Introduction

In our recently-published Introduction To The ARK Innovation ETF (ARKK), we outlined how ARK’s five innovation platforms—public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics—are converging, sparking a new technological revolution that could redefine the next business cycle. In this article, we zoom in on the ARK Autonomous Tech & Robotics ETF (ARKQ), which invests in companies leading the charge to realize a more autonomous future. From electric vehicles and industrial robotics to 3D printing and human-assistive automation, ARKQ reflects our belief that automation is already transforming the global economy.

The Opportunity

Autonomous technology and robotics are revolutionizing industries and creating investment opportunities that should not be ignored. AI-powered autonomous mobility is poised to transform traditional transportation systems by enhancing logistics, by increasing efficiency, and by reducing costs across freight, personal vehicles, and industrial operations.

In parallel, advancements in next-generation nuclear energy, such as small modular reactors (SMRs), offer promising solutions to rising global power demands—particularly as AI workloads and data center energy consumption surge. Innovation in energy storage is also accelerating, with solid-state and lithium-metal batteries pushing the boundaries of energy density, safety, and affordability. These breakthroughs are key to enabling the large-scale adoption of electric vehicles, intelligent robotics, and grid stabilization technologies.

Meanwhile, humanoid robotics is emerging as a breakthrough in labor automation. As these systems become increasingly capable of performing complex physical tasks, they’re helping to fill workforce gaps in sectors like manufacturing, logistics, and services. The convergence of robotics and AI is driving a powerful new wave of productivity, with companies at the forefront well-positioned to generate long-term economic impact and investment return.

Robotaxis: Transforming Personal Mobility While Lowering Costs and Enhancing Safety

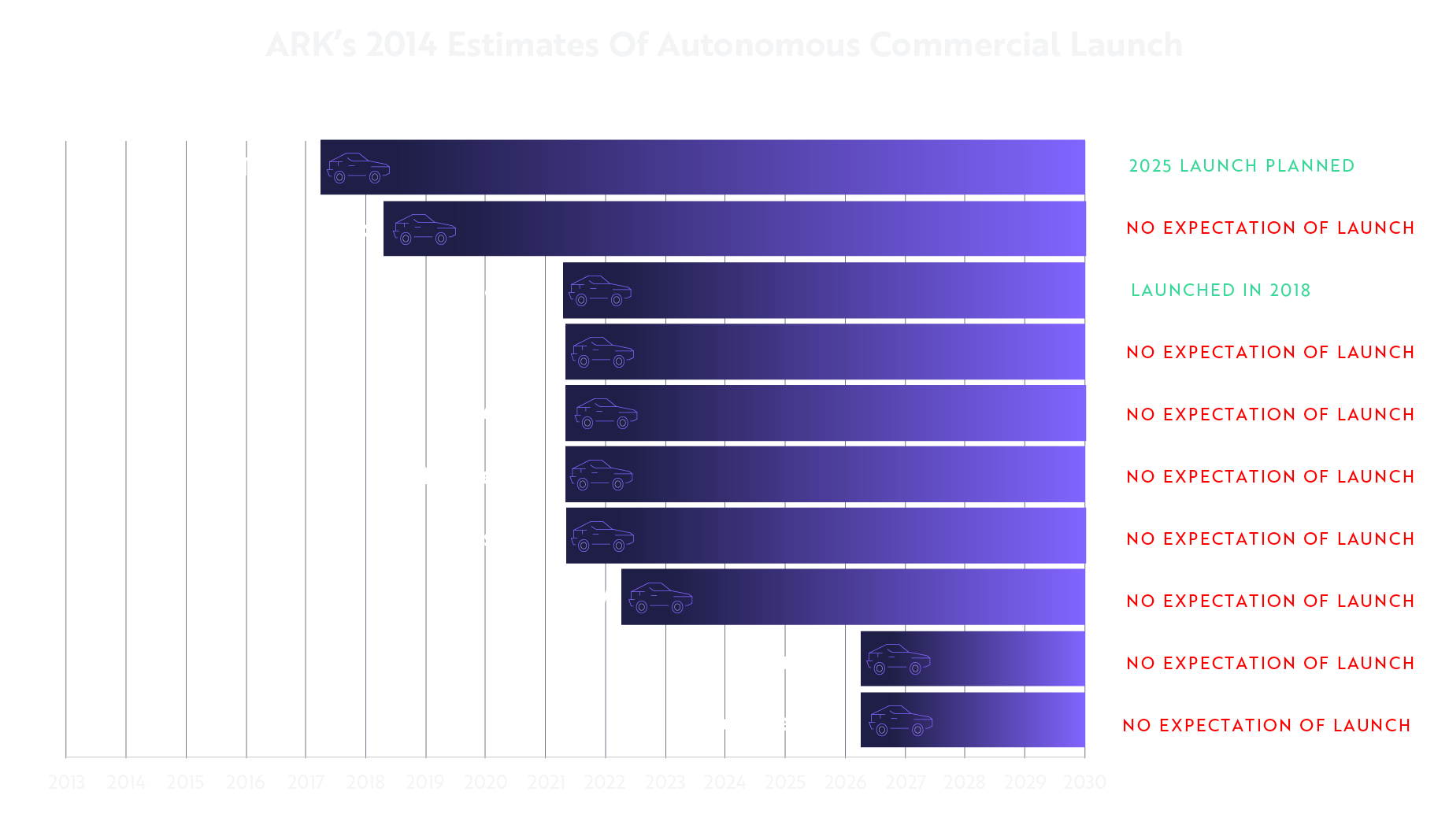

While many automakers predicted they would launch autonomous vehicles by 2020, only Waymo met that timeline, introducing its first commercial autonomous ride-hailing service in 2018. With Tesla now planning to launch its robotaxi network in 2025, Waymo and Tesla are the last serious contenders in the autonomy race.

Their progress suggests that 2025 could be the pivotal year when consumers and businesses broadly recognize that the future of transportation is autonomous.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Despite more than a century of automotive innovation, the inflation-adjusted cost of owning and operating a personal car has remained virtually unchanged since the Model T debuted. We estimate that a robotaxi, when deployed at scale, could reduce transportation costs to just $0.25 per mile—a dramatic decline that could drive widespread adoption.

.png)

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Beyond cost savings, robotaxis have the potential to enhance road safety, reducing accidents caused by human error. They also could expand mobility access for underserved populations, such as the elderly, disabled, or those without driver’s license, reshaping urban design, commuting behavior, and even car ownership itself. As Waymo continues commercial operations and Tesla readies its launch, the world may be on the cusp of the most significant transformation in personal mobility since the advent of the automobile.

Energy: Powering the Artificial Intelligence Revolution

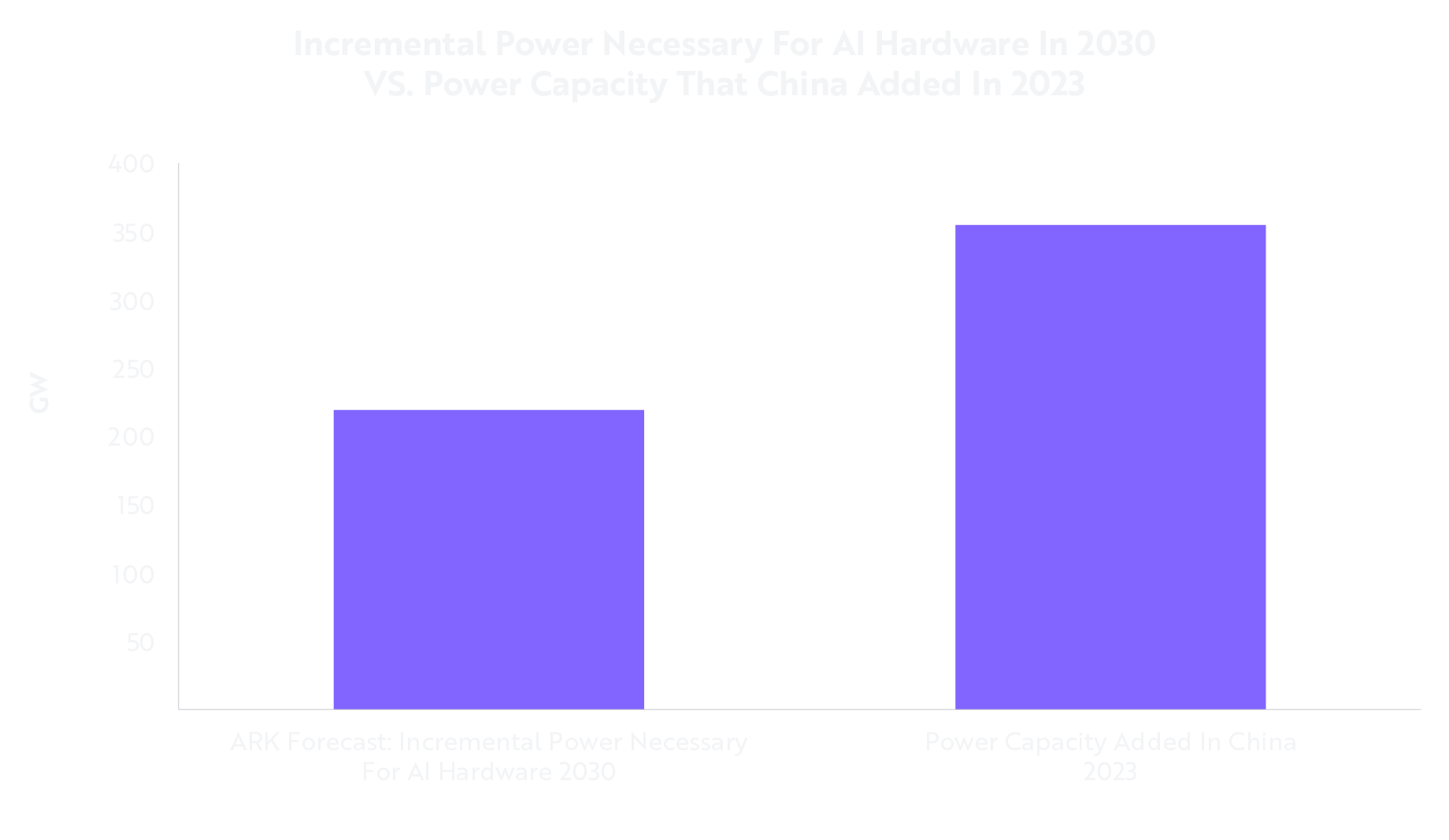

While growth in electricity production globally has averaged ~2.7% at an annual rate for the past five years, our research estimates that the incremental demand from AI data centers will be 0.5 percentage points, pushing the growth in global electricity demand to 3.2% at a compound annual growth rate through 2030. For perspective, electricity generation in China has increased 5.7% at an annual rate over the past five years. According to our estimates, in 2023 alone, China installed more electric generating capacity than will be necessary to meet the likely incremental global demand from AI data centers in 2030. Therefore, increasing the rate at which we build out the needed power should be achievable.

Note: “CAGR”: Compound Annual Growth Rate. “kWh”: Kilowatt-hour, a unit of energy, representing the use or generation of 1 kilowatt of power for 1 hour. “GW”: Gigawatt, a unit of power equal to one billion watts. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

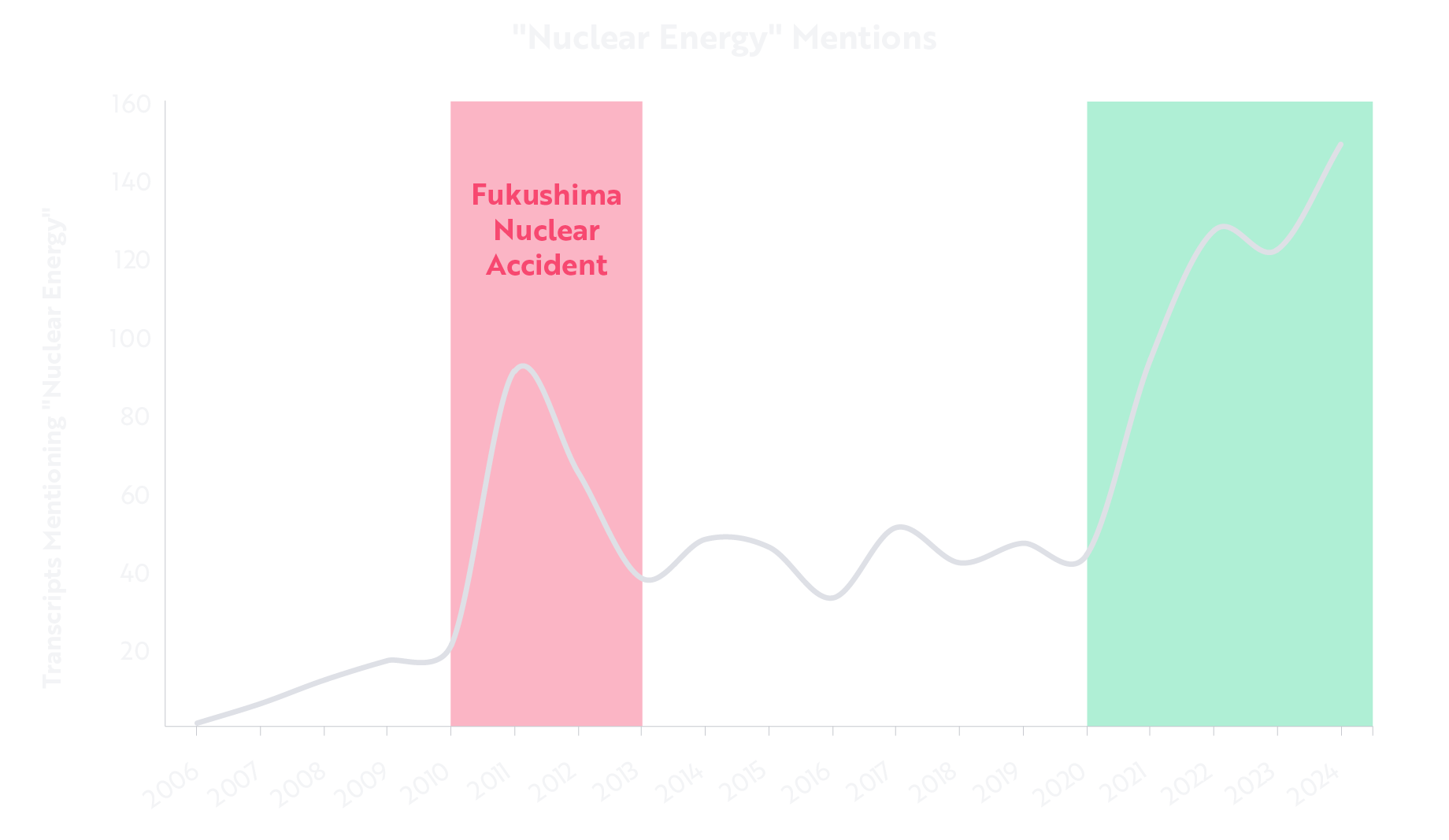

Furthermore, hyperscalers like Microsoft, Google, and Amazon are catching the nuclear energy wave to meet the rising power demands associated with Artificial Intelligence (AI).1 Commitments to net-zero carbon emissions have spurred new and renewed interest in nuclear energy, as shown below. ARK’s research suggests that the US must deploy microreactors, Small Modular Reactors (SMRs), and large-scale reactors to triple nuclear capacity by 2050.

If we are correct, there will be many more announcements regarding the amount of new power being brought online.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including Capital IQ Pro, as of December 18, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including Capital IQ Pro, as of December 18, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

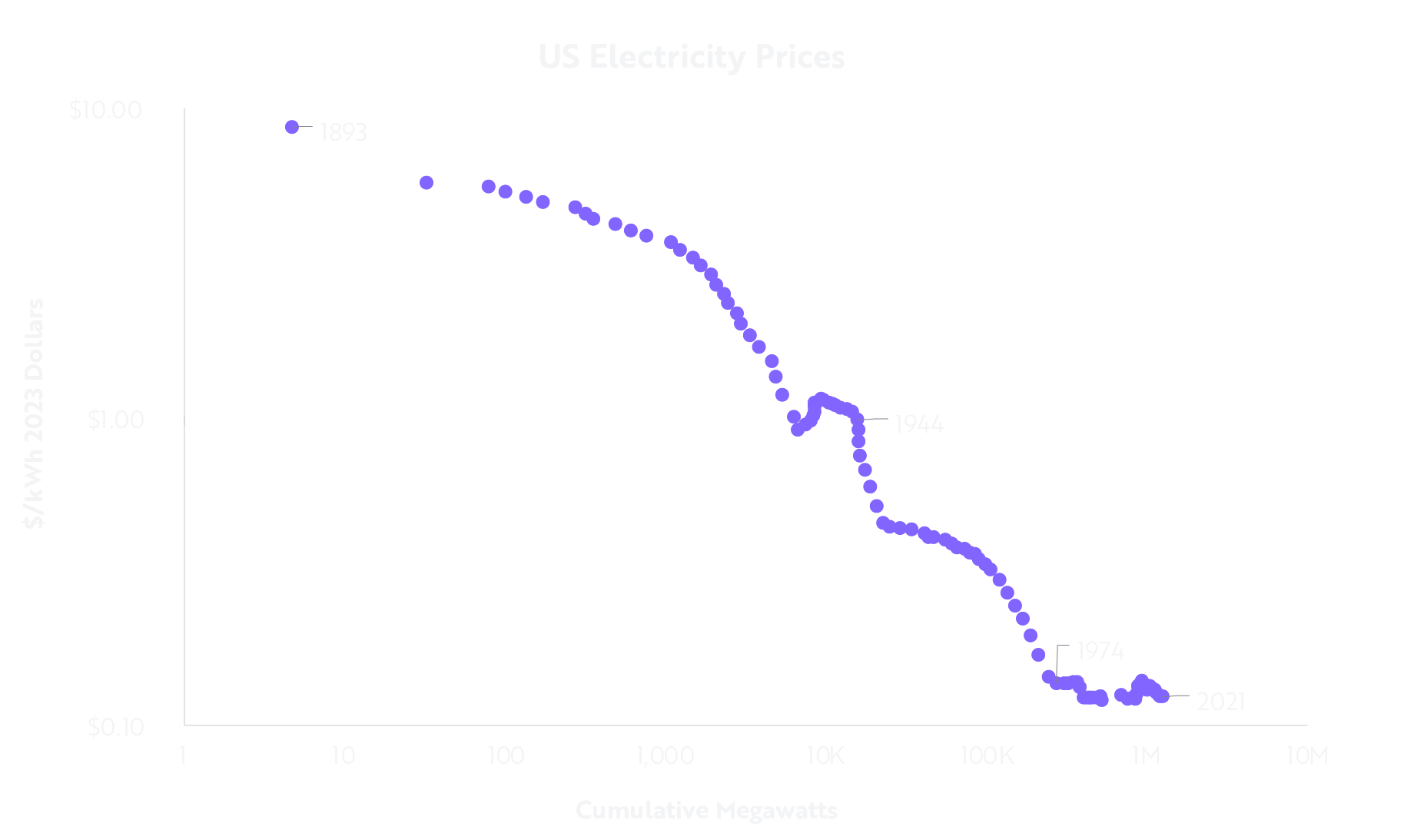

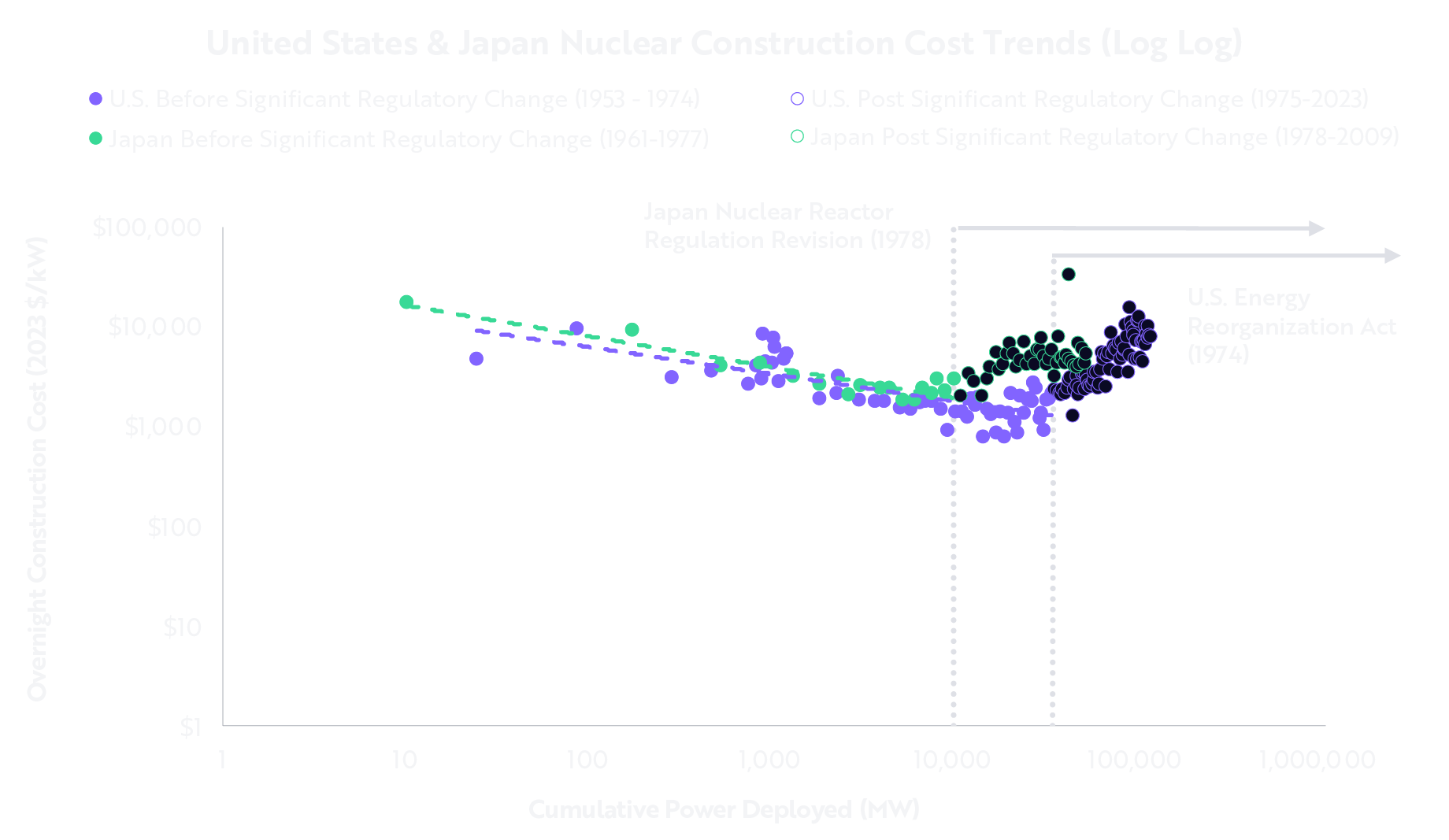

Guided by Wright’s Law,2 our research indicates that, apart from World War II, US electricity prices fell consistently from the late 1800s until 1974. That trend reversed after the US passed the Energy Reorganization Act, which also marked the end of falling nuclear power construction costs.

Note: “MW”: Megawatt, a unit of power equal to one million watts. “kW”: Kilowatt, a unit of power equal to one thousand watts. “kWh”: Kilowatt-hour, a unit of energy, representing the use or generation of 1 kilowatt of power for 1 hour. *Wright’s Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. See Winton 2019. Source: ARK Investment Management LLC, 2025, based on data from Smil 2000 and Cleveland 2023 (left chart) and Lovering et al. 2016 (right chart). For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Note: “MW”: Megawatt, a unit of power equal to one million watts. “kW”: Kilowatt, a unit of power equal to one thousand watts. “kWh”: Kilowatt-hour, a unit of energy, representing the use or generation of 1 kilowatt of power for 1 hour. *Wright’s Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. See Winton 2019. Source: ARK Investment Management LLC, 2025, based on data from Smil 2000 and Cleveland 2023 (left chart) and Lovering et al. 2016 (right chart). For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Today, the US nuclear industry is beginning to revive and could be on the threshold of a renaissance. In July 2024, the ADVANCE Act directed the Nuclear Regulatory Commission (NRC) to streamline licensing,3 and now the Department of Energy (DoE) is investing billions in nuclear energy. Meanwhile, as AI boosts demand for power, hyperscalers like Meta Platforms, Alphabet, Amazon, and Microsoft seem willing to pay higher rates for power purchase agreements (PPAs)4 to fund first-of-a-kind (FOAK) designs. As risk capital encourages new designs and regulators lower hurdles to innovation, Wright’s Law suggests that the cost competitiveness of nuclear power will be restored, ultimately lowering electricity prices and reigniting the powerful trends aborted by regulation in 1974.5

Robotics: Decoupling Physical Labor From Output

Throughout history, automation has driven major productivity gains across industries. Even simple machines—like washing machines—have reduced drastically the time and effort required for everyday tasks. Each leap in automation has allowed people to do more with less, shifting the burden of physical labor to increasingly capable tools.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

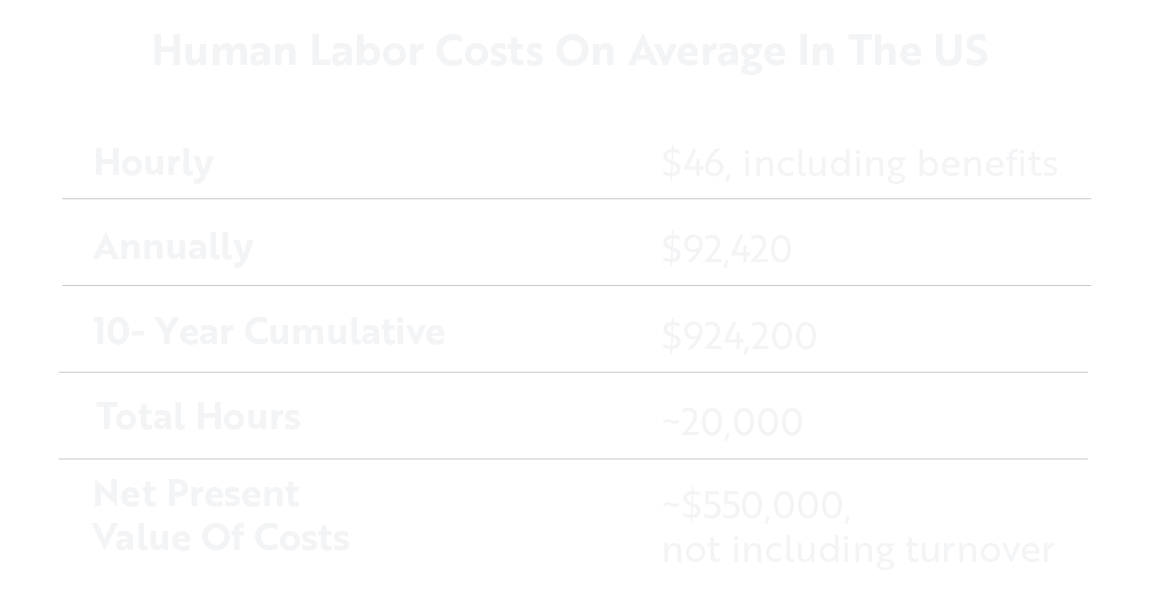

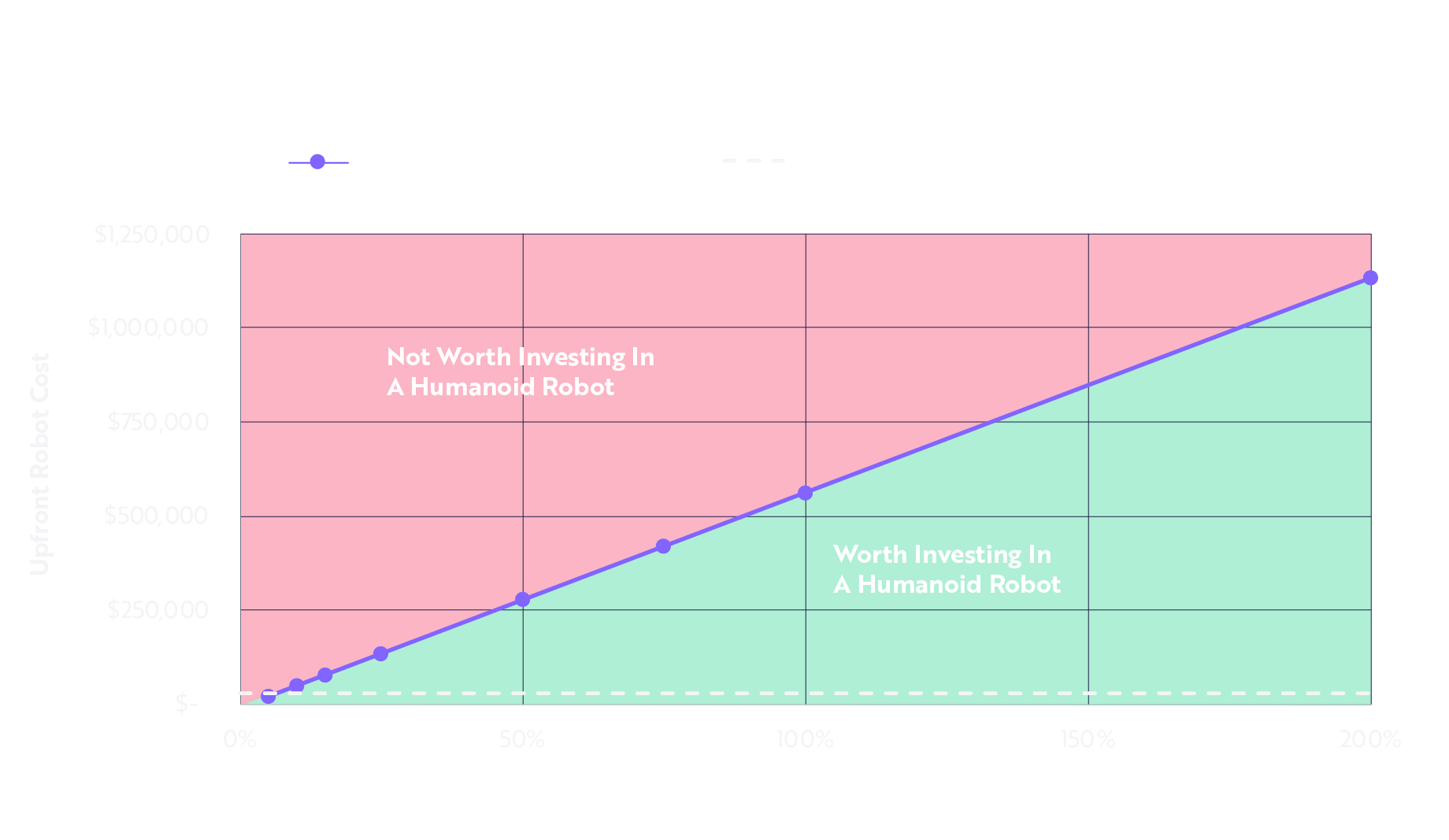

Today, humanoid robots are debuting around the world. Their key advantage lies in generalizability. Unlike specialized tools—such as a wrench, which may outperform a human hand at a single task—humanoid robots are designed to operate in environments built for people, using the same tools, navigating the same spaces, and performing a wide range of tasks without custom infrastructure. Much like the human hand, their versatility is what makes them powerful. As costs decline and their capabilities improve, we believe adoption will accelerate. Over time, humanoid robots could boost productivity without a proportional increase in human labor—unlocking new models of value creation and challenging long-held assumptions about how economic growth is tied to human effort.

Note: Per hour salary based on Bureau of Labor Statistics Employer Costs For Employee Compensation press release on September 10, 2024: Average employer costs for all civilian workers = $46.21 per hour; Wages average = $31.80; average benefit costs = $14.41. We assume a 40-hour work week and a 50-week work year. A positive net present value in this calculation suggests that it would be worthwhile to invest in a humanoid robot at that upfront cost and productivity uplift. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

Note: Per hour salary based on Bureau of Labor Statistics Employer Costs For Employee Compensation press release on September 10, 2024: Average employer costs for all civilian workers = $46.21 per hour; Wages average = $31.80; average benefit costs = $14.41. We assume a 40-hour work week and a 50-week work year. A positive net present value in this calculation suggests that it would be worthwhile to invest in a humanoid robot at that upfront cost and productivity uplift. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

The ARK Autonomous Tech & Robotics ETF (ARKQ)

According to our research, automation, artificial intelligence, and robotics are poised to redefine how the world moves, works, and produces. From self-driving vehicles and autonomous drones to advanced manufacturing and space exploration, these technologies are gaining traction across industries. Unfortunately, many of the companies leading this revolution remain underrepresented in traditional market benchmarks. As a result, investors seeking exposure to this transformational shift may find limited options in conventional portfolios. The ARK Autonomous Tech & Robotics ETF (ARKQ) seeks to address this gap by offering a concentrated portfolio of companies at the forefront of autonomy and next-generation mobility.

The ARK Autonomous Tech & Robotics ETF (ARKQ) is an actively managed ETF designed to capture the full spectrum of autonomous technology. It includes companies advancing electric and autonomous transportation, robotics, 3D printing, energy storage, and space innovation. Whether it's AI-powered robotics reshaping industrial operations or aerial drones unlocking new logistics models, ARKQ targets high-conviction names that are driving real-world adoption of cutting-edge innovation. Like venture capital strategies, ARKQ focuses on early-stage technologies with disruptive potential, though it does so through a liquid, transparent vehicle that can serve as a dynamic component within a modern investment portfolio. ARKQ’s unique exposure also provides diversification benefits relative to traditional sector and style classifications.

Through active research and real-time portfolio management, ARKQ continuously adapts to evolving trends in automation and technology. As breakthroughs in autonomy reshape industries from logistics and agriculture to manufacturing and defense, we believe investors have a significant opportunity to participate in the early stages of a significant global transformation. While disruptive innovation strategies can introduce greater volatility, we see that volatility as the byproduct of long-term growth potential. For those seeking to align their portfolios with the future of productivity and mobility, the ARK Autonomous Technology and Robotics ETF offers a compelling and differentiated path forward.

To learn more about the ARK Autonomous Tech & Robotics ETF please watch Fund In Focus - ARKQ.

Ready to Invest?

We encourage investors to work with a chosen financial professional to explore the potential benefits of incorporating an innovation-based strategy like the ARK Autonomous Tech & Robotics ETF (ARKQ). We would be delighted to provide additional, high-level information for investor review in collaboration with their trusted financial professional. Please reach out for more information. Discover more about the ARK Autonomous Tech & Robotics ETF here.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs’ prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

Investing in securities involves risk and there's no guarantee of principal.

Fund Risks: The principal risks of investing in ARKQ: Equity Securities Risk. The value of the equity securities the Fund holds may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Consumer Discretionary Risk. Companies in this sector may be adversely impacted by changes in domestic/international economies, exchange/interest rates, social trends and consumer preferences." Information Technology Sector Risk. Companies may face rapid product obsolescence due to technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. Detailed information regarding the specific risks of ARKQ ETF can be found in the prospectus. Industrials Sector Risk. Companies in the industrials sector may be adversely affected by changes in government regulation, world events and economic conditions. In addition, companies in the industrials sector may be adversely affected by environmental damages, product liability claims and exchange rates. Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Additional risks of investing in ARKQ include market, management and non-diversification risks, as well as fluctuations in market value and NAV. Shares of ARKQ are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Portfolio holdings will change and should not be considered as investment advice or a recommendation to buy, sell or hold any particular security. Please visit www.ark-funds.com for the most current list of holdings for the ARK ETFs.

To view the holdings for ARKQ, click here.

The information herein is general in nature and should not be considered financial, legal or tax advice. An investor should consult a financial professional, an attorney or tax professional regarding the investor’s specific situation. Certain information was obtained from sources that ARK believes to be reliable; however, ARK does not guarantee the accuracy or completeness of any information obtained from any third party.

ARK Investment Management LLC is the investment adviser to the ARK ETFs.

Foreside Fund Services, LLC, distributor.

McCormick, M. and J. Smyth. 2024. “Microsoft in deal for Three Mile Island Nuclear Power to Meet AI Demand.” Financial Times. Moore, M. 2024. “Google Orders Small Modular Nuclear Reactors for its Data Centres.” Financial Times. Smyth, J. 2024. “Amazon Buys Stake in Nuclear Energy Developers in Push to Power Data Centres.” Financial Times.

Wright’s Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. See Winton, B. 2019. “Moore’s Law Isn’t Dead: It’s Wrong—Long Live Wright’s Law.” ARK Investment Management LLC.

U.S. Nuclear Regulatory Commission. 2024. “ADVANCE Act (Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy Act of 2024).”

Freebairn, W. 2025. “Investment in US nuclear power ready to expand: Guggenheim.” S&P Global.

Korus, S. 2024. “Regulations Have Prevented Electricity Price Declines In The US.” ARK Investment Management LLC.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.