The humanoid robot manufacturer Figure AI is tackling one of the biggest market opportunities that exists: labor. Elon Musk once said, “If you've got a sentient humanoid robot that is able to navigate reality and do tasks at request, there is no meaningful limit to the size of the economy.”1

While Musk envisioned humanoid robots that exceed human capability, ARK’s research suggest that, even before that moment in time, if humanoid robots are able to operate at scale, they could generate tremendous revenue, split roughly equally between household and manufacturing robotics.

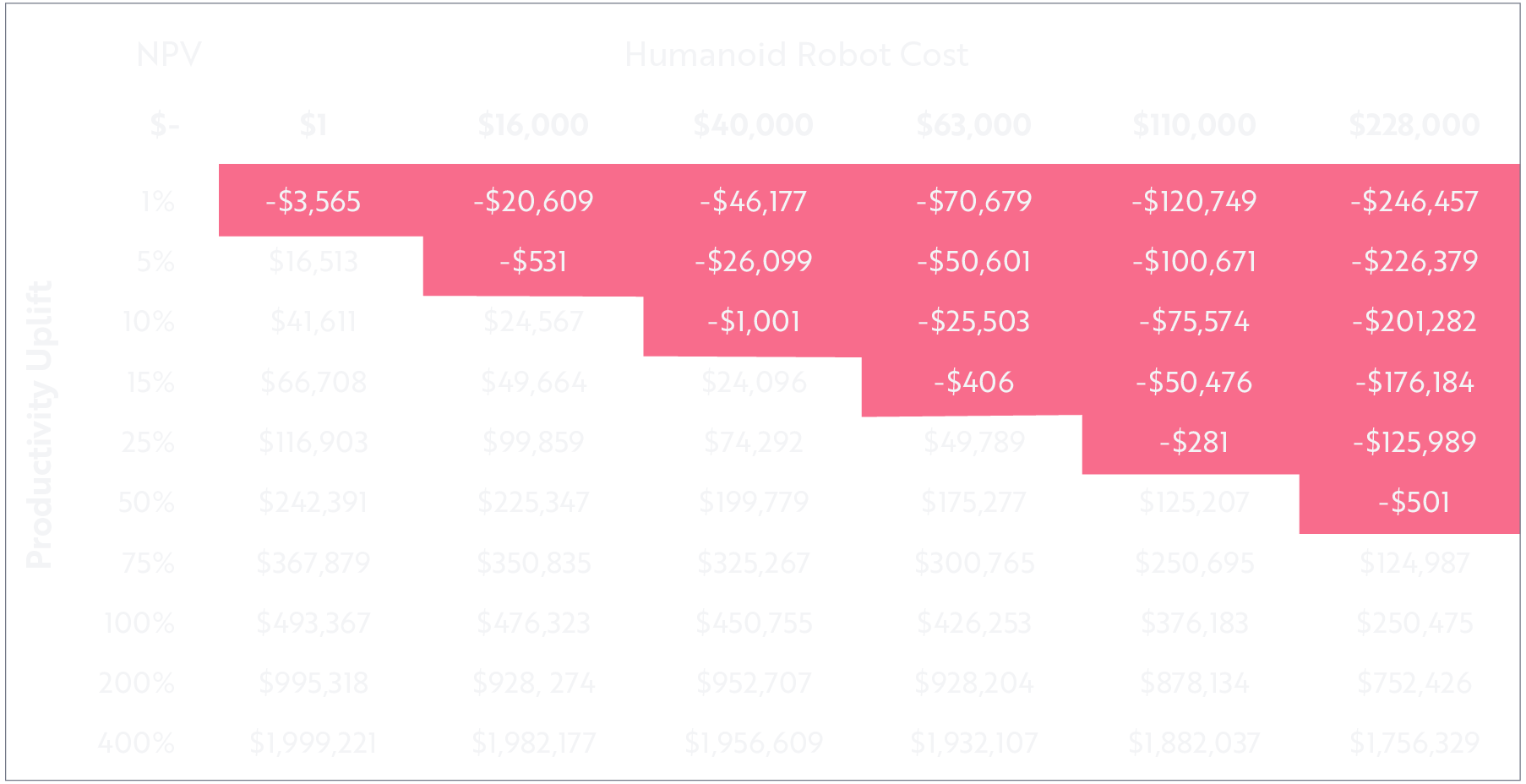

In our view, humanoid robots will become more economically viable than human employees at tipping points in their net present value (NPV)2 that balance the cost of humanoid robots against the productivity gains they will enable, as shown below. At a cost of $16,000, for example, a humanoid robot would have to deliver little more than a 5% gain in productivity relative to its human counterpart to become economically viable.

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of external data source, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Why are humanoid robots feasible now? It’s a story of convergence and cost declines. The combination of AI improvements along with battery and actuator cost declines have led to breakthroughs in what was thought possible in the field of robotics. OpenAI and Microsoft’s investment in Figure3 give the company the necessary access to AI training hardware; and Figure’s partnership with BMW gives it real-world data and feedback. As was proven with Kiva robots at Amazon, if Figure can prove the robot's value, even if in a niche application to start, there can be massive demand within just a handful of companies.

Figure’s leadership team is another critical component of our investment thesis. The company’s founder, Brett Adcock, previously founded Archer, a company in the electric vertical takeoff and landing (EVtol) space, in which ARK is also invested. In our view, Brett does a fantastic job of recruiting top talent, raising capital, and iterating quickly—key areas ARK sees as critical for success in this domain.

Ultimately, Figure’s rate of progress, talent, access to capital, and key partners give us confidence that it will help lead the humanoid robotics space. ARK is proud to have exposure to humanoid robots through our investments in both Figure and Tesla.

Important Information

We offer our view of Figure AI because it is part of the total ARK Venture Fund portfolio. To see the most updated portfolio, please click here. Holdings subject to change. Not a recommendation to buy, sell, or hold any specific security.

BEFORE INVESTING YOU SHOULD CAREFULLY CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES. THIS AND OTHER INFORMATION IS IN THE PROSPECTUS, A COPY OF WHICH MAY BE OBTAINED HERE. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE YOU INVEST.

There is no assurance that the Fund will meet its investment objective. The value of your investment in the Fund, as well as the amount of return you receive on your investment in the Fund, may fluctuate significantly. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. Therefore, you should consider carefully the risks at the bottom of this page before investing in the Fund.

ARK Investment Management LLC is the investment adviser to the ARK Venture Fund.

Foreside Fund Services, LLC, distributor.

Motley Fool Transcribing. 2024. “Tesla (TSLA) Q1 2024 Earnings Call Transcript.”

NPV or Net Present Value is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Palmer, A. 2024. “Humanoid Robot Startup Figure AI Valued at $2.6 billion as Bezos, OpenAI, Nvidia Join Funding.” CNBC.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.