Introduction

In our recently-published Introduction To The ARK Innovation ETF (ARKK), we outlined the convergences happening among ARK’s five innovation platforms—public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics—which we believe will define the emerging technological era. In this article, we focus on the ARK Next Generation Internet ETF (ARKW), which invests primarily in companies that are using artificial intelligence (AI), next generation cloud, intelligent devices, public blockchains, and digital wallets to transform both the internet and financial services.

The Opportunity

Computational systems and software that evolve with data are poised to solve intractable problems, automate knowledge work, and accelerate technology’s integration across economic sectors. Indeed, companies’ adoption of neural networks should create value potentially more momentous even than that associated with the introduction of the internet.

Meanwhile, digital assets are transforming financial markets with new methods for transferring value and financial services, likely disrupting traditional banking. Digitally-native assets like bitcoin and ether use advanced technology like cryptography and distributed networks to make transactions transparent and accessible to everyone; assets can be divided into smaller, fractional units that are transferred easily, their ownership verified through encryption.

We believe digital assets are revolutionizing finance, unlocking new business models, democratizing global access, and enabling instant, borderless transactions while cutting costs and delays. Investors can seek to capitalize on those advancements, potentially redefining our daily lives and fueling economic growth and human prosperity.

The ChatGPT Moment

Building on years of progress since Google invented transformer architecture in 2017, OpenAI’s ChatGPT, released in November 2023, has catalyzed the public’s understanding of Generative AI, as shown below, its simple chat interface immediately giving consumers the tools to harness the power of large language models (LLMs). With impressive performance on a wide range of tests, AI models like GPT-4o have sparked a boom in productivity that our research suggests will accelerate.

ChatGPT Delighted Consumers And Enterprises

.png)

.png)

Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources, which are available upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

AI also is having rather immediate positive impacts on companies’ customer service operations, wherein traditional support teams have long relied on human agents. By integrating AI, customer service teams now can enhance their efficiency significantly—either by increasing the volume of customer interactions handled with the same workforce or by reallocating human agents to complex, higher-value tasks. As it continues to evolve, AI should tackle a growing share of such workloads, enabling businesses to streamline operations while human agents focus on strategic, high-impact responsibilities.

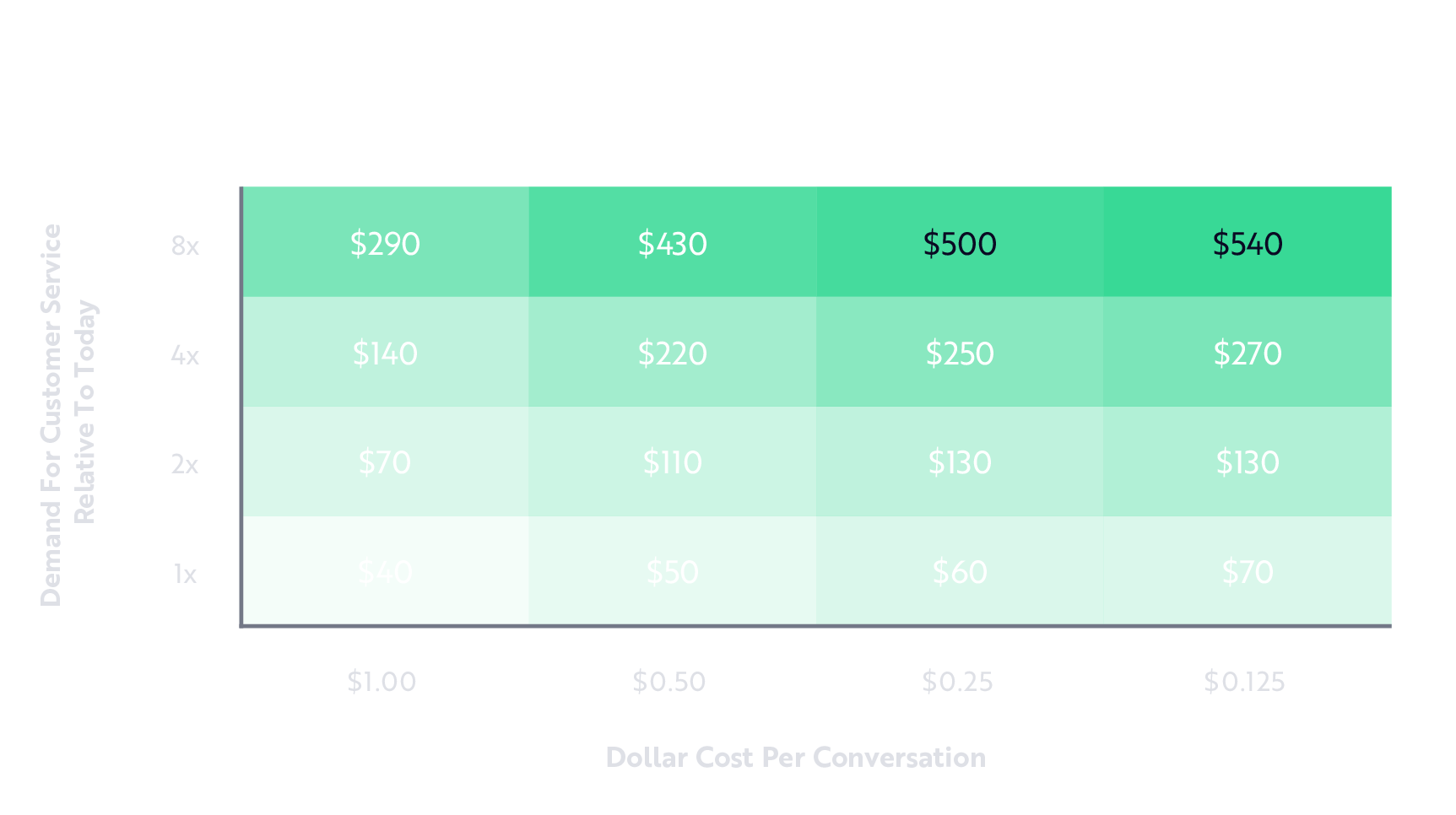

New products from OpenAI and Salesforce are augmenting human customer service representatives cost-effectively. At a conservatively estimated fixed cost of $1 per conversation, our research suggests AI agents could save enterprises significant sums once they can handle 35% of customer service inquiries, as shown below.

AI Cost Declines Should Impact Agent Economics Significantly

.png)

*Assumes fixed cost of $1 per customer interaction. **Assuming 70% of interactions can be handled by AI in all scenarios, corresponding to the 70% bar in the left-hand chart. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources, including ZipRecruiter and OpenAI, as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

AI agents also should reduce onboarding, hiring, and seat-based software costs while offering greater scalability than is possible with human labor.

AI Is Reshaping the Software Value Chain

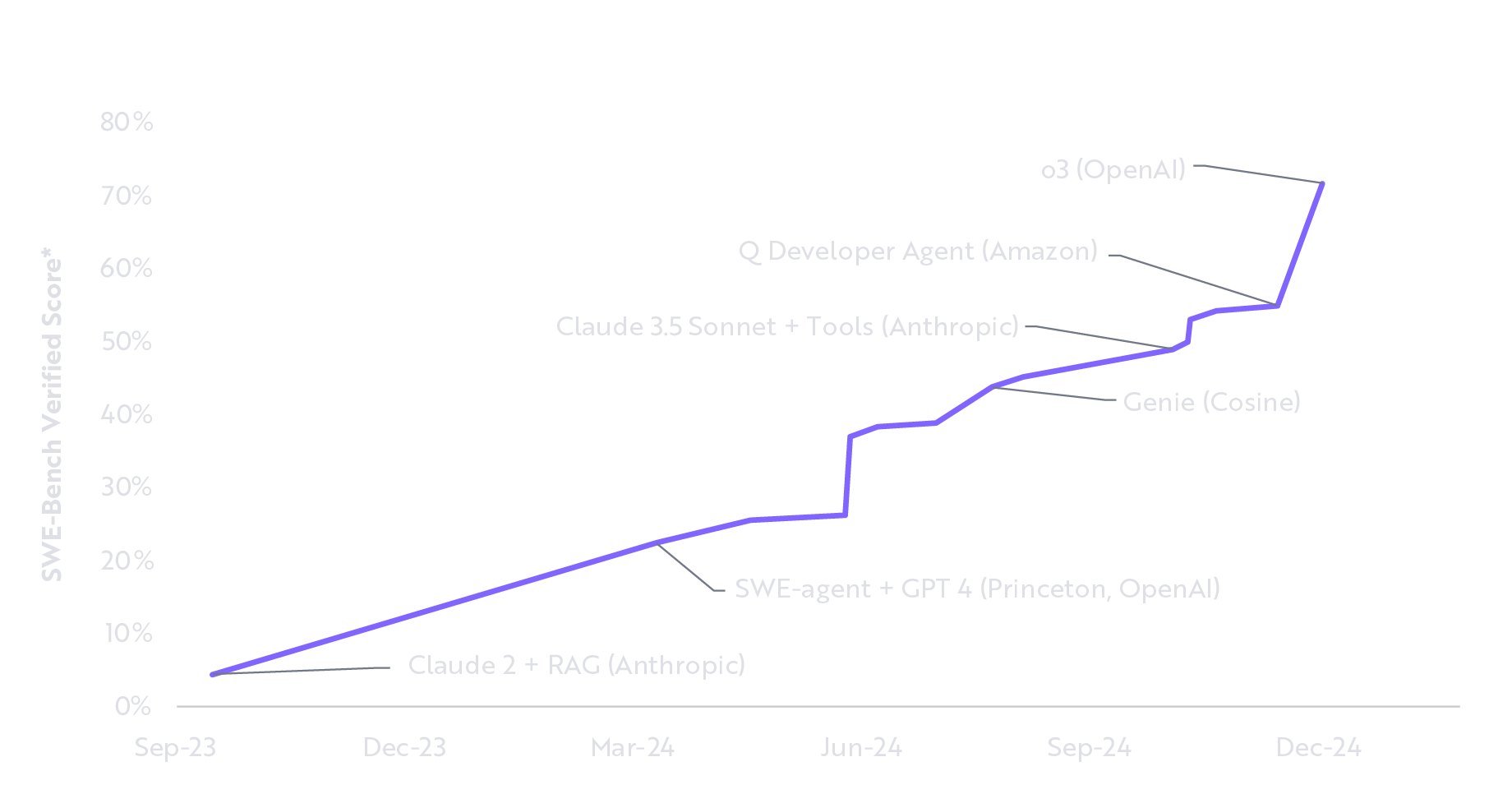

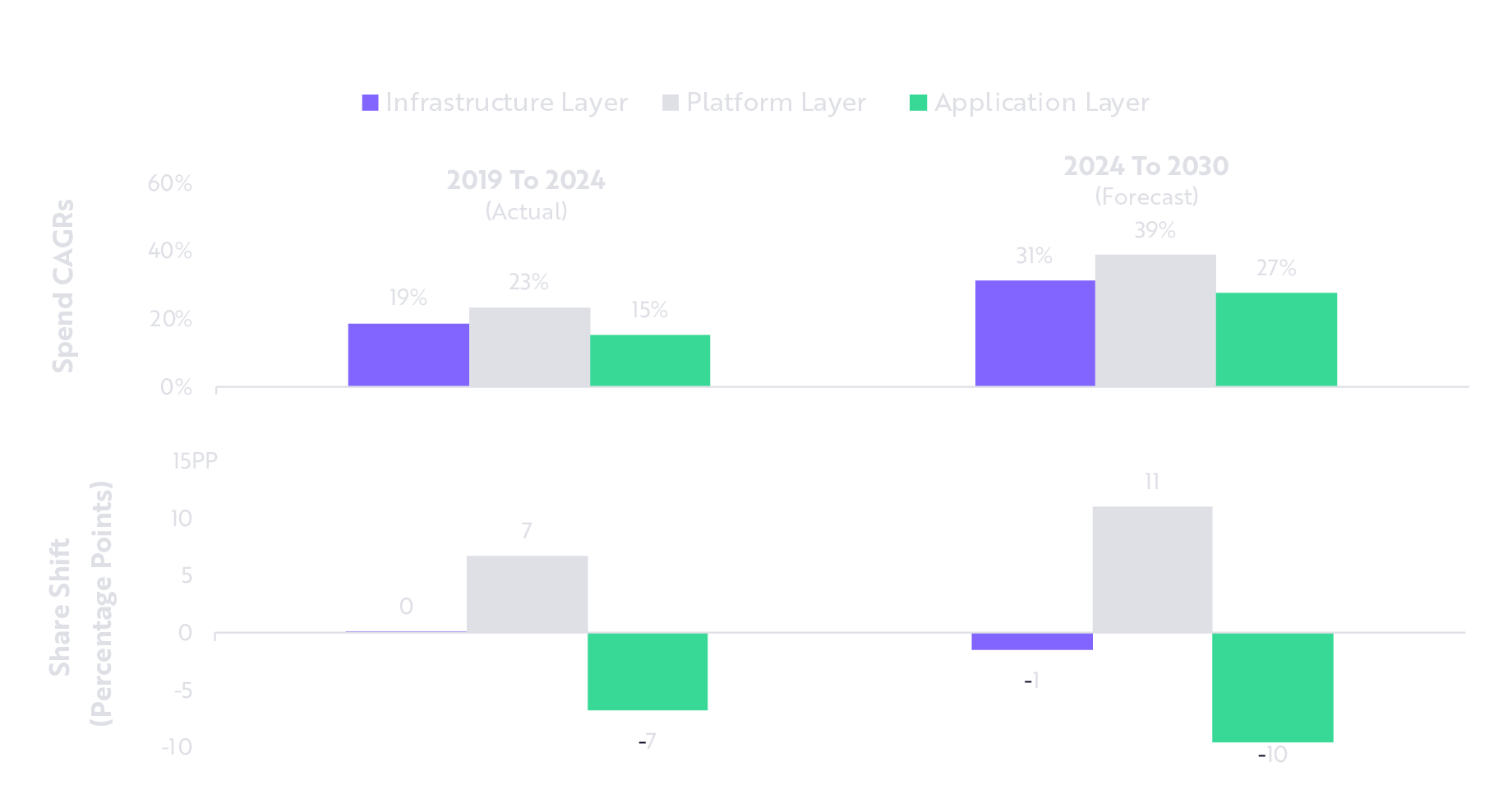

ARK’s research also suggests that AI’s impacts go beyond replacing human work on repetitive tasks. It is fundamentally altering all knowledge work, from customer support to software engineering. AI agents now can solve coding challenges autonomously, for example, accelerating development cycles and enhancing enterprise software solutions. As AI continues to improve, the productivity of software development should shift significantly. AI-driven automation should reshape enterprise IT decisions, making "build vs. buy" a more competitive debate. As customer software proliferates, growth in all layers of the software stack should accelerate, even as share shifts toward the platform layer, as shown below.

Note: “CAGR”: Compound Annual Growth Rate. *SWE-Bench is a benchmark that measures AI agents’ ability to write code autonomously. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

We believe this technological shift presents a generational opportunity for investors—both tech-enthusiasts and those wary of disruption—to capitalize on the next wave of enterprise software and AI-driven innovation. The pace of disruption is accelerating. Are you positioned to capture its full potential?

The ARK Next Generation Internet ETF (ARKW)

Markets have begun to recognize that artificial intelligence (AI) is driving a technological revolution poised to reshape industries on a global scale. The "Magnificent Six"—Apple, Amazon, Google, Meta, Microsoft, and Nvidia—have dominated headlines thanks to their aggressive investment in AI infrastructure, particularly via Nvidia GPUs that have fueled next-generation data centers. As a result, most AI-focused ETFs have concentrated their holdings in those industry giants, capitalizing on their substantial returns during the first wave of AI-driven growth.

That said, ARK’s research strongly suggests that the AI revolution extends far beyond mega-cap tech, its future massive growth potential more likely to be delivered by a more diverse group of innovators. The ARK Next Generation Internet ETF (ARKW) provides investors exposure to some of those companies, ones that our research suggests will drive the next wave of AI. ARKW also actively manages indirect exposure to digital assets like bitcoin and ether.

Again, to learn more about the next wave of AI please read our blog ARK’s Guide To Investing In AI And Robotics.

The ARK Next Generation Internet ETF (ARKW) is an actively managed exchange-traded fund (ETF) that seeks exposure to companies redefining the internet by enabling the seamless integration of artificial intelligence (AI), next gen cloud, intelligent devices, public blockchains, and digital wallets. As the digital world continues to evolve, ARKW offers a public market approach that echoes the tenets of venture capital investing—an attractive choice for investors eager to participate in the emerging trends shaping our increasingly connected future. Furthermore, because ARKW’s relative returns often have a low correlation with traditional growth and value strategies, this ETF can provide potential diversification benefits.

Through active management, ARKW adapts to breakthroughs in technology and changes in the market landscape, positioning investors for potential growth as internet-based platforms reshape industries and daily life. While portfolios centered on disruptive innovation can be more volatile, they also can offer substantial long-term opportunities, especially when risk is properly managed through well-considered allocation strategies. We believe that forward-looking investors stand to benefit from investing in the pioneering companies redefining connectivity, commerce, and communication on a global scale. Ultimately, the ARK Next Generation Internet ETF provides a distinctive opportunity to invest in the next wave of digital transformation poised to reshape economies worldwide.

To learn more about the ARK Next Generation Internet ETF please watch our Funds In Focus – ARKW video.

Ready to Invest?

We encourage investors to work with a chosen financial professional to explore the potential benefits of incorporating an innovation-based strategy like the ARK Next Generation Internet (ARKW). We would be delighted to provide additional, high-level information for investor review in collaboration with their trusted financial professional. Please reach out for more information. Discover more about the ARK Next Generation Internet ETF here.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK Fund before investing. This and other information are contained in the ARK ETFs’ prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

An investment in an ARK Fund is subject to risks and you can lose money on your investment in an ARK Fund. There can be no assurance that the ARK Funds will achieve their investment objectives. The ARK Funds’ portfolios are more volatile than broad market averages. The ARK Funds also have specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Funds’ prospectuses.

The principal risks of investing in the ARK Funds include:

Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Equity Securities Risk. The value of the equity securities the ARK Funds hold may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Health Care Sector Risk. The health care sector may be affected by government regulations and government health care programs. Consumer Discretionary Risk. Companies in this sector may be adversely impacted by changes in domestic/international economies, exchange/interest rates, social trends and consumer preferences. Industrials Sector Risk. Companies in the industrials sector may be adversely affected by changes in government regulation, world events, economic conditions, environmental damages, product liability claims and exchange rates. Information Technology Sector Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins.

Additional risks of investing in ARK ETFs include market, management and non-diversification risks, as well as fluctuations in market value NAV. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

To view the top ten holdings for ARKW click here.

Growth investing is a stock-buying strategy that looks for companies that are expected to grow at an above-average rate compared to their industry or the broader market. Growth investors tend to favor smaller, younger companies poised to expand and increase profitability potential in the future.

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively search for stocks they think the stock market is underestimating.

ARK Investment Management LLC is the investment adviser to the ARK Funds.

Foreside Fund Services, LLC, distributor.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.