| This article discusses digital assets and companies in the digital asset sector. An investment in digital assets or companies in this sector involves significant risks, may be subject to extreme volatility and investors could lose their entire investment. Thus, these investments are not suitable for all investors. Please see the Important Information section at the end of this article for more information. |

Digital assets have changed the way financial markets work by offering new ways to transfer value and provide financial services, all without relying on traditional banks. These assets are purely digital and exist only online. They use advanced technology, like cryptography and distributed networks, to make transactions transparent and open to everyone. Digital assets can be easily transferred, their ownership verified through encryption, and they can be divided into smaller, fractional units. Examples of digital assets include cryptocurrencies like Bitcoin and Ethereum, tokens that represent partial ownership of things like real estate or artwork, digital rights for intellectual property, and non-fungible tokens (NFTs), which are unique digital items that can represent ownership of both digital and physical things.

We believe digital assets are transforming traditional finance and enabling entirely new business models. By providing instantaneous, borderless access to financial systems and investment opportunities, they are democratizing global finance. They also reduce transaction costs and time delays, making processes more efficient and cost-effective. As a proof point, there are businesses today that are built around digital assets and operate with significantly lower expenses and higher margins than traditional counterparts, thanks to the inherent efficiencies of blockchain and distributed ledger technology.1

The first retail investment fund manager to invest in bitcoin—in 2015, as shown below— ARK Invest believes that digital assets will become the new foundation of financial technology.

.png)

Source: Glassnode. As of November 30, 2024. Past performance is not indicative of future results. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell or hold bitcoin or any other cryptocurrency.

By operating through transparent networks, decentralizing finance, and empowering businesses and individual investors and consumers, digital assets have the potential to redefine the global financial landscape and fundamentally alter how people and institutions access and manage capital.

President-elect Donald Trump soon will be the first openly pro-cryptocurrency President of the United States and will join 276 pro-cryptocurrency representatives in the House and 20 in the Senate.2 By January, pro-cryptocurrency lawmakers will outnumber their anti-crypto counterparts across both legislative chambers, setting the stage for a potentially more favorable regulatory environment.

Many expect that the incoming presidential administration and congress will bring favorable regulatory changes to the digital assets space. Key areas of potential impact include the U.S. Securities and Exchange Commission (SEC), where a more crypto-friendly stance could displace Chair Gensler’s “regulation by enforcement” approach and bring long-awaited transparency and predictability to the digital asset sector. Additionally, a reopening of the initial public offering (IPO) window could offer promising opportunities for late-stage digital asset companies like Circle and Kraken, potentially drawing in a broader base of institutional investors. On the legislative front, the Financial Innovation and Technology for the 21st Century Act (FIT21) and the Clarity for Payment Stablecoins Act of 2023—both have passed in the House of Representatives—seek to define jurisdictional boundaries between the SEC and the Commodity Futures Trading Commission (CFTC). These bills would establish clearer frameworks for the exchange and custody of digital assets and stablecoins, giving traditional institutions a defined path to participate in digital asset markets. Additionally, repealing Staff Accounting Bulletin 121 (SAB-121), which restricts traditional financial institutions from holding digital assets, is likely to be a legislative priority, further paving the way for institutional engagement with digital assets.

ARK Funds' Exposure To Digital Assets

While investing directly in cryptocurrencies remains a popular option for gaining exposure to digital assets, many investors seek to benefit indirectly through publicly-traded companies that operate within the digital asset sector. The ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF) all offer exposure to momentum in digital assets. One prominent example is Coinbase (COIN), the largest US-based cryptocurrency exchange. Coinbase is known for its regulatory compliance as a US publicly-listed company and gives investors a way to access the potential growth of digital assets without directly holding individual cryptocurrencies. ARK ETFs ARKK, ARKW, and ARKF all hold and offer investors exposure to COIN, which has rallied significantly in the wake of Trump’s victory.

Coinbase’s strengths lie in its diversified ecosystem, which spans cryptocurrency storage, institutional trading, and an increasing array of decentralized finance (DeFi) applications. As one of the few publicly-traded companies in the cryptocurrency sector, Coinbase represents a differentiated approach to participating in digital asset growth. Its revenue model benefits from increased trading volume and broader adoption of digital assets, making it a key vehicle for investors seeking compliant exposure to the cryptocurrency space.

ARKK, ARKW, and ARKF also hold Block (formerly Square) (SQ) and Robinhood (HOOD), which provide additional exposure to digital wallets and emerging digital payment systems. Block’s Cash App integrates Bitcoin, allowing users to buy, sell, and transact in cryptocurrency; and Robinhood offers a cryptocurrency trading feature, making both companies key players in the broader digital finance ecosystem.

Conclusion: Access To The Digital Asset Wave And Beyond

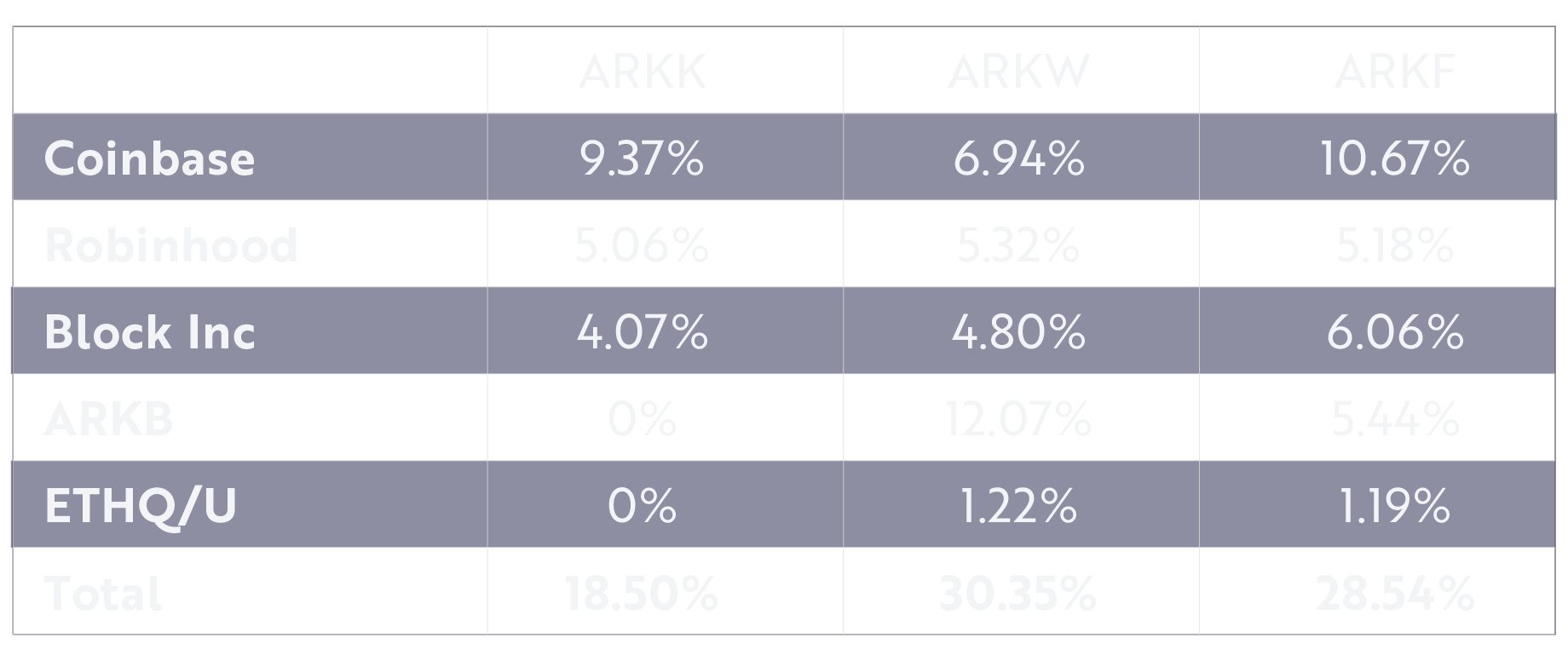

As digital assets and blockchain technology continue to reshape global markets, understanding your exposure is essential. By investing in ARKK, ARKW, and ARKF, investors gain exposure to the potential growth of digital assets and to key players in the broader digital finance ecosystem. Importantly, ARKW and ARKF also offer exposure to digital assets by allocating to the ARK 21Shares Bitcoin ETF (ARKB) and 3IQ Ether Staking ETF (ETHQ/U), as shown below.

As of December 2, 2024. The above list is only a partial list of holdings for each fund. For a complete list of ARKK’s holdings click here, for a complete list of ARKW’s holdings, click here, and for a complete list of ARKF’s holdings click here. Holdings are subject to change. Please note that neither ARKB nor ETHQ/U are a fund registered under the Investment Company Act of 1940, as amended (“1940 Act”), and are not subject to regulation under the 1940 Act, unlike most exchange traded products or ETFs. An investment in either ARKB or ETHQ/U involves significant risks, may be subject to extreme volatility and investors could lose their entire investment. Thus, exposure to ARKB and ETHQ/U through ARKW and/or ARKF is not suitable for all investors.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs' prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

Past performance is not indicative of future performance.

Specific companies are mentioned in this article as examples only, and are not a recommendation to buy, sell or hold any particular security. However, some of the companies discussed may be held in ARKK, ARKF, and/or ARKW.

Securities in ARKK, ARKF, or ARKW’s portfolio will not match those in any index. The actively managed ETFs are benchmark agnostic and corresponding portfolios may have significant non-correlation to any index.

An investment in an ARK Fund is subject to risks and you can lose money on your investment in an ARK Fund. There can be no assurance that the ARK Funds will achieve their investment objectives. The ARK Funds’ portfolios are more volatile than broad market averages. The ARK Funds also have specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Funds’ prospectuses.

The principal risks of investing in the ARK Funds include:

Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Financial Technology Risk. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. Fintech Innovation Companies may not be able to capitalize on their disruptive technologies if they face political and/or legal attacks from competitors, industry groups or local and national governments.

Blockchain Technology Risk. Blockchain technology is new and many of its uses may be untested. Blockchain and Digital commodities and their associated platforms are largely unregulated, and the regulatory environment is rapidly evolving. As a result, companies engaged in such blockchain activities may be exposed to adverse regulatory action, fraudulent activity or even failure.

Cryptocurrency Risk. Cryptocurrency (notably, bitcoin), often referred to as ‘‘virtual currency’’ or ‘‘digital currency,’’ operates as a decentralized, peer-to-peer financial exchange and value storage that is used like money. Some of the ARK actively managed Funds may have exposure to bitcoin, a cryptocurrency, indirectly through an investment in the ARK 21Shares Bitcoin ETF, a 1933-Act exchange traded product. Cryptocurrency operates without central authority or banks and is not backed by any government. Even indirectly, cryptocurrencies may experience very high volatility and related investment vehicles like ARKB may be affected by such volatility. As a result of holding cryptocurrency, the Fund may also trade at a significant premium to NAV. Cryptocurrency is also not legal tender. Federal, state or foreign governments may restrict the use and exchange of cryptocurrency, and regulation in the U.S. is still developing. Cryptocurrency exchanges may stop operating or permanently shut down due to fraud, technical glitches, hackers or malware.

Bitcoin and Ethereum (Ether) are subject to unique and substantial risks, including significant price volatility and lack of liquidity, and theft. The value of an investment in the ARK 21Shares Bitcoin ETF (ARKB) or the 3iQ Ether Staking ETF (ETHQ/U) could decline significantly and without warning, including to zero. Bitcoin and Ethereum (Ether) are subject to rapid price swings, including as a result of actions and statements by influencers and the media, changes in the supply of and demand for bitcoin, and other factors. There is no assurance that either digital asset will maintain their value over the long-term.

Shares of the ARK ETFs may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ARK ETF's shares may be at, above or below the ARK ETF’s net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. The market price of ARK ETF shares may differ significantly from their NAV during periods of market volatility. Shares of the ARK ETFs may only be redeemed directly with the ARK ETFs at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ARK ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ARK ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

ARK Investment Management, LLC is the investment adviser to the ARK ETFs.

Foreside Fund Services LLC, distributor.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Definitions

Bitcoin: A decentralized digital currency. Bitcoin transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. The cryptocurrency was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto. Blockchain: A system in which a record of transactions, especially those made in a cryptocurrency, is maintained across computers that are linked in a peer-to-peer network. The goal of blockchain is to allow digital information to be recorded and distributed, but not edited. In this way, a blockchain is the foundation for immutable ledgers, or records of transactions that cannot be altered, deleted, or destroyed. Cryptocurrency (Crypto): A digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. Ethereum: A decentralized, open-source blockchain platform that allows users to create and run smart contracts and decentralized applications (DApps). It's the second most popular cryptocurrency in the world, after Bitcoin.

Blockchain technology is a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network. Distributed ledger technology (DLT) is the technological infrastructure and protocols that allow simultaneous access, validation, and record updating across a networked database.

Stand with Crypto. https://www.standwithcrypto.org/races

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.