Currently, non-accredited investors seeking exposure to private companies have two options: (1) an interval closed-end fund (ICEF) or (2) an exchange-traded closed-end fund (ETCEF). While both fund structures have merits, the table below outlines the strengths and limitations of each as illustrated by the ARK Venture Fund (ARKVX), an ICEF, and the Destiny Tech100 Inc. (DXYZ), an ETCEF. We selected Destiny Tech100 Inc. to represent an ETCEF in this case, because many of its underlying holdings are similar to the ARK Venture Fund, and both funds seek capital appreciation through investing in private, pre-IPO companies.

Source: ARK Investment Management LLC, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results. The ARK Venture Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. You should not expect to be able to sell your Shares in the ARK Venture Fund other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. [1] The net expense ratio for The ARK Venture Fund takes into account contractual fee waivers/expense reimbursements that currently are scheduled to remain in place through 11/28/2024, and may be terminated sooner by the Board of Trustees of the Fund, upon sixty (60) days’ written notice to the Adviser. Without such fee waivers/reimbursements, performance would have been lower.

Why Did ARK Choose To Offer An Interval CEF Instead Of An Exchange-Traded CEF?

An exchange-traded closed-end fund (ETCEF) can offer benefits relative to an interval closed-end fund, as it trades on an exchange, providing more liquidity and immediate access for most clients.

That said, an ETCEF might not provide the best exposure to private companies. During its initial public offering (IPO), an ETCEF issues a limited number of shares that will trade on an exchange. Market dynamics, trading activity, and company fundamentals will dictate the price of those shares. As a result, ETCEF shares fluctuate, sometimes wildly, above or below the fund’s net asset value (NAV) based on demand relative to the limited supply of the shares. In contrast, ICEFs trade on the underlying asset values of the companies in the fund.

CASE IN POINT

While the ETCEF and ICEF structures share some characteristics, we strongly believe the Premium/Discount to NAV is the most important differentiator.

An exchange-traded closed-end fund recently listed on the New York Stock Exchange, Destiny Tech100 Inc (ticker DXYZ), seeks to offer exposure to 100 of the top venture-backed private technology companies, while offering investors full liquidity during market hours.

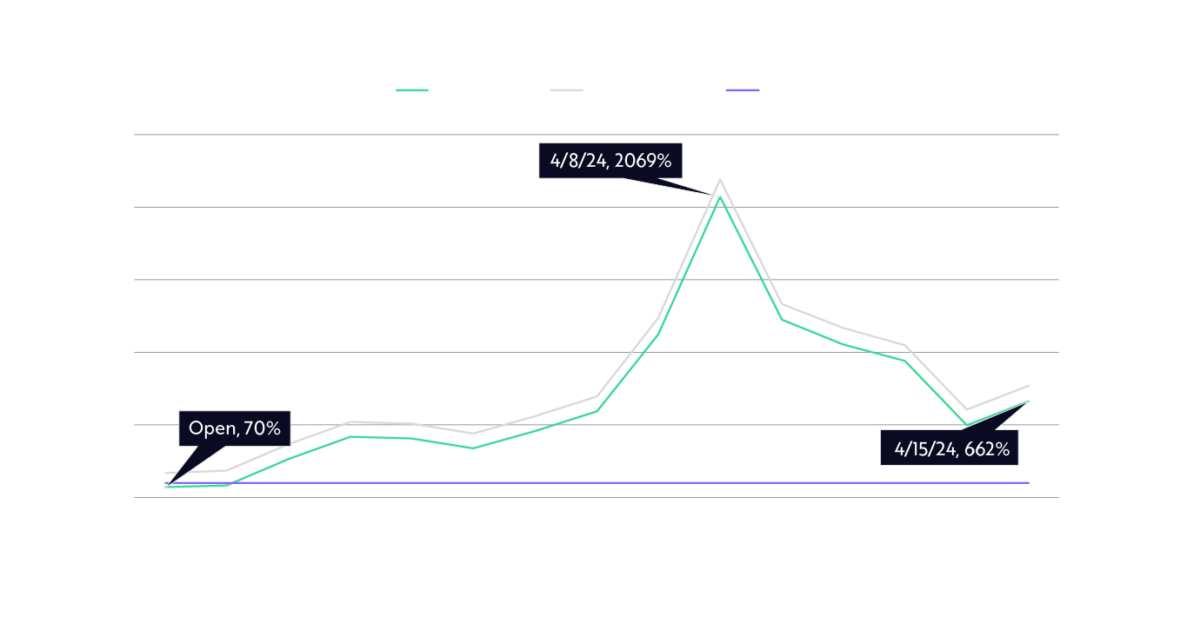

In the fewer than three weeks since its listing on March 26, 2024, DXYZ’s share price shot up more than 1172%, while its NAV remained relatively flat. Based on its audited financial statements as of December 31, 2023, DXYZ’s NAV was $4.84/share but its share price hit a high of $105.00, a 2069% premium to—or 22x—its NAV in early April.

As shown below, the premium to which DXYZ shares have traded relative to NAV has ranged from 70% at its debut on March 26 to 2069% on April 8, as shown below.

Source: DXYZ share price obtained from Yahoo! Finance, including the intraday high on April 8, 2024. NAV obtained from DXYZ’s most recent audited financial statements as of December 31, 2023. Premium was computed based on DXYZ’s share price relative to the NAV on December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Conclusion

Given our mission to democratize access to venture capital, ARK is proud to offer the ARK Venture Fund, a Closed-End Interval Fund, to all investors. ARKVX recently invested in OpenAI, an important addition to our portfolio holdings that include other private disruptive companies like SpaceX, FigureAI, Epic Games, and others. For current holdings and more information about the ARK Venture Fund, visit our fund page here.

Disclosures

For more detailed comparison between the fund's investment objectives, principal investment strategies and risks, please carefully review each of the fund's respective prospectus, below.

Destiny Tech100 Inc. (DXYZ): Click here.

ARK Venture Fund (ARKVX): Click here.

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-ventures.com. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

There are many other material similarities and differences between interval funds and exchange-traded closed-end funds. Please click here for a complete and full comparison of the two fund structures, including any material differences in fees, liquidity and availability.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.