ARK's Venture Commentary is meant to provide ARK's thoughts on the current state of the Venture Capital space.

The AI Executive Order

Last week, the Biden Administration issued a broad Executive Order[1] related to artificial intelligence (AI), effective immediately, with compliance deadlines in the next three to nine months. The order subjects all private large training models to reporting and testing requirements and requires cloud computing and other large datacenter providers to validate and monitor customer identity and behavior. The order also places stringent requirements on AI systems that use biological data.

ARK’s take

In our view, the Executive Order is likely to benefit companies like OpenAI and Anthropic[2] that are focused on foundation models and already operate at commercial scale, at the expense of “scrappier” open-source efforts. Anthropic, for example, has highlighted its founding principle of AI alignment and should meet the new compliance requirements seamlessly. Over time, regulatory oversight could bias more profits to the foundation model layer of the AI value chain which, even before the Executive Order, seemed poised to account for a disproportionate share during the next ten years.

Structurally, however, we believe that the world needs more—not less—innovation and that regulating deep neural nets at this early stage could foreclose important technological pathways. The Executive Order seems so broad that almost any model—even a simple Excel spreadsheet—could qualify as “artificial intelligence.” Imagine what the fate of Excel would have been if dozens of federal agencies had oversight over its evolution!

Although The Leviathan is biting now, a world with more intelligent software systems should prove more humane. A world in which fewer entities compete to provide that software—a near-certain byproduct of an overly broad, more onerous regulatory framework—could prove more brittle, perhaps dangerously so.

We would not be surprised if regulatory overreach, not only in AI but also cryptocurrencies, becomes an election year issue during the next three to nine months of compliance with the Executive Order. That said, the Executive Order could disappear if the Administration changes in January 2025.

Starlink’s Satellites Turn The Cashflow Corner

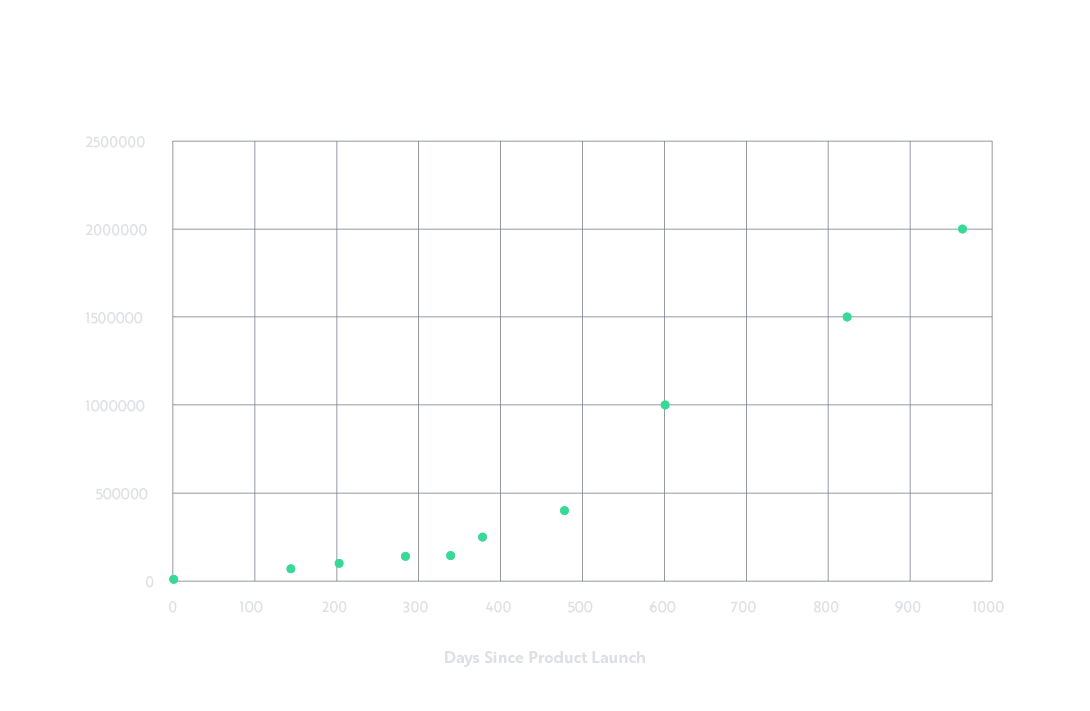

Elon Musk has announced that Starlink, SpaceX’s low-earth orbit satellite communications network,[3] has reached cashflow breakeven.[4] The satellite subsidiary just crossed 2 million customers—doubling within ~9 months[5]—and now serves more than 60 countries. Starlinks constitute more than half of all active satellites currently in orbit.[6]

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

ARK’s take

While already impressive, Starlink’s network remains nascent. The company has ~4,200 satellites in service[7] but has announced ambitions for 10 times as many.[8] Although the modeling is complex, we estimate that at full penetration each incremental satellite could on-board roughly ~30,000 global customers at broadband-type speeds economically. SpaceX’s ability to loft this constellation and achieve direct-to-cellular ambitions quickly is dependent upon its Starship rocket, still in development and slated for a second test launch late this year. Notwithstanding technical risks, the promise of truly global internet accessibility is clear. Positive cashflow is just one marker along that pathway.

Running Out Of Runway?

Third-quarter 2023 venture statistics have been released, and the funding environment remains challenging across all stages. Measured against the third quarter of 2021, total funding has fallen ~80%, and quarter-over-quarter funding is down ~40%.[9] Excluding late-stage companies, valuations haven’t fallen nearly so much, but earlier-stage valuation stability belies weak volume. Seed-stage companies are roughly flat year-over-year, but total cash raised in seed fundings, meanwhile, fell by 20% in the third quarter.[9]

ARK’s take

We are not surprised that funding remains suppressed, given recent public equity market performance and the relative paucity of merger and acquisition (M&A) activity, but the duration of the capital markets’ doldrums may be about to throw a wrinkle into the venture landscape. Usually, venture companies plan to raise capital every 18 to 24 months; today we are 21 months removed from the highest venture funding quarter in history. Thus far, many companies have managed to avoid coming to market—only 1 out of 5 funding rounds has a sticker price lower than the previous raise—but without capital markets relief, companies may be forced to accept valuation reality. There are pockets of strength—AI companies, most notably—but, barring an equity market recovery, we would expect bankruptcies to spike and valuation weakness to extend back into earlier stage companies.

Disclosures

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-ventures.com. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

The White House. 2023. “FACT SHEET: President Biden Issues Executive Order on Safe, Secure, and Trustworthy Artificial Intelligence.”

Anthropic is in the ARK Venture portfolio.

SpaceX is in the ARK Venture portfolio.

Musk, E. 2023. “We are excited to announce that…” X.

SpaceXa. 2023. “Starlink now has more than 1,000,000…” X. Starlink. 2023b. “Starlink is now available…” X.

See note 3.

As of 11/2/23, 4,263 active satellites. See Starlink Map. 2023.

SpaceX just filed for an additional 30,000 satellites with the ITU. See Pultarova, T. and Howell, E. 2023. “Starlink satellites: Everything you need to know about the controversial internet megaconstellation.“ Space.com. Swinhoe, D. 2023. “Starlink files for 30,000 W-band LEO satellites.“ DataCenter Dynamics.

Walker, P. and Dowd, K. 2023. “State of Private Markets: Q3 2023.” CARTA.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.