As we close out the second quarter of 2025, the ARK Venture Fund remains committed to backing transformative technologies and bold founders building for a technologically enabled future. Amid a resilient yet volatile market, our portfolio continues to demonstrate strength through innovation, partnerships, and traction in emerging frontiers like artificial intelligence (AI), neurotechnology, and cloud infrastructure.

This quarter, we expanded the portfolio with two new private names, Neuralink and Ayar Labs, and increased our positions in several of our high-conviction holdings. Below, we highlight key developments and the rationale behind these strategic decisions.

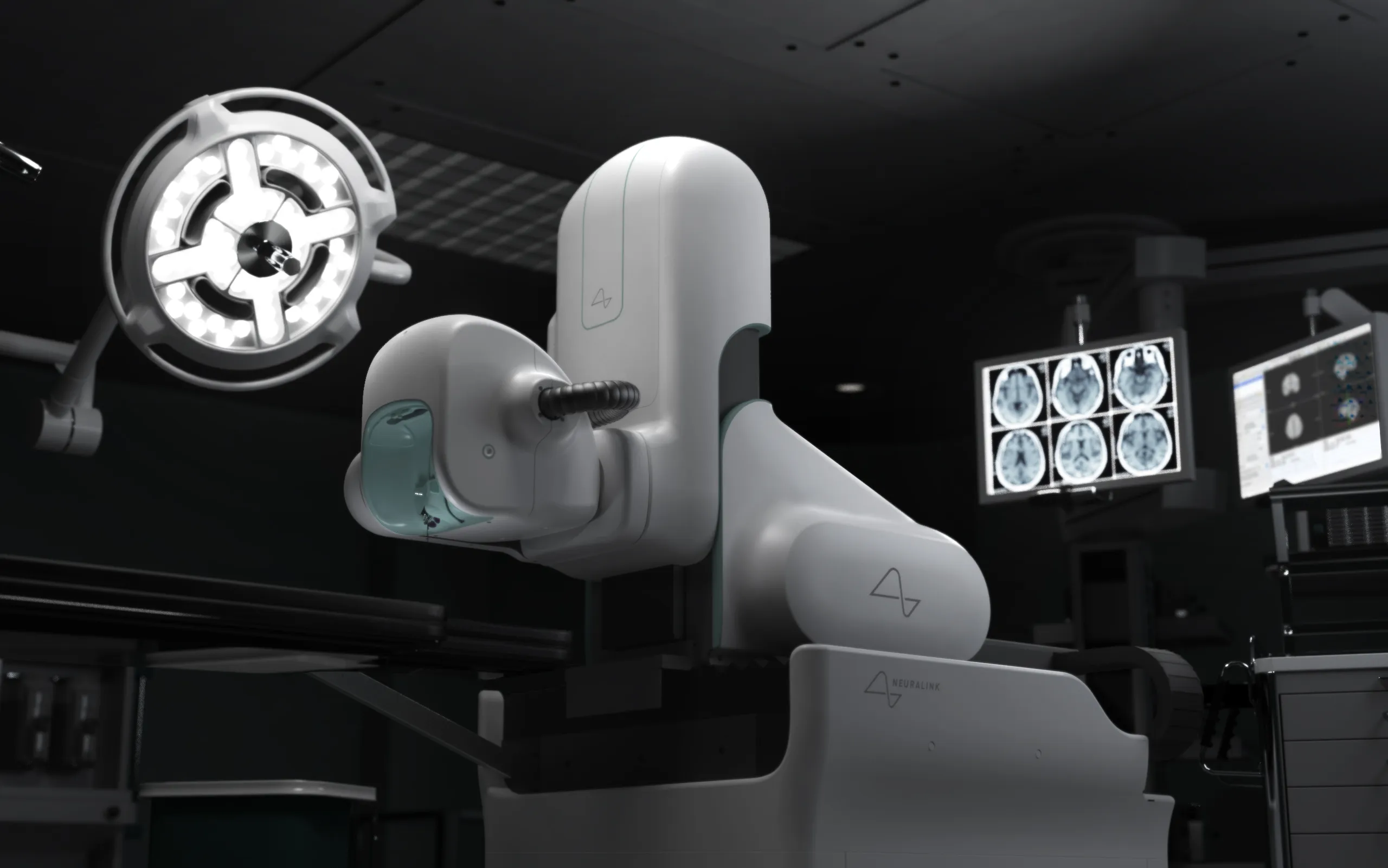

New Investment Highlights: Neuralink and Ayar Labs

ARK’s increasing confidence in the merging of neurotechnology and AI led us to add Neuralink to the ARK Venture Fund. The company’s early results demonstrate better signal resolution and reliability, supporting its long-term goal of enabling high-bandwidth interaction between humans and machines. Elon Musk’s long-term vision for Neuralink, including applications for paralysis treatment, cognitive enhancement, and AI symbiosis, aligns with ARK’s belief in the future of human-machine collaboration. Our research suggests that Neuralink’s vertically integrated approach, from chip design to robotic surgery, gives it a decisive advantage in this rapidly evolving field.

Source: Neuralink and Techcrunch.

Ayar Labs’ groundbreaking optical input/output (I/O) technology is solving the data bottlenecks in AI infrastructure. In March, the company launched the world’s first Universal Chiplet Interconnect Express (UCIe)-compliant optical chiplet, offering 8 Terabits per second bps of bandwidth with significantly lower power and latency, marking a significant advance in AI system efficiency. The offering follows Ayar Labs’ $155 million Series D funding round in late 2024, which was supported by AMD, Intel, and NVIDIA. Ayar’s light-based interconnects present a scalable, standards-based alternative to traditional electrical links, paving the way for the next generation of AI computing.

Doubling Down On Our High-Conviction Names

In Q2, we increased our allocations to several existing positions based on strong performance, positive signals from users or customers, and progress against long-term theses.

Lambda Labs continues to benefit from the rising demand for AI infrastructure. Its graphics processing unit (GPU) cloud offering and vertical hardware-software stack have seen sustained enterprise adoption as companies seek alternatives to large incumbents. Our increased investment reflects conviction in Lambda’s ability to become a key enabler of AI-native enterprises.

Lucra’s peer-to-peer, real-money gaming platform continues to outperform engagement benchmarks in the sports entertainment sector. With new partnerships and league integrations driving daily active user growth, we believe Lucra is positioning itself as a category-defining player in social betting. The fund doubled its position to support the company’s national rollout strategy.

Discord remains one of the most culturally relevant communication platforms for Gen Z. With recent enhancements in AI-powered moderation, server customization, and monetization tools, Discord is evolving from a chat app into a platform for online communities. Our increased stake reflects our view that Discord is poised to become a dominant social and productivity platform for digital-native groups.

Hammerspace continues to execute on its vision of building the “data fabric” for hybrid and edge computing. Recent product launches enabling AI workflows in decentralized environments have received strong technical validation. We invested more this quarter as enterprise adoption began to accelerate, driven by demand from research institutions and media companies alike.

OpenAI’s pace of progress remains unmatched. During the second quarter, it launched advanced personalization features in ChatGPT and deepened its enterprise go-to-market strategy through integrations with Microsoft and the introduction of new developer-facing tools. Personalization with memory increases the stickiness of the product and bodes well for the deepening of the network effect. ARK’s continued investment underscores our view that OpenAI will remain central to the deployment and monetization of frontier models.

Boom Supersonic is advancing toward commercial launch, bolstered by President Trump’s executive order legalizing supersonic flight over land. This regulatory shift supports the company’s rollout of “Boomless Supersonic,” a breakthrough enabling travel up to 50% faster than current jets without an audible boom. The fund increased its investment to support continued commercial development.

.png)

Source: Boom Supersonic.

xAI, Elon Musk’s foundation model company, made rapid strides this quarter. With the release of new versions of its Grok assistant and closer integration into the X platform (formerly Twitter), xAI is beginning to show early traction in product-market fit. We deepened our position in xAI to support its push into multimodal models and agentic use cases.

Looking ahead, the ARK Venture Fund remains committed to investing in companies that push the boundaries of possibility. As we navigate the second half of 2025, we will continue to focus on technologies that are not only disruptive but also mission-critical to shaping a positive trajectory for the future of the world.

We thank our investors for their continued support and look forward to sharing more in Q3.

Chase, Charlie, and the broader ARK Venture Team

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained here. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy. The ARK Venture Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity.

All statements made regarding investment opportunities are strictly beliefs and points of view held by ARK and investors should determine for themselves whether a particular investment or service is suitable for their investment needs. Certain statements contained in this document may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this document may also involve risks and uncertainties described from time to time in ARK’s filings with the US Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this document. Past performance is not a guarantee of future results.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.