Financial advisors facing heightened short-term uncertainty in the public equity markets seek investment options that reduce emotions and encourage long-term decision making. The ARK Venture Fund (ARKVX) provides access to some of the most disruptive and forward-looking companies without subjecting clients to the intra-day trading volatility of ETFs.

ARKVX is designed for long-term investors seeking exposure to breakthrough innovation across both private and public markets.

Why Now?

The innovation economy is accelerating—from AI and robotics, to next-generation therapeutics, and to space exploration. A diversified innovation strategy that includes private market exposure could be a healthy augmentation to public market positions.

ARKVX Complements Public Innovation Investments By Providing:

- Quarterly Liquidity: Clients can redeem up to 5% of fund assets per quarter,1 ensuring a stable capital base and avoiding panic redemptions.

- Valuation Discipline: Unlike some venture funds, ARK uses a consistent and transparent pricing methodology tied to fundamentals and audited by a third party, balancing rigor with investor accessibility.

- Crossover Access: ARKVX invests in companies before and after their initial public offering (IPO), providing access to a broader range of innovation-stage exposure than traditional venture-only strategies.

A Healthier Client Behavioral Dynamic

One of the most vexing risks in innovation investing is client behavior—reacting to drawdowns, trading headlines, or chasing performance. ARKVX’s structure helps to insulate clients from that temptation and encourages longer-term holding periods.

How?

- No daily ticker on a screen.

- No intraday price swings.

- A built-in redemption gate of 5% of fund assets quarterly2 promotes long-term alignment.

Performance And Portfolio Role: Strong Fundamentals, Differentiated Exposure

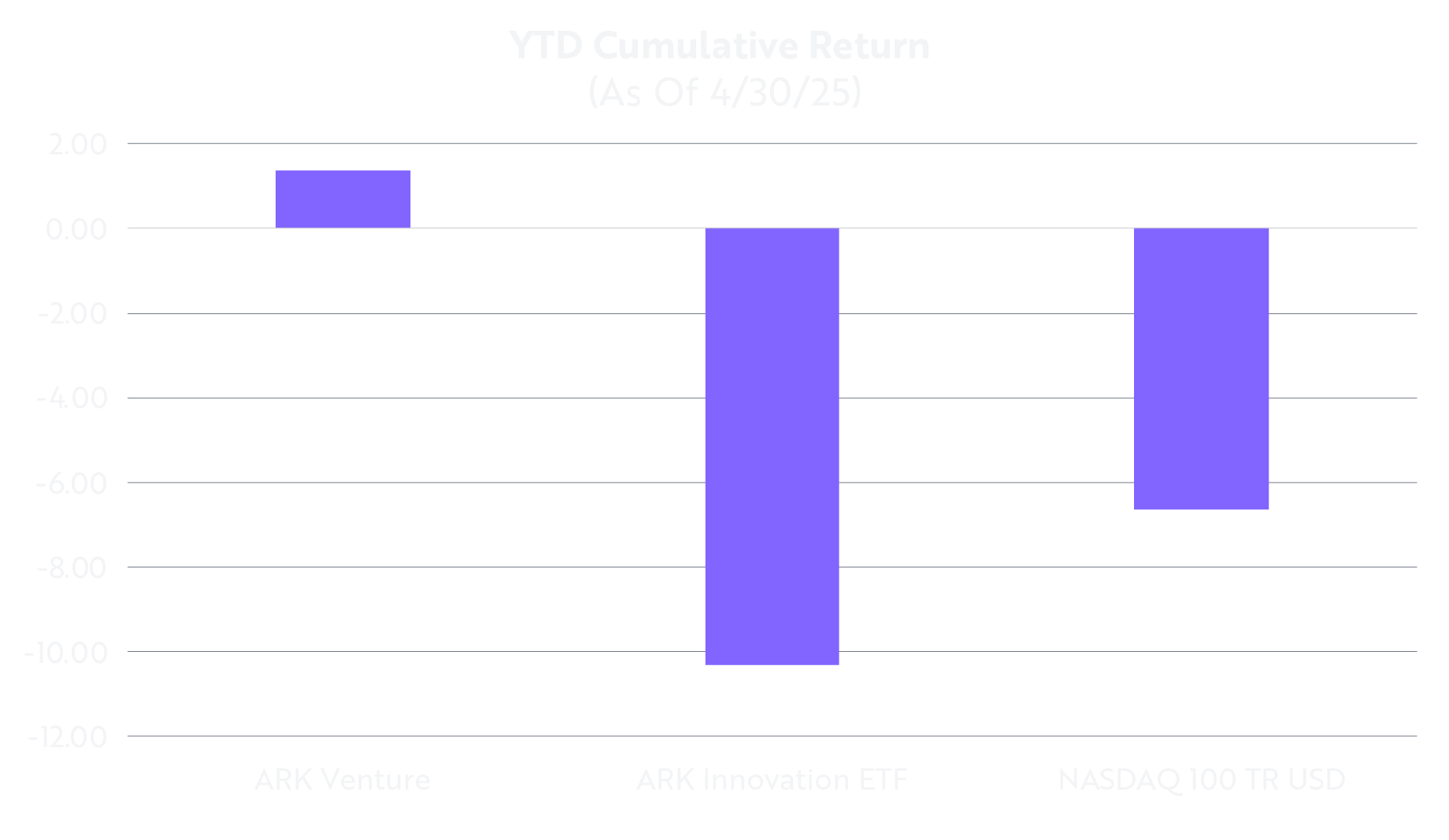

While ARKVX is not marketed as a low-volatility product, its structure and investment universe results in a return experience that differs significantly from daily-traded vehicles, as shown below.

.png) Please find all material differences between the ARK Innovation ETF and the ARK Venture Fund in the “Important Information at the end of this article. Source: ARK Investment Management LLC, as of April 30, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance does not guarantee future results. The inception date of the ARK Innovation ETF (ARKK) is October 31, 2014, the inception date of the ARK Venture Fund (ARKVX) is September 23, 2022, and the inception date of the Nasdaq 100 Index is January 31, 1985.

Please find all material differences between the ARK Innovation ETF and the ARK Venture Fund in the “Important Information at the end of this article. Source: ARK Investment Management LLC, as of April 30, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance does not guarantee future results. The inception date of the ARK Innovation ETF (ARKK) is October 31, 2014, the inception date of the ARK Venture Fund (ARKVX) is September 23, 2022, and the inception date of the Nasdaq 100 Index is January 31, 1985.

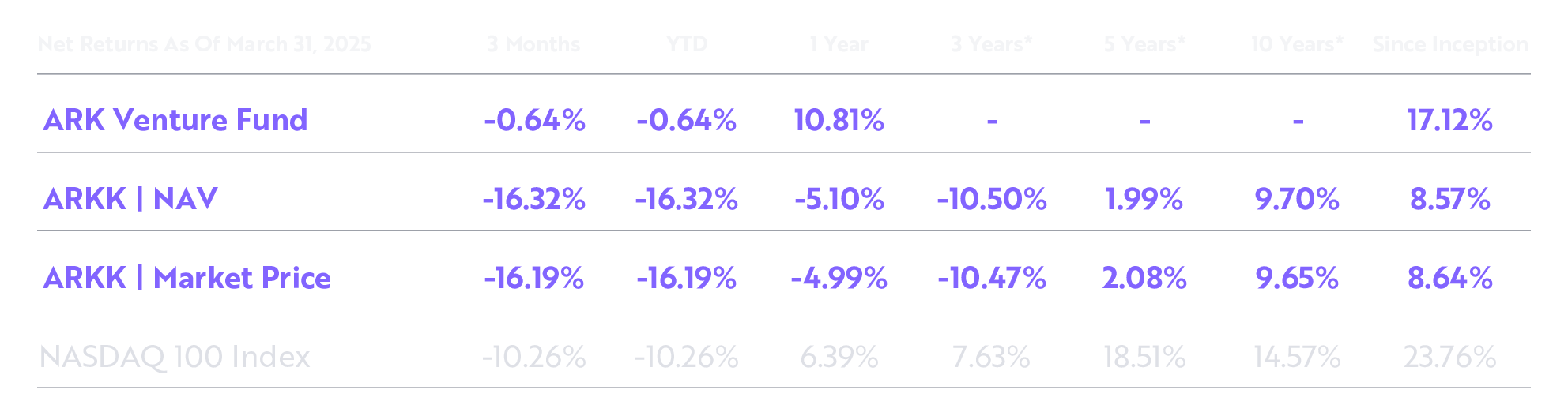

All since inception returns are shown since the ARK Venture Fund’s inception, which was September 23, 2022. The ARK Venture Fund Performance shown is at NAV, as the Fund is not traded on an exchange and does not have Market performance. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor's shares when redeemed may be worth more or less than the original cost. For the Fund’s most recent month end performance, please visit www.ark-funds.com or call 727.810.8160. Returns for less than one year are not annualized. As stated in the ARK ETFs’ and the ARK Venture Fund current prospectuses, the expense ratio for ARKK is 0.75%, the gross expense ratio for ARKVX is 4.71% and the net is 2.90%. The net expense ratio takes into account contractual fee waivers/expense reimbursements that currently are scheduled to remain in place through 11/30/2025, and may be terminated sooner by the Board of Trustees of the Fund, upon sixty (60) days’ written notice to the Adviser. Without such fee waivers/reimbursements, performance would have been lower. Extraordinary performance is attributable in part due to unusually favorable market conditions and may not be repeated or consistently achieved in the future.

All since inception returns are shown since the ARK Venture Fund’s inception, which was September 23, 2022. The ARK Venture Fund Performance shown is at NAV, as the Fund is not traded on an exchange and does not have Market performance. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor's shares when redeemed may be worth more or less than the original cost. For the Fund’s most recent month end performance, please visit www.ark-funds.com or call 727.810.8160. Returns for less than one year are not annualized. As stated in the ARK ETFs’ and the ARK Venture Fund current prospectuses, the expense ratio for ARKK is 0.75%, the gross expense ratio for ARKVX is 4.71% and the net is 2.90%. The net expense ratio takes into account contractual fee waivers/expense reimbursements that currently are scheduled to remain in place through 11/30/2025, and may be terminated sooner by the Board of Trustees of the Fund, upon sixty (60) days’ written notice to the Adviser. Without such fee waivers/reimbursements, performance would have been lower. Extraordinary performance is attributable in part due to unusually favorable market conditions and may not be repeated or consistently achieved in the future.

Additional information about fees and expense levels can be found in the ARK ETFs' and Venture Fund prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK Fund, calculated using the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time. Market returns are based on the trade price at which shares are bought and sold on the exchange using the last share trade. ETF Market performance does not represent the returns you would receive if you traded shares at other times. Total Return reflects reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of ARK ETF shares may differ significantly from their NAV during periods of market volatility. ARK's actively managed ETFs are benchmark agnostic. Index performance provided as a general market indicator.

Source: ARK Investment Management LLC. As of March 31, 2025.

Importantly, the products covered in the charts above are not mutually exclusive. Many investors hold both ARKVX and ARK’s Innovation-focused ETFs as part of a “core-and-satellite” approach to disruptive innovation.

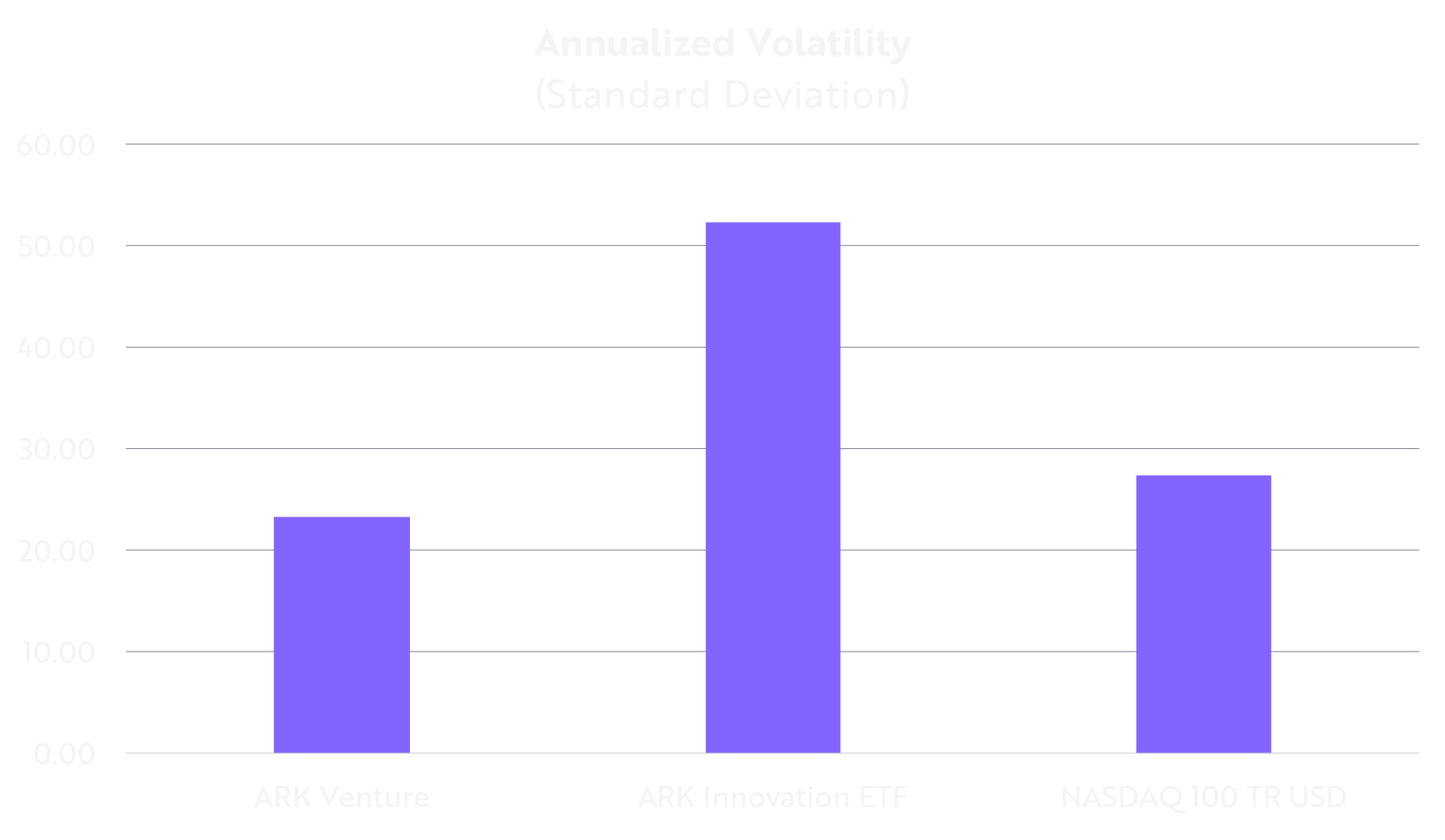

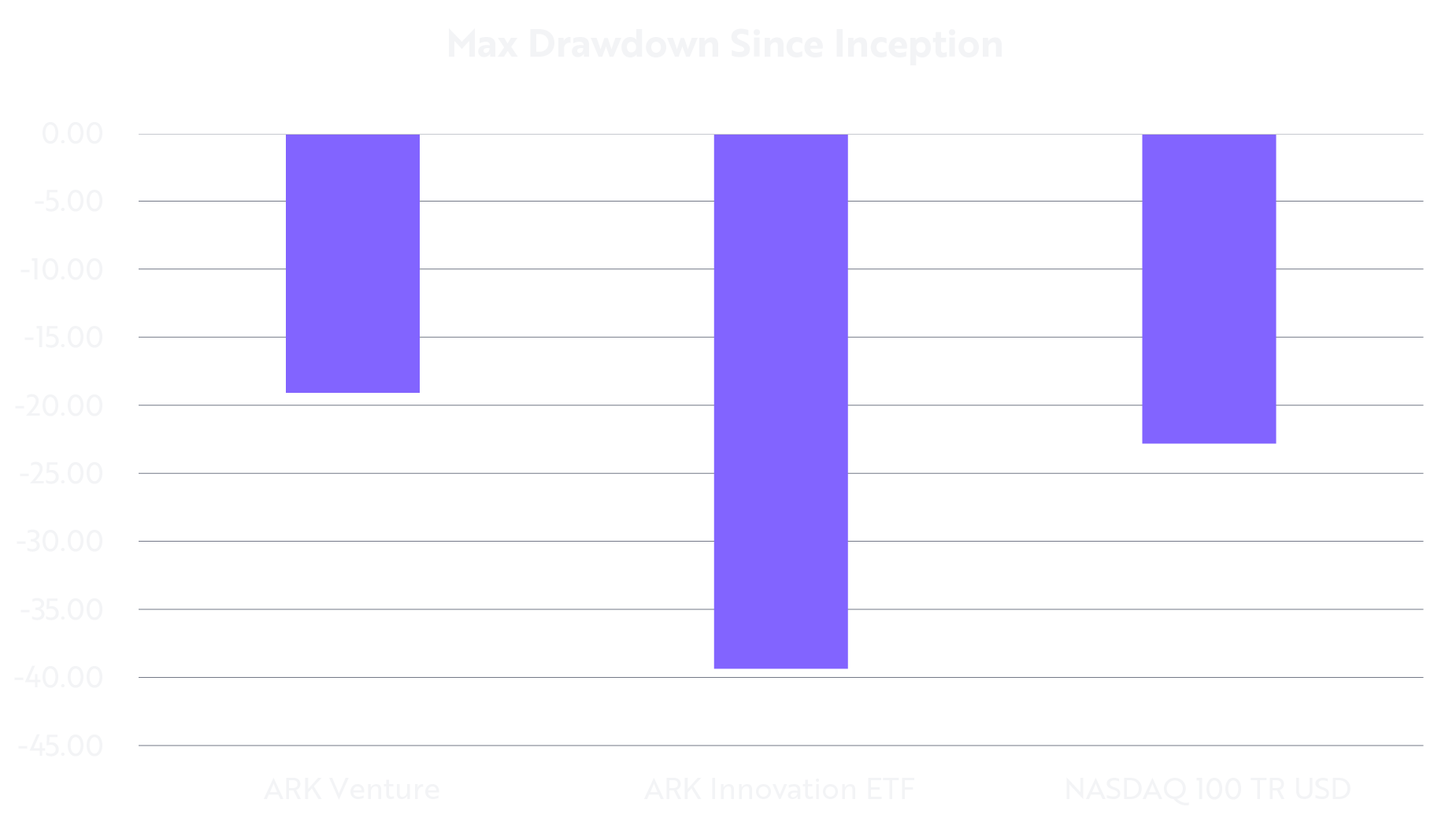

Risk Profile: Volatility And Drawdown Perspective

Although not designed to dampen volatility, ARKVX's structure and diversified exposure have resulted in a differentiated risk experience, as shown below.

Source: ARK Investment Management LLC, as of April 30, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. A maximum drawdown is the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained. Past performance does not guarantee future results.

Source: ARK Investment Management LLC, as of April 30, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. A maximum drawdown is the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained. Past performance does not guarantee future results.

These metrics reflect the fund's balanced approach to capturing innovation upside while supporting a long-term holding mindset. In other words, ARKVX can complement innovation ETFs that offer greater liquidity and trading flexibility.

In Our View, ARKVX Is The Ideal Product For:

- Clients who understand innovation but prefer a more patient investing experience.

- Investors interested in private market access with limited lockups.

- Portfolios seeking to diversify with an alternative growth engine.

Key Differentiators, For Advisors:

- ARKVX helps to align client behavior with long-term objectives.

- ARKVX provides access to high-conviction ARK research across the public and private spectrum.

- ARKVX ensures the transparency and valuation integrity not often found in the venture space.

By design, ARKVX is a strategic complement to public equity innovation exposure, built for clients who value discipline, access, and long-term thinking.

Important Information

Investors should carefully consider the ARK Venture Fund's investment objectives and risks, as well as charges and expenses, before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-funds.com.

The ARK Venture Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

The ARK Venture Fund (ARKVX) is an actively managed closed-end interval fund that seeks long-term growth of capital by investing both private and public equities securities of companies that are relevant to the Fund’s investment theme of disruptive innovation. The ARK Venture Fund seeks to democratize venture capital, offering all investors access to what we believe are the most innovative companies throughout their private and public market lifecycles.

Meanwhile, The ARK Innovation ETF (ARKK) is an actively managed Exchange Traded Fund (ETF) that seeks long-term growth of capital by investing under normal circumstances primarily (at least 65% of its assets) in domestic and foreign equity securities of companies that are relevant to the Fund’s investment theme of disruptive innovation.

Standard deviation is a statistical measurement of how far a variable, such as an investment's return, moves above or below its average (mean) return. An investment with high volatility is considered riskier than an investment with low volatility; the higher the standard deviation, the higher the risk.

All statements made regarding investment opportunities are strictly beliefs and points of view held by ARK and investors should determine for themselves whether a particular investment or service is suitable for their investment needs. Certain statements contained in this document may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this document may also involve risks and uncertainties described from time to time in ARK’s filings with the U.S. Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this document.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up-to-date portfolio, click here.

To view the holdings and other information for ARKK, please click here.

An investment in the ARK Venture Fund is subject to risks, and you can lose money on your investment. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Diversification neither assures a profit nor guarantees against loss in a declining market.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

Although the Fund will offer to repurchase shares on a quarterly basis, shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered shares during a quarterly repurchase offer. An investment in the Fund’s shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

The Board, or a committee thereof, in its sole discretion, will determine the number of Shares that the Fund will offer to repurchase (the “Repurchase Offer Amount”) for a given Repurchase Request Deadline. The Repurchase Offer Amount, however, will be no less than 5% and no more than 25% of the total number of Shares outstanding on the Repurchase Request Deadline.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.