ARK's Venture Commentary is meant to provide ARK's thoughts on the current state of the Venture Capital space.

Databricks Demonstrates Substantial AI Momentum

Databricks, an ARK Venture portfolio company, announced $500+ million in new funding that now values the company at $43 billion,[1] a 13% appreciation relative to its 2021 funding round.[2] The Databricks platform facilitates companies’ access to high-volume unstructured data for artificial intelligence (AI) training and deployment, an offering bolstered significantly by the company’s acquisition of MosaicML, another ARK Venture portfolio company, earlier this year.

ARK’s take

Databricks’ fundraising and financial strength suggest ongoing and robust tailwinds for enterprise AI. Coinciding with its new fundraising round, for example, Databricks disclosed annualized revenue of ~$1.5 billion, suggesting 50% year-over-year growth. A growth rate of that magnitude surpasses ARK’s previous research estimate of ~14% aggregate growth in software spend and ~4% overall IT spend growth in 2023[3]—both of which Databricks’ growth rate surpasses. Databricks’ valuation bump also defies the broader recent venture capital trend, as median late-stage venture valuation levels in contrast have fallen nearly 70% since Databricks’ last funding.[4] While still in the early days of what could prove to be a monumental AI uptake cycle, we expect AI fundraising and product-momentum to continue.

Evidence of Exit Liquidity

In mid-September 2023, tech companies ARM, Instacart, and Klaviyo held their respective initial public offerings (IPOs), collectively raising ~$6 billion from public market investors.[5] Clearly well-accepted by the market, each company continued to trade above its IPO prices as of 9/21, despite market indigestion associated with interest-rate hikes. Meanwhile, Cisco announced its plan to acquire publicly traded big data software platform Splunk for $28 billion in cash, a 31% premium to its most previous traded value.

ARK’s take

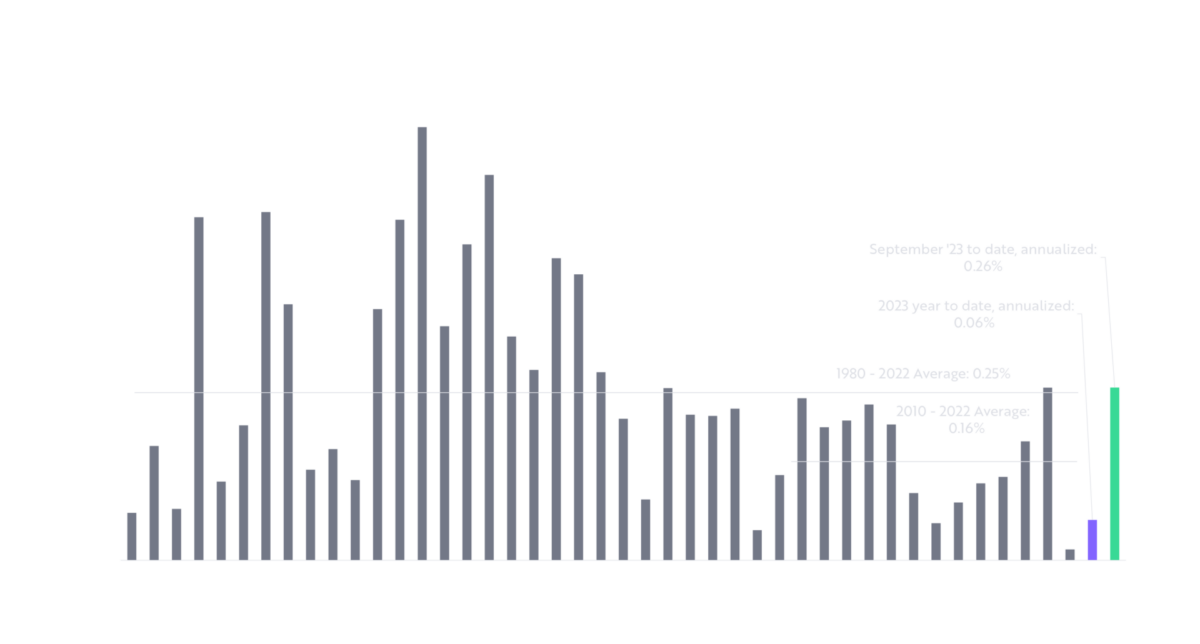

That degree of liquidity should excite venture investors given capital markets’ recent sluggish activity: until September, 2023 was on track to see the second lowest US IPO issuance as a share of equity market capitalization in 43 years (only 2022 was worse), as shown below.

Source: ARK Invest; Jay Ritter, University of Florida; Capital IQ; Robert Shiller, Irrational Exuberance dataset. Data through September 20, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

That said, while mid-September activity feels robust, reaching annual average volumes since 1980 would require early September’s three-week noteworthy deal-flow stretch to repeat 17 consecutive times. Though modest, then, this initial bout of capital markets activity could begin to loosen funding for some later-stage venture opportunities as investors underwrite potential exits.

HBS Measures GPT-4’s Utility

A recent research project[6] tested the performance of Boston Consulting Group with and without the aid of the GPT-4 language model. Findings suggest that consultants using AI completed tasks 25% faster and 40% better than the control group. Our research suggests that when combining the speed and performance quality improvements, GPT-4 can boost the productivity of a generalist knowledge worker by 75%.

ARK’s take

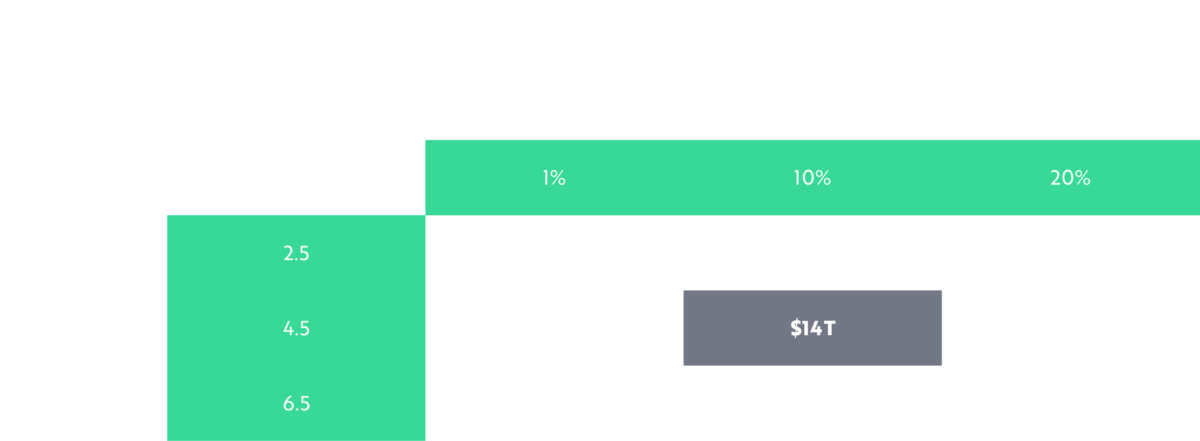

ARK estimates that software spend could reach $14 trillion in 2030, as shown below, and that AI systems have the potential to boost knowledge worker productivity by ~350% by then. The dramatic performance enhancements of today’s AI systems—upgrading GPT3 to GPT4 represented a ~10-fold performance improvement,[7] for example—suggest that ARK’s previous estimates might be too conservative. Indeed, if a GPT-9 equivalent system becomes available by 2030—as we believe it will—even our most radical estimates are quite likely to be far too conservative.

Source: ARK Investment Management LLC, 2023. https://ark-invest.com/big-ideas-2023/ Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Disclosures

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-ventures.com. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Market capitalization refers to the total dollar market value of a company’s outstanding shares of stock. The US equity market cap is the total market cap of all U.S. based public companies.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

Nishant, N. and Hu, K. 2023. “Databricks Raises Over $500 Million at $43 Billion Valuation.” Reuters.

Databricks. 2021. “Databricks Raises $1.6 Million Series H Investment at $38 Billion Valuation.”

Gartner. 2023. “Gartner Forecasts Worldwide IT Spending to Grow 4.3% in 2023.”

Dowd, K. and Walker, P. 2023. “State Of Private Markets: Q2 2023.” Carta.

Wang, E. et al. 2023. “Hopes Rise for IPO Recovery After September Deal Rush.” Reuters.

Dell’Acqua, F. et al. 2023. “Navigating the Jagged Technological Frontier: Field Experimental Evidence of the Effects of AI on Knowledge Worker Productivity and Quality.” Working Paper 24-013. Harvard Business School.

As measured by number of parameters.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.