Introduction

In our recently published Introduction To The ARK Innovation ETF (ARKK), we outlined how ARK’s five innovation platforms—public blockchains, artificial intelligence (AI), multiomic sequencing, energy storage, and robotics—are converging, sparking a new technological revolution that could redefine the next business cycle. In this article, we zoom in on the ARK Genomic Revolution ETF (ARKG), which invests in companies focused on extending and enhancing the quality of life. We expect these companies to benefit meaningfully from advances in multiomics by leveraging breakthroughs in sequencing, analysis, synthesis, and editing modalities that develop innovative products and services.

The Opportunity

For decades, our healthcare system has been more about treating illness than preventing it—a reactive “sick care” model rather than a proactive one. But a revolution is underway.

Today, efforts to solve medicine’s toughest challenges are driving unprecedented breakthroughs in biotechnology, precision medicine, and disease prevention, not only transforming patient care but also opening new frontiers for innovation and investment. We believe this shift presents a unique opportunity to invest in the technologies that will redefine health while delivering significant economic value.

At its core, this is a data-driven revolution. The convergence of multiomics, artificial intelligence, and precision medicine is rewriting the rules of healthcare. With tools that can look deeper into biology than ever before, the amount of data available is rapidly expanding. AI is the catalyst unlocking entirely new possibilities—from early disease detection to AI-powered drug discovery—fundamentally reshaping how we approach and treat disease.

No longer limited to managing illness, the future of healthcare is about preventing, diagnosing, and even curing disease at its roots. The transformation is already in motion, and we believe the innovators and investors driving it forward will not only shape the next era of medicine but also unlock profound societal and economic value.

What is Multiomic Sequencing?

To understand Multiomic Sequencing, let’s first understand Genomic Sequencing. Genomic Sequencing is a process used to determine the complete DNA (Deoxyribonucleic Acid) sequence of an organism’s genome. The genome is the entirety of an organism’s genetic material, encoded in its DNA.

Multiomic Sequencing integrates diverse biological data sources from:

- Genomics, the study of genes

- Transcriptomics, the study of RNA (Ribonucleic Acid)

- Proteomics, the study of proteins

- Metabolomics, the study of small molecules called metabolites

- Epigenomics, the study of heritable changes in gene expression that do not involve changes to the underlying DNA structure

The Central Dogma of molecular biology states that genetic information flows in only one direction: from DNA (the Genome), to RNA (the Transcriptome), to protein (the Proteome), to metabolites (the Metabolome). Proteins, produced based on genetic instructions, perform essential cellular functions, while metabolites are small molecules that result from biochemical processes and help regulate metabolism. Disruptions at any stage—whether in DNA, RNA, proteins, or metabolites—can lead to diseases and altered biological functions.

.png)

By understanding the interactions between and among the pillars of the Central Dogma, we can improve our ability to make predictions, diagnoses, and fundamental biological insights. Medical researchers can uncover complex biological mechanisms, disease pathways, and potential therapeutic targets, leading to more personalized and effective healthcare solutions. This integrated approach offers a more holistic view of an organism’s biological state, versus analyzing each “ome” in isolation or studying only one specific set of molecules at a time without considering the interactions with others.

The Multiomics Flywheel

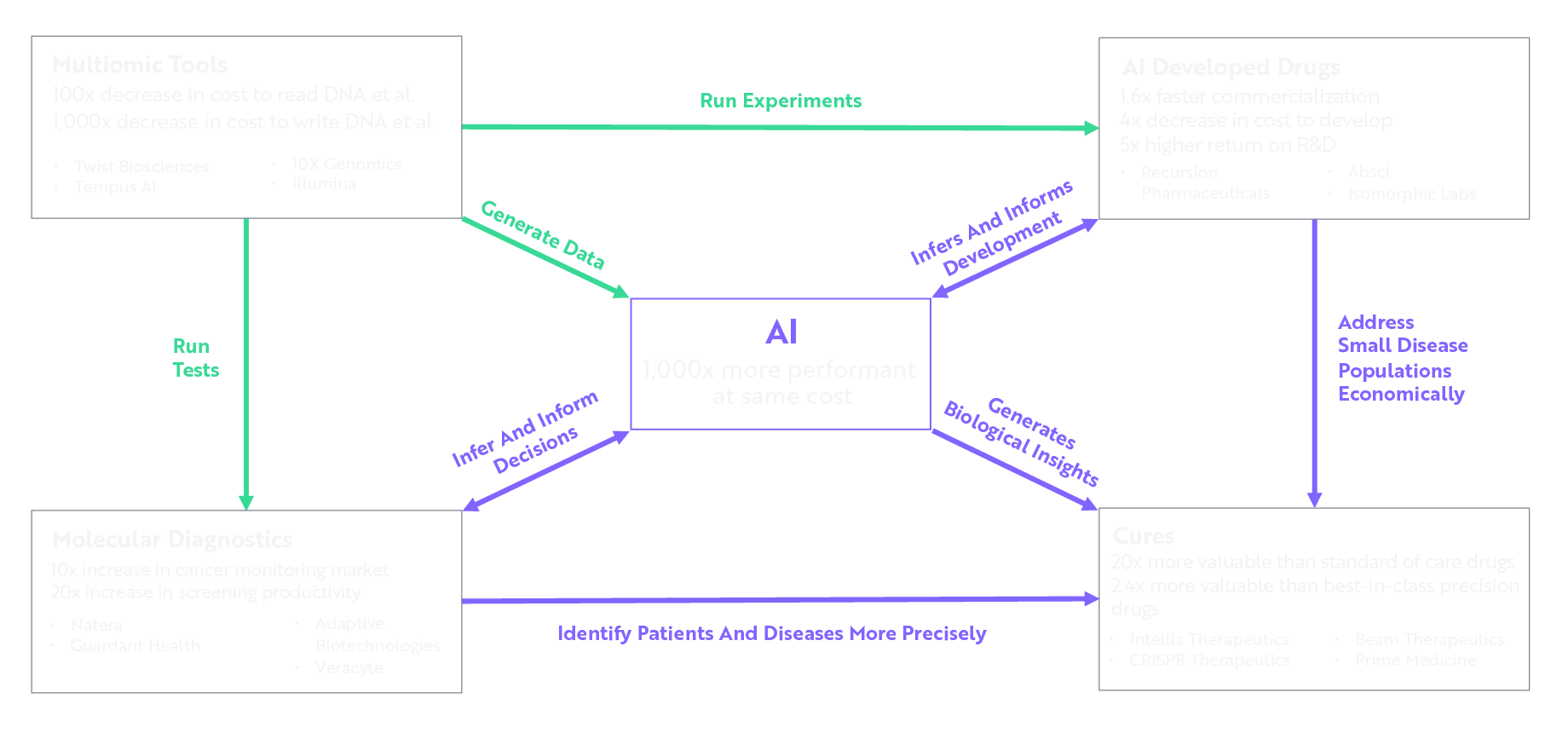

Our multiomics flywheel framework describes a self-reinforcing loop in which AI accelerates every aspect of multiomics—from generating biological data to diagnosing diseases to developing new drugs and cures.

*The multiomics performance statistics provided on this slide represent ARK’s research-based forecasts for 2030, which may not be realized. The companies listed represent companies that are currently working toward achieving the forecasted results, but the list does not include all companies that may be pursuing the same goals, and which may do so more successfully. The companies listed may or may not be held in ARK portfolios. The information provided should not be used as the basis for any investment decision, and it should not be assumed that an investment in any of the companies listed was or will be profitable. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Forecasts are inherently limited and cannot be relied upon.

Multiomic Tools Generate Massive Data Sets (Chart Top Left)

Advances in sequencing instruments across genomics, transcriptomics, and proteomics have reduced the costs of reading and writing DNA by orders of magnitude. Companies like Twist Bioscience, Tempus AI, 10X Genomics, and Illumina are creating increasingly powerful tools to sequence and analyze DNA faster and more affordably. These breakthroughs have made it possible for scientists to generate massive volumes of raw biological data, forming the essential foundation upon which AI can operate and deliver transformative outcomes.

AI Processes and Analyses the Data (Chart Center)

AI plays a central role in transforming raw multiomics data into actionable insights. With performance levels now 1,000 times greater at the same cost, AI systems can recognize disease patterns with greater accuracy, identify potential drug targets faster and more efficiently than humans, and even predict molecular interactions at the atomic level. These capabilities accelerate the entire discovery process and set the stage for more effective diagnostics and therapeutic development.

AI-Driven Molecular Diagnostics Identify Patients More Precisely (Chart Bottom Left)

AI-powered diagnostics have ushered in a new era of early disease detection and precise patient stratification, which is particularly evident in cancer screening, in which molecular diagnostics have seen a 10x to 20x improvement in efficiency. Leading companies like Natera, Guardant Health, Adaptive Biotechnologies, and Veracyte are developing next-generation diagnostic tools that enable clinicians to catch diseases earlier and match patients with the most effective treatments, improving outcomes and reducing unnecessary interventions. For example, Natera’s Signatera test can detect breast cancer recurrence up to 10.5 months earlier than imaging techniques and has twice the sensitivity for ovarian cancer relapse compared to traditional biomarkers.

AI Accelerates Drug Development (Chart Top Right)

Using data from both diagnostics and multiomic tools, AI is revolutionizing the drug development process by enabling researchers to design better drugs more quickly while significantly reducing the associated costs. Specifically, AI cuts research and development expenses by a factor of four, shortens drug development timelines by 1.6 times, and decreases the risk of failure. Companies like Recursion Pharmaceuticals, Absci, and Isomorphic Labs are leading this transformation, making drug discovery more profitable, scalable, and impactful.

Next-Gen Cures Become Possible (Chart Bottom Right)

AI-driven drug discovery is unlocking the potential of gene-editing therapies and precision medicine. Innovations from companies like CRISPR Therapeutics, Intellia Therapeutics, Beam Therapeutics, and Prime Medicine are paving the way for new cures. These next-generation therapies are not only 20 times more valuable than traditional drugs but also 2 to 4 times more effective than today’s best precision medicines. Thanks to the dramatically reduced cost of development, these advanced treatments are increasingly viable—even for rare diseases—bringing the promise of personalized, curative care within reach.

The Self-Reinforcing Loop: AI + Multiomics = The Future of Medicine

This entire process operates as a powerful, self-reinforcing loop. Multiomic tools continue to generate increasingly large, affordable, and high-quality datasets. AI interprets these datasets to unlock complex biological insights, leading to earlier, more precise diagnoses and accelerating drug discovery. As new cures emerge, the breakthroughs feed back into the system, producing more data and driving further improvements in both AI and multiomic capabilities. Together, this synergy is transforming the future of healthcare—making personalized, data-driven, and curative medicine possible at scale.

The ARK Genomic Revolution ETF (ARKG)

According to our research, early detection and precision medicine will become the new standard of care. Remarkably, the companies leading the race in these fields are relatively absent from the healthcare investment benchmarks; as a result, they are not well-represented in many investor portfolios. ARK seeks to provide investors with a portfolio solution that offers exposure to these rapidly unfolding, life-changing developments.

The ARK Genomic Revolution ETF (ARKG) is an actively managed fund that gives investors exposure to the forefront of multiomics innovation. From AI-powered drug discovery and early disease detection to curative gene-based therapies, ARKG targets companies leading the charge in transforming healthcare. As one of the public market strategies closest to venture capital in its ambition and scope, ARKG offers investors access to high-conviction, early-stage innovation through a liquid, transparent ETF. Its low correlation to traditional growth and value strategies also makes it a potential source of diversification within a broader portfolio.

Through active management, ARKG adapts to breakthroughs in technology and changes in the market landscape, positioning investors for potential growth as breakthroughs in medicine change our daily life. While portfolios centered on disruptive innovation can be more volatile, they also can offer substantial long-term opportunities, especially when risk is properly managed through well-considered allocation strategies. We believe that all investors stand to benefit from investing in companies redefining the future of healthcare globally. Ultimately, the ARK Genomic Revolution ETF provides a distinctive opportunity to invest in the next wave of health care.

To learn more about the ARK Genomic Revolution ETF please watch our Fund In Focus - ARKG.

To dive deeper into the advances in biotechnology please read The Transformative Potential Of Biotechnology And AI In Healthcare blog.

Ready to Invest?

We encourage investors to work with a chosen financial professional to explore the potential benefits of incorporating an innovation-based strategy like the ARK Genomic Revolution ETF (ARKG). We would be delighted to provide additional, high-level information for investor review in collaboration with their trusted financial professional. Please reach out for more information. Discover more about the ARK Genomic Revolution ETF here.

Important Information

Investors should carefully consider the investment objectives and risks as well as charges and expenses of an ARK Fund before investing. This and other information are contained in the ARK ETFs’ prospectuses and summary prospectuses, which may be obtained by visiting www.ark-funds.com. The prospectus and summary prospectus should be read carefully before investing.

An investment in an ARK Fund is subject to risks and you can lose money on your investment in an ARK Fund. There can be no assurance that the ARK Funds will achieve their investment objectives. The ARK Funds’ portfolios are more volatile than broad market averages. The ARK Funds also have specific risks, which are described below. More detailed information regarding these risks can be found in the ARK Funds’ prospectuses.

The principal risks of investing in ARKG: Equity Securities Risk. The value of the equity securities the Fund holds may fall due to general market and economic conditions. Foreign Securities Risk. Investments in the securities of foreign issuers involve risks beyond those associated with investments in U.S. securities. Health Care Sector Risk. The health care sector may be adversely affected by government regulations and government health care programs, restrictions on government reimbursements for medical expenses, increases or decreases in the cost of medical products and services and product liability claims, among other factors. Many health care companies are heavily dependent on patent protection and intellectual property rights and the expiration of a patent may adversely affect their profitability. Biotechnology Company Risk. A biotechnology company’s valuation can often be based largely on the potential or actual performance of a limited number of products and can accordingly be greatly affected if one of its products proves, among other things, unsafe, ineffective or unprofitable. Biotechnology companies are subject to regulation by, and the restrictions of, the U.S. Food and Drug Administration, the U.S. Environmental Protection Agency, state and local governments, and foreign regulatory authorities. Pharmaceutical Company Risk. Companies in the pharmaceutical industry can be significantly affected by, among other things, government approval of products and services, government regulation and reimbursement rates, product liability claims, patent expirations and protection and intense competition. Detailed information regarding the specific risks of ARKG can be found in the ETF’s prospectus. Additional risks of investing in ARKG include Foreign Securities Risk, Information Technology Sector Risk, equity, market, management and non-diversification risks, as well as fluctuations in market value and NAV. Disruptive Innovation Risk. Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies that develop disruptive technologies may face political or legal attacks from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme.

Additional risks of investing in ARK ETFs include market, management and non-diversification risks, as well as fluctuations in market value NAV. ETF shares may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

To view the top ten holdings for ARKG click here.

ARK Investment Management LLC is the investment adviser to the ARK Funds.

Foreside Fund Services, LLC, distributor.

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. ARK and its clients as well as its related persons may (but do not necessarily) have financial interests in securities or issuers that are discussed. Certain of the statements contained may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements.

ARK Trade Notifications

ARK offers fully transparent Exchange Traded Funds (“ETFs”) and provides investors with trade information for all actively managed ETFs.