MACRO BACKDROP

The fourth quarter underscored how quickly markets can reprice growth, liquidity, and policy risk. Following the Federal Reserve’s (Fed’s) initial rate cut in September, additional easing in October and December brought the target range to 3.50%–3.75%, helping stabilize financial conditions after a volatile November drawdown in equities. By late December, markets rebounded as investors gained confidence that moderating inflation and slowing labor conditions were compatible with further easing in 2026. Importantly, the Fed’s policy stance extended beyond rate cuts: the October signal to end balance-sheet runoff and the December commitment to purchase short-term Treasuries “as needed” to maintain ample reserves provided an underappreciated liquidity backstop, reinforcing risk appetite into year-end.

At the same time, global equities1 broadly moved higher as markets weighed tariff and geopolitical uncertainty against a powerful mix of deregulation, tax incentives, and declining interest rates. In our view, innovation-driven assets are being revalued as former headwinds become structural tailwinds. Fiscal catalysts embedded in the One Big Beautiful Bill (OB3) legislation, particularly accelerated depreciation, are set to improve returns on invested capital materially, positioning the US as one of the most tax-competitive economies globally. That shift should attract foreign direct investment, support the dollar, reinforce downside inflation surprises, and exert further downward pressure on interest rates, creating a constructive backdrop for innovation-led growth.

PERFORMANCE

In this environment, the ARK Venture Fund (ARKVX) outperformed broad-based global equity indices. The top contributors to performance were SpaceX, xAI, and Revolut, all of which benefited from valuation step-ups implied by recent fundraising activity, reflecting strong investor demand for category-defining companies aligned with long-term innovation themes. As public markets stabilized and liquidity expectations improved late in the quarter, private market leaders with scale, revenue traction, and strategic importance were re-rated higher.

SpaceX continued to benefit from its dominant position in launch services and satellite communications, reinforced by an insider tender offer that implied a substantial valuation increase and highlighted growing confidence in Starlink’s revenue trajectory and long-term cash-flow potential.

xAI was a top contributor as well, following capital raises that valued the company among the leading players in foundational artificial intelligence, reflecting both the strategic importance of frontier models and the scarcity value of scaled AI platforms.

Revolut contributed meaningfully after fundraising activity underscored its global expansion, improving profitability profile, and position as one of the most comprehensive digital financial platforms serving consumers and businesses across Europe and beyond.

Together, these companies exemplify how, even amid macro uncertainty, capital continues to concentrate in a narrow set of innovation leaders that have large addressable markets and that are accelerating adoption curves and improving unit economics—dynamics that supported ARKVX’s relative performance during the fourth quarter.

The top detractors from performance were Freenome, Intellia, and Bitmine Immersion Technologies.

Freenome faced pressure during the quarter as diagnostics and gene-editing companies contended with slower funding velocity, heightened investor selectivity, and extended timelines to commercialization, despite continued progress toward its planned public listing and long-term clinical milestones.

Shares of Intellia Therapeutics detracted from performance during the period following a clinical update to its Phase 3 nex-z program, which included a patient death after a prior episode of Grade 4 liver transaminase and bilirubin elevation, prompting a clinical hold. The company has suspended nex-z milestone guidance pending feedback from the U.S. Food and Drug Administration (FDA) and temporarily paused two Phase 3 trials in transthyretin amyloidosis with cardiomyopathy and polyneuropathy. Management expects enrollment to resume following alignment with regulators on risk-mitigation strategies. In our view, the share price reaction reflected heightened clinical and regulatory uncertainty, not a definitive change in the long-term potential of Intellia’s gene-editing platform.

Shares of Bitmine Immersion Technologies detracted from performance during the quarter amid heightened volatility in digital asset markets, including sharp drawdowns in Ethereum following a large October liquidation event. Shares were further pressured after the company proposed a significant increase in authorized shares, raising near-term dilution concerns. Despite those headwinds, Bitmine continued to execute strategically, expanding its Ethereum holdings to approximately 4.1 million ETH (more than 3% of total supply), advancing its Made in America Validator Network (MAVAN) initiative through partnerships with staking providers, and maintaining substantial unencumbered cash. In our view, the stock’s weakness reflected short-term market and technical pressures rather than a change in the company’s long-term strategic positioning.

ACTIVE MANAGEMENT

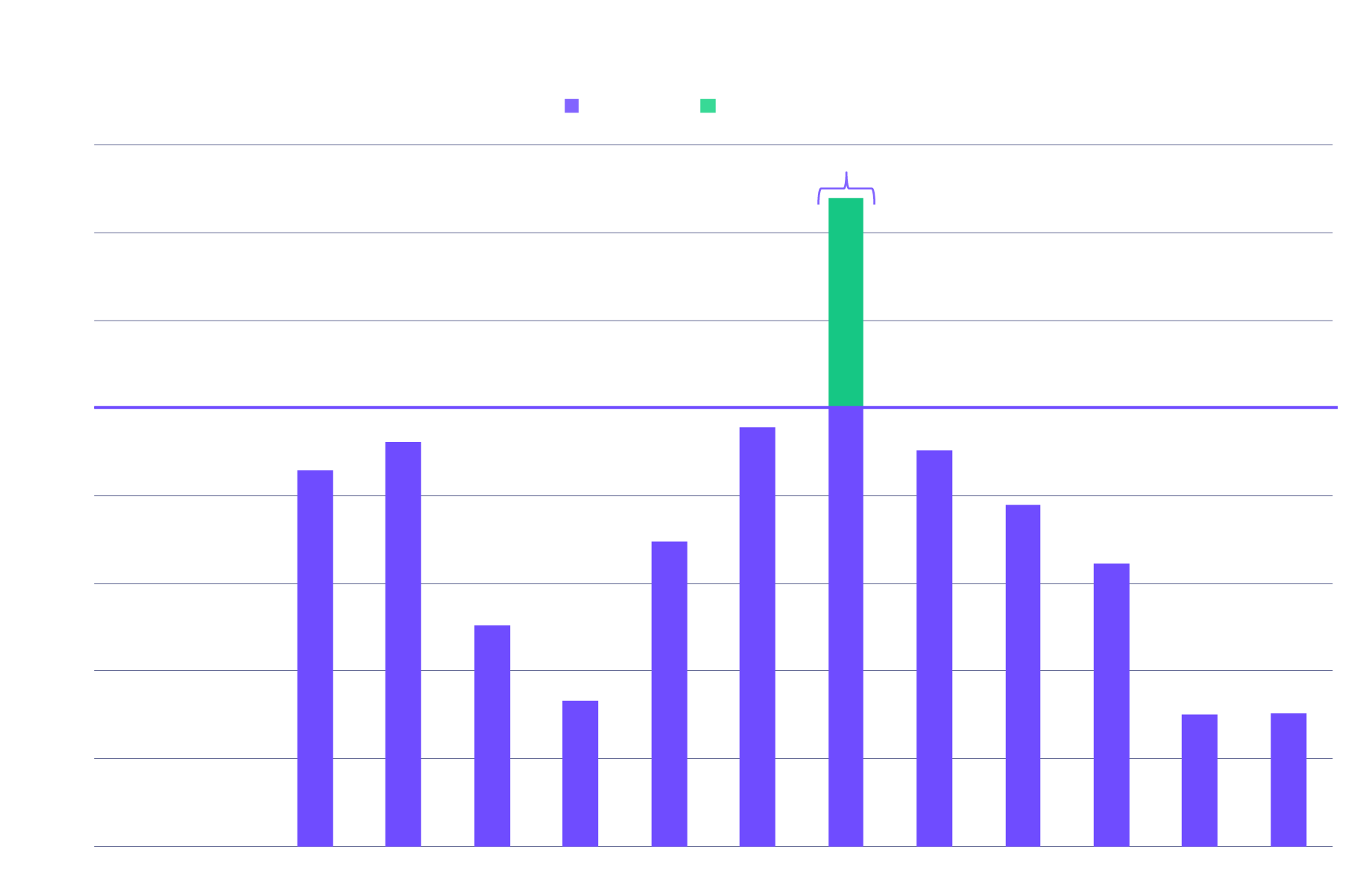

During the quarter, the Fund’s assets under management (AUM) increased from $330 million to $491 million, thanks to market appreciation and $120 million of net inflows.

New Positions

We deployed this capital, alongside selective sales of public equities, to initiate new positions in Architect, Iambic Therapeutics, Impulse Labs, Kalshi, Manna Drone Delivery, and X-energy.

- Architect is an institutional financial-technology company building next-generation infrastructure for global capital markets. Founded in 2023 and headquartered in Chicago, the firm is led by Brett Harrison, a market-structure and trading-systems expert who previously ran algorithmic trading technology at Jane Street and Citadel Securities and served as President of FTX US. Architect combines deep derivatives expertise with modern software engineering to deliver a vertically integrated stack across brokerage, execution, and exchange matching.

- Iambic Therapeutics is pioneering the next generation of drug discovery with its AI-powered platform that integrates physics-informed algorithms, quantum chemistry, and high-throughput biology. The company rapidly designs differentiated therapeutic candidates—including a brain-penetrant HER2 inhibitor and dual CDK2/4 program—that should accelerate traditionally long discovery timelines into weekly cycles. With partnerships and strategic collaborations, Iambic is enabling the creation of medicines for challenging biological targets and redefining how the biotech industry discovers and develops therapies.

- Impulse Labs manufactures an induction cooktop. Its key technology is the Impulse Core, a patent-pending modular power platform capable of operating across a range of home appliances. Long term, the company aims to operate as a Virtual Power Plant, with each Impulse Core connected to the grid and capable of storing, dispatching, and balancing energy to support grid stability.

- Kalshi is a federally regulated financial exchange that enables users to trade on the outcomes of future events—known as “event contracts.” It operates under a license from the U.S. Commodity Futures Trading Commission (CFTC), making it the first CFTC-regulated exchange focused exclusively on event-based markets. Through Kalshi, participants can take positions on topics like inflation, elections, or economic data, using a transparent and compliant framework similar to traditional futures exchanges.

- Manna Drone Inc is an Ireland-based technology company founded in 2018 that specializes in autonomous drone delivery services. The company focuses primarily on the European market and is the only drone operator with European Union Aviation Safety Agency (EASA) approval to self-certify delivery sites across 31 EU countries.

- X-energy is a Small Modular Reactor (SMR) nuclear energy company developing the Xe-100, a 320 MWe (megawatt electrical) high-temperature gas-cooled, pebble-bed reactor. The company also has developed a patented fuel, TRISO-X, which it plans to fabricate in-house and supply for the Xe-100 and other TRISO-fueled reactors.

Increased Positions

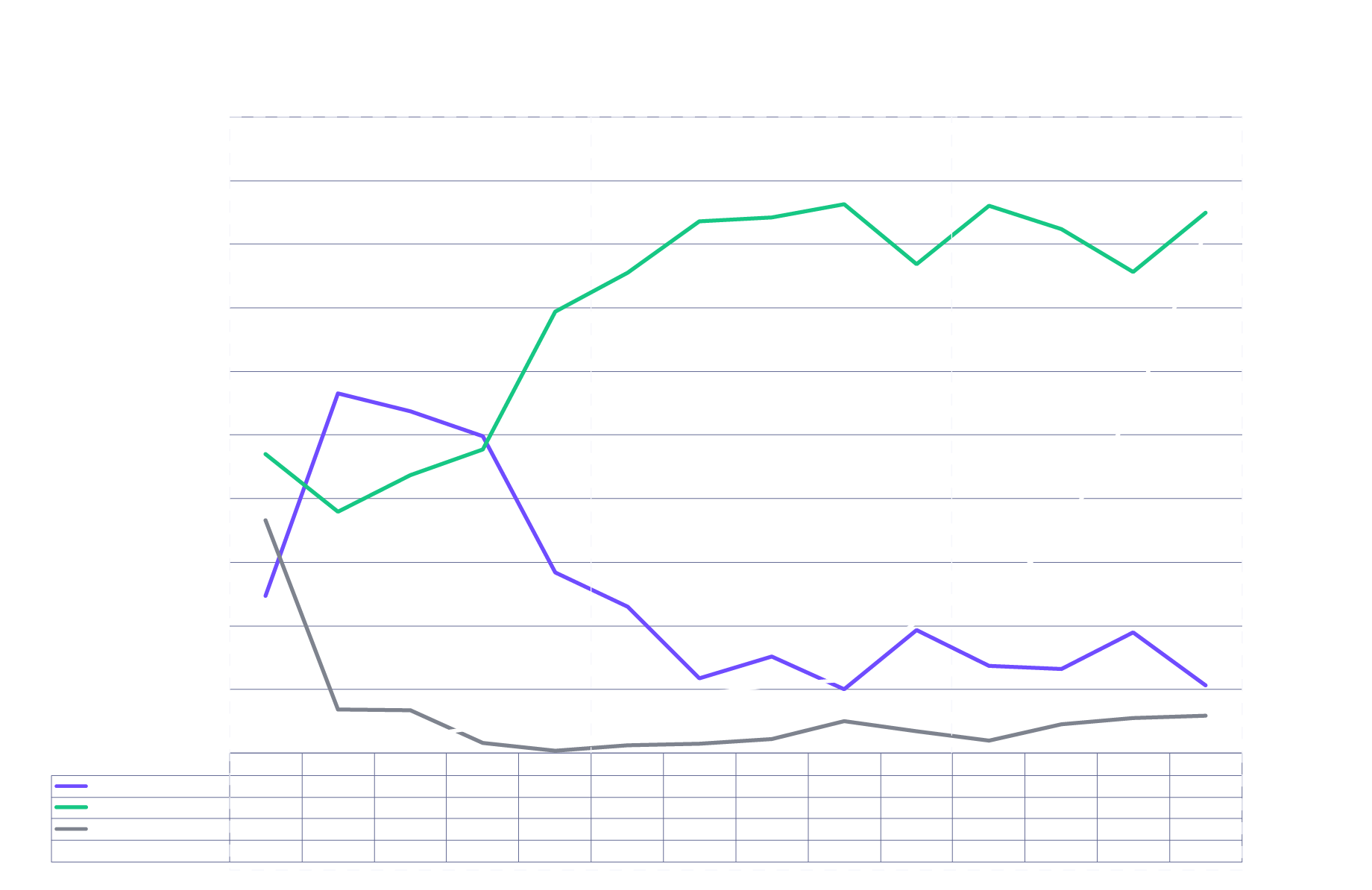

We also added to existing positions in Apptronik, Iambic Therapeutics, Epic Games, Discord, Tenstorrent, Boom, Zipline, Radiant, and xAI, maintaining approximately 80% exposure to private companies, as shown below.

Source: ARK Investment Management LLC 2026, based on data as of 12/31/25. The data presented is for informational purposes only. Total assets under management (AUM) and allocation breakdown are subject to change. Historical increases in AUM are not a guarantee of future increases as AUM may decrease during down markets and/or as the result of redemptions.

Liquidity Management

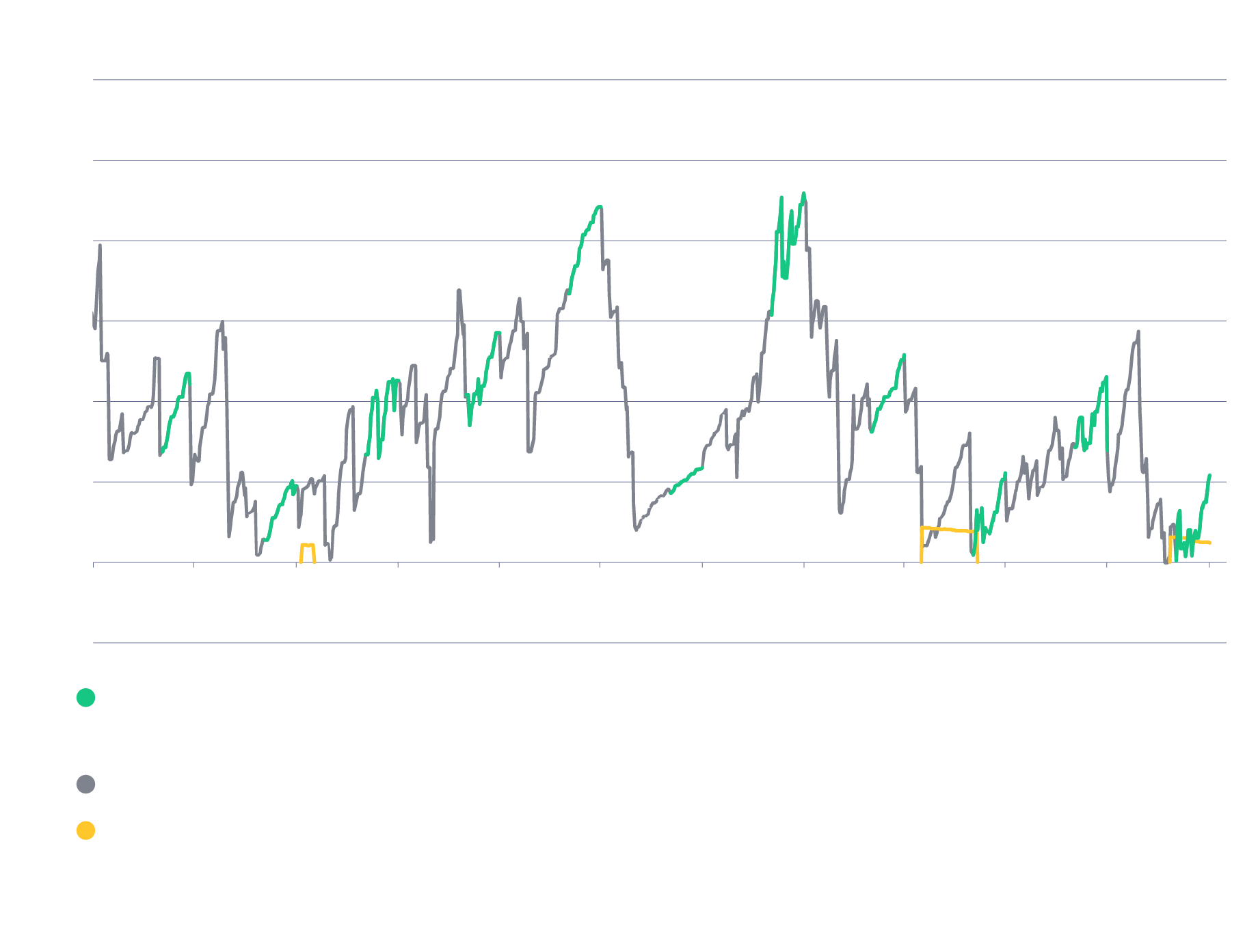

The Fund offers quarterly liquidity at the end of each calendar quarter. Approximately three - four weeks prior to each redemption deadline, the Fund (1) proactively accumulates up to ~5% cash to meet anticipated liquidity needs, (2) reserves capital for near-term private investments, and (3) allocates the remainder to public equities. This approach seeks to minimize taxable transactions and avoid forced selling of public positions.

Source: ARK Investment Management LLC. As of December 31, 2025. The data presented is for informational purposes only.

As of December 31, 2025, redemption requests totaled $7.4 million or 1.5% of the Fund, which were fully covered by cash accumulated prior to quarter end.

Source: ARK Investment Management LLC. As of December 31, 2025. Past grants of liquidity is not a guarantee of future liquidity. The data presented is for informational purposes only.

Looking ahead, we expect 2026 to mark a selective reopening of the initial public offering (IPO) market instead of a broad return to speculative issuance. In our view, public markets increasingly reward companies that enter with meaningful revenue scale, strong product-market fit, and durable competitive advantages, while remaining less receptive to earlier-stage or capital-dependent models. This dynamic aligns with our long-held belief that access to public markets should support continued scaling and strategic flexibility, not signal an endpoint in a company’s growth trajectory.

Within this framework, we closely monitor a number of private companies across innovation-driven sectors that appear increasingly aligned with public-market readiness. Several AI-native businesses—particularly in foundational models, enterprise AI, and developer tooling—are already generating multi-billion-dollar annualized revenues and scaling far more quickly than prior generations of software companies. Similarly, select infrastructure-oriented platforms in connectivity, data, and compute are reaching levels of operational maturity that could support public listings, should market conditions allow. While we do not speculate on specific timelines, we believe these companies represent the types of platforms that could emerge as category leaders in the next phase of the IPO cycle.

More broadly, the macro backdrop appears increasingly supportive of this transition. Beneath headline gross domestic product (GDP) growth, ARK’s research suggests that the US economy has experienced a rolling recession since 2022, tightening a “coiled spring” that could release into a productivity-driven expansion. As monetary policy eases, inflation pressures decelerate, and converging breakthroughs across AI, robotics, energy storage, blockchain, and multiomics accelerate productivity, we believe public markets will become more receptive to long-duration innovation. In this environment, IPO activity should re-emerge in a measured way, led by companies with real economic traction and the potential to be foundational platforms for the next decade of growth.

Important Information

Investors should carefully consider the ARK Venture Fund's investment objectives and risks, as well as charges and expenses, before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-funds.com.

The ARK VENTURE FUND is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

All statements made regarding investment opportunities are strictly beliefs and points of view held by ARK and investors should determine for themselves whether a particular investment or service is suitable for their investment needs. Certain statements contained in this document may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this document may also involve risks and uncertainties described from time to time in ARK’s filings with the U.S. Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this document.

You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

There is no assurance that the Fund will meet its investment objective. The value of your investment in the Fund, as well as the amount of return you receive on your investment in the Fund, may fluctuate significantly. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. Therefore, you should carefully consider the following risks before investing in the Fund.

Principal Risks of the Fund Include:

Private Company Risk. The Fund invests in private, early-stage companies that may be considered highly speculative. As a result, investment in shares of the Fund involves substantial risks including risks associated with uncertainty regarding the valuations of private company investments, high rate of failure among the early-stage companies, and restricted liquidity in securities of such companies. Communications Sector Risk. The Fund will be more affected by the performance of the communications sector than a fund with less exposure to such sector. Cyber Security Risk. As the use of Internet technology has become more prevalent in the course of business, funds have become more susceptible to potential operational risks through breaches in cyber security. Disruptive Innovation Risk. Companies that the Adviser believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Financial Technology Risk. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. Next Generation Internet Companies Risk. The risks described below apply, in particular, to the Fund’s investment in Next Generation Internet Companies.

Foreign Securities Risk. The Fund’s investments in foreign securities can be riskier than U.S. securities investments. Investments in the securities of foreign issuers (including investments in ADRs and GDRs) are subject to the risks associated with investing in those foreign markets, such as heightened risks of inflation or nationalization. The prices of foreign securities and the prices of U.S. securities have, at times, moved in opposite directions. In addition, securities of foreign issuers may lose value due to political, economic and geographic events affecting a foreign issuer or market. During periods of social, political or economic instability in a country or region, the value of a foreign security traded on U.S. exchanges could be affected by, among other things, increasing price volatility, illiquidity, or the closure of the primary market on which the security (or the security underlying the ADR or GDR) is traded. You may lose money due to political, economic and geographic events affecting a foreign issuer or market. The Fund normally will not hedge any foreign currency exposure. Future Expected Genomic Business Risk. The Adviser may invest some of the Fund’s assets in Genomics Revolution Companies that do not currently derive a substantial portion of their current revenues from genomic-focused businesses and there is no assurance that any company will do so in the future, which may adversely affect the ability of the Fund to achieve its investment objective. Emerging Market Securities Risk. Investment in securities of emerging market issuers may present risks that are greater than or different from those associated with securities of developed market issuers due to less developed and liquid markets and such factors as increased economic, political, regulatory, or other uncertainties.

Cryptocurrency Risk. Cryptocurrencies (also referred to as “virtual currencies” and “digital currencies”) are digital assets designed to act as a medium of exchange. Cryptocurrency is an emerging asset class. There are thousands of cryptocurrencies, the most well-known of which is bitcoin. The Fund may have exposure to cryptocurrencies, such as bitcoin indirectly through an investment in the Bitcoin Investment Trust (“GBTC”), a privately offered, open-end investment vehicle that invests in bitcoin. Health Care Sector Risk. The health care sector may be affected by government regulations and government health care programs, restrictions on government reimbursement for medical expenses, increases or decreases in the cost of medical products and services and product liability claims, among other factors. Leverage Risk. The use of leverage can create risks. Leverage can increase market exposure, increase volatility in the Fund, magnify investment risks, and cause losses to be realized more quickly. Non-Diversification Risk. The Fund is classified as a “non-diversified” investment company under the 1940 Act. Therefore, the Fund may invest a relatively higher percentage of its assets in a relatively smaller number of issuers or may invest a larger proportion of its assets in a single issuer. As a result, the gains and losses on a single investment may have a greater impact on the Fund’s NAV and may make the Fund more volatile than more diversified funds.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up-to-date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks, and you can lose money on your investment. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Diversification neither assures a profit nor guarantees against loss in a declining market.

“OB3” or the “One Big Beautiful Bill Act” is a U.S. federal statute passed by Congress containing tax and spending policies that form the core of President Donald Trump's second-term agenda.

“Rolling Recession” refers to a type of recession that affects different sectors of the economy at different times—not simultaneously.

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

Broad-based global equity indexes are defined as the S&P 500 Index and the MSCI World Index.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds: