Introduction

In our Introduction To The ARK Innovation ETF (ARKK), we outlined how ARK’s five innovation platforms—public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics—are converging, sparking a new technological revolution that could redefine the next business cycle. In this article, we introduce the ARK Defined Innovation Exposure Term (DIET) Buffer ETFs, a new series of funds that provide exposure to disruptive innovation with a built-in structure that helps to limit losses and give clearer expectations for potential gains.

The Opportunity: A More Defined Path To Innovation Exposure

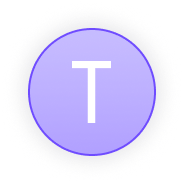

Innovation has always been the engine of growth. From the steam engine to electricity, the telephone, and the internet, every breakthrough has sparked new industries, reshaped daily life, and fueled the global economy. The waves of progress not only changed technology but also redefined entire eras, as shown below.

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying sources, which may be provided upon request.1 The chart uses GPT 4 prompting to survey a comprehensive list of general purpose technologies using the identification framework detailed therein. Where available, academic literature is also used to assess attributable economic impact. A GPT-4 scoring rubric assesses technology-by-technology impacts. The impact measured directly is matched against the scoring to tune all scores to produce technology-by-technology estimates of economic impact (even when direct measures of economic impact are unattainable). Consistent with General Purpose Technology theory, these technologies are assumed to go through a period of investment in which economic impact is negative before productivity advances begin to realize into economic data. All technologies are assumed to have the same diffusion and realization cycle. If recent technologies are assumed to diffuse more quickly, the current wave would appear steeper. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. The historical economic impact of innovation does not guarantee a similar impact at any point in the future.

Source: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying sources, which may be provided upon request.1 The chart uses GPT 4 prompting to survey a comprehensive list of general purpose technologies using the identification framework detailed therein. Where available, academic literature is also used to assess attributable economic impact. A GPT-4 scoring rubric assesses technology-by-technology impacts. The impact measured directly is matched against the scoring to tune all scores to produce technology-by-technology estimates of economic impact (even when direct measures of economic impact are unattainable). Consistent with General Purpose Technology theory, these technologies are assumed to go through a period of investment in which economic impact is negative before productivity advances begin to realize into economic data. All technologies are assumed to have the same diffusion and realization cycle. If recent technologies are assumed to diffuse more quickly, the current wave would appear steeper. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. The historical economic impact of innovation does not guarantee a similar impact at any point in the future.

Another turning point is happening now, as five powerful innovation platforms are advancing simultaneously: public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics. Importantly, while each of those platforms alone could transform industries, their timely convergence today is accelerating change at an unprecedented pace. Our research shows that we are in the early innings of a new era of growth whose scale surpasses that of past innovation revolutions.

Big investment opportunities often come with big market swings. As their long-term stories manifest their shape, innovation stocks can rise quickly and they can fall sharply—a volatility that can pose challenges to investors. The ARK DIET Buffer ETFs are designed as a kind of anchor that maintains investors’ opportunity to potentially benefit from innovation while tempering the waves of volatility that attend its fruition. The DIET ETFs give investors a more stable way of participating in one of the most transformative periods in history.

How The ARK DIET Buffer ETFs Work

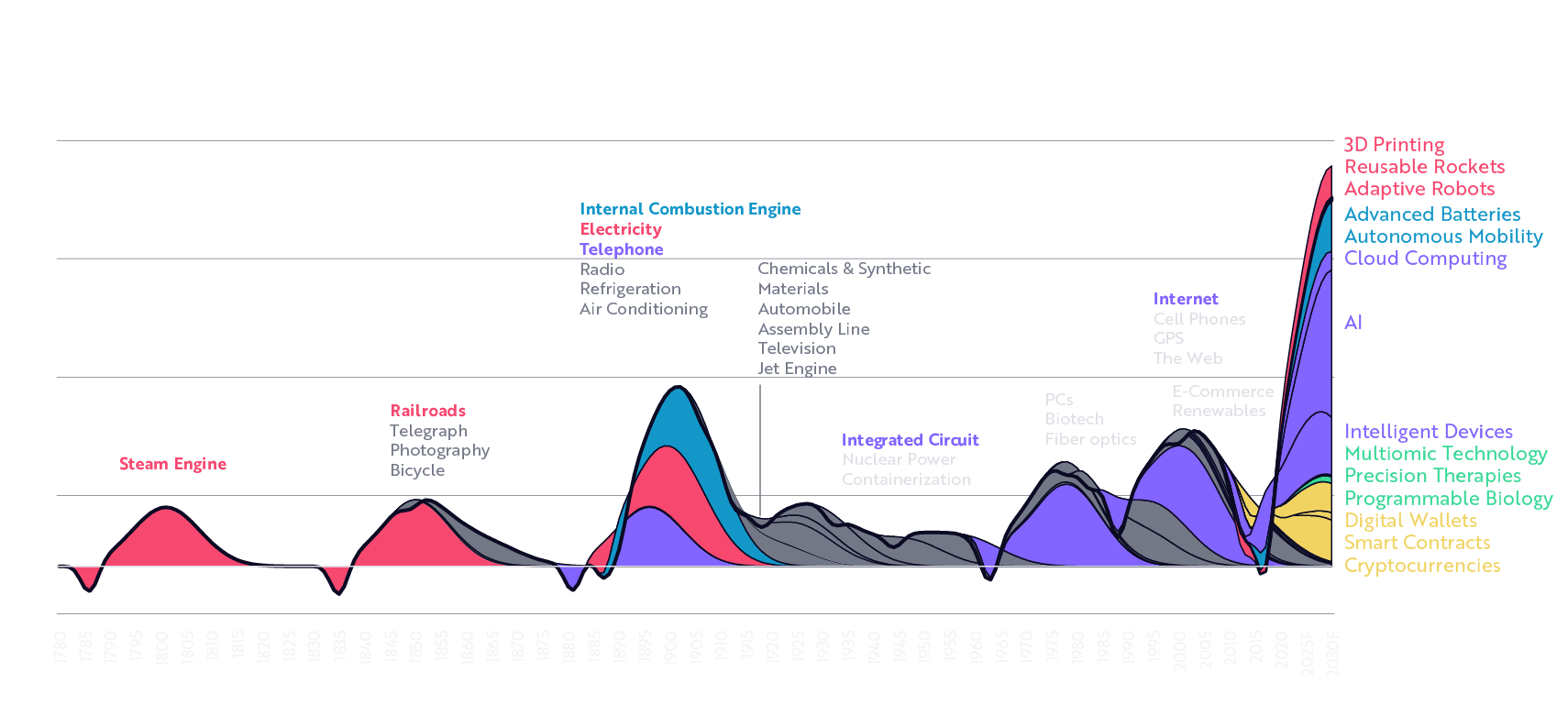

The ARK DIET Buffer ETFs deliver a “buffered” return profile linked to the ARK Innovation ETF (ARKK) before fees and expenses. In essence, they are a modified version of ARKK designed to limit losses while preserving some upside potential. The suite of products is intended for investors who seek innovation exposure with a more controlled risk profile over a fixed 12-month outcome period.

The strategy targets reduced downside participation. If ARKK declines during the outcome period, the ARK DIET Buffer ETFs will participate in approximately half the loss.

To fund that limited protection, investors sacrifice the first ~5% of ARKK’s gains each year. Doing so allows the strategy to offer ongoing upside participation after the 5% hurdle, at a defined participation rate.

Once ARKK’s returns exceed the ~5% hurdle, the ARK DIET Buffer ETFs participate in approximately 50–80%2 of any additional upside. The ARK DIET ETFs target 50–80% upside participation after the 5% hurdle, but the precise level depends on market conditions at the start of each outcome period. Because the costs of the limited downside participation and option premiums change with volatility and interest rates, participation could be higher in calmer markets and lower when protection is more expensive.

.png)

Source: ARK Investment Management LLC, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. The examples provided are hypothetical and are not representative of actual return scenarios. For more complete information on the potential outcomes of ARK DIET ETFs please view the prospectus here.

The ARK DIET Buffer ETFs allow investors to remain linked to ARKK’s performance while incorporating built-in limited downside participation against major drawdowns. Each fund in this strategy has a 12-month outcome period. The defined payoff profile is set at launch and runs for one year, after which it resets.

To provide flexibility, ARK is launching the ARK DIET Buffer ETFs on a rolling quarterly schedule, as follows:

ARK DIET Buffer ETF Suite | |

| January 2, 2026 | ARK DIET Q1 Buffer ETF (ARKD) |

| April 1, 2026 | ARK DIET Q2 Buffer ETF (ARKI) |

| July 1, 2026 | ARK DIET Q3 Buffer ETF (ARKE) |

| October 1, 2025 | ARK DIET Q4 Buffer ETF (ARKT) |

A new outcome period for each product begins in January, April, July, and October each year—a schedule that ensures investors can enter the strategy at regular intervals and always have the option to start with a fresh one-year outcome period.

ARKD, ARKI, ARKE, and ARKT are the first implementations of ARK’s broader Defined Innovation framework. They offer a systematic way of reshaping exposure to innovation themes without exiting the market or relying on defensive assets.

Fitting Into A Broader Portfolio

The ARK DIET Buffer ETFs are designed to serve a clear role within a diversified portfolio: to maintain exposure to innovation while reshaping the risk profile over a defined 12-month period. The strategy should appeal to investors who are aligned with ARK’s long-term vision but want greater control over near-term drawdowns. By targeting reduced downside participation during the outcome period and offering structured upside participation beyond the 5% hurdle—with no fixed maximum return but at a defined participation rate—the ETF provides a more defined return path over the course of a year.

This strategy should resonate with conservative investors who have avoided potentially risky innovation-focused strategies. The strategy also should be particularly useful for investors approaching retirement or other time-bound financial goals, where drawdowns in the final years of accumulation are especially consequential.

In portfolio construction, ARK’s DIET Buffer ETFs can function as a partial substitute for traditional equity exposure, offering a buffered path through sectors that can be highly volatile. It can also complement existing ARKK allocations by reducing sensitivity to short-term declines—especially after periods of strong performance or during heightened macro uncertainty.

Investors will find that the one-year outcome period aligns naturally with annual financial planning and portfolio reviews.

In practice, the strategy allows for more granular control over innovation exposure. It expands the toolkit available to portfolio managers who want to remain invested in long-term innovation trends while addressing near-term risk management goals.

Conclusion: Why Now?

Innovation is accelerating now, and we do not expect it to slow anytime soon. We believe it is better to remain invested in innovation in some capacity than to sit on the sidelines entirely.

The ARK DIET Buffer ETFs are designed to provide investors with exposure to innovation while mitigating its sometimes volatile motions. In today’s fast-moving markets, the balance between conviction and comfort has never been more important.

Disruptive innovation historically has rewarded some investors who can be patient through a bumpy ride. The ARK DIET Buffer ETFs are designed to be a steadier course—to maintain exposure to innovation themes while aiming to manage near-term risk along the way.

To learn more, please read our ARK DIET Buffer ETFs Whitepaper, A New Toolkit For Accessing Innovation With Predefined Risk And Return Profiles.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs' prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

The ARK DIET Buffer ETFs have characteristics unlike traditional investment products and are not suitable for all investors.

There is no assurance that the Fund will meet its investment objective. The value of your investment in the Fund, as well as the amount of return you receive on your investment in the Fund, may fluctuate significantly. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments.

Hurdle: In this case, the hurdle refers to the appreciation that the ARK Innovation Fund (ARKK) must achieve before any ARK DIET Buffer ETF starts to participate in returns. Specifically, the ARK DIET Buffer ETFs capture 50-80% of ARKK’s return after the first 5%. So, 0-5% is the hurdle.

The principal risks of investing in the ARK DIET Buffer ETFs include: Limited Loss Risk. There is no guarantee that the Fund will be successful in its strategy to limit the Fund's exposure to losses in the Underlying ETF’s share price to no more than 50% of the Fund’s NAV during the Outcome Period. In the event an investor purchases shares after the commencement of the Outcome Period or redeems shares prior to the end of the Outcome Period, the investor may not fully participate in the share price gains of the Underlying ETF beyond the Hurdle to which the Fund seeks to provide exposure. Derivatives Risk. Derivatives involve risks different from, and, in certain cases, greater than, the risks presented by more traditional investments. These include credit risk, liquidity risk, management risk and leverage risk. Derivative products are highly specialized instruments that require an understanding not only of the underlying instrument but also of the derivative itself, without the benefit of observing the performance of the derivative under all possible market conditions. The failure of another party to a derivative to comply with the terms may cause the Fund to incur a loss. Adverse changes in the value or level of the underlying asset, rate or index can result in a loss substantially greater than the amount invested in the derivative itself. Option Writing Risk. The Fund invests in options that derive their performance from the performance of the Underlying ETF. Writing and buying options are speculative activities and entail investment exposures that are greater than their cost would suggest, meaning that a small investment in an option could have a substantial impact on the performance of the Fund. The Fund’s use of options, due to the cost of the options, will reduce the Fund’s ability to get returns equal to the Underlying ETF. FLEX Options Risk. The Fund utilizes FLEX Options guaranteed for settlement by the OCC, and it bears the risk that the OCC will be unable or unwilling to perform its obligations under the FLEX Options contracts, which is a form of counterparty risk. Additionally, FLEX Options may be less liquid than certain other securities, such as standardized options. The Fund may experience substantial downside from certain FLEX Option positions, and FLEX Option positions may expire worthless. Liquidity Risk. The Fund may invest in securities or instruments that trade in lower volumes and may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. There is no guarantee that a liquid secondary trading market will exist for the listed and OTC options in which the Fund may invest. A less liquid trading market may adversely impact the value of the listed options and the value of your investment. Other Investment Companies Risk. In addition to investing in options, the Fund invests in the Underlying ETF, which is another investment company. Accordingly, shareholders will bear both their proportionate share of Fund expenses and, indirectly, the expenses of the Underlying ETF. Furthermore, the Fund is exposed to the risks to which the Underlying ETF may be subject.

New Fund Risk. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board may determine to liquidate the Fund if it determines that liquidation is in the best interest of shareholders. Liquidation of the Fund can be initiated without shareholder approval. As a result, the timing of the Fund’s liquidation may not be favorable.

Outcome Period Risk. The Fund’s investment strategy is designed to deliver returns that match the Underlying ETF, subject to the Hurdle and the Fund's strategy to limit the Fund's exposure to losses in the Underlying ETF’s share price to no more than 50% of the Fund’s NAV during the Outcome Period, only if shares are bought by the first day of the Outcome Period and held until the end of the Outcome Period. If an investor purchases or sells shares during the Outcome Period, the returns realized by the investor will not match those that the Fund seeks to achieve. In addition, the Hurdle may change from one Outcome Period to the next within the range stated above and is unlikely to remain the same for consecutive Outcome Periods. Moreover, the Fund’s returns will be reduced by Fund fees and expenses as well as any brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses incurred by the Fund throughout an Outcome Period. Accordingly, the performance of the Fund over an Outcome period will be reduced by these fees and expenses.

Shares of ARK ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Although the Funds have an effective registration with the SEC, each fund will not be available for trading until the respective dates mentioned above.

ARK Investment Management, LLC is the investment adviser to the ARK DIET Buffer ETFs.

Foreside Fund Services LLC, distributor.

Not FDIC Insured – No Bank Guarantee – May Lose Value

We use GPT 4 prompting to survey a comprehensive list of general purpose technologies using the identification framework detailed in https://core.ac.uk/download/pdf/85004244.pdf. Where available, we sample academic literature to assess attributable economic impact. We feed GPT-4 a scoring rubric to assess technology-by-technology impacts. The directly measured impact is matched against the scoring to tune all scores to produce technology-by-technology estimates of economic impact (even when direct measures of economic impact are unattainable). Consistent with GPT theory, these technologies are assumed to go through a period of investment where economic impact is negative before productivity advances begin to realize into economic data. A more complete detailing of this methodology is forthcoming.

Subject to change with each quarterly strike, for each of the four ETFs.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.

.png)