Dear ARK Venture Investors,

We’re delighted to share updates on some of the exciting progress in the portfolio, with significant and value-accretive milestones occurring with many of our carefully chosen companies. We continue to advance ARK’s mission to democratize venture capital and bring the highest quality private investments to you. Headline news items include our new investment in OpenAI and other important events. A detailed summary of Q3 2024 progress is offered below.

For regular updates, subscribe to our Venture Fund updates here, or follow ARK Funds on X.

OpenAI

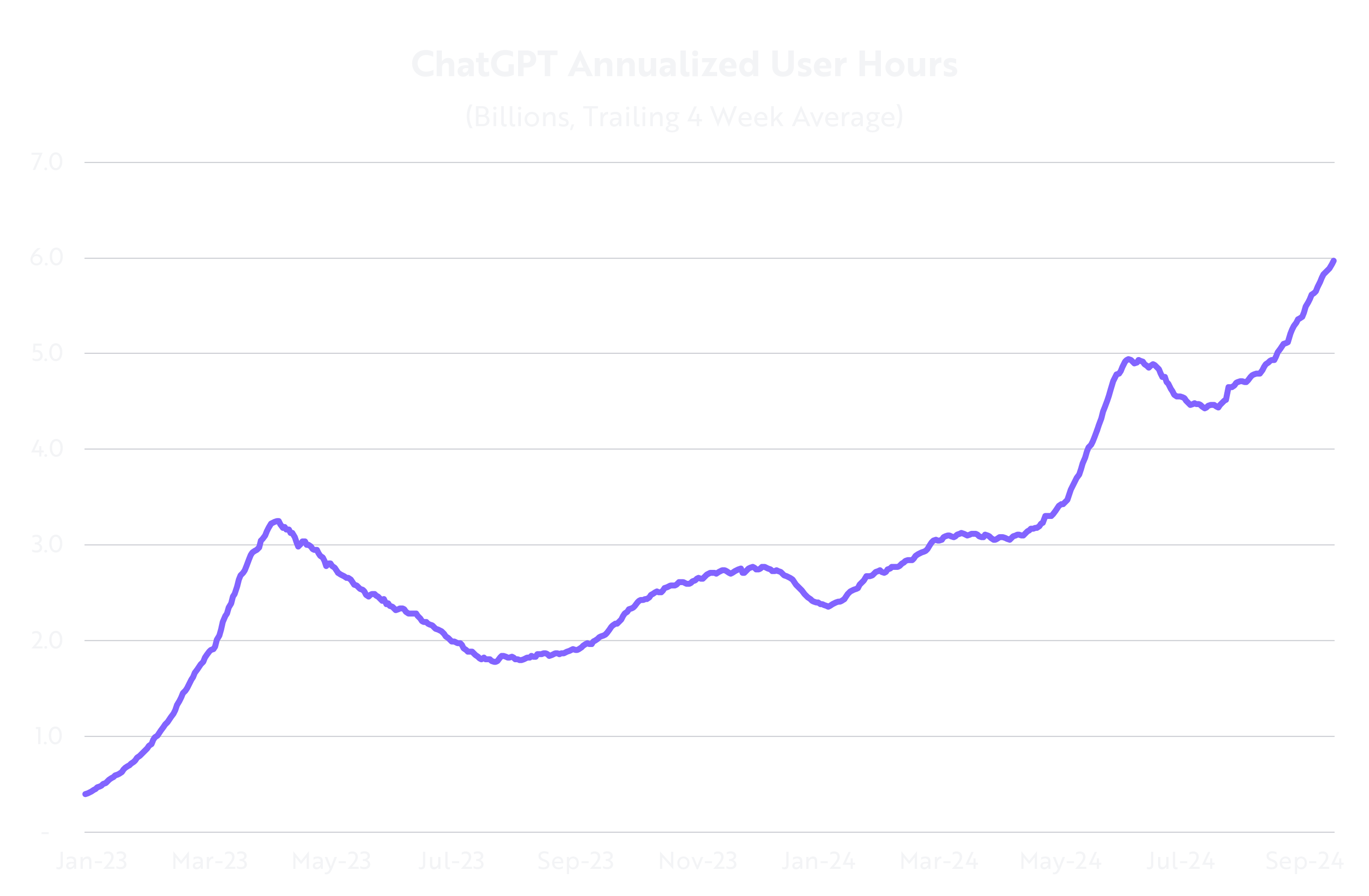

Artificial intelligence (AI) is perhaps the most profound of the convergent and transformative technologies reshaping the global economy and our wider world today. OpenAI has developed ground-breaking large language models (LLMs) and other models in contrastive learning and images/video. Now, we believe the company is poised to continue to lead in this field by enabling unprecedented advancements in automation, decision making, and creativity, potentially shifting the fundamentals of its business customers’ growth. Similar to the current Infrastructure-as-a-Service (IaaS) market in which just three players control a majority of the market, we expect concentration in the market for frontier AI models. Supporting our view are the continuation of significant training costs despite cost declines and the network effects likely to accrue disproportionately to early winners. Within the first two months of its release in November 2022, and with awareness spreading virally, ChatGPT gained 100 million users, the fastest application uptake of all time. Its traffic has continued to grow to over 350 million users,1 and user hours are climbing steadily, as shown below. According to reports, by June 2024, OpenAI’s annualized revenue had roughly tripled year-over-year to $3.4 billion, thanks to growing revenue from freemium and enterprise use alike.2

Source: ARK Investment Management LLC, 2024, based on data from SensorTower and SimilarWeb as of September 24, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

ARK’s Investment In OpenAI

Following the initial investment into OpenAI announced earlier in the year, ARK Venture Fund concentrated into the position this past quarter with an additional investment, making it the third-largest holding in the portfolio, as of this writing. As reported in Business Insider in early October, our group’s total investment into OpenAI’s latest funding round of $6.6B was $250 million, with the ARK Venture Fund as a key participant. Other investors reportedly included Microsoft and Nvidia, alongside lead investor Thrive Capital. We believe that exposure to OpenAI offers our investors the opportunity to benefit from the continued growth of a defining leader in the AI revolution. We are excited to see the incredible progress continue—especially in a world of increasingly “agentic” AI3 systems in which autonomous agents increasingly will perform more and more complex tasks and allow humans to focus on higher level creative pursuits and set overall goals. We hope that agentic AI is the ultimate labor-saving technology, freeing us all to work on the many things that will still need fixing for some time to come: healthcare/healthspan, energy and environmental research, new entertainment modalities for all that free time…and getting to Mars!

Please refer to our recent Investment Thesis on OpenAI for a more detailed discussion.

KINO Continues its Hyper-Growth

Hollywood experienced a historic double strike last year that completely shut down the industry, and 2025 is proving that the industry is not returning to the legacy status quo. Social media continues to eat Hollywood’s lunch, making it clear that technological innovation is necessary to solve the critical discovery, efficiency, and engagement problems preventing film/TV creators from finding their audiences. KINO is solving this problem head-on with its app, which fans have lovingly dubbed “TikTok meets Netflix.”

KINO continues its path of hyper-growth with recent partnerships signed with William Morris Endeavor “WME” (a top talent agency in Hollywood) and Sugar23 (with Michael Sugar joining KINO’s Board of Advisors). Most recent projects include the Proctor & Gamble / Wayfarer film Empire Waist (starring Rainn Wilson and Missi Pyle) and Ernest Hemingway adaptations Across the River and Into the Trees (starring Liev Schrieber and Josh Hutcherson), with a stacked lineup of Live Digital Premieres nearly booking out all of 2025. KINO is currently in discussions and negotiating library partnerships with every major studio. Thousands of titles will be available soon on KINO mobile and TV apps.

KINO will host its first Investor Day in November, during which the team will unveil the next generation of groundbreaking features, from KINO Discovery-GPT to Connect Mode to Shared Playlists to the all-new KINO Discover Feed.4

SpaceX’s Mechazilla Chopstick Makes Historic Starship Catch

SpaceX, the largest holding in the ARK Venture fund, launched the fifth test flight of its Starship rocket. Remarkably, its Mechazilla chopstick arms successfully caught the booster, as shown below. This impressive feat of engineering is difficult to overstate, as it will be crucial to reusing the Starship just hours after its last launch. This is a prime example of how SpaceX continues to execute and is in a league of its own.5

Credit: SpaceX on X.

Mastering the Venture Mindset

This quarter, we had the pleasure of speaking with Ilya Strebulaev, one of the world's top venture capital and private market researchers, about his book The Venture Mindset: How to Make Smarter Bets and Achieve Extraordinary Growth. Below are a few fundamental principles for success highlighted during our conversation.6

Agree to Disagree: Companies’ decisions are often driven and made by consensus. Strebulaev's research concludes that the likelihood of hitting a home run is not increased by following the group mindset. Conviction beats consensus; build your conviction and stick to it.

Get outside of the four walls: VCs have extremely diversified networks. Even the average corporate VC is a much smaller and less diversified network compared to a more traditional VC. The same is true for most people. It is best to focus on expanding one’s network beyond their own organization and alma mater. By increasing your reach, you’ll see more opportunities.

Avoid preselection and the NIH syndrome (Not Invented Here Syndrome): Companies should avoid not investing in something just because they fear it could compete with or disrupt the existing core of the business.

Back the jockey, not the horse: At the end of the day, it’s not about the idea. It’s about the person who executes the idea and brings it to fruition. Successful founders often are charismatic, resilient, and fair.

xAI Gigafactory Colossus Online

xAI built Colossus, a “Gigafactory of Compute." This ambitious project has created one of the world's largest supercomputers. The supercomputer is intended to use around 100,000 Nvidia H100 GPUs, making it larger than existing GPU clusters used for AI training and development.

The project was not without controversy. There's been discussion about the ecological impact, mainly due to the significant power requirements. xAI has deployed temporary gas generators to manage power needs, raising concerns among environmental groups regarding emissions and legal permits.

For Memphis, this project represents one of the largest new investments in technological infrastructure, promising significant financial benefits. However, the exact number of jobs and the total capital investment have yet to be fully disclosed.

Beyond its sheer scale, Colossus aims to advance xAI's mission, particularly in training its AI chatbot, Grok, and potentially other AI models, by providing them unprecedented computational power for training and operation. The supercomputer has advanced cooling solutions, including liquid cooling technologies from Supermicro, to reduce energy consumption and environmental impact. This is in line with Musk's broader interests in sustainable technology.

Musk has also stated publicly that he plans to double the size of the cluster to 200,000 Nvidia GPUs, Including 50,000 H200s in the coming year.7

Investment in Gatik AI Inc.

We recently invested in Gatik AI, a leader in middle-mile autonomous trucking. While many autonomous truck players are focused on long-haul trucking, Gatik is using Class 3-7 box trucks to tackle shorter distances. This strategy allowed Gatik to be first to market with a short-haul fully driverless truck route with Walmart in 2021.8 While that route has closed, Gatik plans to re-launch driverless operations in Texas early next year. In addition to Walmart, Gatik is partnered with Tyson Foods, Kroger, and others, as well as strategic investor partners, including Isuzu and Nippon Express Holdings.

ARK estimates that Gatik could be a formidable player, potentially in the top handful of companies who have logged real-world driving miles, a crucial step to train and launch an autonomous truck network.

As we head into Q4 and look to next year, we remain optimistic about the future and are excited as innovation continues to thrive. We want to thank you, our investors, for keeping the ARK Venture fund at the top of your minds and for the continuous flow of new ideas and great companies that we have been able to evaluate.

Warm Wishes,

Chase, Charlie, and The Broader ARK Team

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained here. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy. The ARK Venture Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity.

All statements made regarding investment opportunities are strictly beliefs and points of view held by ARK and investors should determine for themselves whether a particular investment or service is suitable for their investment needs. Certain statements contained in this document may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this document may also involve risks and uncertainties described from time to time in ARK’s filings with the U.S. Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this document. Past performance is not a guarantee of future results.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

Hu, Krystal. Reuters. February 2, 2023. “ChatGPT sets record for fastest-growing user base - analyst note.”

Palazzolo, Stephanie and Woo, Erin. The Information. June 12, 2024. “OpenAI’s Annualized Revenue Doubles to $3.4 Billion Since Late 2023.

Pounds, Erik. “What Is Agentic AI?” October 22, 2024. https://blogs.nvidia.com/blog/what-is-agentic-ai/

Update from Austin Worrell, KINO CEO.

Korus, Sam.ARK Disrupt Newsletter. “SpaceX's Mechazilla chopstick makes a historic catch of the Starship, and more...” October 20, 2024.

Mastering Venture Capital: Ilya Strebulaev’s Key Principles for Success - Ark Invest. (n.d.). https://www.ark-invest.com/podcast/mastering-venture-capital-ilya-strebulaevs-key-principles-for-success

Elon Musk's xAI expands Colossus, the world's largest AI supercomputer. SemiWiki.

Update from Gatik CEO. “Gatik and Walmart achieve fully driverless deliveries, marking a worldwide first.”

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.