Historically, much of the performance for many companies has occurred in the private markets, before public-only investors (most individual investors) can participate. That trend continues, the estimated value of private companies in the US now surpassing $10 trillion.1

Three years ago, ARK established the ARK Venture Fund to transform access to private markets, even as the macroeconomics were unfriendly.

Following an unprecedented series of interest rate hikes that created a punishing macroeconomic environment for investors in growth technology, many funds, including leading sector specialists in biotech and other deep tech domains, saw their portfolios decline in value by double-digit percentages in 2022. Private market valuation resets were lagging those in public markets, and the private market fundraising environment was becoming increasingly challenging for startups and funds alike.

But we understood the possibilities that lay ahead and embarked on a mission to democratize venture capital in a way that we believed would benefit both investors and the promising companies identified by our research. We believe that investor accreditation status2 should not be a barrier to investing in high-quality private companies. Investors in the Venture Fund can access venture capital (VC) through a minimum investment of only $500. Many are young, highly informed investors who are early in their careers and investing at a time when the compounding effect can be at its most significant in the private markets. No longer excluded by accreditation barriers centered undemocratically on existing wealth, those investors can now participate.

Three years in, we are honored to be able to serve you and to welcome you to our family of enthusiasm for what we believe to be top-tier portfolio companies. The ARK Venture Fund, which aims for an ~80/20 private/public split, has grown from $0 to over $325+ million in assets from its launch in September 2022 through September 30, 2025. And the future is looking great.

We Are More Motivated Than Ever

Together, we have invested in some of the most transformative companies the world has ever seen. SpaceX expanded Starlink to more than 6,000 satellites in orbit,3 cementing its position as the world’s largest satellite constellation and a leader in global broadband coverage. OpenAI launched GPT-5, advancing multimodal reasoning capabilities, and recently received $100 billion of investment from Nvidia to fund a strategic partnership that will build next-generation artificial intelligence (AI) infrastructure.4 Meanwhile, Replit significantly expanded its agentic AI capabilities, enhancing its developer platform to enable autonomous code generation, iteration, and deployment at scale. In our view, the ARK Venture Fund’s companies will reap rewards for investors while building a better future.

ARK trailblazed a new approach to private investing. Now we’d like to share a snapshot of our “State of the Union” at this three-year milestone.

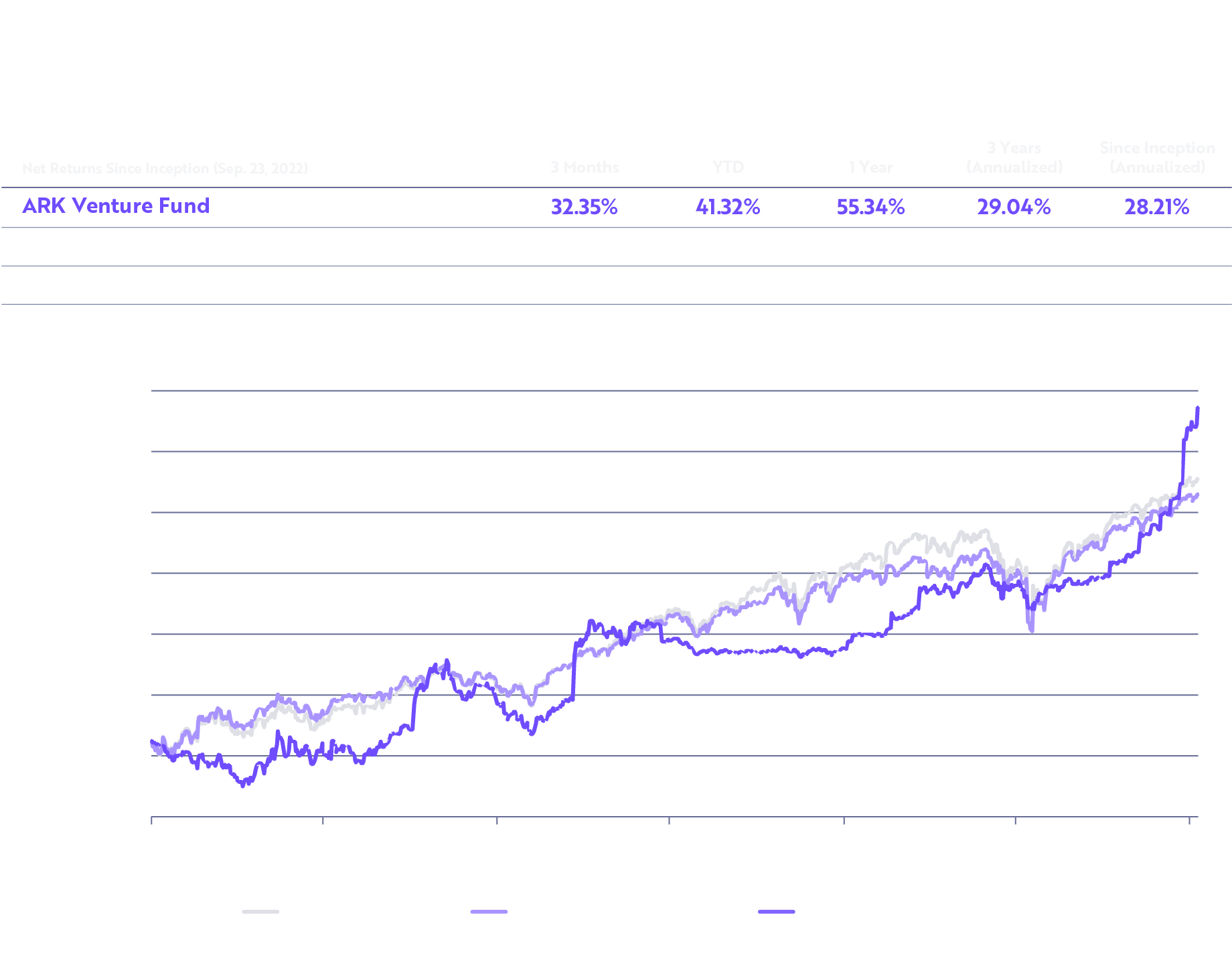

As of September 30, 2025, we hold 43 private companies, 23 public companies, and have grown assets under management (AUM) to $325.3 million from a standing start. And even in a tough market, performance excelled. As of September 30, 2025, the ARK Venture Fund has returned 28.21% annualized since inception, generating Sortino and Sharpe ratios5 of 4.85 and 3.73 over the last year, respectively. Notably, during the same timeframe, some equivalent vintage venture efforts have struggled to deliver a positive return. For example, a Carta review of venture capital vintages from 2022 showed median returns of -2.3% as of Q2 2025.6, 7 As always, transparency around research, performance, holdings, weightings, and concentration is a core feature of ARK’s work and investment practice. We value open awareness and welcome discussion of what we are doing and how we can improve.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares when redeemed may be worth more or less than the original cost. The Fund’s most recent month-end performance can be found on ark-funds.com/funds/arkvx.

Returns for less than one year are not annualized. The net asset value (NAV) per Share for the Fund is computed by dividing the value of the net assets of the Fund (i.e., the value of its total assets less total liabilities) by the total number of Shares outstanding. Expenses and fees, including the Management Fee, are accrued daily and taken into account for purposes of determining NAV. The NAV of the Fund is determined each business day as of the close of trading (ordinarily 4:00 p.m., Eastern time) on the New York Stock Exchange. Any assets or liabilities denominated in currencies other than the U.S. dollar are converted into U.S. dollars at the current market rates on the date of valuation as quoted by one or more sources. The line graph reflects the growth of a hypothetical $10,000 investment in the ARK Venture Fund based on the Fund's net asset value, including the reinvestment of distributions, compared with the S&P 500 Index and MSCI World Index. Indexes are unmanaged, do not reflect the deduction of any fees or expenses, and are not available for direct investment.

Source: ARK Investment Management LLC. As of September 30, 2025.

We Are Committed To Partnering With High Conviction Companies

In addition to our quest to democratize venture investing, we take a highly deliberative approach to identifying the companies we want to understand as potential investees. We build a Research Wishlist, commence deep research, and identify potential targets. We find ways—often by drawing on our relationships with well-known VCs with whom we co-invest—to meet with the companies, so that we can begin cultivating our relationships. We have been studying some of the most innovative and successful public and private companies for over a decade, and we know what to look for and what to find out. We want to work closely with founders and leadership teams so that we can support their companies and build strong returns for our investor clients. We offer four key types of support:

What’s Next For The ARK Venture Fund?

We will expand our exposure to leading private companies through several strategies:

- Use careful portfolio rebalancing to strengthen our investments in existing high-conviction names.

- Integrate new names that meet our investment standards.

- Enter high-conviction select opportunities with larger initial investment sizes.

As always, thank you for becoming part of ARK’s journey. Together, we are democratizing access to the companies that are changing the world. Stay innovative.

Charlie, Chase, Rob & the broader ARK Ventures Team

Important Information

Investors should carefully consider the ARK Venture Fund's investment objectives and risks, as well as charges and expenses, before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-funds.com.

The ARK VENTURE FUND is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

All statements made regarding investment opportunities are strictly beliefs and points of view held by ARK and investors should determine for themselves whether a particular investment or service is suitable for their investment needs. Certain statements contained in this document may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this document may also involve risks and uncertainties described from time to time in ARK’s filings with the U.S. Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this document.

ARK assumes no obligation to update any forward-looking information contained in this document.

You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

There is no assurance that the Fund will meet its investment objective. The value of your investment in the Fund, as well as the amount of return you receive on your investment in the Fund, may fluctuate significantly. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. Therefore, you should carefully consider the following risks before investing in the Fund.

Principal Risks of the Fund Include:

Private Company Risk. The Fund invests in private, early-stage companies that may be considered highly speculative. As a result, investment in shares of the Fund involves substantial risks including risks associated with uncertainty regarding the valuations of private company investments, high rate of failure among the early-stage companies, and restricted liquidity in securities of such companies. Communications Sector Risk. The Fund will be more affected by the performance of the communications sector than a fund with less exposure to such sector. Cyber Security Risk. As the use of Internet technology has become more prevalent in the course of business, funds have become more susceptible to potential operational risks through breaches in cyber security. Disruptive Innovation Risk. Companies that the Adviser believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Financial Technology Risk. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. Next Generation Internet Companies Risk. The risks described below apply, in particular, to the Fund’s investment in Next Generation Internet Companies.

Foreign Securities Risk. The Fund’s investments in foreign securities can be riskier than U.S. securities investments. Investments in the securities of foreign issuers (including investments in ADRs and GDRs) are subject to the risks associated with investing in those foreign markets, such as heightened risks of inflation or nationalization. The prices of foreign securities and the prices of U.S. securities have, at times, moved in opposite directions. In addition, securities of foreign issuers may lose value due to political, economic and geographic events affecting a foreign issuer or market. During periods of social, political or economic instability in a country or region, the value of a foreign security traded on U.S. exchanges could be affected by, among other things, increasing price volatility, illiquidity, or the closure of the primary market on which the security (or the security underlying the ADR or GDR) is traded. You may lose money due to political, economic and geographic events affecting a foreign issuer or market. The Fund normally will not hedge any foreign currency exposure. Future Expected Genomic Business Risk. The Adviser may invest some of the Fund’s assets in Genomics Revolution Companies that do not currently derive a substantial portion of their current revenues from genomic-focused businesses and there is no assurance that any company will do so in the future, which may adversely affect the ability of the Fund to achieve its investment objective. Emerging Market Securities Risk. Investment in securities of emerging market issuers may present risks that are greater than or different from those associated with securities of developed market issuers due to less developed and liquid markets and such factors as increased economic, political, regulatory, or other uncertainties.

Cryptocurrency Risk. Cryptocurrencies (also referred to as “virtual currencies” and “digital currencies”) are digital assets designed to act as a medium of exchange. Cryptocurrency is an emerging asset class. There are thousands of cryptocurrencies, the most well-known of which is bitcoin. The Fund may have exposure to cryptocurrencies, such as bitcoin indirectly through an investment in the Bitcoin Investment Trust (“GBTC”), a privately offered, open-end investment vehicle that invests in bitcoin. Health Care Sector Risk. The health care sector may be affected by government regulations and government health care programs, restrictions on government reimbursement for medical expenses, increases or decreases in the cost of medical products and services and product liability claims, among other factors. Leverage Risk. The use of leverage can create risks. Leverage can increase market exposure, increase volatility in the Fund, magnify investment risks, and cause losses to be realized more quickly. Non-Diversification Risk. The Fund is classified as a “non-diversified” investment company under the 1940 Act. Therefore, the Fund may invest a relatively higher percentage of its assets in a relatively smaller number of issuers or may invest a larger proportion of its assets in a single issuer. As a result, the gains and losses on a single investment may have a greater impact on the Fund’s NAV and may make the Fund more volatile than more diversified funds.

The S&P 500® Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the U.S. stock market. The MSCI World Index represents large and mid-cap equity performance across 23 developed markets countries.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up-to-date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks, and you can lose money on your investment. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Diversification neither assures a profit nor guarantees against loss in a declining market.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

Robinhood. 2025. “Introducing Robinhood Ventures.” https://newsroom.aboutrobinhood.com/introducing-robinhood-ventures/

In investing, "accreditation status" refers to an investor's qualification as an Accredited Investor, a designation granted by the U.S. Securities and Exchange Commission (SEC) to individuals or entities meeting specific financial thresholds. The accreditation income threshold is earning $200,000+ individually or $300,000+ with a spouse in each of the past two years, with a reasonable expectation of similar income in the current year. The Net Worth accreditation status is a net worth of at least $1 million, excluding the value of a primary residence.

AIAA. 2024. “SpaceX Has Nearly 6,000 Starlink Satellites on Orbit Following Sunday’s Falcon 9 Launch.” https://aiaa.org/2024/05/13/spacex-has-nearly-6-000-starlink-satellites-on-orbit-following-sunday-s-falcon-9-launch/#:~:text=Spaceflght%20Now%20reports%20that%20the,number%20in%20orbit%20to%205%2C999

OpenAI. 2025. “OpenAI and NVIDIA announce strategic partnership to deploy 10 gigawatts of NVIDIA systems.” https://openai.com/index/openai-nvidia-systems-partnership/

The Sortino Ratio measures an investment's risk-adjusted return by evaluating its performance relative to its downside deviation, or the volatility of negative returns, rather than overall volatility like the Sharpe ratio. A higher Sortino ratio indicates a better risk-adjusted return, signifying more return for every unit of downside risk an investor takes on. The Sharpe Ratio is a financial metric that measures an investment's risk-adjusted return, calculated by subtracting the risk-free rate from the investment's average return and dividing the result by the investment's standard deviation (volatility). A higher Sharpe ratio indicates a better risk-adjusted performance, with ratios of 1.0 or higher generally considered good.

Q2 2025 VC Fund Performance Walker, P. et al. 2025. “Q2 2025 VC Fund Performance.” Carta. https://carta.com/data/vc-fund-performance-q2-2025-full-report/

Please note that the Carta report takes into consideration Venture Capital Funds that could have been launched at any time during 2022. The ARK Venture Fund was launched on September 23, 2022.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.