Material Similarities and Differences Between Exchange-Traded Closed-End Funds and Interval Funds

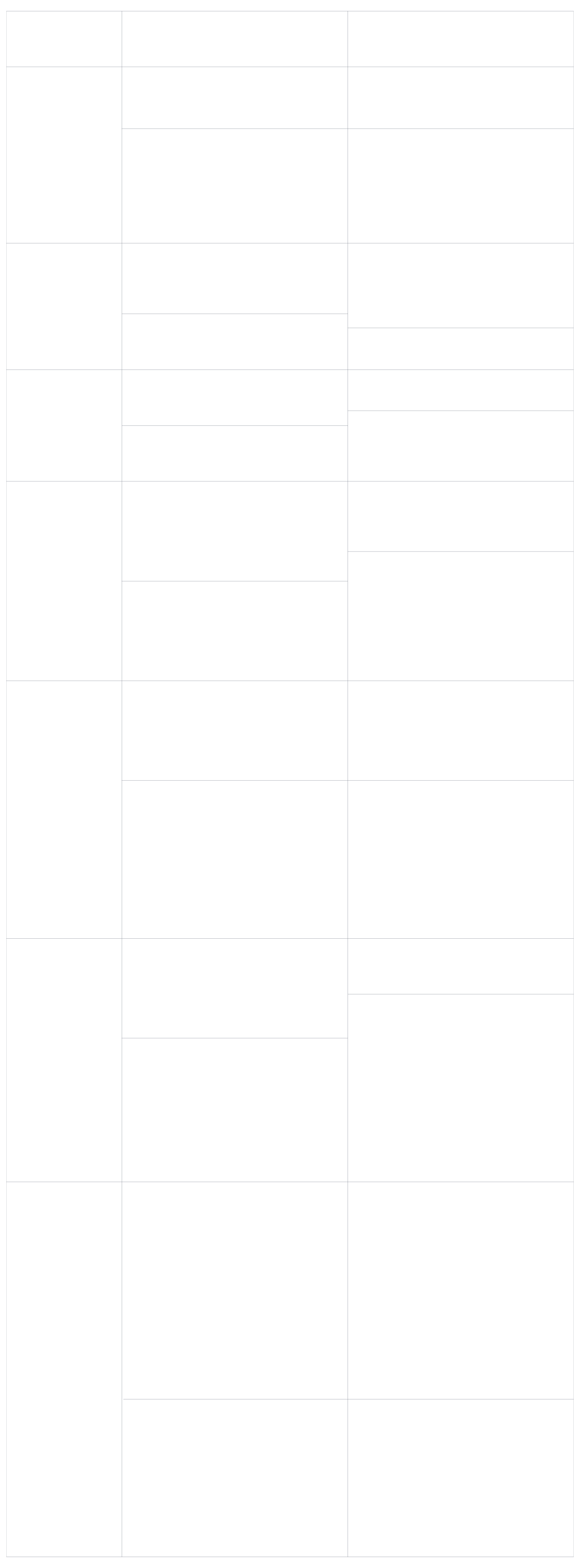

Exchange-traded closed-end funds (CEFs) and interval funds are both types of investment funds with some similarities, but they also have notable differences, especially in terms of liquidity, availability, and tax implications. In the table below, please find a detailed outline of the similarities and difference between closed-end interval funds, like the ARK Venture Fund (ARKVX) and the exchange-traded closed-end funds, like the Destiny Tech 100 Fund (DXYZ).

[1] The net expense ratio takes into account contractual fee waivers/expense reimbursements that currently are scheduled to remain in place through November 28, 2024, and may be terminated sooner by the Board of Trustees of the Fund, upon sixty (60) days’ written notice to the Adviser.

Source: ARK Investment Management LLC, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results. Obtained from the most recent prospectus of ARKVX dated November 14, 2023. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001905088/000121390023086193/ea164993_486bpos.htm.

Material Similarities

Professional Management: Both CEFs and interval funds are professionally managed portfolios that invest in a variety of securities, such as stocks, bonds, or other assets.

Diversification: Investors can achieve diversification through both types of funds as they pool money to invest in a wide range of securities.

Regulated Structures: Both are regulated investment products, though their specific regulations may differ.

Material Differences

Trading and Liquidity:

CEFs: They are listed on stock exchanges and trade like stocks throughout the trading day at market prices, which can be above (at a premium) or below (at a discount) their net asset value (NAV). This provides a high level of liquidity, as shares can be bought or sold at any time during market hours.

Interval Funds: These funds offer liquidity at specific intervals, typically quarterly. They do not trade on exchanges. Instead, the fund periodically offers to buy back shares from investors at NAV, subject to a specified repurchase offer amount. This means liquidity is limited to these intervals and is not guaranteed.

Availability:

CEFs: Since they are traded on exchanges, their availability is as broad as any publicly traded stock, accessible to anyone with a brokerage account.

Interval Funds: These might be more restricted in terms of availability, often targeted at accredited investors or sold through specific platforms or advisors.

Tax Implications:

CEFs: The tax implications can be complex, depending heavily on whether the fund distributes capital gains or income. CEFs might employ leverage, which can also impact their distributions and thus their tax implications for investors.

Interval Funds: These funds may also have complex tax situations, especially since their buyback features and the types of assets they hold can influence the character of distributions (ordinary income, capital gains, return of capital).

Pricing:

CEFs: The market price can differ significantly from the NAV because it is influenced by supply and demand dynamics on the exchange.

Interval Funds: They are typically bought and sold at NAV during the specified intervals, not influenced by market supply and demand in the same way as CEFs.

Investment Strategies:

CEFs: Often use leverage to enhance returns, which can increase both the potential for higher gains and the risk of losses.

Interval Funds: May invest in illiquid assets more freely due to their redemption structure, potentially targeting higher returns or diversification benefits from non-traditional investments.

When considering an investment in either type of fund, it's important to understand your own liquidity needs, investment horizon, risk tolerance, and the specific characteristics of the fund, including its investment strategy, fees, and tax implications. Consulting with a financial advisor who understands your personal financial situation is always recommended before making investment decisions.

For more detailed comparison between the fund's investment objectives, principal investment strategies and risks, please carefully review each of the fund's respective prospectus, below.

Destiny Tech100 Inc. (DXYZ): Click here.

ARK Venture Fund (ARKVX): Click here.