Introduction

In our Introduction To The ARK Innovation ETF (ARKK), we outlined how ARK’s five innovation platforms—public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics—are converging, sparking a new technological revolution that could redefine the next business cycle. In this article, we zoom in on the ARK Space & Defense Innovation ETF (ARKX), which invests in companies leading advances across orbital aerospace, sub-orbital aerospace, next-generation defense, enabling technologies, and aerospace beneficiaries. These categories encompass satellites, launch systems, autonomous platforms, and the supporting infrastructure that enables both commercial and defense applications.

The Opportunity

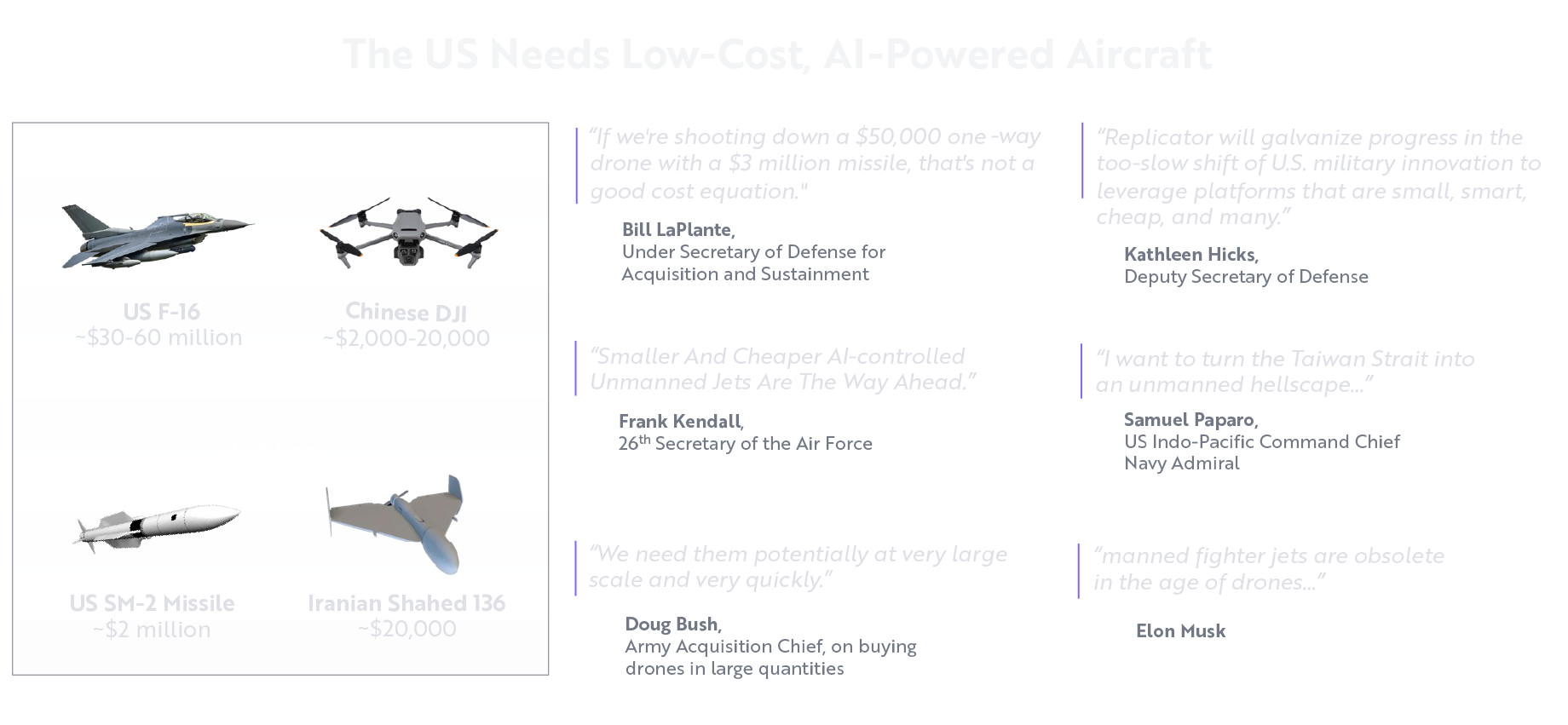

Global defense is entering a new era defined by speed, software, and cost efficiency. Advances in autonomy, artificial intelligence, and hypersonic propulsion are compressing the cost and time of deployment while expanding reach, precision, and deterrence.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

The U.S. Department of War has made clear that it must move away from high-cost, low-volume manned systems toward scalable, AI-enabled platforms. The graphic above captures the cost asymmetry shaping modern deterrence. America’s adversaries can deploy thousands of drones for the price of a single fighter jet, and future military advantage will be earned by those who innovate best. ARKX seeks to capture this evolution by investing in companies accelerating this transition through AI-powered sensors, autonomous flight systems, and adaptive mission software.

For decades, defense investment was concentrated on a small group of established contractors operating under long procurement cycles. That model is being overtaken by a new generation of innovators who iterate rapidly and integrate digital technologies into every system. The conflict in Eastern Europe underscores that shift. Drones have replaced tanks as the dominant symbol of deterrence, and real-time data integration has become as vital as raw firepower.

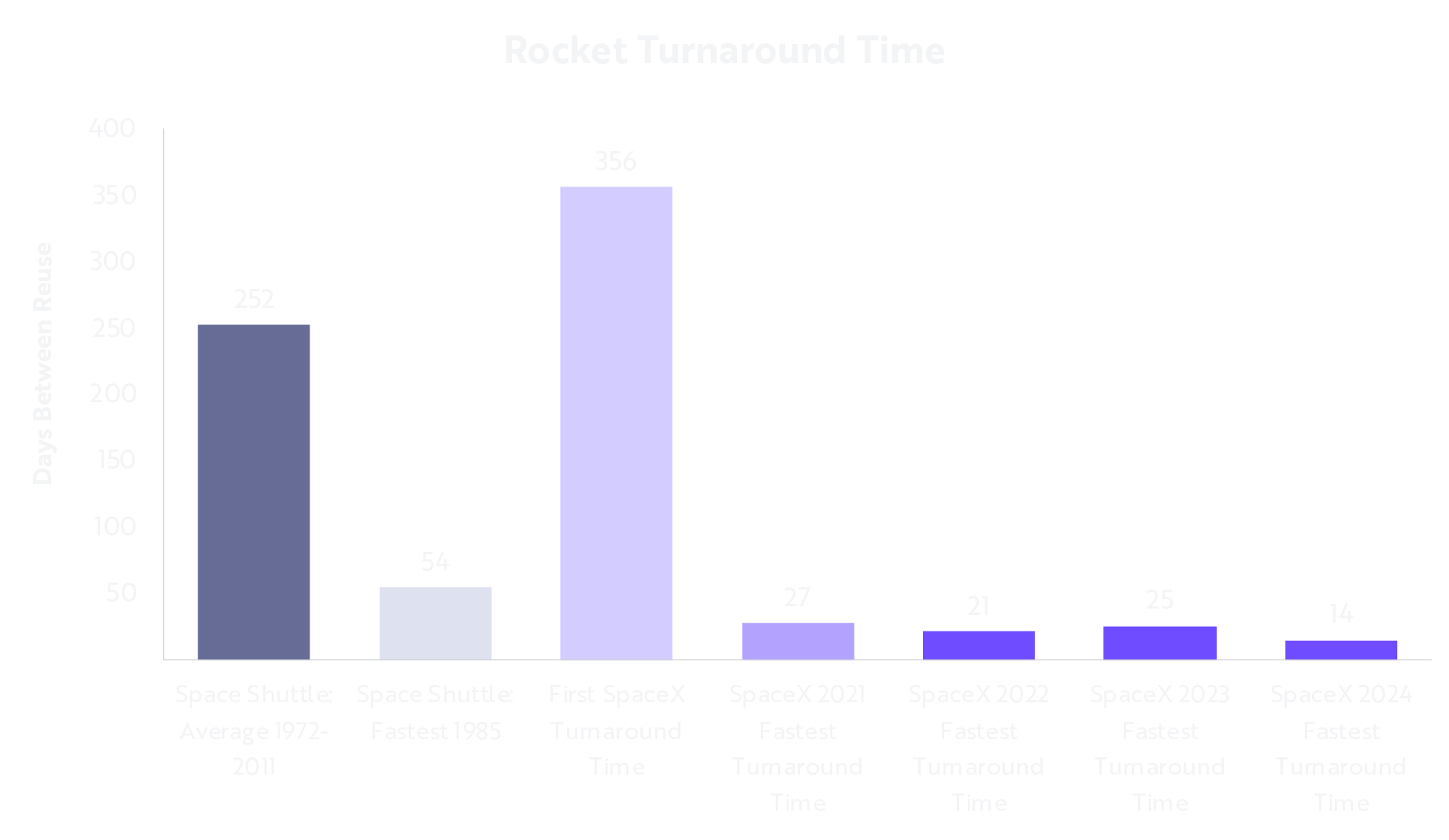

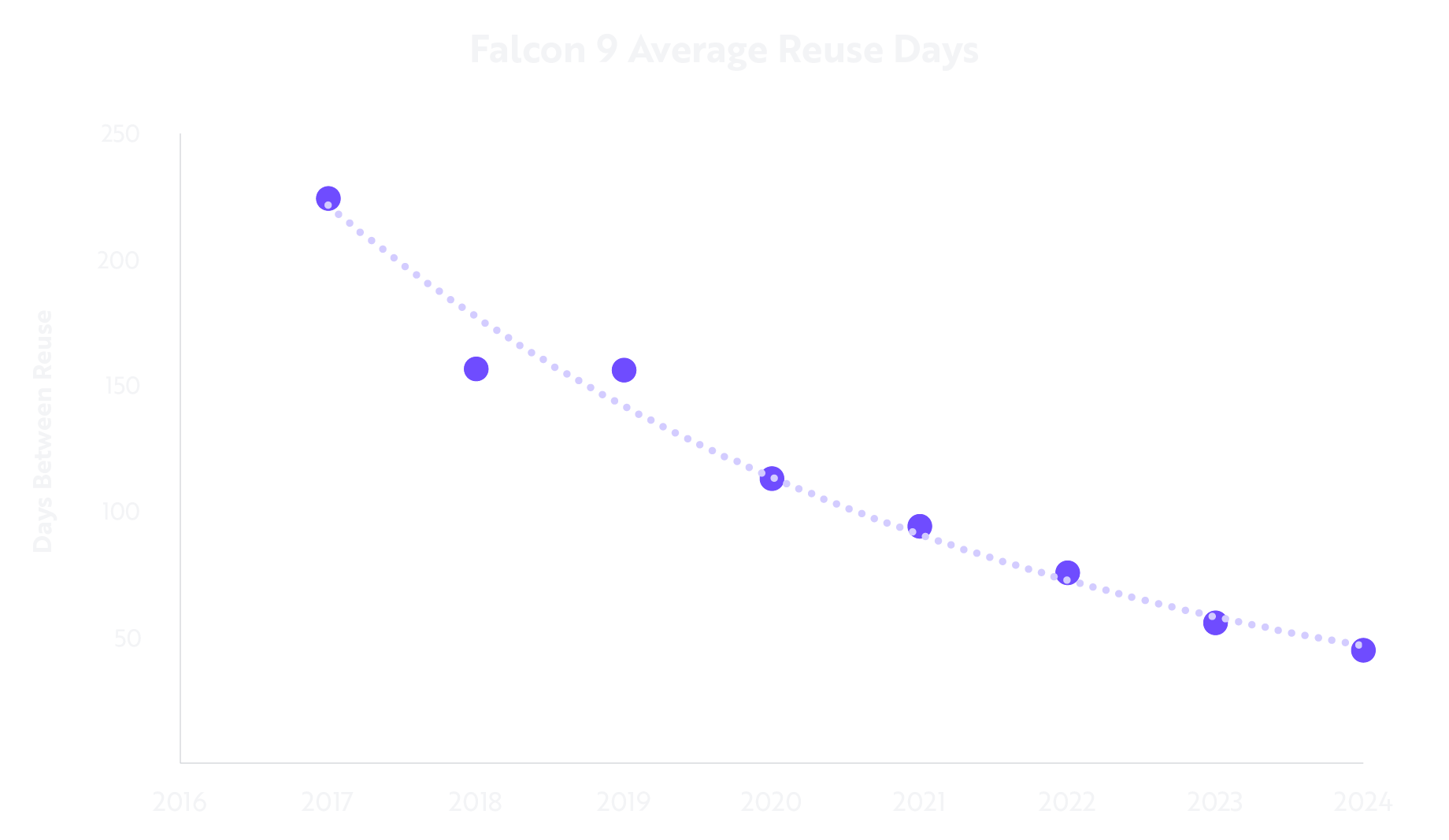

The same dynamics are unfolding in space. SpaceX’s rapid turnaround rockets are a clear example of how deflationary technology can reshape entire industries. The ability to refurbish and relaunch rockets within days has reduced launch costs by more than an order of magnitude. What once required billions in capital now can be achieved for a fraction of the cost. The shift has transformed space from an episodic destination to a persistent operating environment that serves both commercial and defense purposes. For investors, reusable launch systems demonstrate how innovation compounds through scale. As production increases, costs decline, adoption accelerates, and entirely new markets open.

SpaceX Is Refurbishing Rockets In Record Time

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Investing in the Next Generation of Defense Leaders

ARKX focuses on the innovators driving this structural transformation. Its holdings include companies like Kratos Defense & Security Solutions, which is redefining air combat through cost-effective autonomous drones, and AeroVironment, whose small, attritable unmanned systems are indispensable on today’s battlefields. In space infrastructure, Rocket Lab is pioneering low-cost, responsive launch capabilities, while Palantir Technologies is providing the artificial intelligence backbone for situational awareness and command systems.

These companies reflect ARK’s conviction that future defense and aerospace leadership will depend on agility, software sophistication, and rapid iteration. ARKX also includes adaptive incumbents like Airbus and Thales Group, which are modernizing their platforms for an era defined by autonomy and connectivity.

Dual Exposure: Space and Defense

Most funds separate space and defense. ARKX recognizes that they are intimately entwined on today’s battlefields. The technologies transforming aerospace—satellites, drones, artificial intelligence, and reusable rockets—are the same forces reshaping global security. ARKX unites these themes within a single, actively managed strategy designed to capture the feedback loop between commercial innovation and national defense.

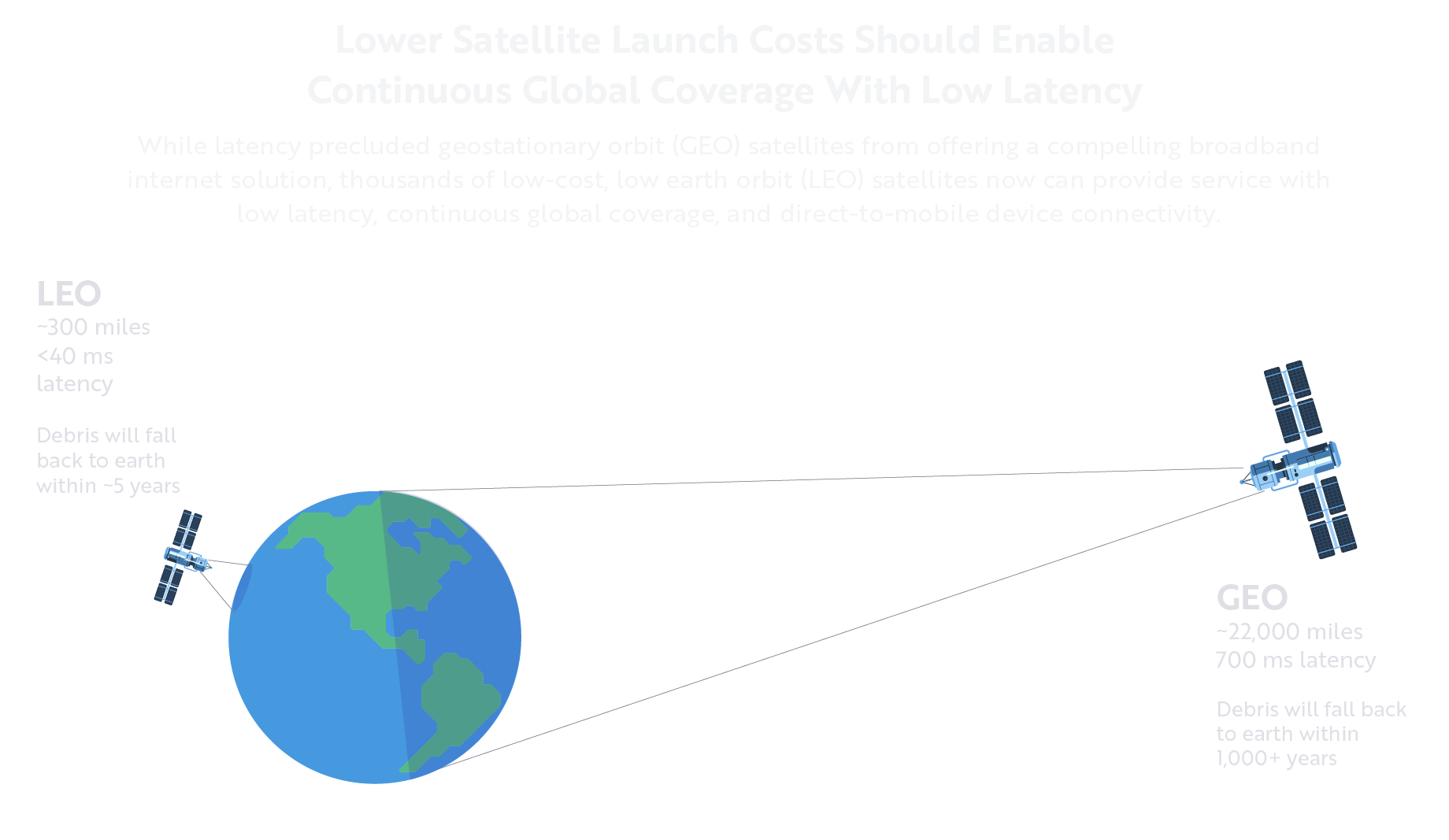

The collapse in launch costs and the proliferation of low Earth orbit satellites are building a continuous layer of communication, reconnaissance, and navigation around the planet. What once was the domain of a few geostationary systems has become a resilient network of thousands of smaller satellites capable of near-instantaneous data transfer. This infrastructure is transforming the indispensable organs of contemporary war: command and control, intelligence collection, and precision operations. ARKX invests in the companies enabling this transformation, from next-generation satellite manufacturers to analytics firms that convert orbital data into strategic advantage.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of January 10, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

ARKX also targets technologies that serve both defense and civilian markets. Companies like Archer Aviation and Joby Aviation are developing electric vertical takeoff and landing aircraft that can be adapted for military logistics or commercial air mobility—dual-use applications that reinforce one another, accelerating innovation and expanding the addressable market for aerospace technology.

A Global And Innovation-Centric Approach

Innovation, like military conflict, transcends geography. ARKX reflects that reality. The fund invests globally, across the United States, Europe, and Asia, focusing on technological advancement instead of location. By selecting companies based on their capacity for innovation, ARKX seeks to identify emerging leaders regardless of traditional classifications, including geography.

This approach results in minimal overlap with conventional aerospace and defense ETFs and provides investors with a differentiated, forward-looking allocation. ARKX is built to complement rather than replicate the existing holdings of its competitors, providing targeted exposure to the technologies shaping the next decade of defense and space innovation.

Why ARKX, Why Now

Global competition is accelerating the demand for technological superiority. Defense budgets are being restructured to prioritize digital capabilities, autonomy, and orbital infrastructure. Simultaneously, commercial space activity is expanding rapidly, as private and public actors race to build the next generation of connectivity and observation systems.

We believe ARKX positions investors at the center of this convergence. By focusing on innovation-driven cost declines and scalability, the fund captures both the deflationary economics of commercial space and the modernization cycle of global defense. In an era where technological leadership defines geopolitical power, ARKX offers investors exposure to the unprecedented kinds of companies that are shaping that future.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs’ prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus should be read carefully before investing.

Investing in securities involves risk and there's no guarantee of principal.

Fund Risks: The principal risks of investing in ARKX: Equity Securities Risk. The value of the equity securities the Fund holds may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. These risks are greater in emerging markets. Industrials Sector Risk. The industrials sector includes companies engaged in aerospace and defense, electrical engineering, machinery, and professional services. Companies in the industrials sector may be adversely affected by changes in government regulation, world events and economic conditions. In addition, companies in the industrials sector may be adversely affected by environmental damages, product liability claims and exchange rates. Information Technology Sector Risk. The information technology sector includes companies engaged in internet software and services, technology hardware and storage peripherals, electronic equipment instruments and components, and semiconductors and semiconductor equipment. Information technology companies face intense competition, have limited product lines, markets, financial resources or personnel, face rapid product obsolescence, are heavily dependent on intellectual property and the loss of patent, copyright and trademark protections may adversely affect the profitability of these companies.

Aerospace and Defense Company Risk. Companies in the aerospace and defense industry rely to a large extent on U.S. (and other) Government demand for their products and services and may be significantly affected by changes in government regulations and spending, as well as economic conditions, industry consolidation and other disasters. For other risks regarding the fund please see the prospectus. There can be no assurance that the ETF will achieve its investment objective. The ETF’s portfolio is more volatile than broad market average. Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme. Special Purpose Acquisition Companies (SPAC) Risk. A SPAC is a publicly traded company that raises investment capital for the purpose of acquiring or merging with an existing company. Investments in SPACs and similar entities are subject to a variety of risks beyond those associated with other equity securities. Because SPACs and similar entities do not have any operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the SPAC’s management to identify a merger target and complete an acquisition.

Shares of ARKX are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Securities in the ETF’s portfolio will not match those in any index. The active ETFs are benchmark agnostic and corresponding portfolios may have significant non-correlation to any index. Index returns are generally provided as an overall market indicator. You cannot invest directly in an index. Although reinvestment of dividend and interest payments is assumed, no expenses are netted against an index’s returns. An indication of interest in response to this advertisement will involve no obligation or commitment of any kind.

Portfolio holdings will change and should not be considered as investment advice or a recommendation to buy, sell or hold any particular security.

To view the top ten holdings for ARKX click here.

The information herein is general in nature and should not be considered financial, legal or tax advice. An investor should consult a financial professional, an attorney or tax professional regarding the investor’s specific situation. Certain information was obtained from sources that ARK believes to be reliable; however, ARK does not guarantee the accuracy or completeness of any information obtained from any third party.

ARK Investment Management LLC is the investment adviser to the ARK ETFs.

Foreside Fund Services, LLC, distributor.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.