ARK's Venture Commentary is meant to provide ARK's thoughts on the current state of the Venture Capital space.

Silicon Valley Breaks The Bank

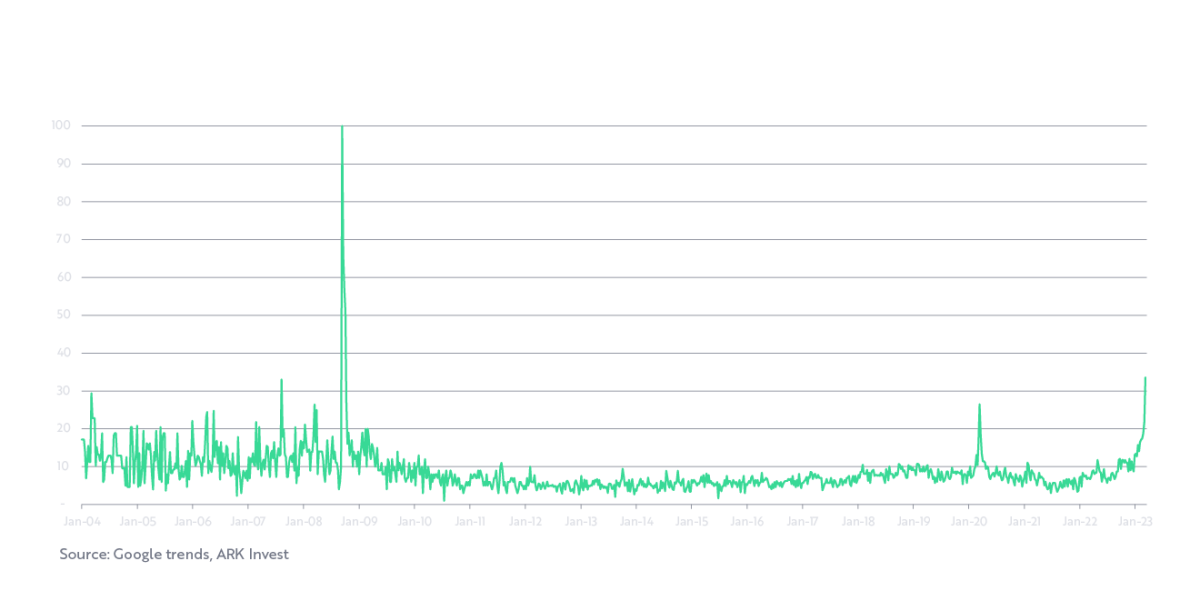

Silicon Valley Bank (SVB) collapsed under the weight of depositor outflows as its customers worried about the bank’s solvency due to mark-to-market losses embedded in its mortgage-backed security portfolio. Although the Federal Deposit Insurance corporation (FDIC) guaranteed SVB depositors, the emergency action could not forestall broader destabilization of the deposit base across the banking industry.

ARK’s take

While the ramifications of SVB’s collapse continue to unfold across the economy, credit is likely to tighten as the banking system adjusts to the higher cost of capital. Additional bank failures could follow as skittish customers seek safe haven for what they once believed were safe assets. SVB served an important financing function within the start-up ecosystem.[1] We are hopeful that those business lines will continue to operate. The FDIC took control of the bank on March 10, and SBV remains in receivership as the bankruptcy process unfolds and aspects of the business are sold off. On March 27, for example, First Citizens Bank acquired $72 billion of the SVB deposits and loans business—now called Silicon Valley Bridge Bank (SVBB).[2] In our view, interest rate risk catalyzed this banking crisis—not credit deterioration, as is more typical—suggesting that further financial unwinding could follow.

Source: ARK Invest, Google Trends.

Source: For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

GPT4 Enters The World Of Chat

OpenAI released its long-rumored, radically performant AI model, GPT4,[3] whose logical reasoning skills advance substantially beyond those of its predecessors. The model can generate large blocks of working code, scores quite well on a range of tests—the equivalent of college credit on an Advanced Placement calculus exam, for example, and in the 90th percentile on the Bar exam. While still in “closed beta,” the model also can interpret and respond to images, coding a web layout based on hand-drawn sketches, for example.[4]

ARK’s take

In our view, AI models like GPT-4 have the potential to supercharge knowledge-worker productivity, and software coding is likely to be the first, most important site in which that uplift will manifest. ARK recently estimated[5] that AI software would increase the average software developer’s productivity by 10x by 2030. GPT4’s capabilities appear to have accelerated that timeline dramatically, as multiple developer teams already report needing just a few hours for programming modules that recently took take them days to complete.[6] Custom software that enables them to stitch together and accelerate all work functions is likely to proliferate as enterprises take advantage of this new capability.

Diffusion Models Approach Photorealism

Adobe, Microsoft, and Midjourney all have launched new diffusion-based image generation AI models: Microsoft is embedding the capability in its revitalized Bing;[7] Adobe is catering to liability-averse corporates by touting its model’s fully licensed training data set;[8] and Midjourney upgraded users to its 5th model release that reaches an unprecedented level of photorealism.

ARK’s take

AI is advancing at an astonishing rate. The first paper introducing the diffusion architecture was published in mid 2020.[9] Midjourney launched 20 months later, and within a year its model consistently generates novel photorealistic images from a text prompt. The models should achieve higher definition in the near future, offering more precise output control and integrating improvements into video. Moreover, advances in diffusion models are likely to advance far beyond image generation, as academic papers already demonstrate how the diffusion architecture applies to robotic motion, traffic simulations, and other domains.[10]

Midjourney image generation for the prompt, “a human eye extremely close up, hazel iris, lace-like iris, eyelashes visible framing the image, extreme closeup, the pupil reflects the rest of the room, the eye is staring into the future in awe, highly detailed.”

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-ventures.com. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

https://www.cnbc.com/2023/03/15/in-client-call-svb-new-ceo-focuses-on-venture-startup-relationships.html

First Citizens is acquiring $72B in deposits and loans from Silicon Valley Bridge Bank

https://openai.com/research/gpt-4

https://www.semafor.com/article/03/14/2023/what-gpt4-can-do

Page 27 of https://ark-invest.com/big-ideas-2023/

For example: https://twitter.com/coderboy_exe/status/1636915430999695360?s=20 and https://twitter.com/Altimor/status/1636777319820935176?s=20 and https://twitter.com/AbhiGutgutia/status/1636787029924257794?s=20

https://www.bing.com/create

https://news.adobe.com/news/news-details/2023/Adobe-Unveils-Firefly-a-Family-of-new-Creative-Generative-AI/default.aspx

[2006.11239] Denoising Diffusion Probabilistic Models (arxiv.org)

https://arxiv.org/pdf/2205.09991.pdf and https://arxiv.org/pdf/2210.17366.pdf for example.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.