The Opportunity

Venture capital (VC) and private asset funds invest in startups with high growth potential. Venture investors receive equity in those companies, aiming to reap significant gains from their investments. An early investment of $10,000 in Facebook—the startup—for example, would have generated $500 million in gains upon its IPO.1 By selecting and managing a portfolio of young innovative companies, venture capitalists aim to achieve returns that are much higher than those possible through traditional investment channels, making venture capital an important diversifier among investment options.

The Problem

Historically, only “accredited” and high-net-worth investors have had access to venture capital opportunities. Why?

- High Risk Tolerance: Venture capital investments in early-stage startups come with risks, as the risk of failure among startups is higher than that of established companies. Regulators deem accredited investors with income and/or net worth well above average to have the financial sophistication and the wherewithal to withstand potential losses from high-risk investments.

- Illiquidity: Typically, investors in private companies cannot sell their equity stakes easily or quickly. Accredited investors have the financial resources to maintain their capital commitments for extended periods of time.

- Information Asymmetry: Private companies are not required to disclose as much information as public companies. Regulators expect accredited investors to have the expertise and resources to conduct their own due diligence on private companies.

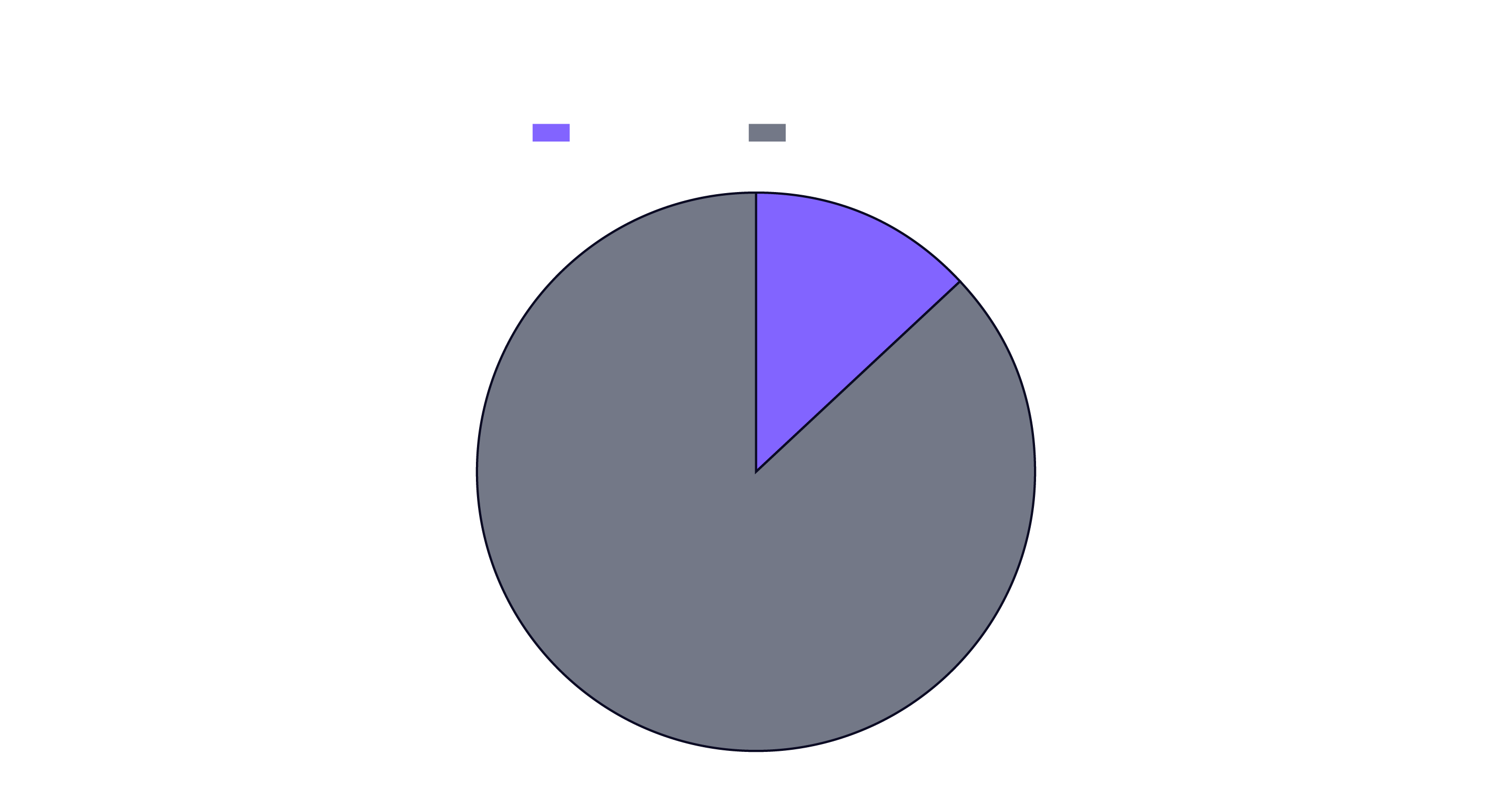

As a result, most retail investors do not have access to investment opportunities unique to the private markets, as shown below.

Source: ARK Investment Management LLC, 2024, Federal Reserve SCF data as of October 20, 2023. https://dqydj.com/accredited-investors-in-america/. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security.

The Securities and Exchange Commission’s (SEC) rules2 around accredited investors’ access to venture opportunities are the government’s efforts to protect unaccredited retail investors from risk. At the same time, with the advent of interval funds in the 1990s, the government has provided a way to mitigate those risks while offering retail investors access to potential exponential growth opportunities in the private markets.

The ARK Venture Fund

The ARK Venture Fund, an interval fund, seeks to democratize venture capital, offering all investors—including those who are not wealthy or classified as accredited—access to what we believe are the most innovative companies throughout their private and public market lifecycles. Importantly, ARK has designed the ARK Venture Fund to address risk, liquidity, and information asymmetry.

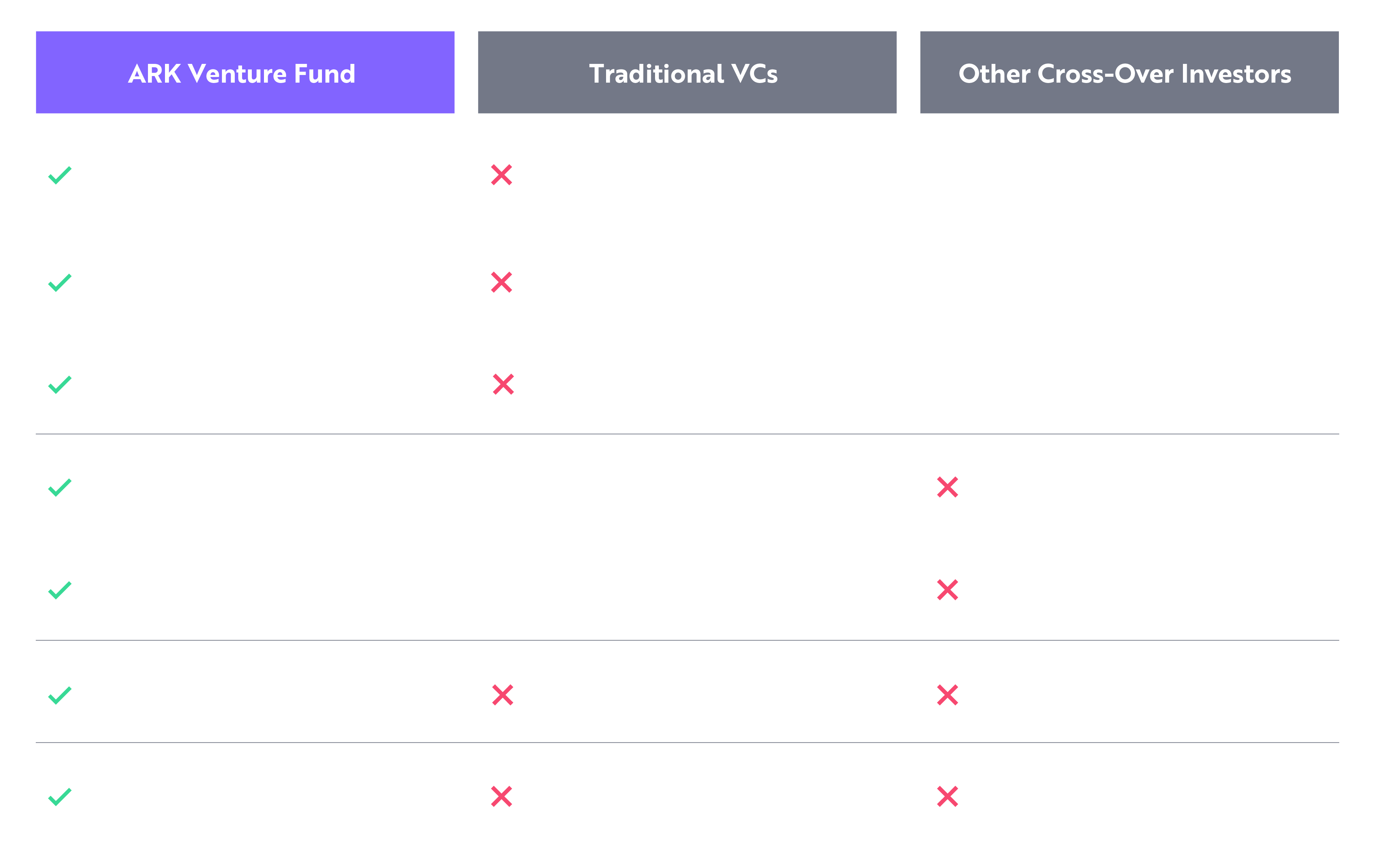

Unlike traditional venture funds with minimum investments in the hundreds of thousands, if not millions, of dollars, the ARK Venture Fund is open to all investors who would like to access the private markets, with an initial investment as low as $500. In addition, the Fund offers 5% liquidity on a quarterly basis3 so that investors are not locked up for years like traditional venture capital. We believe our differentiated value proposition combined with our network of co-investors, public companies, founders, and academics offers access to the most promising companies in both the private and public markets. For a side-by-side comparison between the characteristics of the ARK Venture Fund, traditional venture capital, and other cross-over investment funds, please see the chart below.

Source: ARK Investment Management LLC, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

The ARK Venture Fund blends the growth potential of private companies with the liquidity of public markets. We adjust our allocation to private and public equities dynamically, both to maintain fund liquidity and to potentially capitalize on equities with the highest long-term return potential. Our technology specialists are sector generalists who collaborate with experts surfaced through ARK’s open-research ecosystem to focus on the potential of technologically enabled innovation to scale across sectors as costs fall. The ARK Venture Fund includes companies that our research suggests will address unmet needs and create significant addressable markets. We conduct due diligence on such companies and invest in those we believe will become industry leaders.

Among them today are SpaceX, Epic Games, Databricks, Anthropic, and Discord. Investors in the ARK Venture Fund also have access to video, audio, and written updates, some from the founders of companies in the Fund. For a deeper dive into our portfolio, click here.

Ready to Invest?

We believe that everyone should have access to the high-growth innovation opportunities historically reserved for a select group of people. The ARK Venture Fund is democratizing that access. Discover more about the ARK Venture Fund and begin investing in the future today.

Disclosures

Investors should carefully consider the investment objectives and risks as well as charges and expenses of the ARK Venture Fund before investing. This and other information are contained in the ARK Venture Fund’s prospectus, which may be obtained here. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs. The Fund’s Shares will not be listed on any securities exchange, and the Fund does not expect a secondary market in the Shares to develop. Shares may be transferred or sold only in accordance with the Fund’s prospectus. Although the Fund will offer to repurchase Shares on a quarterly basis, Shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered Shares during a quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy. The ARK Venture Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity.

All statements made regarding investment opportunities are strictly beliefs and points of view held by ARK and investors should determine for themselves whether a particular investment or service is suitable for their investment needs. Certain statements contained in this document may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The matters discussed in this document may also involve risks and uncertainties described from time to time in ARK’s filings with the U.S. Securities and Exchange Commission. ARK assumes no obligation to update any forward-looking information contained in this document. Past performance is not a guarantee of future results.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. The ARK Venture Fund also has specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC (“ARK Invest”) is the investment adviser to the ARK Venture Fund.

https://wiss.com/blog/the-risks-and-rewards-of-investing-in-private-companies/

https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor

Although the Fund will offer to repurchase shares on a quarterly basis, shares are not redeemable and there is no guarantee that shareholders will be able to sell all of their tendered shares during a quarterly repurchase offer.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.