As we recently discussed in our Introduction to the ARK Next Generation Internet ETF (ARKW) blog, artificial intelligence (AI) is rapidly transforming industries—from reshaping enterprise software to revolutionizing customer service and beyond. Building on those foundational insights, this article dives deeper into the revolutionary implications of AI agents, examining their architecture, economic implications, and inevitable disruption of traditional software models.

The software industry stands on the threshold of its most significant transformation since the birth of cloud computing. As highlighted in ARK’s Big Ideas 2025, AI agents—intelligent systems capable of autonomous reasoning, planning, and execution—are poised to reshape nearly every facet of business and consumer life, driving what may become the most profound computing shift since the internet itself.

Source: ARK Investment Management LLC, 2025.1 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

The Evolution of Software: From Static to Autonomous

Historically, software has been relatively deterministic and passive—tools waiting for direct human commands. AI agents fundamentally reverse that relationship. By leveraging advanced natural language understanding and generative reasoning, the new systems become proactive, autonomous problem-solvers—not passive executors.

Source: ARK Investment Management LLC, 2025.2 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Whereas traditional software is built around rule-based logic and explicit programming, AI agents leverage large language models (LLMs), real-time reasoning, and autonomous learning capabilities to:

- Identify user intent intuitively via natural language understanding.

- Independently generate and execute multi-step action plans without human oversight.

- Continuously improve and adapt by incorporating reinforcement learning and external feedback loops.

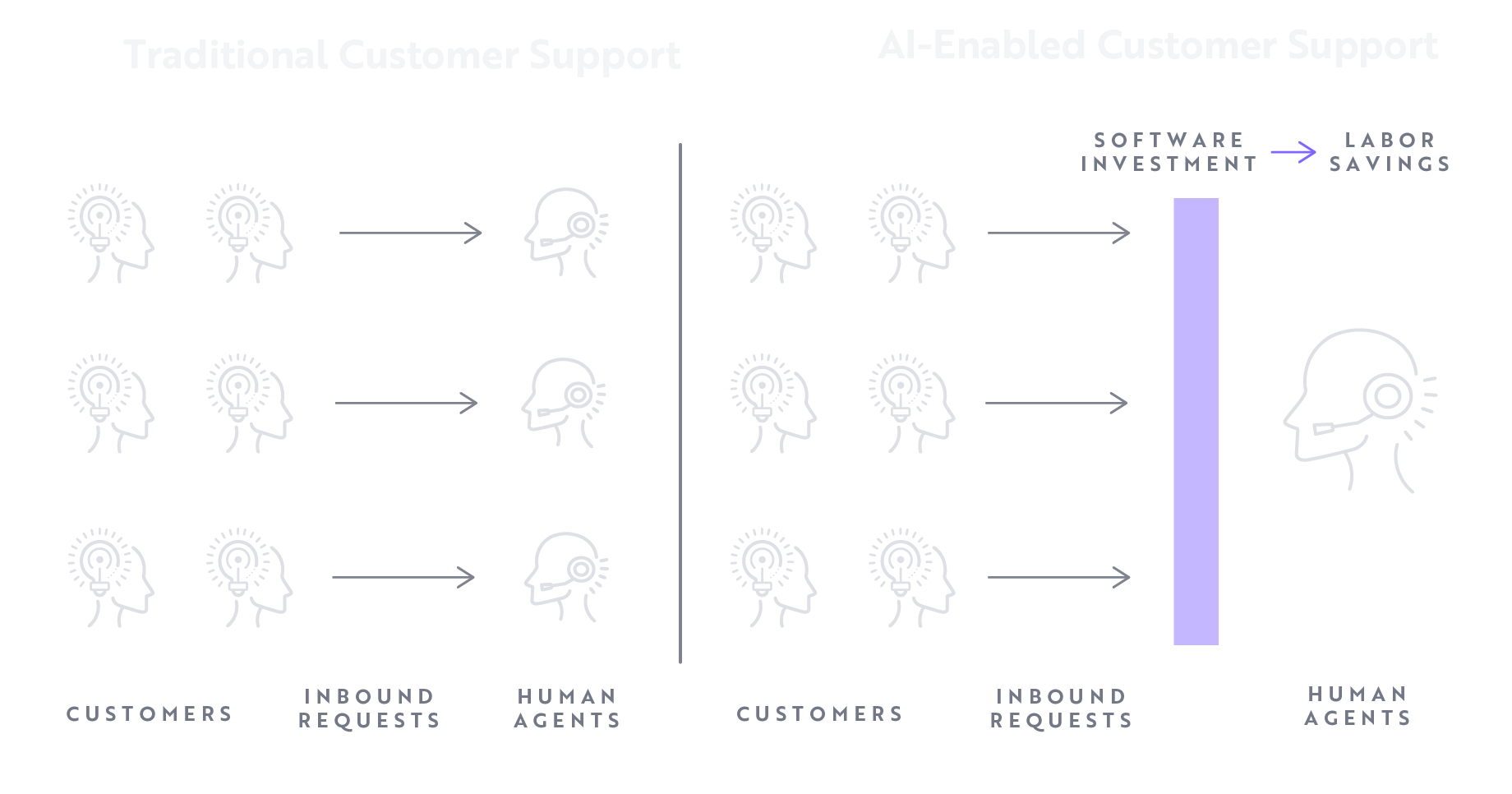

Economic Impact and Productivity Gains

Our research forecasts that AI agents could deliver unprecedented productivity increases, fundamentally altering enterprise software economics. By 2030, enterprise spending on AI-native software could expand dramatically as firms increasingly rely on autonomous systems to streamline operations. Innovative platforms offered by companies like Palantir embed agent-like functionality into enterprise workflows, signaling the early stages of this economic shift. Positioned as the operating system for government and enterprise AI applications, Palantir’s artificial intelligence platform (AIP) enables enterprises to build custom AI-driven software solutions instead of using the one-size-fits-none software products currently available. By providing a unified platform—customized to the needs of each enterprise—for data integration, automation, and decision making, Palantir helps organizations leverage AI to enhance operational efficiency and strategic planning.

Palantir’s offerings potentially represent a structural shift in economics on the order of that seen when personal computing replaced mainframes or when cloud computing overtook traditional data centers. We believe that businesses adopting AI-agent technologies early could experience substantial competitive advantages through enhanced efficiency, lower labor costs, and superior decision-making processes.

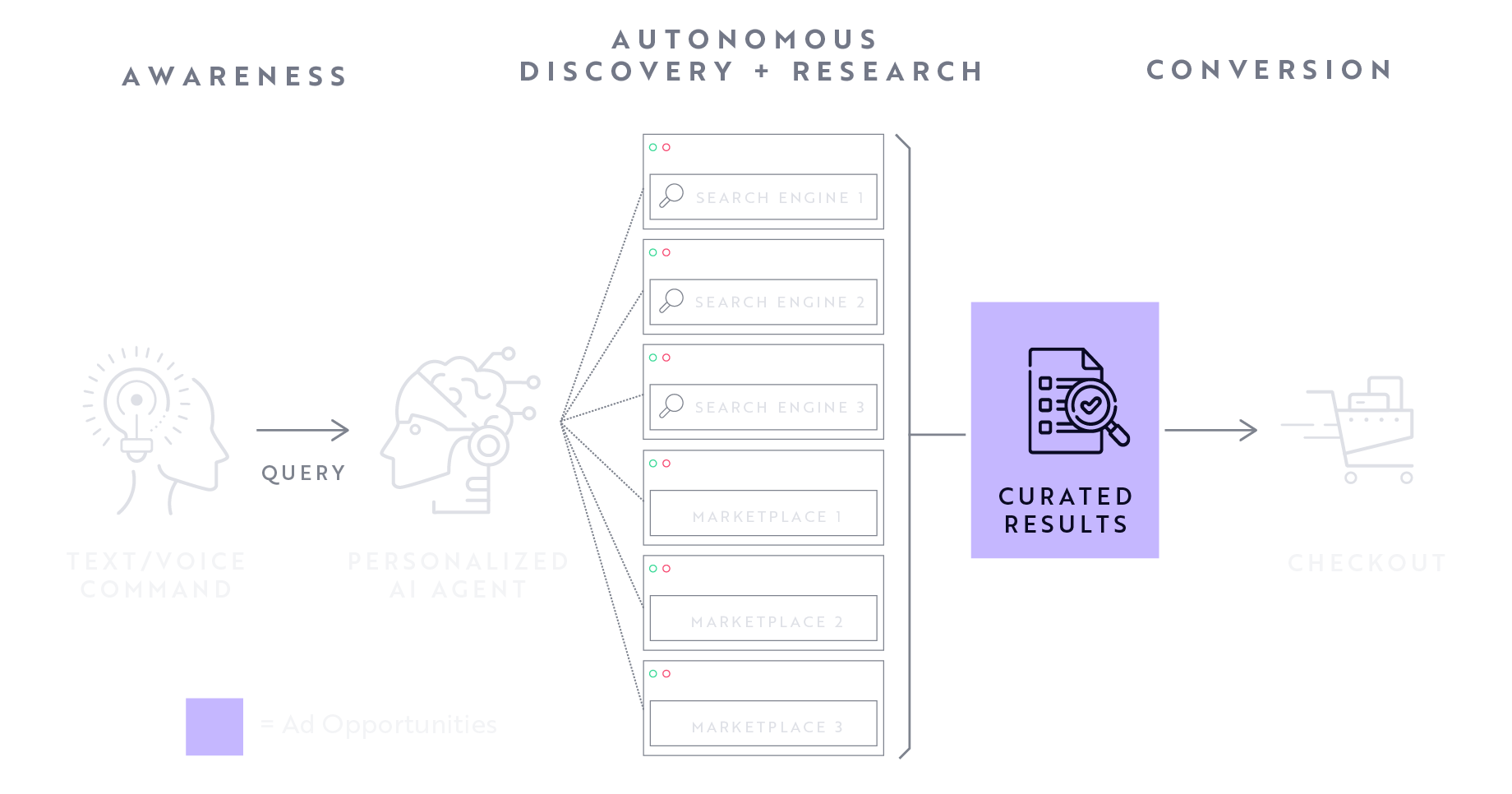

The Consumer AI Revolution

Our research suggests that consumers are increasingly likely to move away from traditional apps toward AI agents that fulfill needs proactively. Instead of navigating separate apps manually, consumers should come to rely on personalized digital assistants that anticipate intent, manage complex tasks (from travel planning to financial management), and integrate into daily routines seamlessly. Some digital wallets are bringing this process to life today. Integrated with Perplexity.ai, Shop Pay, offered by Shopify (SHOP), addresses search by encouraging users to explore product recommendations and complete purchases. Similarly, Klarna’s OpenAI-powered shopping assistant combines search and aggregation with product suggestions based on user preferences, as shown below.

Source: ARK Investment Management LLC, 2025.3 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

In our view, companies that fail to integrate agentic AI will be unable to meet rising expectations for convenience and personalization, ultimately losing relevance.

Scientific Acceleration and Catalyzing R&D Breakthroughs

AI agents are also uniquely capable of managing complex, iterative scientific and engineering processes. Our analyses show that AI-driven research workflows should shorten research and development (R&D) timelines, reduce costs, and accelerate discovery across biotech, pharmaceuticals, and materials science. Specifically:

- Drug Discovery: AI agents simulate millions of molecular interactions autonomously, significantly accelerating new therapies. Companies like Recursion Pharmaceuticals (RXRX) and Absci (ABSI) are at the forefront of this transformation, utilizing AI to automate and accelerate the identification and development of new drugs. Interestingly, “Big Pharma” companies are not the innovators in this field; they are following innovation through partnerships. Players like Recursion should be poised to hold dominant positions in the space.

- Recursion has reduced the cost and time of drug development by leveraging AI to run millions of experiments simultaneously, an approach that speeds up the discovery process and reduces the risk of failure by allowing researchers to focus on the most promising candidates early on. Recursion’s recent merger with Exscientia, a leader in AI-driven chemistry, further enhances its ability to bring first-in-class and best-in-class drugs to market more quickly and less expensively.

- Another great example of AI-drug discovery integration, Absci’s "zero-shot"4 approach to antibody development exemplifies the power of AI in drug discovery. By predicting the best design for a new antibody without the need for extensive trial and error, Absci can shorten the drug development timeline and reduce costs significantly, improving patient outcomes by bringing effective treatments to market more quickly while benefiting investors through faster returns on investment. As it has improved its efficiencies, Absci also has achieved increased efficacy relative to incumbents. In their seminal paper on "zero-shot," Absci identified five antibody candidates that demonstrated superior performance compared to the current market leader in antibody-based drugs targeting human epidermal growth factor receptor (HER2) in breast cancer.

- Software Development: AI reduces timelines dramatically by identifying bugs and writing and testing code autonomously. Companies like GitLab (GTLB) are advancing this frontier by creating AI-powered development environments that boost coder productivity and automate low-level software engineering tasks. GitLab is a DevOps platform that provides a comprehensive suite of tools for software development, deployment, and collaboration, allowing development teams to manage the entire software development lifecycle in one centralized location.

Industries historically limited by labor-intensive R&D could witness rapid leaps in innovation as AI agents autonomously explore solutions at unprecedented scale and speed.

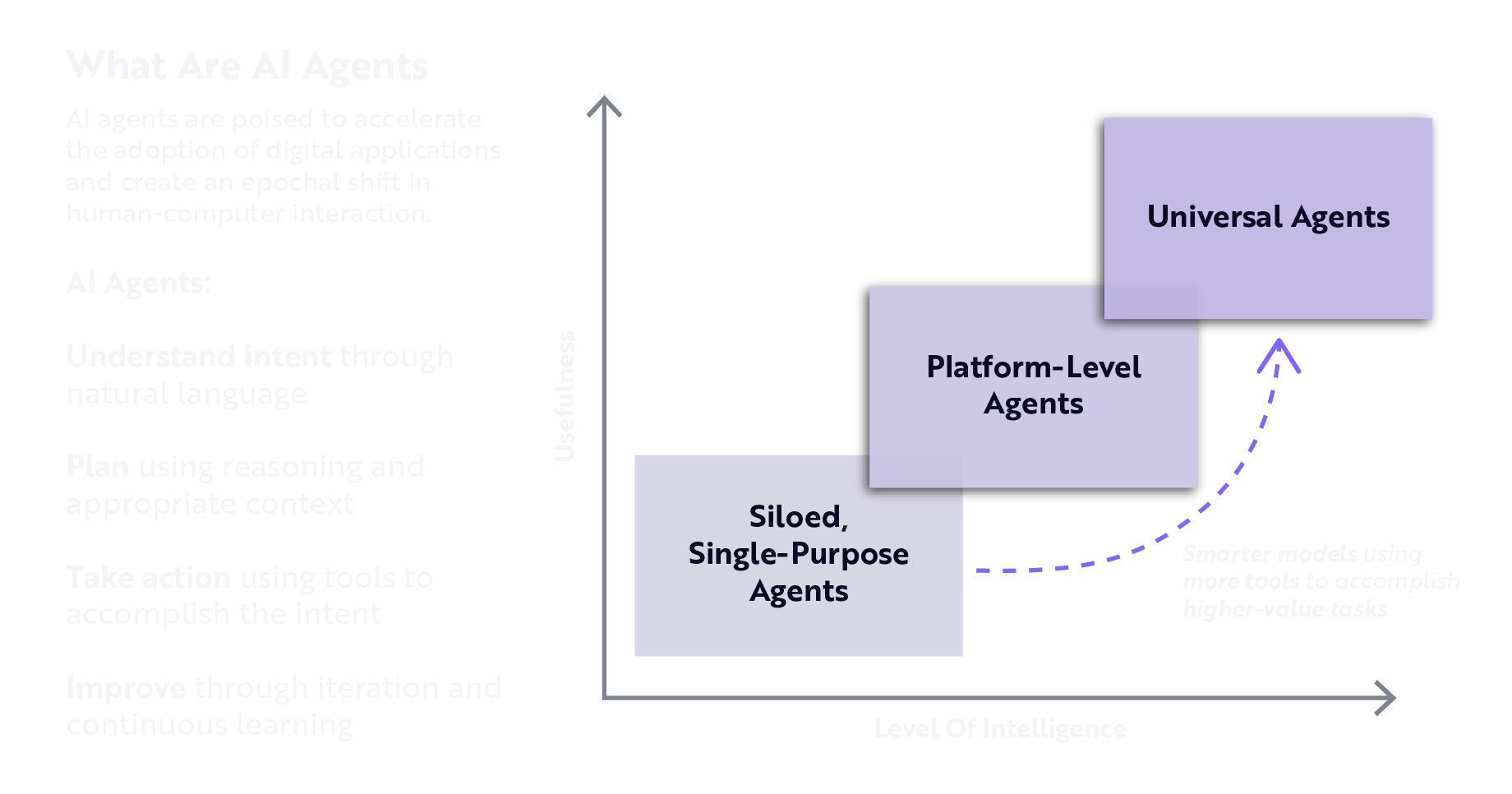

3 Phases of AI Agents: Siloed → Platform → Universal Intelligence

The journey toward fully autonomous AI is incremental, yet profound. At ARK, we have identified three distinct phases:

- Siloed, Single-Purpose Agents: Specialized AI systems for isolated tasks.

- Platform-Level Agents: AI integrated into platforms, handling complex workflows across multiple domains autonomously.

- Universal Agents: General-purpose autonomous AI systems with human-like adaptability.

Today, the world is progressing swiftly into the platform-level agent phase, with major implications for industry structure and human employment. Platform-level agents increasingly will manage integrated business processes—such as complex enterprise resource planning, logistics, and customer management—requiring minimal human intervention.

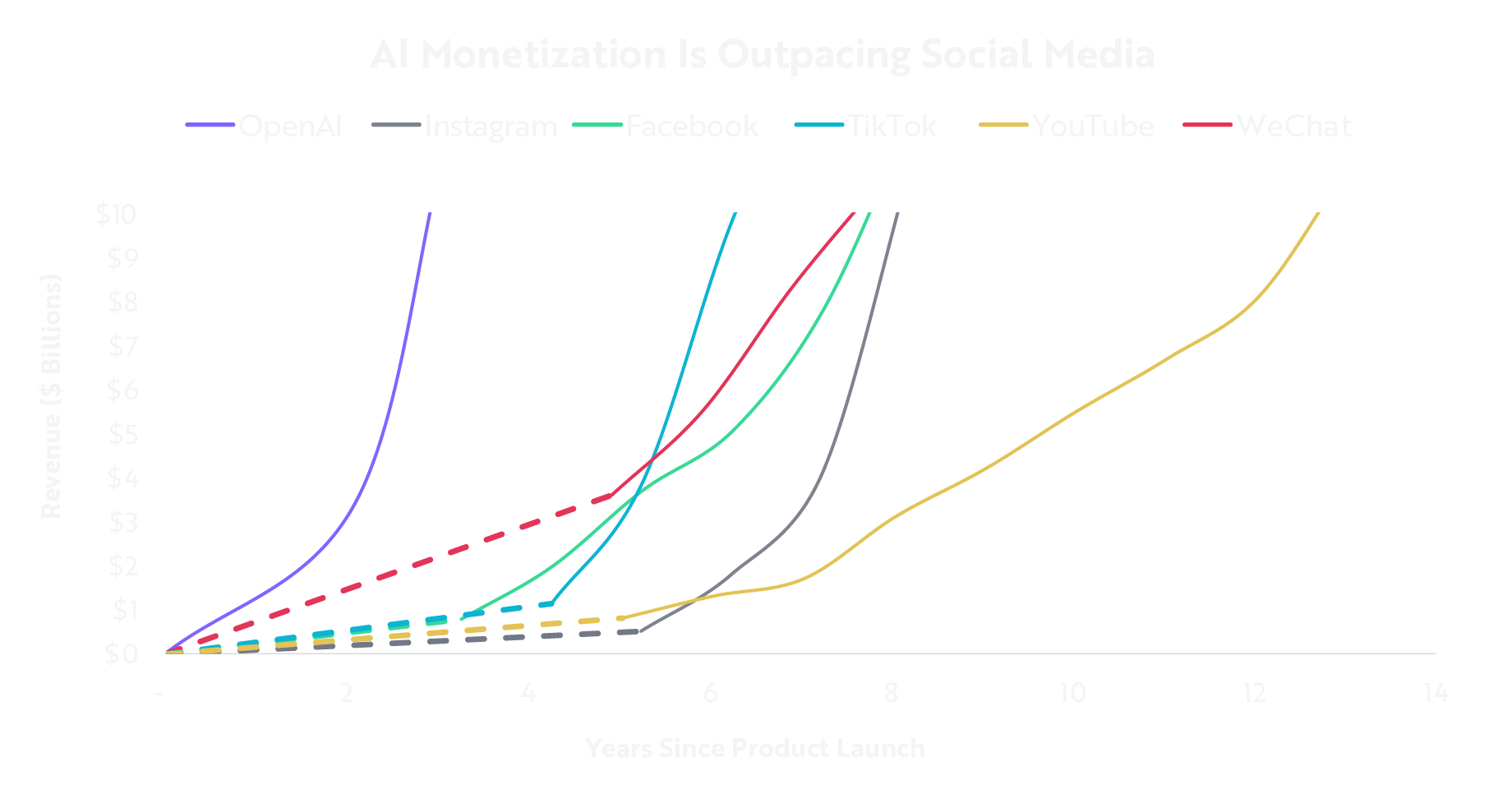

Monetization and the Creation of New Marketplaces

While the market currently is experimenting with various pricing strategies for AI capability, we anticipate significant economic value creation from AI agents, arising primarily from three monetization strategies:

- Agent-as-a-Service (AaaS): Subscription models for sophisticated AI-driven workflows.

- AI Marketplaces and APIs (Application Programming Interfaces): Platforms that allow businesses and consumers to exchange AI-driven capabilities and tasks, charging for those tools based on consumption.

- Autonomous Commerce: AI agents performing transactions independently, boosting e-commerce growth and reshaping market dynamics.

It is likely that companies will mix and match those monetization methods in search of an optimal strategy. For example, Replit, which offers an AI coding agent as part of its cloud-native software development environment, provides a specific amount of AI usage credits as part of a base subscription but will charge on a consumption basis for overage. The pricing method gives businesses the stability baseline expenses they are looking for while aligning interests on value delivered for heavy users.

Source: ARK Investment Management LLC, 2025.5 This ARK analysis draws on a range of external data sources, including Hartig 1998, Dediu 2017, and Sidoti et al. 2024, as of December 31, 2024, which may be provided upon request.6 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

As shown in the chart above, companies like OpenAI at the forefront of deploying those monetization strategies are positioning themselves within emerging, high-value marketplaces enabled by AI agents. The viral success of OpenAI’s ChatGPT created a powerful data flywheel that continues to refine and improve its underlying models. Simultaneously, paid tiers for “prosumers” and business users have spurred strong demand for ChatGPT as a commercial offering tailor-made for employees eager to integrate generative AI into their workflows. Furthermore, API access to OpenAI’s products is creating an ecosystem of AI applications that leverage OpenAI models and agentic frameworks, cultivating a community of developers who are expanding the potential use cases for ChatGPT.

To see ARK’s full investment thesis on OpenAI please visit our OpenAI Investment Thesis.

Reshaping Our Future

As articulated in ARK’s Investment Opportunity Report, AI agents represent a revolutionary computing paradigm shift that redefines software, consumer behavior, and business productivity. Far beyond incremental change, this structural evolution of software into autonomous intelligent systems will touch every industry and create entirely new economic ecosystems.

ARK’s active strategies like the ARK Next Generation Internet ETF (ARKW), the ARK Genomic Revolution ETF (ARKG), and the ARK Venture Fund (ARKVX) are designed to capture these transformative shifts as AI agents reshape software, productivity, and value creation across industries. The companies and sectors prepared to integrate these powerful agents today will lead tomorrow’s economy.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK Fund before investing. This and other information are contained in the ARK ETFs’ prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

An investment in an ARK Fund is subject to risks and you can lose money on your investment in an ARK Fund. There can be no assurance that the ARK Funds will achieve their investment objectives. The ARK Funds’ portfolios are more volatile than broad market averages. The ARK Funds also have specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Funds’ prospectuses.

The principal risks of investing in the ARK Funds include:

Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Equity Securities Risk. The value of the equity securities the ARK Funds hold may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Health Care Sector Risk. The health care sector may be affected by government regulations and government health care programs. Consumer Discretionary Risk. Companies in this sector may be adversely impacted by changes in domestic/international economies, exchange/interest rates, social trends and consumer preferences. Industrials Sector Risk. Companies in the industrials sector may be adversely affected by changes in government regulation, world events, economic conditions, environmental damages, product liability claims and exchange rates. Information Technology Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins.

Additional risks of investing in ARK ETFs include market, management and non-diversification risks, as well as fluctuations in market value NAV. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

To view the top ten holdings for ARKW click here.

To view the top ten holdings for ARKG click here.

To view the top ten holdings for ARKVX click here.

ARK Investment Management LLC is the investment adviser to the ARK Funds.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC. 2025. “Big Ideas 2025.” Section on AI Agents.

ARK Investment Management LLC. 2025. “Big Ideas 2025.” Section on AI Agents.

ARK Investment Management LLC. 2025. “Big Ideas 2025.” Section on AI Agents.

A method that involves designing antibodies to bind to specific targets without using any training data of antibodies known to bind to those specific targets.

ARK Investment Management LLC. 2025. “Big Ideas 2025.” Section on AI Agents.

Hartig, K. 1998. “TUNING IN: Communications Technologies Historically Have Had Broad Appeal for Consumers,” The Wall Street Journal. Dediu, H. 2017. “Share of United States Households Using Specific Technologies.” Our World in Data. Sidoti, O. et al. 2024. “Mobile Fact Sheet.” Pew Research Center.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

Explore ARK Funds

Featured Funds:

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.