capitalization of the US equity market are defined as large cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). Most of these portfolios focus on companies in rapidly expanding industries. Morningstar.

Top-down research examines how the world is changing and where it is headed. Bottom-up research examines individual companies that could benefit from those changes.

The term federal funds rate refers to the target interest rate range set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Cash flow is the net cash and cash equivalents transferred in and out of a company.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.