Introduction

In our recent Introduction To The ARK Innovation ETF (ARKK), we outlined how ARK’s five innovation platforms—public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics—are converging, sparking a new technological revolution that could redefine the next business cycle. In this article, we zoom in on the ARK Fintech Innovation ETF (ARKF), which invests in companies that we believe are revolutionizing the financial industry. Regulatory changes have shifted the economics of intermediating capital, reconfiguring the value-chain in ways that competitors can exploit. Technology is changing the ability of financial institutions to assess risk, interact with customers, and facilitate transactions.

The Opportunity

Fintech innovation is reshaping the global financial landscape by leveraging advanced technologies like artificial intelligence, blockchain, and mobile platforms to create faster, more inclusive, and more efficient financial systems. At its core, fintech represents the convergence of technology and financial services to transform legacy infrastructure and unlock powerful, previously unimaginable business models.

Just as the internet revolutionized the flow of information, fintech is revolutionizing the flow of value. Digital wallets, peer-to-peer payments, blockchain-based networks, and decentralized financial platforms (DeFi) are enabling real-time, borderless transactions, reducing friction, and expanding access to capital markets. These breakthroughs are not only disintermediating traditional banks and payment processors but also extending financial services to billions of underbanked and unbanked individuals worldwide.

As this transformation unfolds, investors have the opportunity to participate in the early stages of a financial renaissance that we believe will accelerate productivity, reduce inequality, and drive a more connected and prosperous global economy.

Digital Wallets Are Consolidating Financial Services and E-Commerce

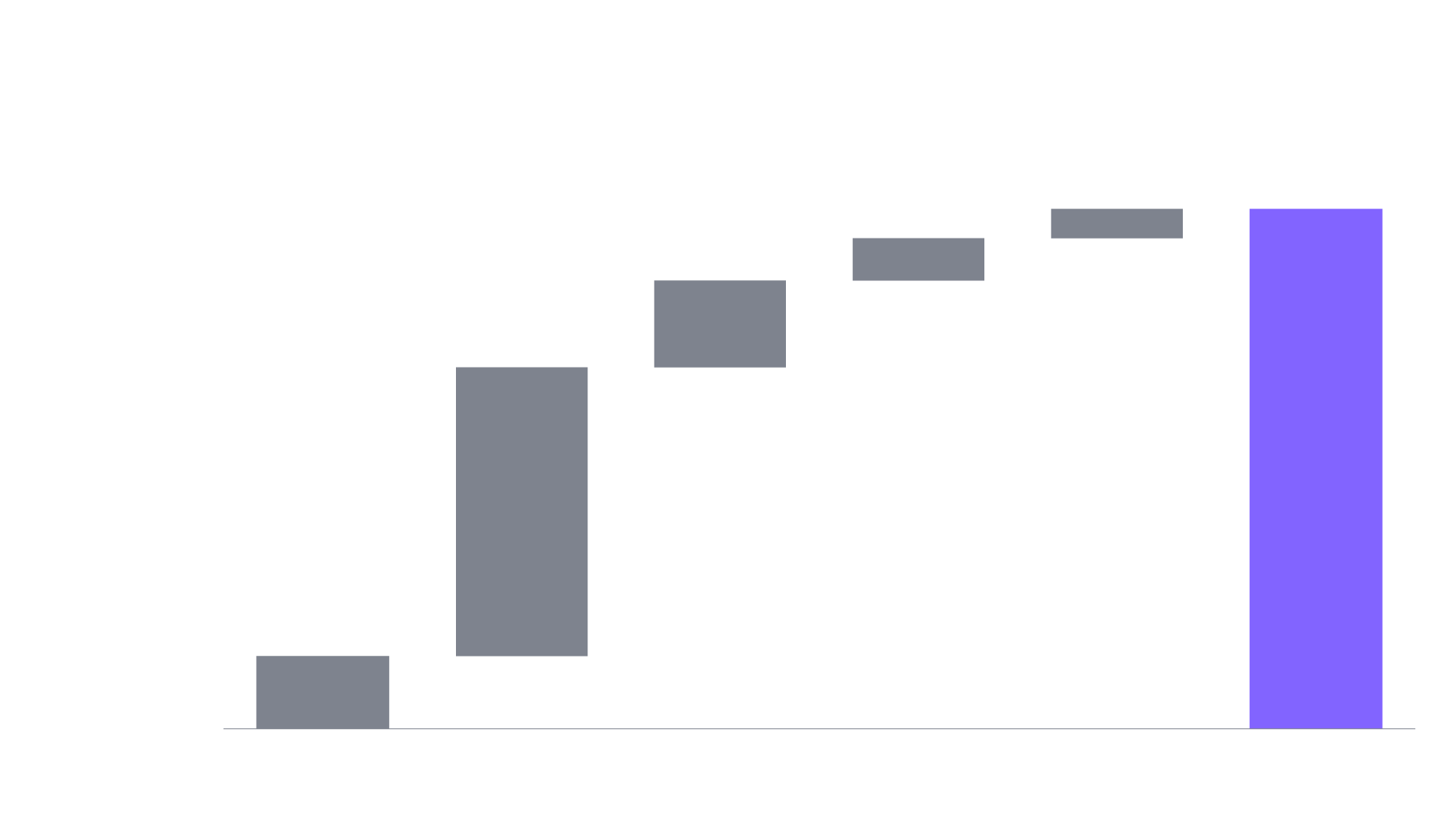

Based on our research, consumer-facing digital wallet platforms like Block, Robinhood, and SoFi are capturing enterprise value of approximately $1,800 per user today—value based on the many services layered into these ecosystems, including: $250 from checking and savings, $1,000 from lending, $300 from insurance, $150 from investing, and $100 from e-commerce, as shown below. As digital wallets expand their capabilities, they are capable of replacing traditional banking products and becoming comprehensive financial hubs that seamlessly blend payments, credit, investing, and shopping within one app . This consolidation positions digital wallets as powerful drivers of consumer engagement and revenue growth across financial and commerce sectors.

Note: “Checking & Savings” data include Checking & Savings, Debit Card, and Peer to Peer Payments. “Lending” data include Loans & Mortgages, Credit Card, and Buy Now Pay Later (BNPL). Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources representing the revenues, margins, and multiples of leading digital wallets and established incumbents, as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

AI Agents Poised to Transform Consumer Search and Discovery

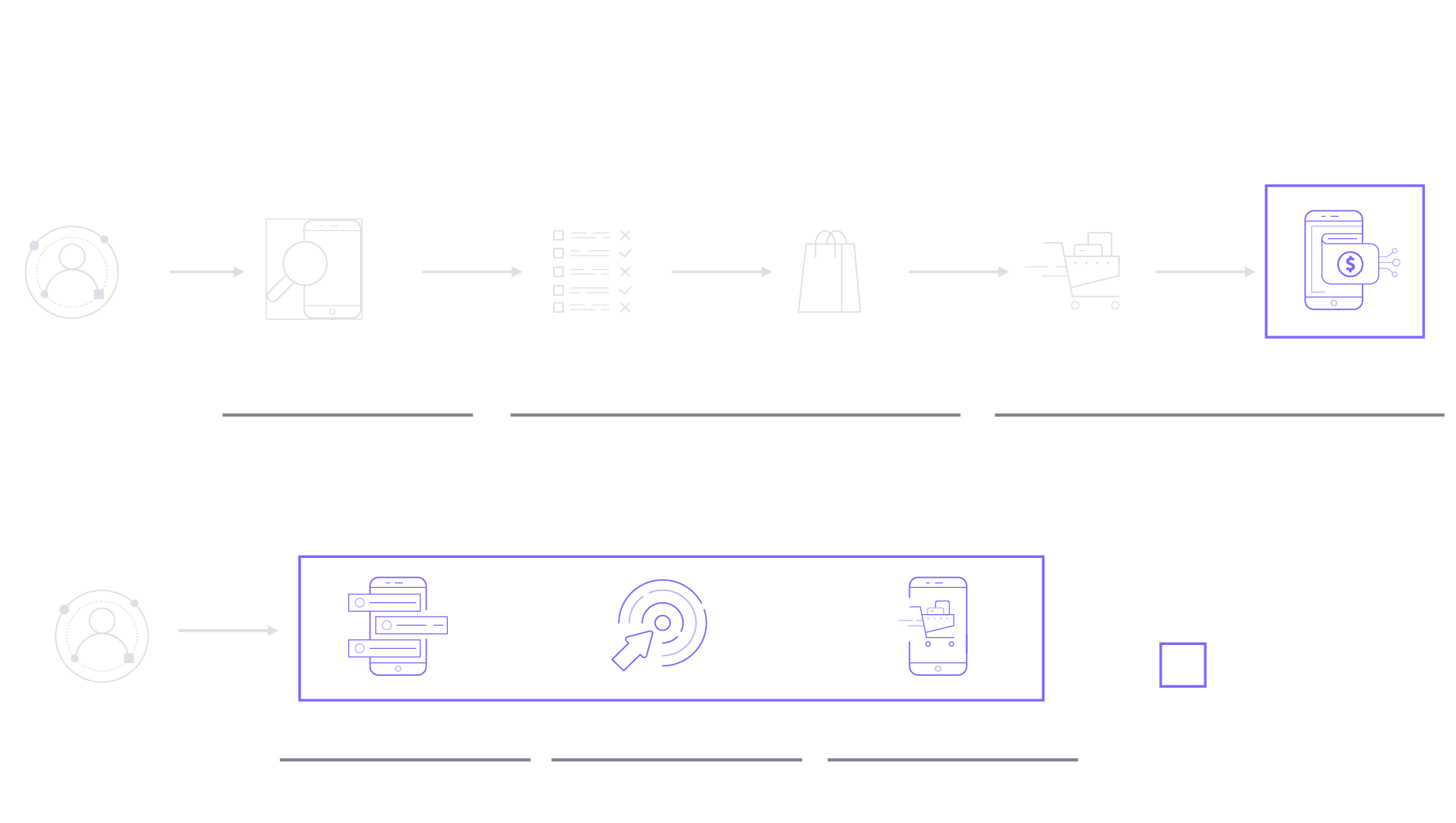

Building on that trend, AI agents are set to redefine how consumers interact with these digital ecosystems. As recently discussed in our AI Agents And The Intelligent Software Economy blog, AI agents are poised to reshape nearly every facet of business and consumer life, including the shopping journey. Instead of consumers navigating search engines, aggregators, and shopping carts, AI-powered agents autonomously will handle discovery, evaluation, and checkout in one seamless flow. That process will replace today’s fragmented, multi-step “one-query purchasing,” in which consumers issue a single instruction and the agent completes the transaction using integrated digital wallet payment.

Instead, as shown in the graphic below, purchasing agents will move digital wallets upstream, beyond simple checkout tools, transforming them into personalized commerce hubs. These agents will interact directly with marketplaces, deliver tailored results, and execute automatic checkouts. Our research suggests that this shift could unlock major efficiencies, giving consumers time-saving convenience and pushing digital wallets to the forefront of e-commerce and digital spending globally.

Source: ARK Investment Management LLC, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Digital Assets and Payment Innovation: Transforming Financial Infrastructure

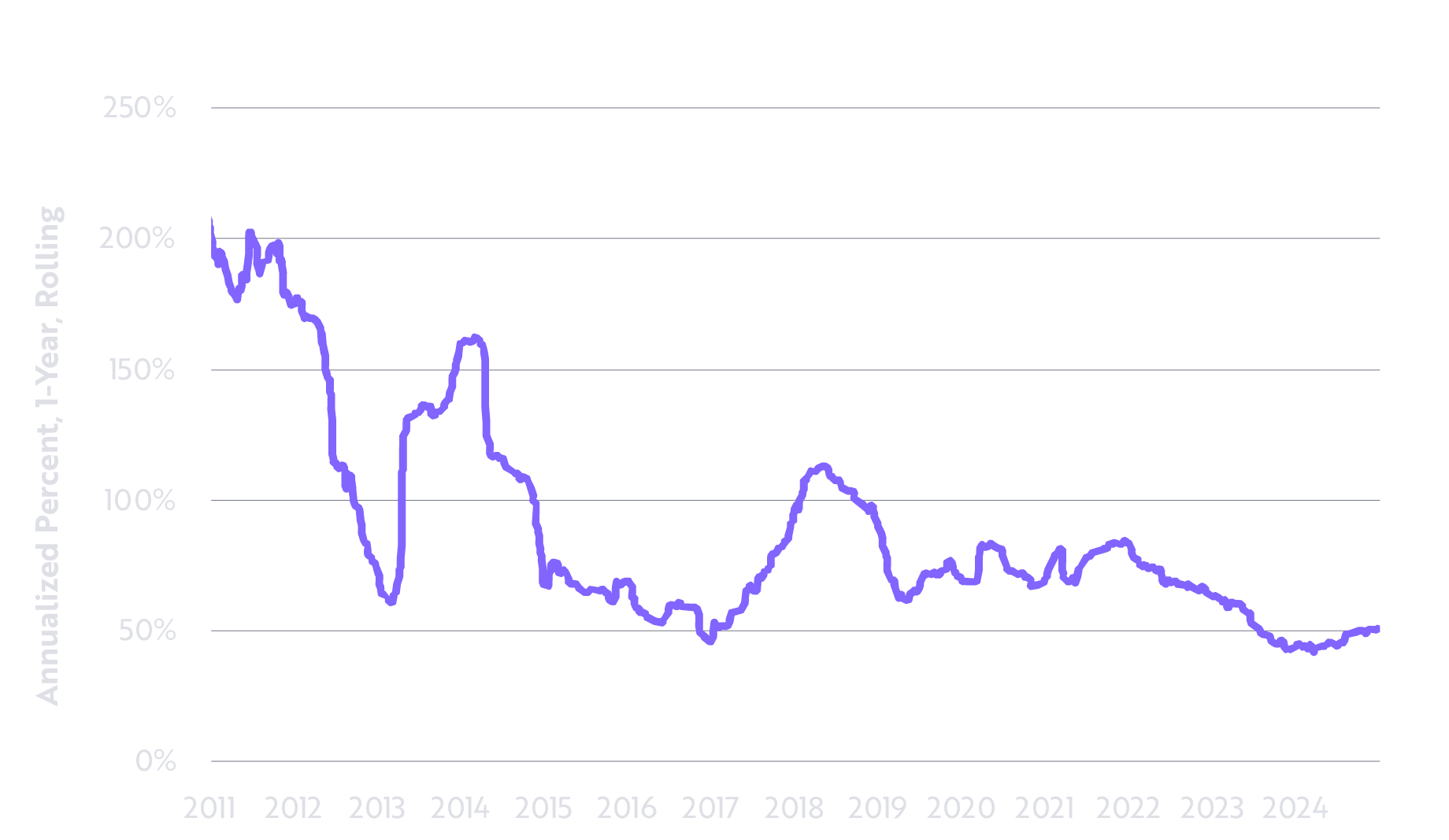

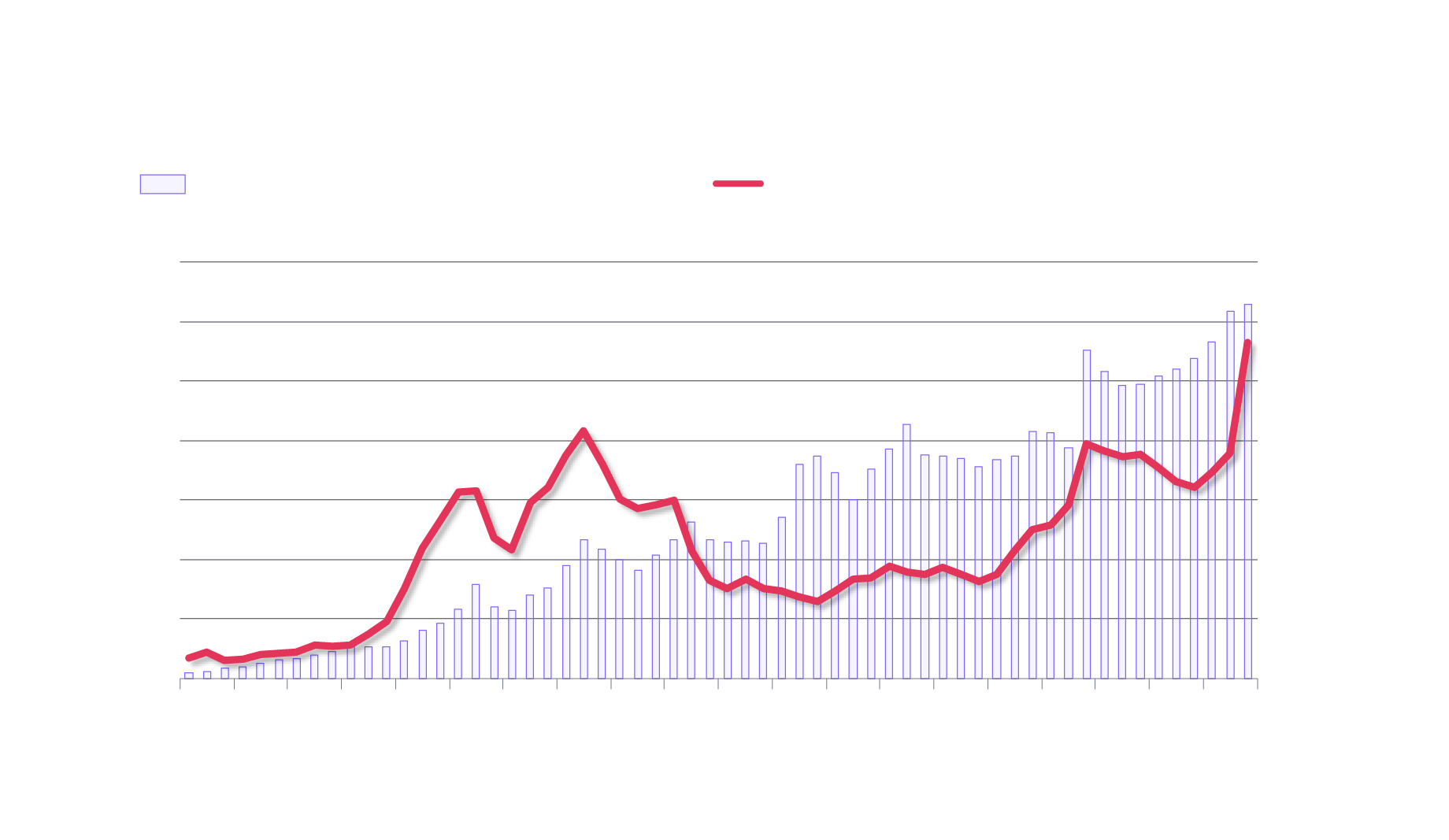

In parallel with the rise of digital wallets and AI-powered financial services, digital assets are reshaping global financial infrastructure. The launch of spot bitcoin ETFs, for example, has marked the most successful ETF rollout in history, attracting over $4 billion in inflows on the first day and reaching nearly $100 billion in assets under management (AUM) within the first year. Remarkably, this surge in institutional adoption has coincided with bitcoin’s annual volatility falling to historic lows, highlighting a maturing asset class with growing investor confidence.

.png)

[1] GBTC and DEFI are not included. [2] “AUM”: assets under management. Source: ARK Investment Management LLC, 2025, based on data from Glassnode and World Gold Council as of December 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

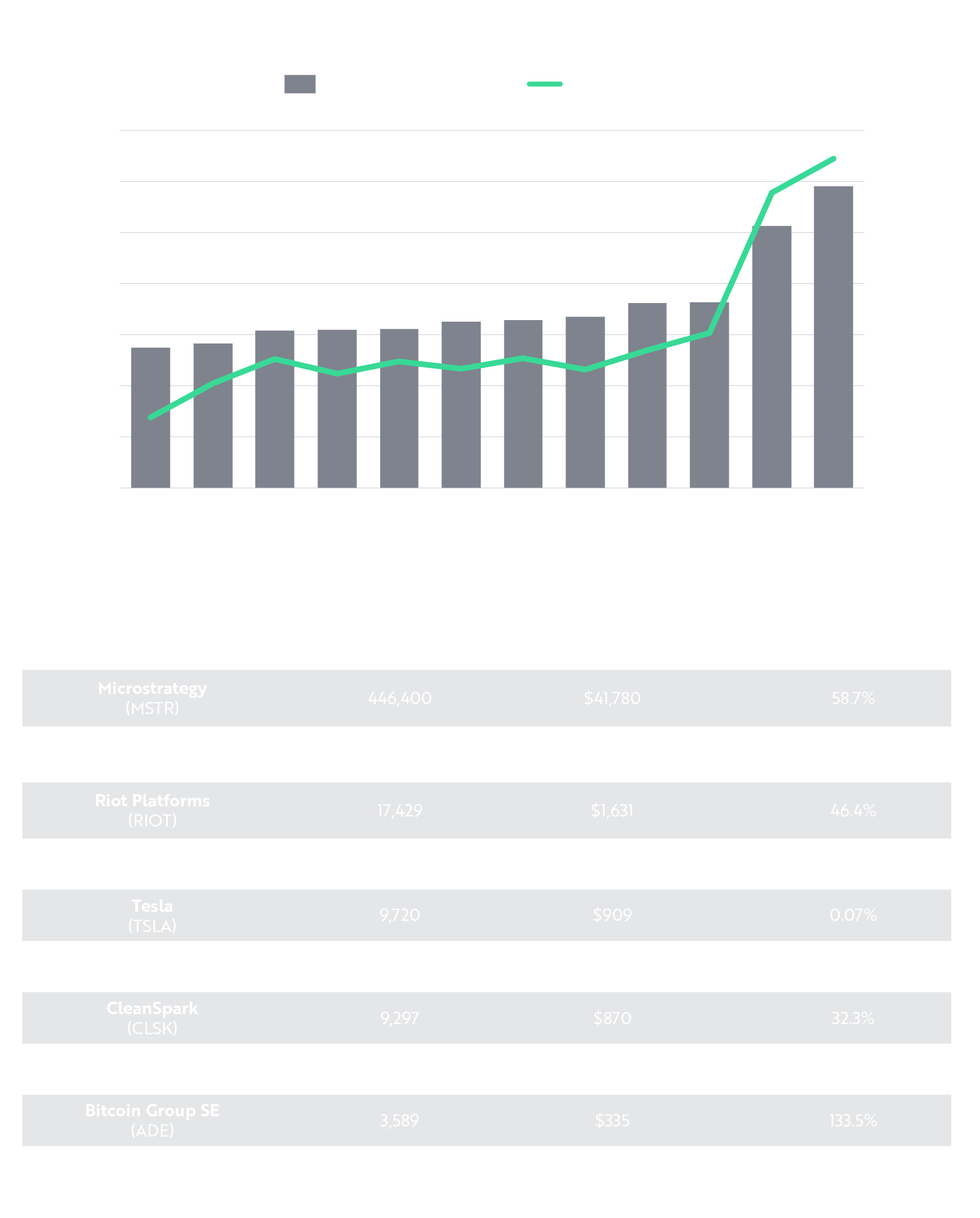

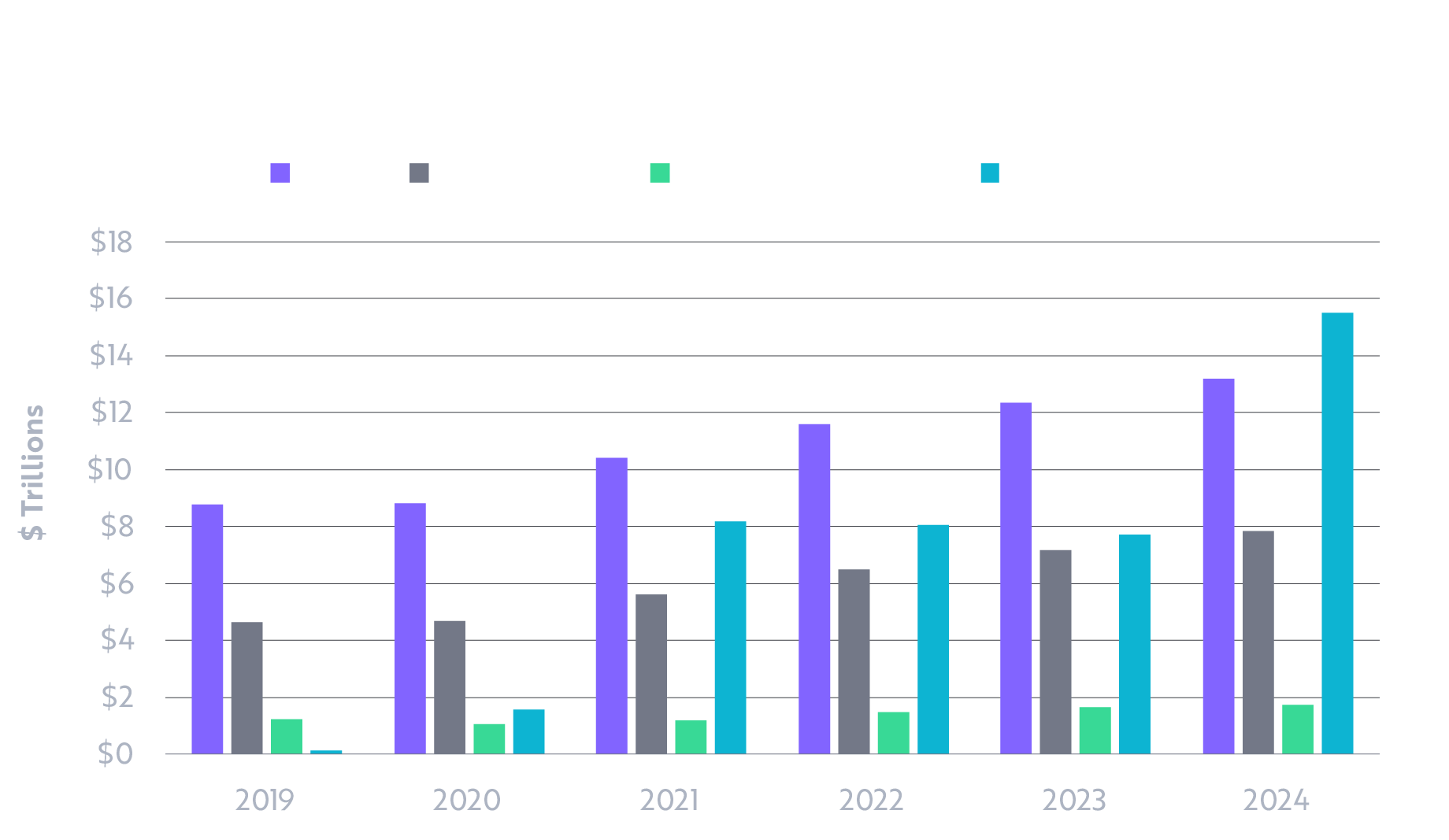

At the same time, an increasing number of public companies are incorporating bitcoin into their balance sheets, recognizing its potential as a treasury reserve asset. Over 70 public companies now hold bitcoin, with combined values surging from $11 billion in 2023 to $55 billion in 2024, as shown below. That trend underscores the growing corporate acceptance of digital assets as part of capital strategy and risk management.

Source: ARK Investment Management LLC, 2025, based on data from Bitcoin Treasuries and TradingView as of December 31, 2024. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency.

Finally, stablecoins have emerged as one of the fastest-growing segments in digital payments, surpassing Visa and Mastercard in annual transaction value in 2024, as shown below. With more than $15 trillion in stablecoin transactions, these digital currencies are enabling high-value, borderless commerce and payment settlement at scale—another indicator that blockchain-based systems increasingly challenge traditional financial rails.

Note: In the lefthand chart, stablecoins data are for calendar year, while credit card data are for fiscal year. Source: ARK Investment Management LLC, 2025. This ARK analysis is based on a range of external data sources, including Wall Street Zen, CoinGecko, and Visa OnChain Analytics, as of December 31, 2024, which may be provided upon request, For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency.

These trends reinforce ARK’s conviction that digital assets, blockchain technology, and associated payment innovations will be integral to the future of financial services—areas that ARKF aims to capture through active research and focused portfolio construction.

The ARK Fintech Innovation ETF (ARKF)

According to our research, digital wallets, artificial intelligence, blockchain technology, and fintech innovations are poised to redefine the global financial system. From mobile payments and digital lending to crypto assets, neobanking, and AI-driven financial services, these technologies are transforming how consumers and businesses manage, move, and grow capital. Yet, many of the companies at the forefront of this shift remain underrepresented in traditional financial sector benchmarks. As a result, investors seeking exposure to this disruptive wave may find conventional portfolios lacking. The ARK Fintech Innovation ETF (ARKF) aims to address that gap by offering a concentrated, high-conviction portfolio focused on companies we believe are enabling the future of financial services and commerce.

The ARK Fintech Innovation ETF (ARKF) is an actively managed ETF designed to capture the breadth of fintech innovation. It includes companies advancing mobile payments, blockchain technology, digital wallets, peer-to-peer lending, and financial data analytics, as well as platforms that integrate AI to enhance personalization and risk management in financial services. Whether it’s digital wallet providers transforming e-commerce or blockchain networks redefining how assets are transferred and secured, ARKF targets firms that are reshaping financial infrastructure at a global scale. Like venture strategies, ARKF seeks exposure to early-stage technologies with disruptive potential—but it does so through a liquid, transparent vehicle that can serve as a dynamic allocation within a modern portfolio. Its unique focus also offers potential diversification benefits beyond traditional financial sector exposures.

Through active research and real-time portfolio adjustments, ARKF continuously evolves to reflect emerging trends in fintech and digital commerce. As innovations like artificial intelligence, digital wallets, and blockchain technology converge to unlock new business models, we believe investors have an opportunity to participate in the transformation of financial services. While disruptive innovation strategies can introduce greater volatility, they also reflect the powerful long-term growth potential inherent in fintech innovation. For those seeking to align their portfolios with the future of financial ecosystems and digital commerce, the ARK Fintech Innovation ETF offers a differentiated and forward-looking solution.

To learn more about the ARK Fintech Innovation ETF please watch Fund In Focus - ARKF.

Ready to Invest?

We encourage investors to work with a chosen financial professional to explore the potential benefits of incorporating an innovation-based strategy like the ARK Fintech Innovation ETF (ARKF). We would be delighted to provide additional, high-level information for investor review in collaboration with their trusted financial professional. Please reach out for more information. Discover more about the ARK Fintech Innovation ETF here.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK ETF before investing. This and other information are contained in the ARK ETFs’ prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus should be read carefully before investing.

Investing in securities involves risk and there's no guarantee of principal.

Fund Risks: The principal risks of investing in ARKF: Equity Securities Risk. The value of the equity securities the Fund holds may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Financial Technology Risk. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. Fintech Innovation Companies may not be able to capitalize on their disruptive technologies if they face political and/or legal attacks from competitors, industry groups or local and national governments. A Fintech Innovation Company may not currently derive any revenue, and there is no assurance that such company will derive any revenue from innovative technologies in the future. Technology companies may have limited product lines, markets, financial resources or personnel. The products of technology companies may face rapid product obsolescence due to technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. Blockchain technology is new and many of its uses may be untested. Blockchain and Digital commodities and their associated platforms are largely unregulated, and the regulatory environment is rapidly evolving. Because blockchain works by having every transaction build on every other transaction, participants can self-police any corruption, which can mitigate the need to depend on the current level of legal or government safeguards to monitor and control the flow of business transactions. As a result, companies engaged in such blockchain activities may be exposed to adverse regulatory action, fraudulent activity or even failure. Digital assets that are represented and trade on a blockchain may not necessarily benefit from viable trading markets. For other risks regarding the fund please see the prospectus. Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme. Digital Wallet Risk. Digital wallets are convenient because you don't have to memorize your private key, write it down or store it elsewhere. However, a downside of wallets is that they, like any service connected to the Internet, are vulnerable to hackers and malicious code. Desktop and mobile app wallets that store keys locally on a device are susceptible to loss, destruction and theft. For example, if you lose your phone that has a mobile app wallet that stores your cryptocurrency keys, you may permanently lose your investment.

Shares of ARKF are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Securities in the ETF’s portfolio will not match those in any index. The active ETFs are benchmark agnostic and corresponding portfolios may have significant non-correlation to any index. Index returns are generally provided as an overall market indicator. You cannot invest directly in an index. Although reinvestment of dividend and interest payments is assumed, no expenses are netted against an index’s returns. An indication of interest in response to this advertisement will involve no obligation or commitment of any kind.

Portfolio holdings will change and should not be considered as investment advice or a recommendation to buy, sell or hold any particular security.

To view the top ten holdings for ARKF click here.

The information herein is general in nature and should not be considered financial, legal or tax advice. An investor should consult a financial professional, an attorney or tax professional regarding the investor’s specific situation. Certain information was obtained from sources that ARK believes to be reliable; however, ARK does not guarantee the accuracy or completeness of any information obtained from any third party.

ARK Investment Management LLC is the investment adviser to the ARK ETFs.

Foreside Fund Services, LLC, distributor.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.