ARK’s investment strategy centers on identifying and investing in disruptive innovation. Among the many transformative technologies reshaping the global economy, artificial intelligence (AI) is perhaps the most profound. We believe that OpenAI, with its advanced large language models (LLMs), is uniquely positioned to be a leader in the AI revolution. With products like ChatGPT and frontier models like o1 and GPT-4o, OpenAI has demonstrated its ability to leverage its research capabilities to drive consumer and enterprise adoption of AI. By enabling unprecedented advancements in automation, decision-making, and creativity, OpenAI’s technology represents a foundational shift in how businesses will operate and grow.

Our focus on generative AI rests on the belief that it will catalyze a step-function increase in automation across industries and job functions, driving dramatic productivity growth throughout this decade and beyond. Similar to the current Infrastructure-as-a-Service market, in which just three players control a vast majority of the market, we expect the market for commercialized frontier AI-models will be concentrated—especially given their capital intensity and the importance of network effects. We believe OpenAI’s first mover advantage, product execution, and data flywheels position the company to be a leader in the emergent AI industry.

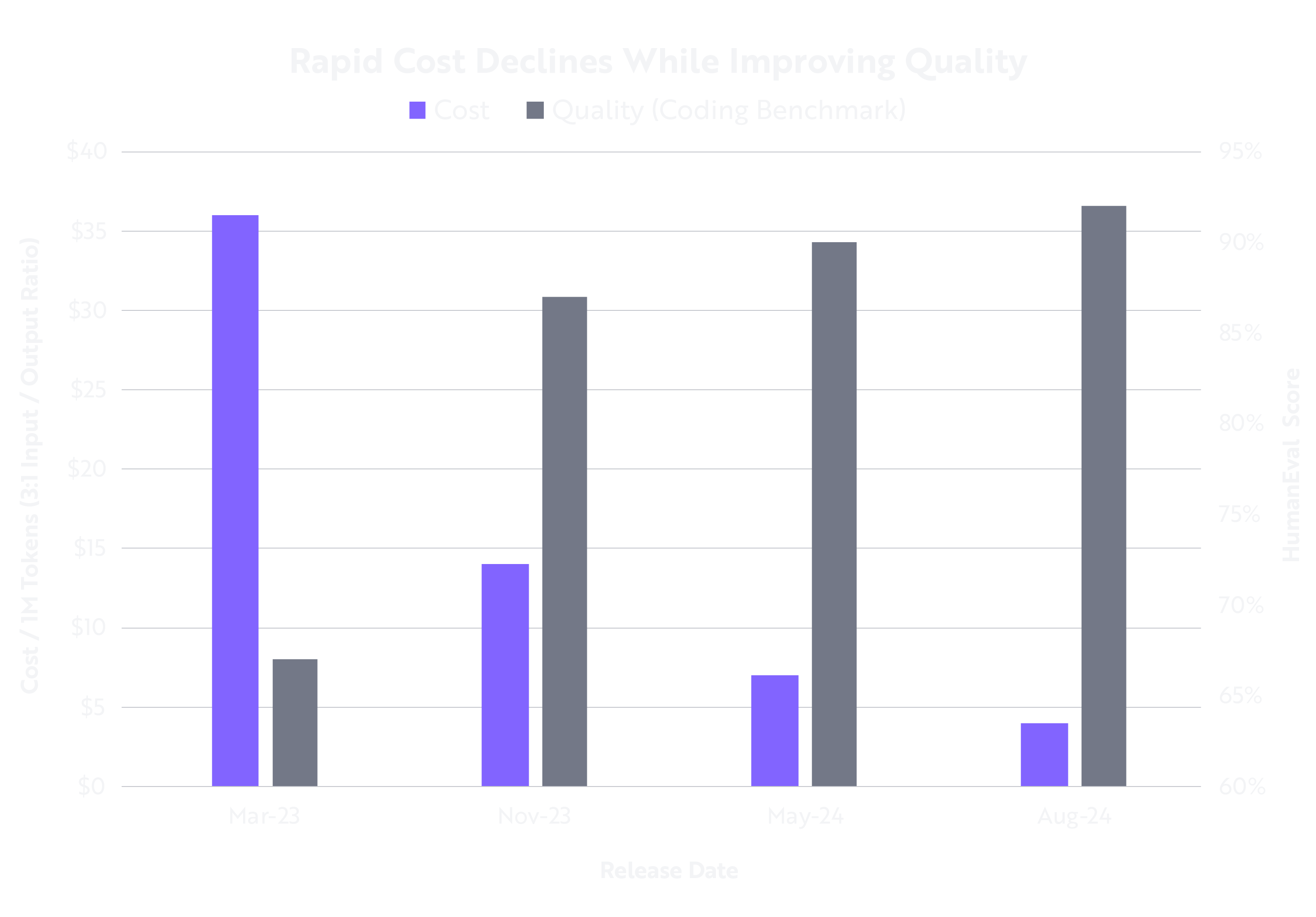

Innovation is at the heart of OpenAI’s success. The company has consistently demonstrated its ability to iterate rapidly on its foundational models, improving both performance and cost efficiency, as shown below.

Note: The “HumanEval” score measures performance on 164 original programming questions written in Python, covering a broad range of basic coding skills. Source: ARK Investment Management LLC, 2024, based on data from OpenAI and Artificial Analysis as of August 24, 20241 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

AI training and inference cost declines have continued to surprise us, increasing our confidence in the technology’s ability to continue improving scale. OpenAI's latest model2—named “o1”—is the first AI model trained specifically to reason about problems before providing answers. OpenAI researchers have demonstrated that o1’s thinking time improves the model’s performance on PHD-level questions in domains such as coding, math, and science. Notably, the longer the model spends thinking, the better its answers—a breakthrough discovery that may have launched a new era of model performance improvements.

In addition to its language models, OpenAI is also a leader in image and video generation. Its models DALL-E and SORA are pointing to significant areas for product expansion.

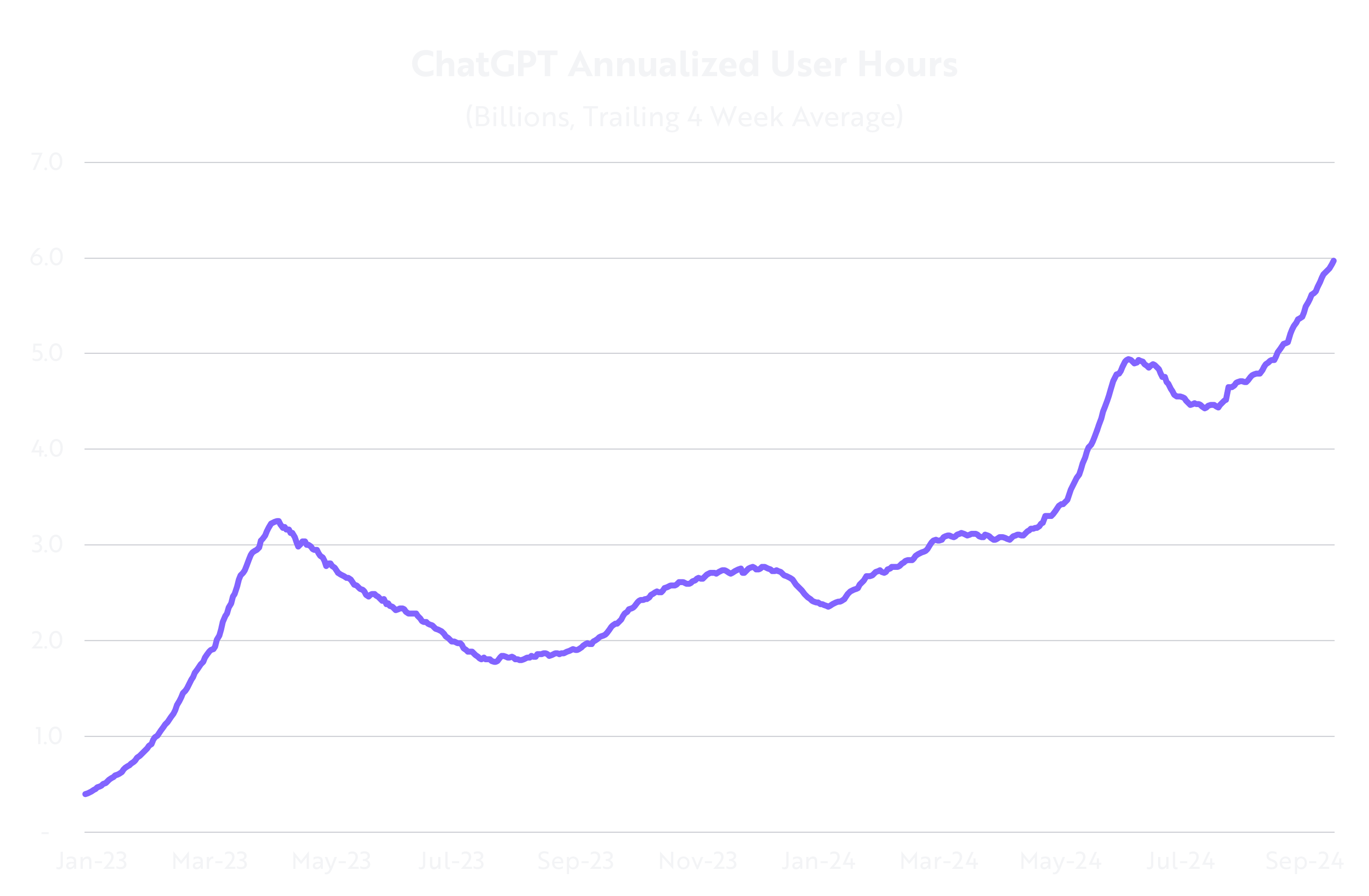

Indeed, OpenAI is driving advances that are likely not only to boost demand for its foundation models in the form of application programming interface (API) services, but also to stimulate demand for its AI-enabled applications. Within the first two months of its initial release in November 2022, ChatGPT gained 100 million users3 in the fastest application uptake of all time. Other major consumer platforms with billions of users today needed years to reach this milestone. Web traffic data suggest that ChatGPT usage has continued to grow as OpenAI has shifted to a freemium model and enhanced it with new features and functionality over time, as shown below.

Source: ARK Investment Management LLC, 2024, based on data from SensorTower and SimilarWeb as of September 24, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

The viral success of ChatGPT created a powerful data flywheel that continues to refine and improve its underlying models. Simultaneously, paid tiers for “prosumers” and business users have spurred strong demand for ChatGPT as a commercial offering tailor-made for employees eager to integrate generative AI into their workflows. Furthermore, the GPT Store is creating an ecosystem of AI applications that leverages OpenAI models, cultivating a community of developers who are expanding the potential use cases for ChatGPT.

ARK monitors closely and continuously all the transformative technologies in which we invest, not least those in the rapidly evolving AI space in which OpenAI is aiming to outperform the competition. To cement its lead over competitors, the company will have to evolve both model capability and new product development aggressively. Notably, Anthropic’s Claude and Meta’s Llama models have met and exceeded GPT-4o in certain capabilities, while the latter’s open-sourced strategy has democratized LLM access in potentially threatening ways.

On the product side, Google and Apple are rolling out consumer-facing AI agent capabilities, while OpenAI’s partner, Microsoft, is competing for enterprise use cases. Given those threats, OpenAI must retain top talent and demonstrate operational excellence that continues to shine in the face of headline leadership departures.

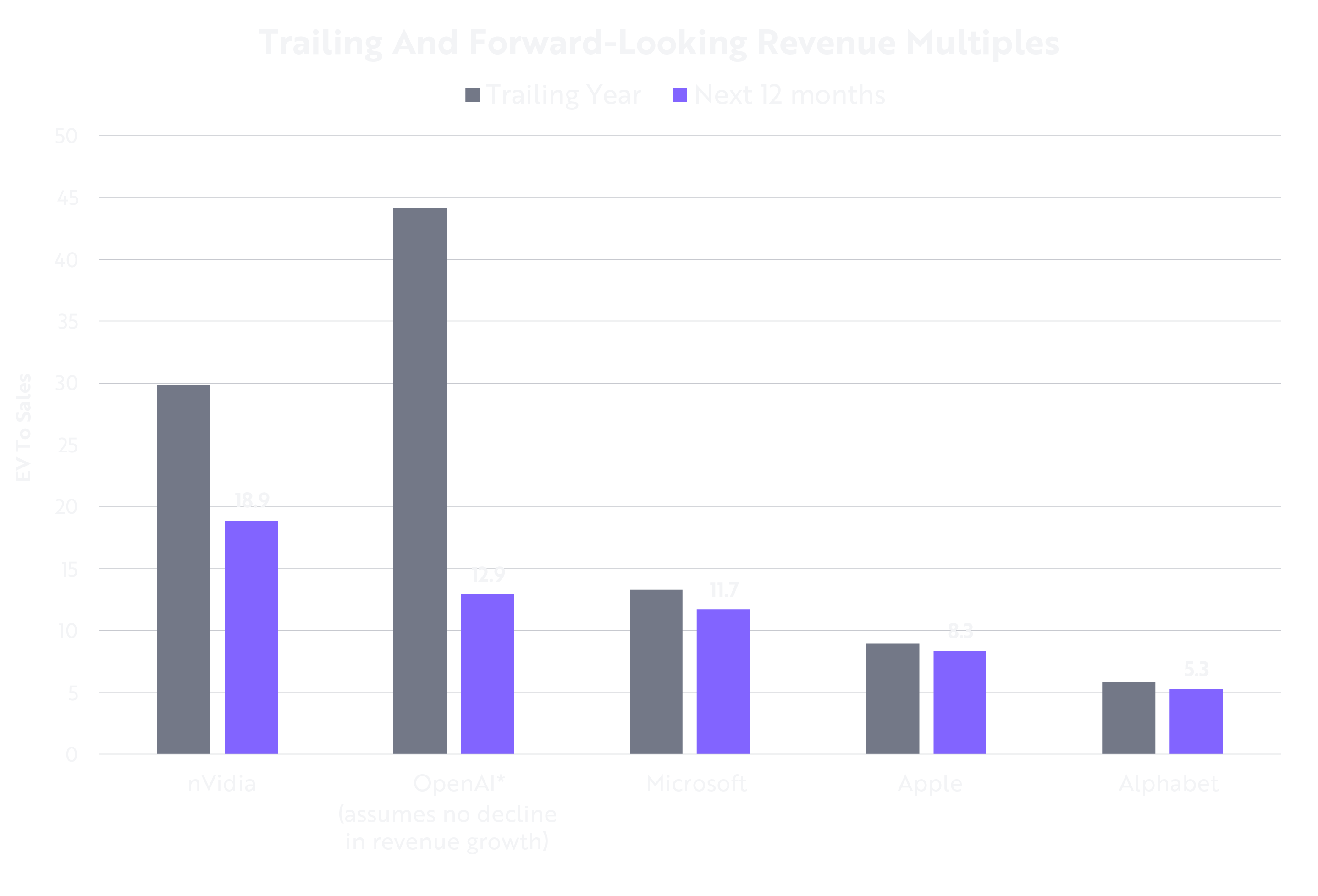

According to reports4 in June 2024, OpenAI’s annualized revenue roughly tripled year-over-year to $3.4 billion. Were that trend to continue, the company’s current pre-money equity value at $150 billion5 suggests that its forward enterprise value-to-sales multiple6 could land between those of Nvidia and Microsoft, as shown below.

*OpenAI revenues are reported annualized revenue numbers and assume no change in revenue growth rates. For publicly traded companies, forward revenue expectations reflect the Visible Alpha analyst consensus. Source: ARK Investment Management LLC, 2024. This ARK analysis draws on a range of external data sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

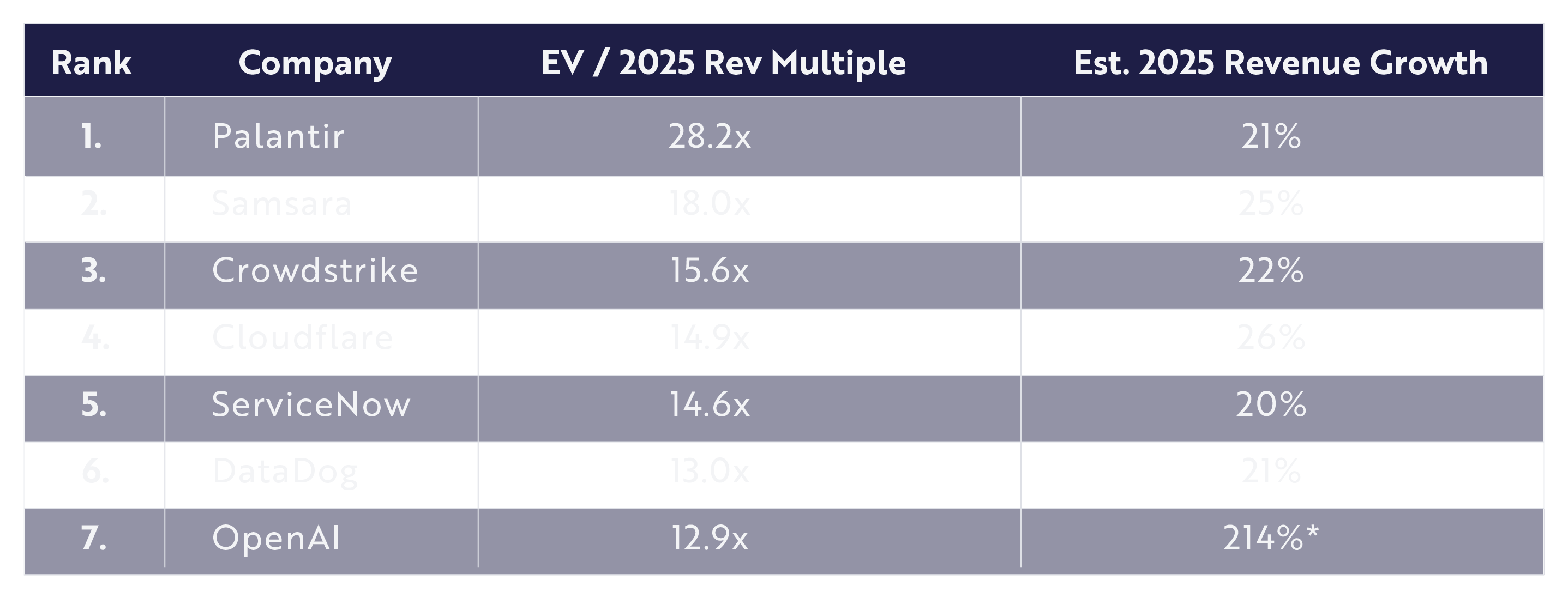

In the context of high-growth software companies, OpenAI’s valuation looks reasonable, as shown below. Relative to forward year revenue expectations, OpenAI’s 12.9x multiple is just below the top six highest multiple software companies, despite its superior revenue growth.

*OpenAI forward revenue multiple and growth is based on revenue targets reported by Reuters and other outlets. Note: The Enterprise Value-to-Revenue Multiple (EV/R) is a metric that compares a company's enterprise value (EV) to its annual revenue. The EV/R is a valuation metric that can be used to: gauge whether a stock is reasonably priced, estimate a company's value in a potential acquisition, or make informed decisions about financing or other strategic investments. Source: ARK Investment Management LLC, 2024, based on data from Ball 2024 as of October 11, 2024.7 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

In our view, OpenAI’s product leadership, research, first-mover advantage, and generative data flywheel will insulate it against competitive pressures. Based on its strategic assets and ability to execute rapidly, we are confident that OpenAI will continue to lead the AI revolution, capturing a significant share of the multi-trillion-dollar opportunity by 2030.

Important Information

We offer our view of OpenAI because it is part of the total ARK Venture Fund portfolio. To see the most updated portfolio, please click here. Holdings subject to change. Not a recommendation to buy, sell, or hold any specific security.

BEFORE INVESTING YOU SHOULD CAREFULLY CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES. THIS AND OTHER INFORMATION IS IN THE PROSPECTUS, A COPY OF WHICH MAY BE OBTAINED HERE. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE YOU INVEST.

There is no assurance that the Fund will meet its investment objective. The value of your investment in the Fund, as well as the amount of return you receive on your investment in the Fund, may fluctuate significantly. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. Therefore, you should consider carefully the risks at the bottom of this page before investing in the Fund.

ARK Investment Management LLC is the investment adviser to the ARK Venture Fund.

Foreside Fund Services, LLC, distributor.

OpenAI. 2024. “Pricing.” See also Artificial Analysis. 2024. “Independent Analysis of AI Models and API Providers.”

OpenAI. September 12, 2024. “Learning to Reason with LLMs.”

Hu, Krystal. Reuters. February 2, 2023. “ChatGPT sets record for fastest-growing user base - analyst note.”

Palazzolo, Stephanie and Woo, Erin. The Information. June 12, 2024. “OpenAI’s Annualized Revenue Doubles to $3.4 Billion Since Late 2023.

OpenAI. October 2, 2024. “New funding to scale the benefits of AI”

The enterprise value-to-sales (EV/sales) ratio is a valuation metric that compares a company's enterprise value (EV) to its annual revenue. The EV/sales ratio is considered a more accurate measure of a company's value than the price/sales ratio because it takes into account a company's debt.

Ball, J. 2024. “Clouded Judgement 9.20.24 - Rate Cuts Begin!”

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.