As recently discussed in our Introduction To The ARK Autonomous Tech & Robotics ETF (ARKQ) blog, automation historically has transformed industries by drastically increasing productivity and reducing costs. Importantly, however, previous automation has been focused on addressing repetitive, specialized tasks. According to ARK’s Big Ideas 2025, humanoid robotics—the next evolution in automation—extends the potentials of automation to what we call “generalized” tasks, promising to decouple physical labor from economic output in ways that could catalyze unprecedented advances in productivity.

Why Humanoid Robots?

Until now, automation has excelled primarily in highly specialized tasks—think industrial robots welding cars or assembling electronics—and is not well-suited for tasks that require human flexibility and versatility.

Our research suggests that humanoid robots will be a game-changer.

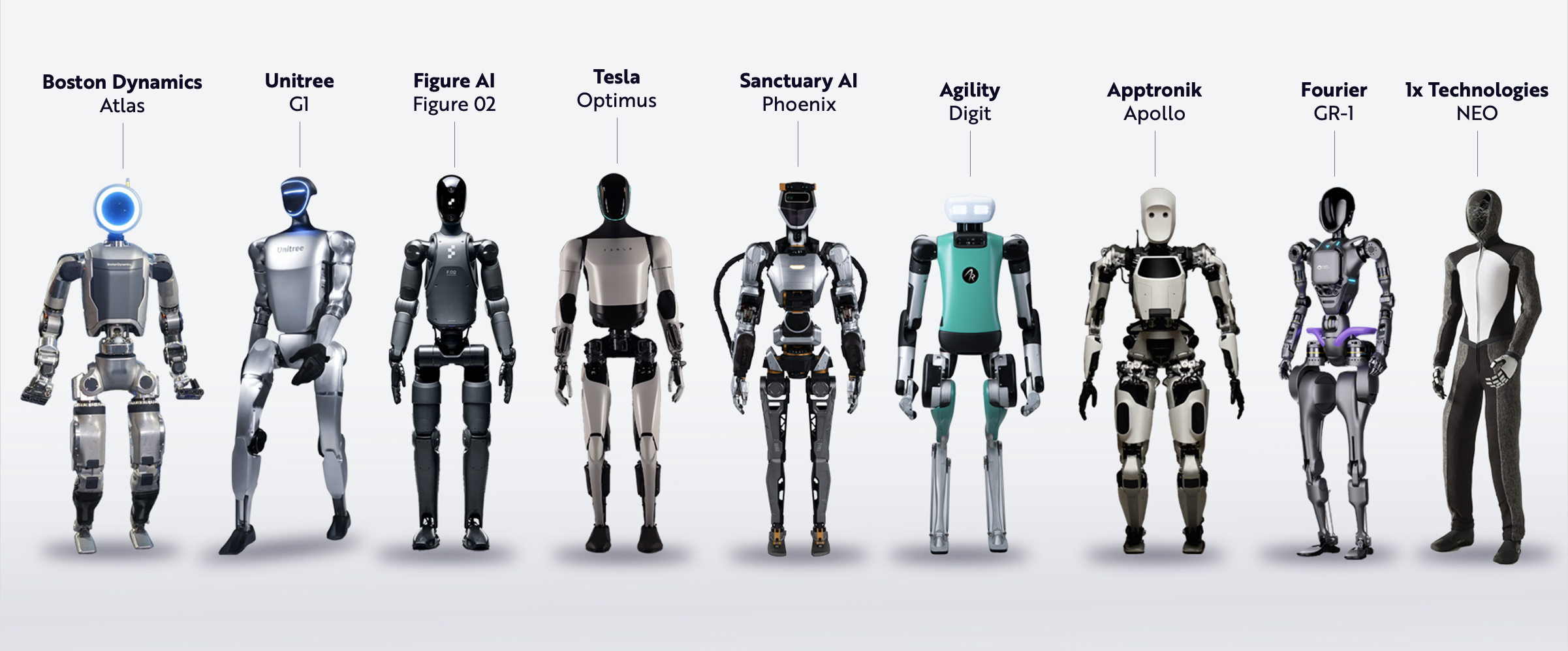

Designed explicitly for generalized tasks, these robots mimic the versatility of the human form factor, which should enable the automation of jobs in environments built specifically for humans—from warehouses to restaurants, from hospitals to hotels. Current examples already emerging globally include Tesla’s Optimus, Sanctuary AI’s Phoenix, Figure AI’s Figure 02, and Boston Dynamics’ Atlas, each of which is capable of performing increasingly sophisticated physical tasks across industries.

Humanoid Robotics Are Debuting Around The World

Source: ARK Investment Management LLC, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Why Now?

We believe that three factors are converging to enable the productivity achievement envisioned above:

- Breakthroughs in Artificial Intelligence: Advanced large language models (LLMs), vision recognition systems, and neural networks now enable robots to understand, reason, and interact with humans seamlessly. Tesla (TSLA) is leading the charge with Optimus, leveraging its full-stack AI capabilities and autonomous driving expertise to pioneer humanoid functionality.

- Rapidly Declining Component Costs: Sensors, actuators, and compute power have fallen in price dramatically, significantly reducing the cost barriers to developing humanoid robots. Companies like Advanced Micro Devices (AMD) and NVIDIA (NVDA) are central to the shift—AMD with its high-performance CPUs and GPUs that power advanced robotic systems, and NVDA with its cutting-edge AI accelerators and robotics platforms Jetson and Isaac becoming foundational in the robotics ecosystem.

- Massive Global Labor Shortages: Numerous countries, particularly those with developed markets, are facing escalating labor shortages. Robots capable of general-purpose labor could fill critical gaps, providing relief and efficiency at scale.

In addition, humanoid robots are likely to be able to replace more than existing automation; they should be able to create entirely new markets by converting unpaid household and informal labor into market-based, revenue-generating activities.

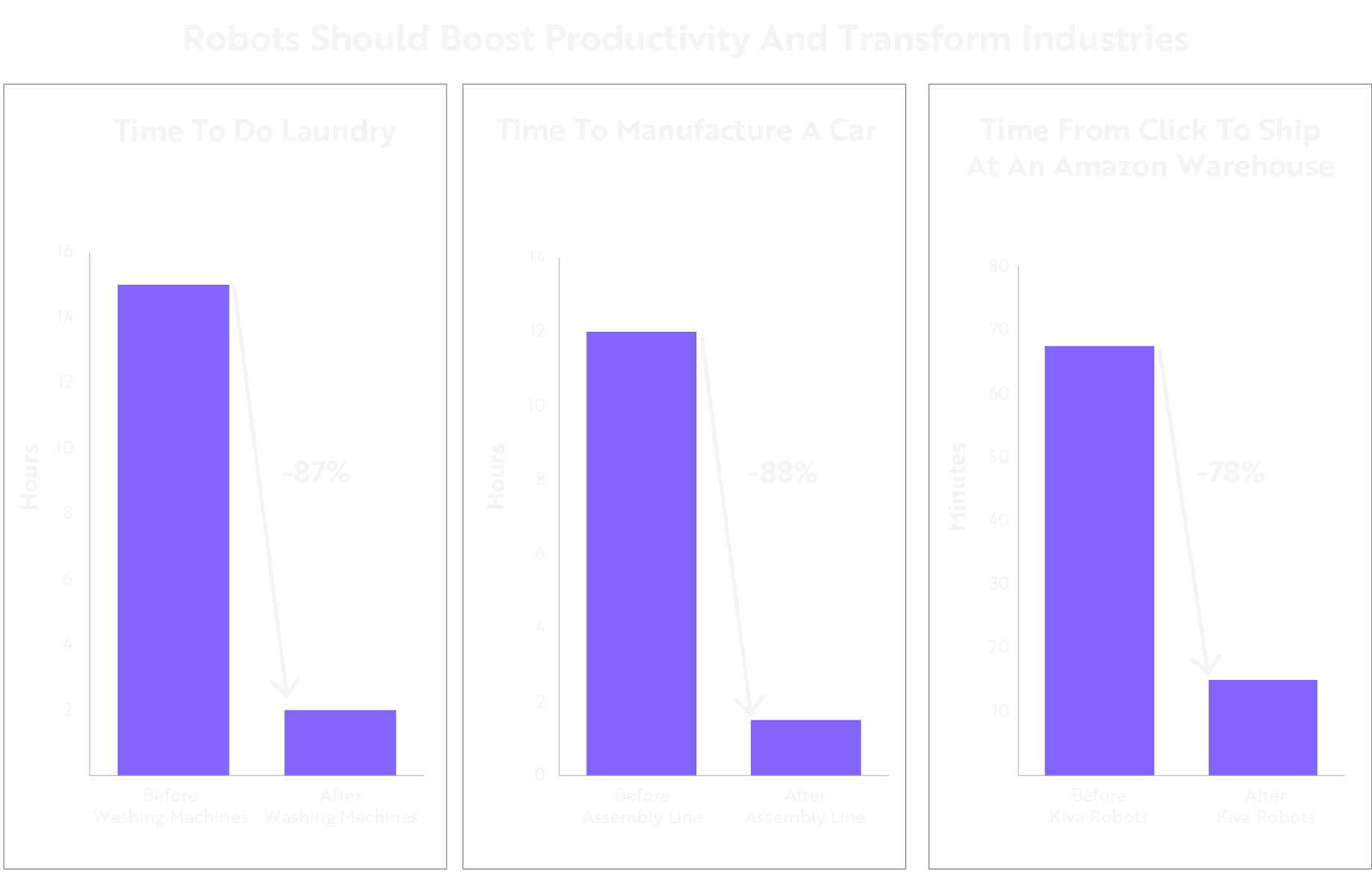

Productivity Gains Associated with the Decoupling of Labor and Output

Historically, automation has transformed industries dramatically. Even simple household robots like washing machines reduced time spent on manual tasks by nearly 90%. Humanoid robotics promise similar, if not greater, productivity leaps across a variety of more complex, currently labor-intensive and expensive tasks.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

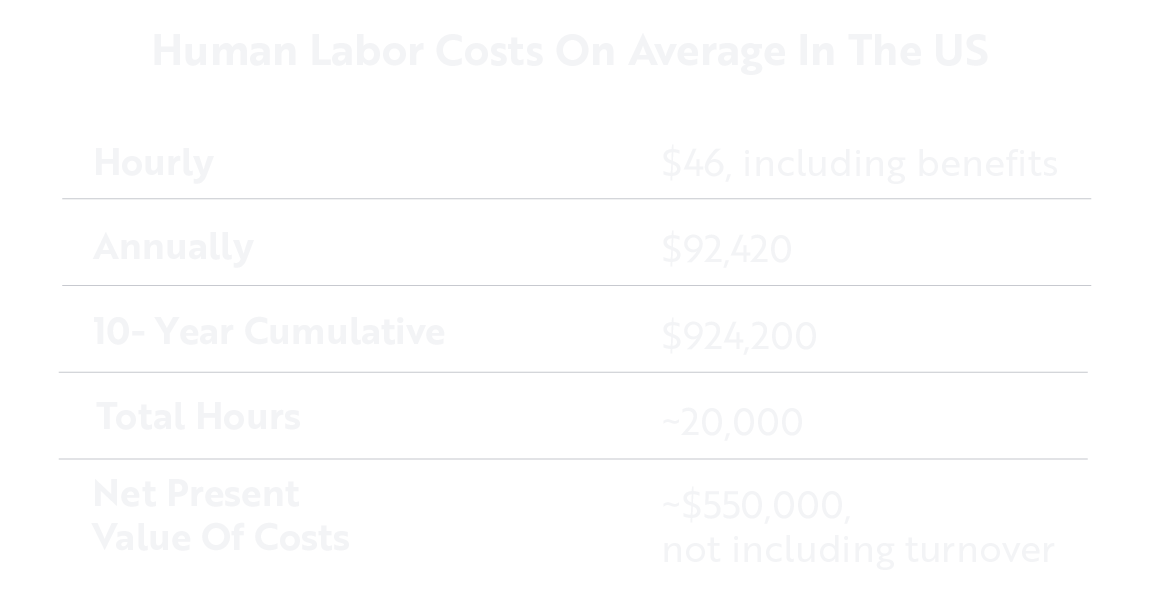

Cost Reductions Are the Key to Mass Adoption

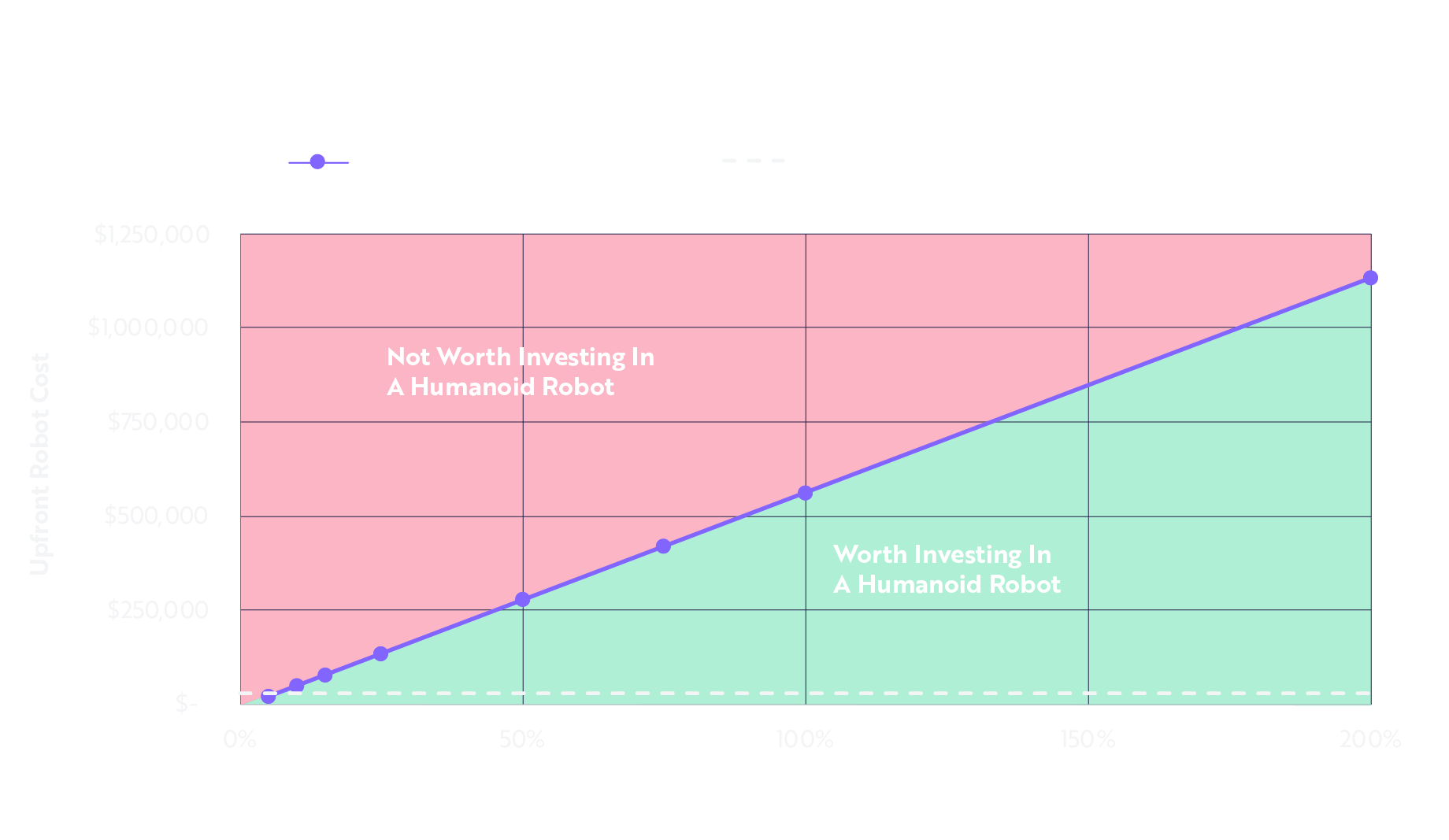

Historically, large-scale adoption of new technologies depends significantly on declining costs. We project that humanoid robots will experience dramatic unit cost declines over the next several years, similar to those that have characterized other transformative technologies.

Note: Per hour salary based on Bureau of Labor Statistics Employer Costs For Employee Compensation press release on September 10, 2024: Average employer costs for all civilian workers = $46.21 per hour; Wages average = $31.80; average benefit costs = $14.41. We assume a 40-hour work week and a 50-week work year. A positive net present value in this calculation suggests that it would be worthwhile to invest in a humanoid robot at that upfront cost and productivity uplift. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Forecasts are inherently limited and cannot be relied upon.

As prices fall, adoption of robots across industries should rise sharply, creating an exponential growth trajectory that is similar to those of past automation cycles.

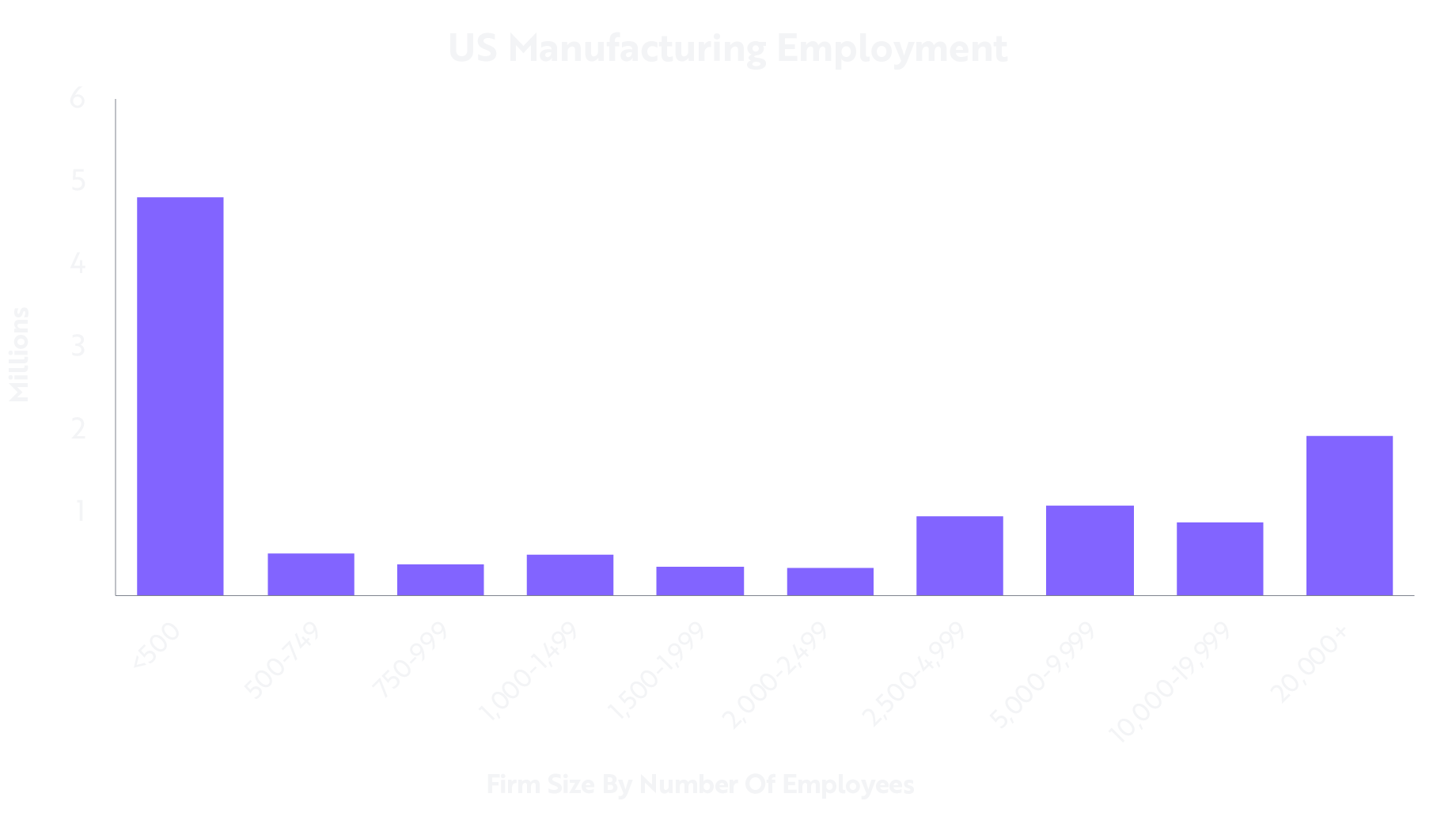

Small Businesses Set to Benefit Disproportionately

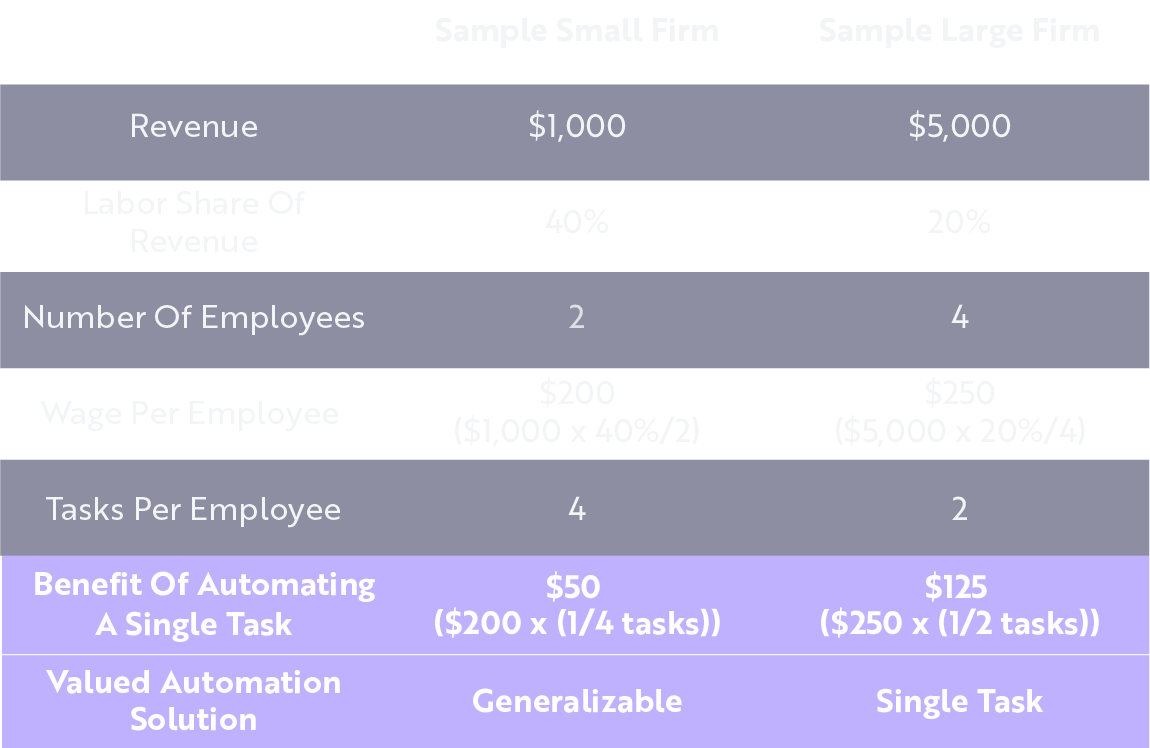

Historically, large manufacturing companies benefited most from the adoption of automation. Why? Specialized robotic solutions required significant upfront capital and worked best in the precise, discrete, and repetitive workflows of large, highly scaled organizations. Smaller businesses were hard-pressed to find affordable automation solutions that were suited to address their varied tasks.

Our research suggests that humanoid robots are the first broadly applicable automation technology that small businesses can adopt realistically and with advantageous, affordable outcomes. If we are right, humanoid robots could level the playing field significantly, enabling smaller enterprises to automate numerous tasks that previously were not affordable to address through automation machinery.

Given their inherent flexibility, humanoid robots offer small businesses the opportunity to cut labor costs dramatically while scaling efficiently. In other words, humanoid robots could benefit small-to-medium-sized enterprises disproportionately relative to large manufacturing enterprises.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including U.S. Census Bureau 2023, as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Forecasts are inherently limited and cannot be relied upon.

Transforming Unpaid Labor Into Measurable Economic Activity

Humanoid robots could expand measurable gross domestic product (GDP) by automating previously unpaid labor like household chores and caregiving, that is, activities currently invisible economically—performed but not recorded as market activity.

In the US alone, the revenue opportunity for automating basic household tasks like dishwashing could rise to roughly $250 billion annually. For example, while professional dishwashing at restaurants already counts as economic activity, currently unpaid household dishwashing represents meaningful, untapped market, potentially shifting billions into measurable GDP as robots handle those daily tasks.

.png) Note: For the value of unpaid time spent washing dishes, we assume, based on a study, that people value their free time at half their wage. From the Bureau of Labor Statistics, we take a median wage of ~$35. The Bureau of Labor Statistics reports that people spend 0.65 hours per day on food prep and cleanup. We assume .22 hours is spent on cleaning. We then multiply by the working age population. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Note: For the value of unpaid time spent washing dishes, we assume, based on a study, that people value their free time at half their wage. From the Bureau of Labor Statistics, we take a median wage of ~$35. The Bureau of Labor Statistics reports that people spend 0.65 hours per day on food prep and cleanup. We assume .22 hours is spent on cleaning. We then multiply by the working age population. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Addressing Global Labor Shortages And Demographic Challenges

The global labor force is shrinking, particularly in developed economies where populations are aging rapidly. Humanoid robotics present a compelling solution to those labor gaps, particularly in labor-intensive fields like eldercare, hospitality, healthcare, and logistics. Some promising use cases are listed below:

- In its pursuit of general-purpose robotics, Tesla (TSLA) has highlighted eldercare and home assistance as key application areas for its Optimus humanoid robot.

- In healthcare, Intuitive Surgical’s (ISRG) robotic-assisted surgical systems exemplify how robotics can extend healthcare capabilities in the face of clinical staff shortages.

- In logistics, Amazon (AMZN) is integrating robotics across its fulfillment centers to manage warehouse operations and reduce dependence on human labor amid rising demand and declining worker availability.

- Symbotic (SYM), another logistics-focused robotics company, is deploying AI-powered robotic automation in supply chains to improve throughput and efficiency, directly addressing labor constraints in distribution centers.

- Deer & Co. (DE) is advancing automation in agriculture and heavy equipment, creating semi-autonomous and autonomous machinery to address shortages in skilled rural labor.

- Teradyne (TER) owns Universal Robots, a leader in collaborative robots used in manufacturing and light industrial settings, helping factories scale output even as workforce participation declines.

Clearly, the vast potential of humanoid robots extends far beyond their capacity to be tools of productivity: they are also a demographic imperative, enabling sustainable economic growth amid demographic shifts that limit labor availability.

Redefining Global Productivity

As articulated in ARK’s Investment Opportunity Report, widespread adoption of humanoid robotics could lead to unprecedented productivity gains, fueling significant expansion of GDP. By decoupling economic growth from human labor constraints, humanoid robotics seems poised to unleash a new era of efficiency and innovation, analogous to but surpassing that of previous industrial revolutions.

For businesses and investors, understanding and positioning for this tectonic shift is critical to harnessing transformational economic benefits. Active ARK strategies like the ARK Autonomous Tech & Robotics ETF (ARKQ), the ARK Space Exploration ETF (ARKX), and the ARK Venture Fund (ARKVX) are designed to capture long-term growth opportunities by investing in companies we believe are best positioned to lead and benefit from the technological revolution in automation, artificial intelligence, and robotics.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK Fund before investing. This and other information are contained in the ARK ETFs’ and ARK Venture Fund’s prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectuses should be read carefully before investing.

An investment in any ARK fund is subject to risks and you can lose money on your investment in an ARK fund. There can be no assurance that the ARK funds will achieve their investment objectives. Additional risks of investing in ARK funds include equity, market, management and non-diversification risks, as well as fluctuations in market value and NAV.

The ARK ETFs’ portfolios are more volatile than broad market averages. Shares of ARK ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

You should not expect to be able to sell your Shares in the ARK Venture Fund other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy. The ARK Venture Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity.

This material is for informational purposes only and should not be relied upon as the basis for any investment decision. It does not constitute, either explicitly or implicitly, any provision of services or products by ARK, and investors should determine for themselves whether a particular investment management service is suitable for their investment needs. All statements made regarding companies or securities are strictly beliefs and points of view held by ARK and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. Historical results are not indications of future results.

Certain of the statements contained in this material may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of ARK and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. ARK assumes no obligation to update any forward-looking information contained in this material. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain information was obtained from sources that ARK believes to be reliable; however, ARK does not guarantee the accuracy or completeness of any information obtained from any third party.

ARK Investment Management LLC is the investment adviser to the ARK ETFs and the ARK Venture Fund.

Foreside Fund Services, LLC, distributor.

Portfolio holdings will change and should not be considered as investment advice or a recommendation to buy, sell or hold any particular security. Please visit www.ark-funds.com for the most current list of holdings for the ARK Funds.

To view the holdings for ARKQ, click here.

To view the holdings for ARKX, click here.

To view the holdings for ARKVX, click here.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.