ARK's Venture Commentary is meant to provide ARK's thoughts on the current state of the Venture Capital space.

An AI Funding Boom?

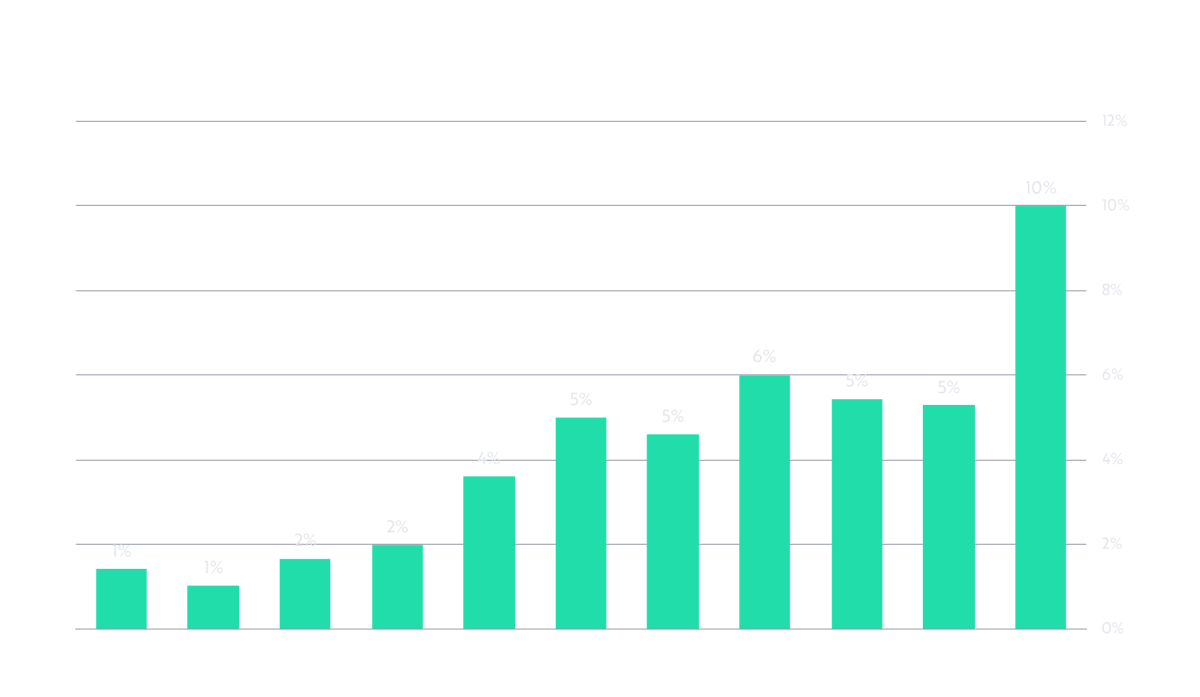

Artificial Intelligence (AI) funding has been heating up, even within the recently-waning private venture space. Bolstered by OpenAI’s giga-deal with Microsoft earlier this year, roughly 10% of startup equity investments have flowed into AI-focused companies over the past year, roughly doubling the average over the previous five, as shown below.

Share of equity dollars invested into startups that are described as AI or neural net focused, as of 6/29/23.

Source: Source: ARK Investment Management LLC, 2023, based on data from Crunchbase as of June 29, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

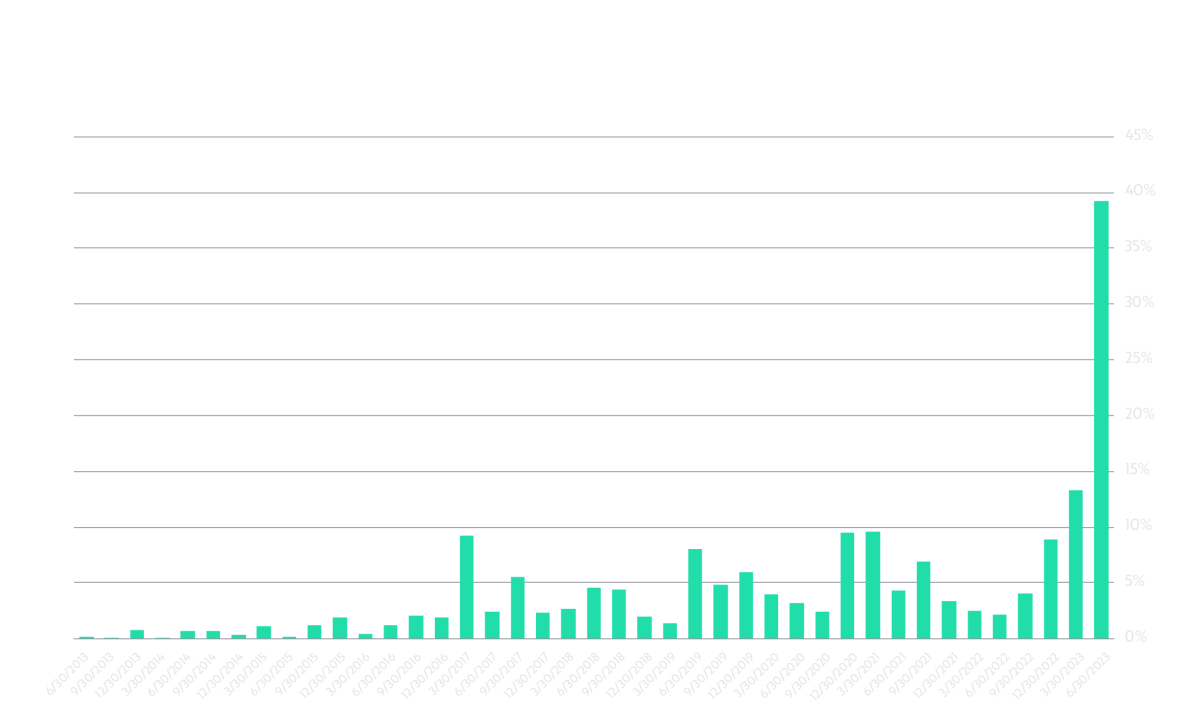

Share of aggregate pre-money value of fundraising companies attributable to startups that are described as AI or neural net focused.

Source: Source: ARK Investment Management LLC, 2023, based on data from Crunchbase as of June 29, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

ARK’s Take

Venture investors are pursuing AI opportunities because they understand that enterprises across the board are seeking AI solutions. AI software has the potential to force-multiply knowledge workforces, and businesses appear to be willing to pay to get more done for less over time. We expect the share of dollars pursuing the AI opportunity to grow significantly by 2030.

AI Traction Takes Shape As Databricks and MosaicML Join Forces

Venture investors are not alone in acquiring equity in AI companies. This quarter, analytics platform Databricks (private) announced plans to acquire MosaicML, an ARK Venture portfolio company currently valued $1.3 billion,[1] a ~6x increase[2] over its previous fundraise and ARK’s cost basis. An analytics platform that helps enterprises harness big data and train their own AI language models, MosaicML’s annualized revenue scaled from $1 million in January 2023 to $20 million by the time of the acquisition, expected by July 31, 2023.[3]

ARK’s Take

We believe the Databricks-MosaicML pairing makes good business sense. Databricks helps enterprises store and extract raw data for analysis, and MosaicML helps enterprises turn that data into performant language models. If data is the new oil, then Databricks provides the oil rigs and MosaicML the refinery. Every Databricks enterprise customer that needs a generative AI strategy would have a ready solution. As the new deal will be secured through an all-stock transaction, we are confident that the MosaicML team won’t take its foot off the pedal.

Watch Our Full Video Explanation of the Acquisition

When Investment Dollars Become Revenue Dollars

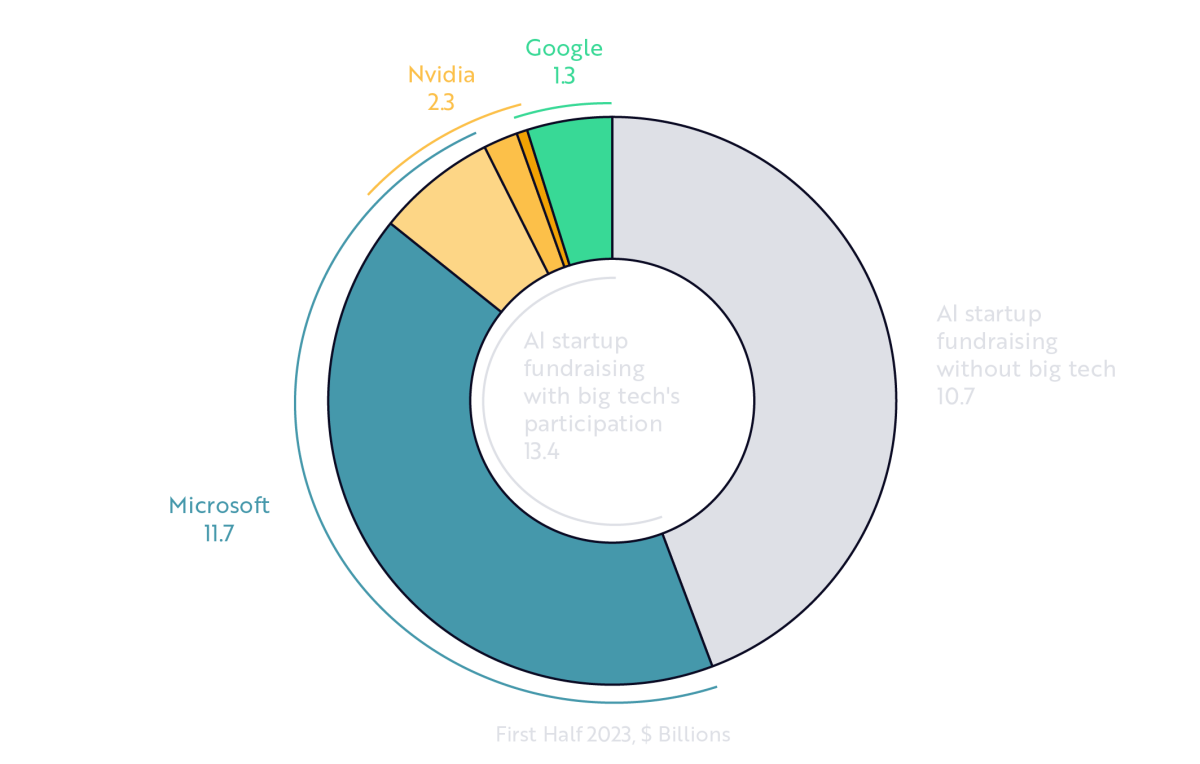

Year-to-date, Google, Microsoft, and Nvidia have participated in over 50% of all AI startup funding rounds by dollar volume, $13.4 billion of the overall $24.1 billion in AI startup financing this year, as shown below.[4] The proportion is important, because all three mega-caps also sell compute resources to AI startups. Most recently, Nvidia announced its participation in a $1.3 billion funding round for Inflection AI, which is using that money to fund its build-out of an AI compute cluster featuring ~$800 million in Nvidia chips.[5]

Source: ARK Investment Management LLC, 2023, based on data from Crunchbase as of June 29, 2023.

Source: For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

ARK’s Take

The transformation of balance sheets into future revenue is a vector of concern and rhymes with misbehavior that commonly occurs over the course of every tech cycle. On the other hand, every industry practices vendor financing to some degree. When overdone—or carried past the point of sustainability—it could potentially portend financial disaster;[6] in the AI space, however, we are still quite early. While the dollar amounts noted above are meaningful in themselves, they are small when compared to the scale of the opportunity that we believe lies ahead. We do have concerns about the potential for the mega-cap infrastructure providers to use their ownership stakes in startups to thwart competition. Is an Nvidia-funded startup prevented from switching to an Advanced Micro Devices or other chip, even when doing so would be economically advantageous? We will watch this space.

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-ventures.com. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

“Mega-cap companies” or “mega-caps” refers to companies with market capitalizations in excess of $200 billion, and Google, Microsoft and Nvidia are examples of such companies. Market capitalization refers to the total dollar market value of a company’s outstanding shares of stock.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

As of June 26, 2023. https://www.databricks.com/company/newsroom/press-releases/databricks-signs-definitive-agreement-acquire-mosaicml-leading-generative-ai-platform

https://www.itpro.com/business/acquisition/databricks-ceo-rebuffs-claims-of-generative-ai-bubble-following-dollar13bn-mosaicml-acquisition

All data are from an analysis of Crunchbase through June 29th, 2023

Inflection AI has announced the build out of a 22,000 H100 cluster. Current pricing for H100s is on the order of $30,000 to $40,000, though Inflection AI should receive a volume discount given the partnership and order size.

For example, Lucent famously imploded when attempting to deliver top line growth by offering credit to undercapitalized customers. Source; https://www.technologyreview.com/2005/02/01/231676/how-lucent-lost-it/amp/

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.